IBM Plunges After Another Dismal Quarter

Another quarter, and another masterclass by IBM at obfuscating financial reality, only this one did not work quite as expected.

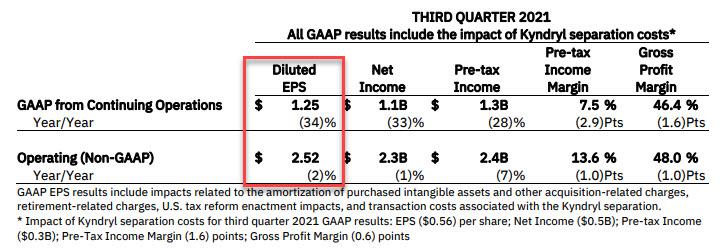

Moments ago IBM, which had seen its stock run up in the past month into earnings, seemingly forgetting that the company is the biggest melting ice cube of all, reported EPS of $2.52, a number that as usual, has been exquisitely goalseeked to just beat expectations, which this quarter were $2.50.

So far so good, but as usual, looking just one layer deeper reveals the ugly truth, because while the company's massively adjusted, and "one-time charged" EPS was a solid $2.52, or down just a modest 2% Y/Y, the GAAP EPS was down a whopping 34% to a number that was 50% lower than the adjusted one, or $1.25!

(Click on image to enlarge)

