How Viridian Sciences Fits In Akerna’s Business Model

TM Editors' Note: This article discusses penny stocks and/or microcaps. Such stocks are readily manipulated; do your own careful due diligence.

One of the biggest bottlenecks that the cannabis industry has faced over the last decade is a lack of a clear regulatory framework. For instance, in the US, some states allow controlled levels of production, usage, and marketing of cannabis products while others allow specific uses of the product. This is a conundrum that has proved very challenging to cannabis companies especially when coming up with long-term strategies.

However, the world’s first compliance and analytics technology company in the cannabis industry Akerna Corp (Nasdaq: KERN) could help address some of the flaws that have held the industry back. The company has developed platforms that facilitate the tracking of cannabis products from seed to sale.

Regulatory institutions could use this technology to ensure that the mainstream cannabis industry operates without the drawbacks of the unregulated market. This creates a clear playing field, which could be a significant attraction to companies looking to get into the cannabis business.

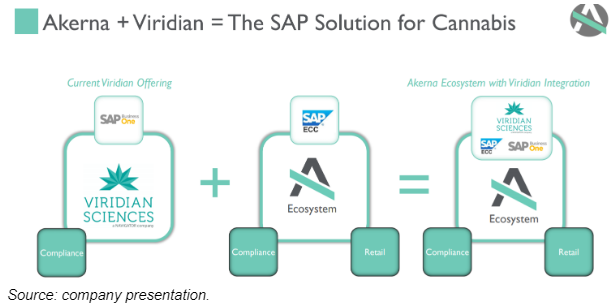

The company recently completed the acquisition of Viridian Sciences, an Enterprise Resource Management software provider for cannabis businesses. This acquisition revamps Akerna by making it the only cannabis-compliant SAP Business One offering the market. It will enable Akerna to offer cannabis clients software products for both compliance and analytics, while at the same time helping them to integrate all their business operations. Integration of all financial, accounting, taxation, and supply chain operations could be key given the rapid growth of the cannabis industry in the coming years. Viridian, in addition to Akerna’s other products, will play a key role in helping businesses to adapt to modern financial accounting and reporting practices.

Globally, cannabis sales were estimated at $21.3 billion in 2020, an increase of about 48% from 2019’s figure of about $14.4 billion. Current estimates project that sales will cross the $55 billion mark by 2026.

Fitting Viridian in Akerna’s business model

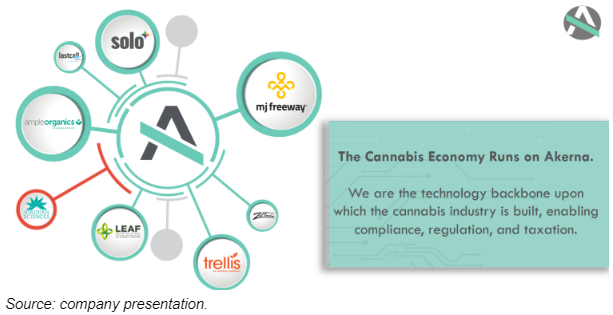

Prior to this acquisition, Akerna had six products on offer. They all focus on helping companies to gain market insights while at the same time creating a more transparent environment. Viridian expands its product offering to ERP solutions.

An overview of Akerna’s leading products

(Click on image to enlarge)

MJ Freeway

Its leading product the MJ Freeway platform is a hub where business analysts can find all the information about the industry transactions. It also helps to track cannabis products from seed to sale.

In one of the latest flash reports, US legal cannabis sales are predicted to reach $370 million between April 16 and April 20. April 20 is an unofficial cannabis consumption holiday. The market is expected to report about $95 million worth of cannabis sales on the holiday date.

Late last month, the company released another report that showed a significant increment in cannabis sales on St. Patrick’s day following the release of the stimulus checks in the US. Such insights can help cannabis businesses plan future production accordingly in anticipation of a spike in sales.

Several industries use big data analytics software to gain market insights and now, it looks like Akerna is helping bring the same services to the cannabis industry.

