HubSpot Is Positioned For Attractive Returns

One of the most critical priorities for businesses of all kinds is implementing the right tools to attract customers and to sustain growth over the long term. HubSpot (HUBS) is the top player in inbound marketing software, a better and more effective approach to sustainable growth.

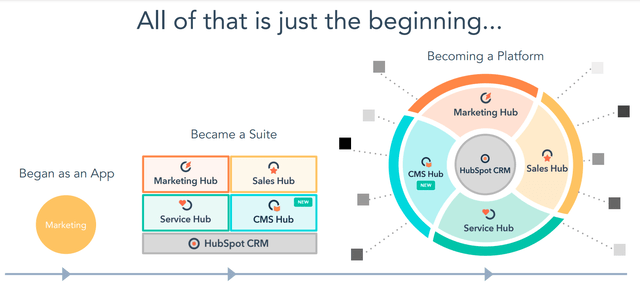

The company is expanding its ecosystems of services and solutions, while also attracting new customers and consolidating its competitive position over time. Financial performance is consistently strong, and HubSpot has abundant potential for growth in the years ahead.

A Better Approach To Growth

HubSpot is a founder-led business. The company's co-founders Brian Halligan and Dharmesh Shah are currently the company's CEO and CTO, respectively. Like many of the most successful businesses of our time, HubSpot was created when its founders realized that there was a better way to do things and to provide a superior solution to online marketing.

While being at graduate school at MIT, Brian Halligan and Dharmesh Shah realized that online marketing was often too intrusive and an unwelcome disruption to potential buyers. Unsolicited messages and calls or pop-up internet ads are clear examples of this uncomfortable approach to marketing.

Potential customers don't like these kinds of intrusions, and they tend to avoid them as much as possible. Even when the marketing message reaches the right destination, bothering your potential customers with information that they did not want to receive at that specific point in time is far from ideal.

Inbound marketing, on the other hand, means that the customer should seek the product or the service. By creating high-quality content, you start by giving your potential customer something that the customer wants to get and actually appreciates. This opens the door to a more productive and comfortable relationship with those customers, and it provides a more effective path to sustained growth.

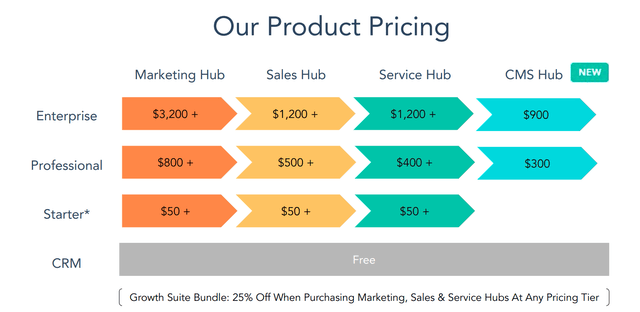

HubSpot provides a suite of software solutions that helps companies generate better growth venues via marketing, sales, service, and the recently added content management system.

The company has a freemium business model that attracts a wide variety of customers and moves those customers to paid solutions overtime. The paid version of the software has a three-tiered payment pricing system: Starter, Professional, and Enterprise.

Source: HubSpot

HubSpot is focused on the mid-market, which has been traditionally underserved. Customer churn is higher in this segment, but having exposure to relatively small and mid-sized businesses allows HubSpot to benefit from the customers that are growing in size over time. The company is essentially a growth enabler for relatively small businesses with plenty of potential for long-term growth.

As customers grow in size, they generate more revenue for HubSpot, and they also tend to have higher switching costs, which consolidates HubSpot's competitive position in the sector.

Source: HubSpot

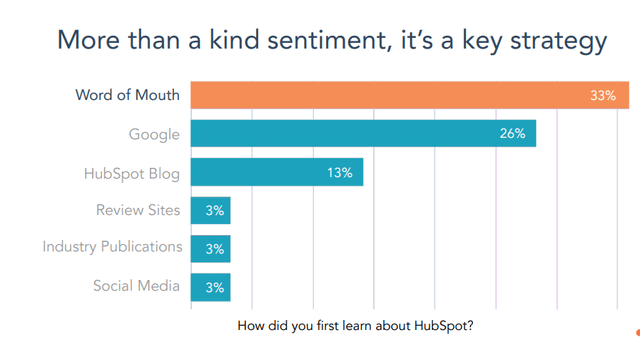

Word of mouth is a key source of new customers for HubSpot, and this shows that the company is consistently adding value to its customers. Needless to say, growing through word of mouth is a notoriously effective and profitable driver.

Source: HubSpot

The Numbers

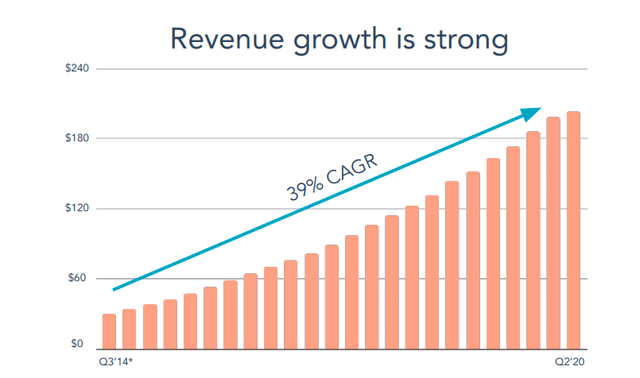

The company has a rock-solid track record of consistent revenue growth over the long term. The recession has affected the business recently, but the numbers are still healthy. Total revenue was $203.6 million last quarter, up 25% versus the same quarter in the prior year. Subscription revenue was $196.4 million, up 26% year over year.