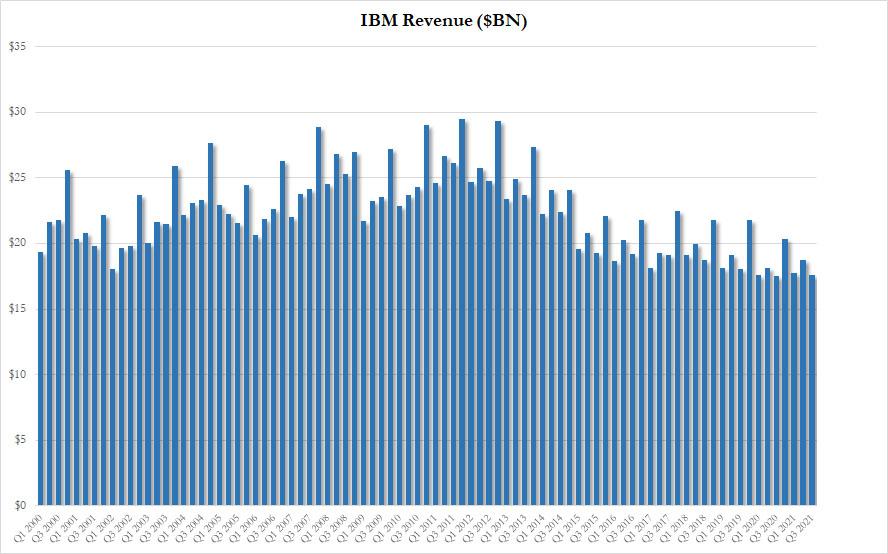

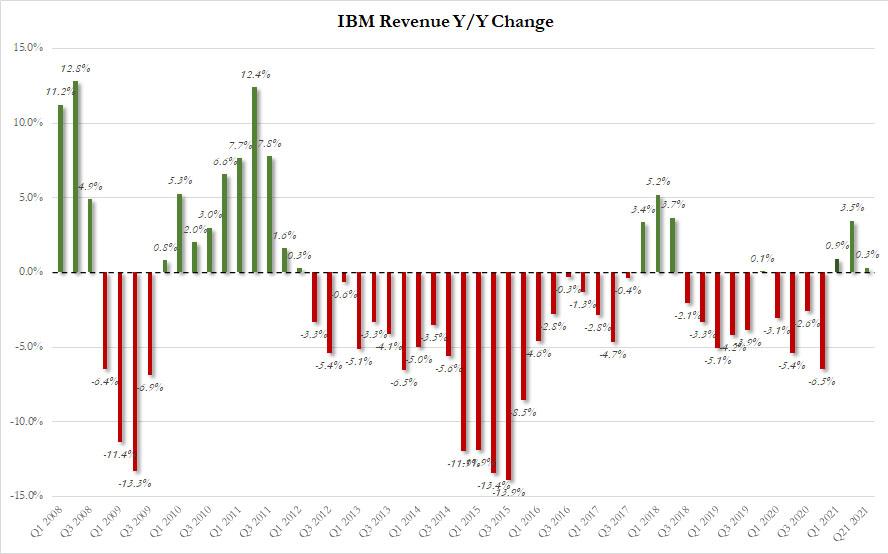

But while IBM can fudge its EPS with impunity and without any pushback from the analyst community, or its own shareholders, doing the same with revenues is impossible and here there was more pain with the company missing on the top line again, reporting just $17.618BN in revenue which missed consensus estimates of $17.77BN...

... yet was masterfully just barely higher compared to a year ago, rising by a meager 0.3% from Q3 2020, avoiding a return to the shameful period of over two years when the company failed to post a single revenue increase.

(Click on image to enlarge)

What's even worse is that after a few quarters of strength, IBM's flagship "cloud and cognitive software" segment once again misfired, and missed consensus estimates. In fact, 4 of the 5 revenue segments missed!

- Cloud and cognitive software revenue $5.69 billion, +2.5% y/y, missing estimate $5.78 billion

- Global business services revenue $4.43 billion, +12% y/y, beating estimate $4.27 billion

- Global technology services revenue $6.15 billion, -4.8% y/y, missing estimate $6.29 billion

- Systems revenue $1.11 billion, -12% y/y, missing estimate $1.26 billion

- Global Financing revenue $220 million, -19% y/y, missing estimate $259.9 million

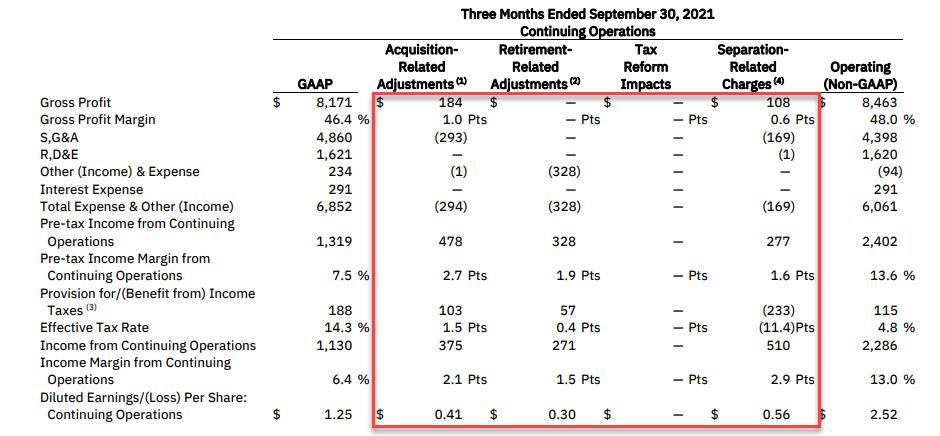

And the kicker: gross margin also missed, printing at 48%, down from 49% a year ago, and below the 49.6% consensus estimate.