Leaf Data Systems

As mentioned earlier, regulation has been one of the biggest drawbacks of the cannabis market. The market is not uniformly regulated, which makes it difficult to mass-produce and sell products without considering potential implications in different legal jurisdictions. Many governments that still restrict the production and sale of cannabis do so because of the challenges of tracking the product.

However, with a good tracking system, things could change soon. Governments could be able to clearly track the legal production, sale, and consumption of cannabis products.

Leaf Data Systems is a compliance technology solution offered by Akerna to state governments for regulatory oversight. This technology can also help governments create and enforce an effective taxation system for the industry. This technology could help increase the legalization of cannabis thereby increasing the addressable market.

Ample Organics

This platform is created for the Canadian cannabis market. It is a seed-to-sale software solution built to foster transparency in the industry while at the same time facilitating compliance. This will help to build trust between the cannabis license holders, the government, and the public.

This solution combines some features of MJ Freeway and Leaf Data Systems with the key difference here being that it only focuses on the Canadian market. Canada is one of the world’s largest cannabis markets and it continues to lead in terms of innovation and legalization. Recreational cannabis sales are projected to surpass $2 billion in 2021 after hitting $1.8 billion last year.

Other products offered by Akerna include Trellis, a web-based platform that tracks inventory from seed to wholesale, and Solo Sciences, which is an interactive packaging solution that is helping companies to fight counterfeiting in the industry.

The company also offers Last Call Analytics, a solution that offers consumption trends and data for beverage alcohol. It is good to note that there are companies exploring the possibility of producing cannabis-infused beverages. This will further widen the addressable market by bringing in those who prefer cannabis in beverage form as compared to other forms on offer.

Viridian Sciences

Viridian Sciences is the leading provider of ERP software for cannabis companies. This product will be integrated into Akerna’s product offering which will help create a complete operating system for cannabis companies. Businesses will not only be able to track products from seed to sale but they will also generate financial reports, tax reports and prepare accounting budgets based on analytics reports from the MJ platform.

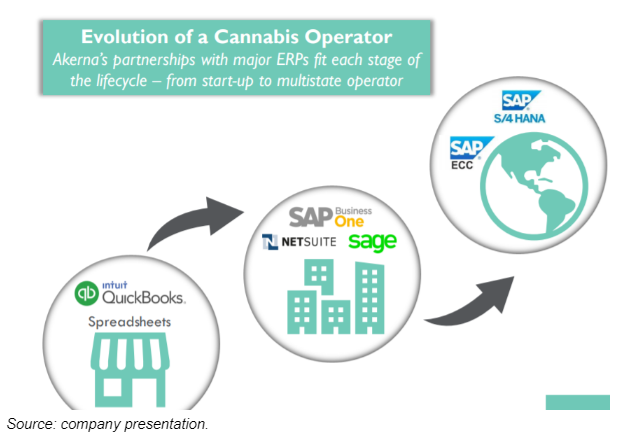

The all-stock acquisition was completed for $6 million, which is about 1.7 times the company’s 2020 SaaS revenue. Akerna has also partnered with SAP, Netsuite, and Sage to help businesses integrate their financials and tax planning.

(Click on image to enlarge)

The fully integrated system can be used by small starters all the way to multi-state operators. This means that businesses do not need to switch from one system to another as they evolve and grow.

Following the completion of the acquisition, Akerna Chief Executive Officer Jessica Billingsley said "leading enterprise organizations across industries choose SAP Business One for its ability to automate key financial business functions. By combining Viridian's financial integrations with Akerna's compliance and regulatory solutions, we continue to strengthen our channel connections with existing ERP providers for the cannabis businesses of today and the post-legalized world."

This acquisition puts Akerna in a prime position to generate sustainable revenues now and in the world to come. As more countries and states legalize various forms of cannabis use, Akerna will be well-positioned to help businesses in streamlining their operations and complying with regulatory practices.

Highlights from recent results

Akerna is yet to turn a positive bottom line. However, recent results indicate that it won’t be long before it hits the break-even point.