Source: HubSpot

HubSpot grew total customers to 86,672 on June 30, 2020, this is an increase of 34% compared to June 30, 2019. The total average subscription revenue per customer was $9,466 during the second quarter of 2020, down 5%. This decline in revenue per customer was due to aggressive pricing discounts to accelerate customer growth during the period.

Management highlighted in the conference call that the worse seems to be already in the past regarding the impact of the recession, and the company could be even benefitting from new business paradigms emerging from the pandemic.

In the words of CEO Brian Halligan:

Today, I’m thankful to say that the disruptive headwinds we faced early in Q2 have eased and might have even begun to shift a bit in our favor, helped along by some nice execution in some important plays we ran. We’ve had a strong product year so far that’s raised the power of our enterprise tier while also adding new products to the mix.

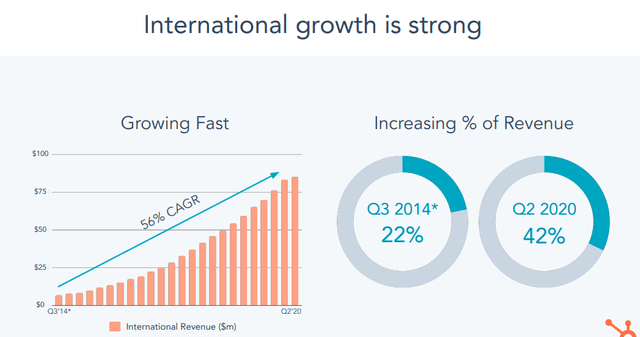

International growth has been very healthy over the past several years and also in the most recent quarter, with constant currency revenue growing by 36% year over year. HubSpot is already making 42% of total revenue from international markets, and a higher share of total sales coming from global markets should have a positive impact on total revenue growth in the years ahead.

Source: HubSpot

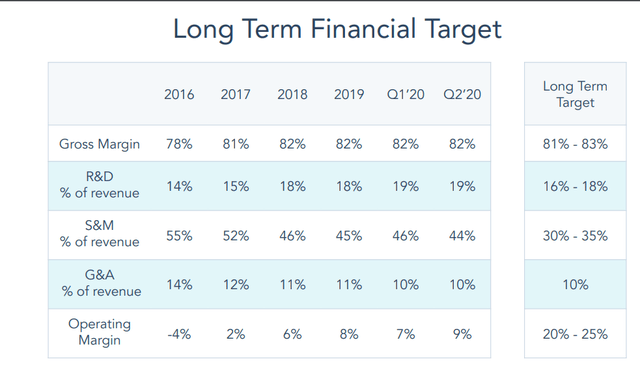

Profit margins are moving in the right direction over time, and management aims to generate operating margins in the neighborhood of 20-25% over the long term.

Source: HubSpot

The stock is trading a forward price to sales ratio of 15 times expected revenue for 2020 and 13 times sales estimates for 2021. The stock is not cheap, but valuation is not excessive for a company with such an attractive potential for sustained expansion in both sales and earnings over the years ahead. From current prices, and even assuming that the price to sales ratio could contract over time, vigorous revenue growth could drive attractive returns for investors in HubSpot in the long term.

| Fiscal Period Ending | Revenue Estimate | YoY Growth | FWD Price/Sales |

|---|---|---|---|

| Dec 2020 | 831.32M | 23.18% | 15.35 |

| Dec 2021 | 1.00B | 20.40% | 12.75 |

| Dec 2022 | 1.24B | 24.03% | 10.28 |

Source: Seeking Alpha

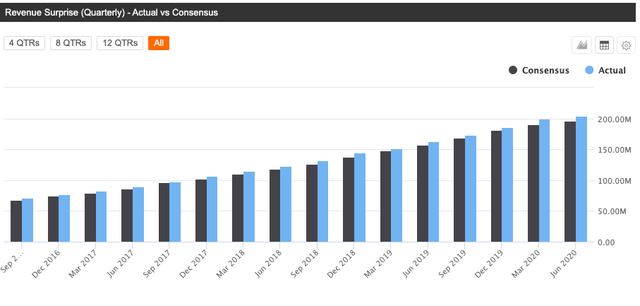

It is also worth noting that HubSpot has exceeded both revenue and earnings estimates in each and every quarter since the third quarter of 2016. If past history is any valid guide, it wouldn't be much of a surprise to see HubSpot doing better than expected in the years ahead too, which would ultimately mean that the stock is actually cheaper than it seems to be based on current estimates.

Source: Seeking Alpha

Source: Seeking Alpha

Risk And Reward Going Forward

Since HubSpot is focused on relatively smaller businesses than other high-growth software companies, this generally means lower dollar retention rates and higher customer churn for HubSpot in comparison. This has both pros and cons because the company also gets to benefit from the success of its customers over the years, but during a recession, smaller companies are generally much more affected than big corporations.

As many of its customers grow in size and also due to the fact that HubSpot is building more sophisticated solutions, the company will be facing growing competition from big players such as Salesforce (CRM). The market tends to be too myopic when assessing the competitive landscape in a sector, the opportunity is large enough for both HubSpot and Salesforce to do well int the long term, and HubSpot doesn't need to dethrone Salesforce in order to reward shareholders with solid gains. Nevertheless, this is still a relevant risk factor to keep an eye on, and it could have an impact on market perceptions regarding HubSpot.

Those risk factors being acknowledged, HubSpot provides a superior solution to online marketing to an underserved niche, the company has a smart business model, a proven management team, and solid financial performance. In the years ahead, the company has ample room for growth by gaining more customers in the U.S. and abroad, and also by increasingly monetizing those customers with more and better solutions. The stock is priced for growth, but it still should offer attractive returns for investors over the long term.

Disclosure: I am/we are long HUBS, CRM.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

moreComments

No Thumbs up yet!

No Thumbs up yet!