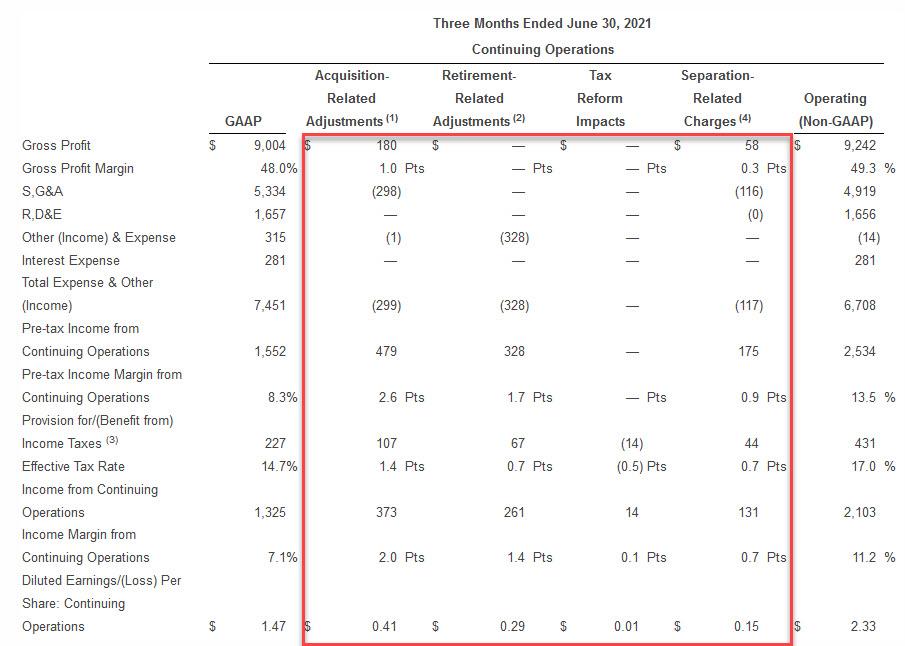

Going back to IBM's bottom line, there was as usual much more, because the GAAP to non-GAAP bridge was, as usual, ridiculous and a continuation of an "one-time, non-recurring" addback trend that started so many years ago we can't even remember when, but one thing is certain: none of IBM's multiple-time, recurring charges are either one-time, or non-recurring.

(Click on image to enlarge)

We have said it before, but we'll say it again: here is IBM's "one-time, non-recurring" items In Q2 2021...

(Click on image to enlarge)

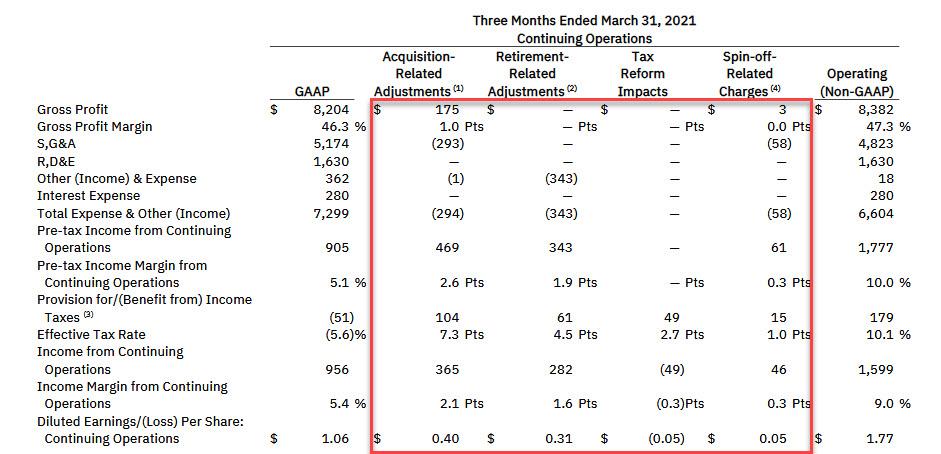

In Q1 2021...

(Click on image to enlarge)

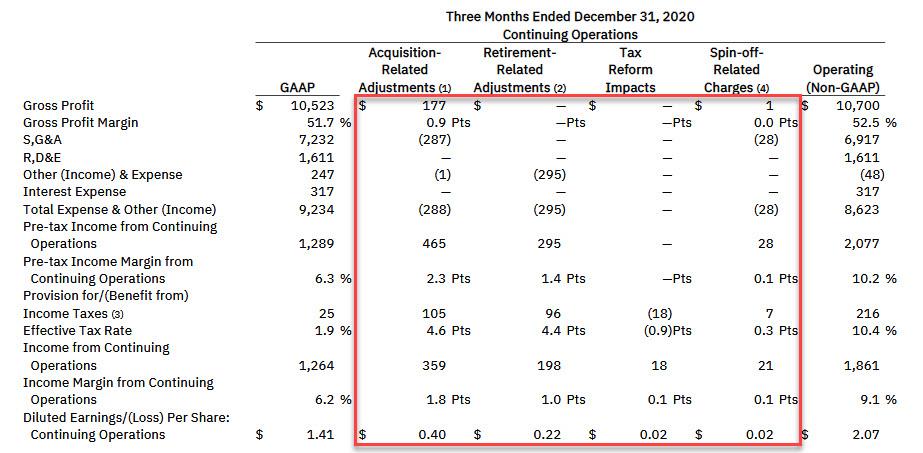

... and Q4 2020...