In the company’s most recent quarterly results for the period ended December 31, 2020. Akerna reported a 32.5% improvement in the bottom line to a $0.27 loss per share. This was still below the consensus Street estimate of ($0.21) per share.

The company’s revenue also reported a significant increment of 24.35% to $4.11 million, which beat the consensus analyst estimate of $4.02 million.

Most of Akerna’s revenue comes from its commercial software platforms. The platforms generated $3.4 million in the most recent quarter, up 38% year-over-year. The company’s gross profit increased by a whopping 60% to $2.7 million. If the company can continue to improve its gross profit margins, then it will soon begin to turn profits.

Its adjusted EBITDA of ($1.9 million) was also a significant improvement from the previous year’s figure of ($2.7 million).

The company’s new MJ platform orders increased 52% year-over-year while total MJ platform transactions were up 63%. Retail order value rose 105% versus a volume increase of 56%. This indicates a significant improvement in the average order price due to an increase in the number of new orders.

Looking forward, Akerna acquisition of Viridian Sciences will help augment the company’s existing business verticals which in turn will boost revenue and earnings.

(Click on image to enlarge)

Viridian will be bringing in $3.5 million in SaaS revenue based on last year’s top line. It also enjoys more than 70% in software margins, which have helped the company to generate positive cash flows. It has more than 30 customers on record and is ranked the number one cannabis ERP built on SAP Business One.

Akerna has transitioned to a fully remote workforce after closing offices during the quarter. This will help in cutting costs, which will contribute to a better bottom line in the coming quarters. The company expanded to five new locations following the November elections. In the US, its MJ platform is now serving 17 states. The acquisition of Viridian Sciences also gives it access to more markets.

Akerna has also switched its end of the year to Dec. 31 from Jun. 30. Investors will now be looking forward to its fiscal first-quarter, 2021 results for the three months ending March 31. This will be interesting given the developments made in the previous quarter.

Risks

Akerna reported total debt of $15.6 million as of December 31, 2020. This compares to a total cash of $17.84 million, which translates to a net cash position of $2.24 million. Therefore, it is correct to say that the company’s debt position is currently manageable.

However, the big problem is that the company is losing cash because it is not profitable yet. Its negative EBITDA suggests that some of the short-term maturing obligations may need to be paid for using cash reserves. This cannot continue for long if the company wants to begin turning profits in the near future. Akerna may have to raise more cash soon, which could affect its debt position.

Another thing that investors may need to be wary of is the competition from existing ERP solutions providers. Akerna’s competitive advantage comes from its ability to develop solutions that only target the cannabis industry. On the other hand, some of the giant ERP solution providers have access to financing that they can use to develop products to rival Akerna’s solutions.

Akerna’s market cap of just over $100 million makes it a small-cap stock. This means that it is a potentially thinly traded stock and this could make it highly volatile. However, its price of about $4.00 per share means that it is less likely to be manipulated compared to other small-cap stocks that trade at prices less than $1.00.

Valuation

From a valuation perspective, shares of Akerna trade at a price-sales ratio of 5.98, which is significantly better than Saleforce.com’s (NYSE: CRM) P/S ratio of 9.91. SAP SE (NYSE: SAP) trades at an equivalent of 4.87. Therefore, from the perspective of the price-sales ratio Akerna does not seem to be overvalued compared to some of the leading enterprise resource solutions providers.

In fact, when you look at the price-book value multiples, Akerna’s ratio of 2.20 is significantly better than CRM’s 5.14 and SAP’s 5.34 based on the most recent quarterly results.

Conclusion

In summary, Akerna has identified a segment of the cannabis industry that has not been addressed properly. It is now offering unique solutions that could help bring more players to the industry while at the same time helping governments relax their restrictions and legalize various uses of cannabis. This will in turn result in a bigger addressable market for Akerna thereby creating a pathway to profitability.

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their ...

more

Thanks for putting this stock on my radar. $KERN

Nice analysis.

Good read, thanks.