I Guarantee You Most Investors Aren’t Ready For This

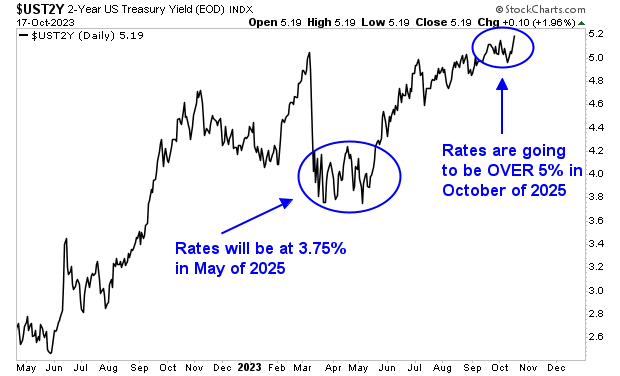

The yield on the 2-Year U.S. Treasury hit a new high yesterday.

Why does this matter?

Because…

1) It indicates the Fed’s fight to tame inflation is NOT done.

2) Stocks are in for a world of hurt in the coming months.

Regarding #1, back in May 2023, the 2-Year U.S. Treasury was anticipating that the Fed would have rates at 3.75% in May of 2025. At the time, this meant the Fed would cut rates at least two times before May of 2025 (rates were at 5.25% in May 2023).

Fast forward to today, and the 2-Year U.S. Treasury has just broken out to new highs of 5.20%. This means the market is now anticipating that the Fed will have cut rates possibly ONCE by October of 2025. Moreover, the idea that rates will be ABOVE 5% instead of BELOW 4% in late 2025 is a HECK of a shift.

(Click on image to enlarge)

Put simply, the bond market is figuring out that the Fed will need to keep rates MUCH higher for MUCH longer. And this brings us to #2 in our list above.

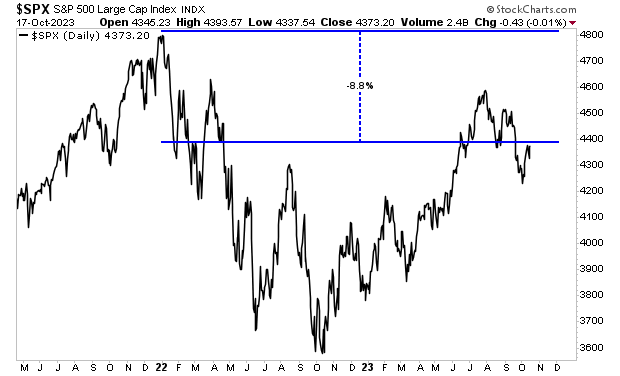

Stocks are in for a world of hurt.

Stocks are priced based on Treasury yields. This is one of the primary reasons why stocks remain down almost 10% from their all-time highs despite the fact the economy is growing. After all, if you can earn 5.25% risk free in bonds for two years, why risk putting your money into much riskier stocks where both the earnings yield AND the dividend yield are lower (4.07% and 1.62%, respectively).

(Click on image to enlarge)

The great crisis of our lifetimes is fast approaching.

In 2000, the Tech Bubble burst.

In 2007, the Housing Bubble burst.

The long term U.S. Treasury bubble burst in 2022. And the crisis is now approaching.

Smart investors are already taking steps to prepare for this.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

More By This Author:

When It Comes To Debt, The US Has Chosen Option TwoThree Questions To Ask Any Guru Opining On The Situation In The Middle East

The Bears Failed, Again - So What’s Next For The Markets?