(Click on image to enlarge)

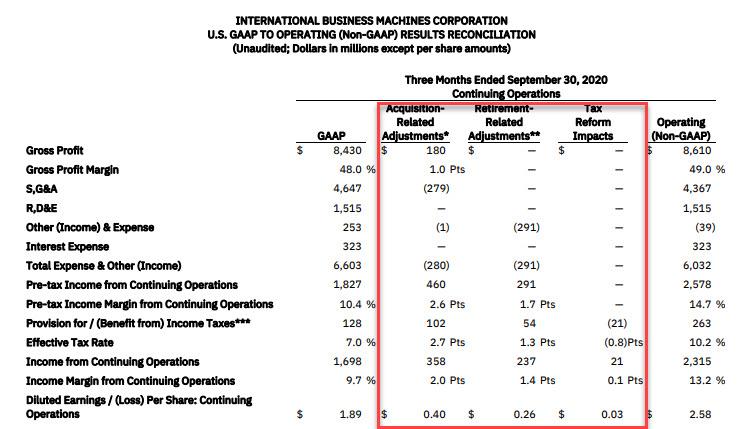

... and Q3 2020...

(Click on image to enlarge)

And so on.

Commenting on the quarter, Chairman and CEO Arvind Krishna said that “we continue to make progress in our software and consulting businesses, which represent our higher growth opportunities. With our increased focus and agility to better serve clients, we are confident in achieving our medium- term objectives of mid-single digit revenue growth and strong free cash flow generation.”

Maybe... although like in the past four quarters, IBM did not have enough visibility into the future to give any guidance for 2022.

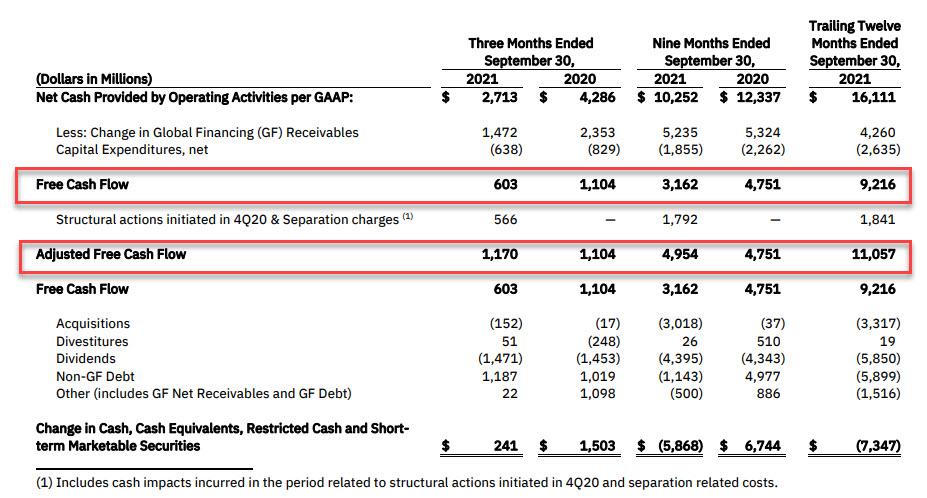

And speaking of IBM's cash flow target which the company disclosed previously as $11-$12BN, it will have to work extra hard in the rest of the year, because the adjusted Free Cash Flow in Q3 of just $603MM some $500MM lower than a year ago, and on an LTM basis is just $9.2BN, well below the $11-12BN runrate, unless of course the company is counting on adding back various varporware addbacks to its Adjusted FCF number.

(Click on image to enlarge)

Commenting on the company's balance sheet and cash flow CFO James Kavanaugh said "we again had solid cash generation for the quarter and over the last year, while maintaining a strong balance sheet and the liquidity to support our hybrid cloud and AI strategy."

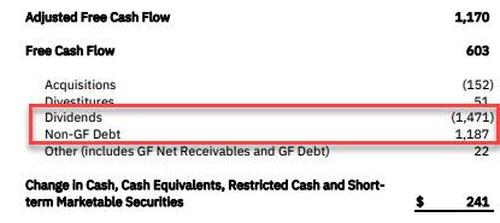

The cash flow generation was "so solid" IBM had to pay for its $1.5BN in dividends with $1.2BN in new debt.

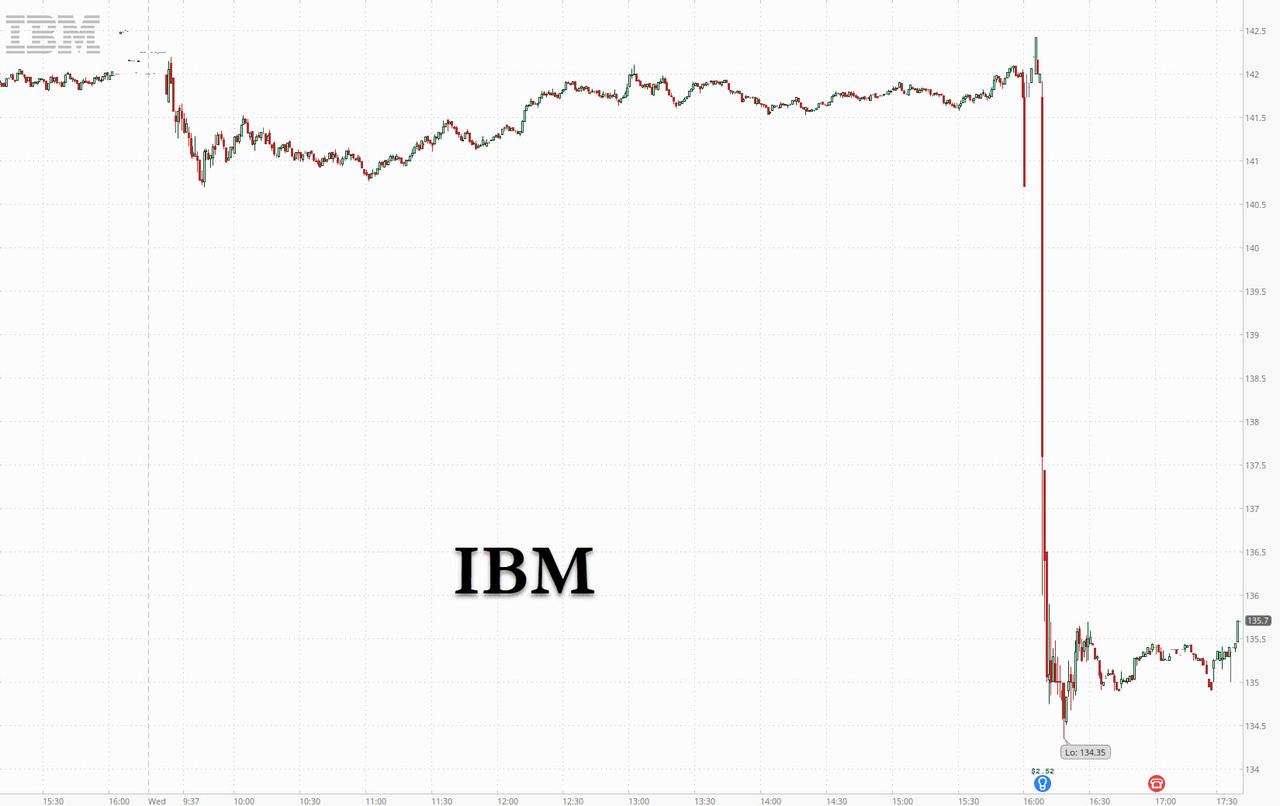

There was more in the press release but this should be sufficient to explain why the stock is plunging after hours, as investors have by now learned to read between the lines of IBM's quarterly masterclass in how to be the worst US company in cooking the books.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more