How To Use Common Size Analysis To Compare Companies To Peers

“People constantly evaluate themselves, and others, in domains like attractiveness, wealth, intelligence, and success. According to some studies, as much as 10 percent of our thoughts involve comparisons of some kind.”

Quote source: Psychology Today

Comparisons in the investing world are not different; there are many forms of comparison, some flattering, some not. But the use of comparisons to help you find the best investment is called common size analysis.

Common size analysis allows us to compare our company across its many years of performance, plus comparing one company to others in the same/different industry, or to benchmarks. All of those comparisons allow us to see what is important, trends, or any other items that might help us make the best decision.

One of my favorite shareholder letters is from Chris Bloomstran of Semper Augustus. He uses common size analysis to compare his fund’s performance against the S&P 500, and it is a great analysis. It helps see how his fund is performing relative to important metrics and gives you a sense of the direction the fund is going relative to the market. Let’s dive in and learn more about common size analysis.

What is Common Size Analysis?

Common size analysis according to CorporateFinanceInstitute is:

“Common size analysis, also referred as vertical analysis, is a tool that financial managers use to analyze financial statements. It evaluates financial statements by expressing each line item as a percentage of the base amount for that period. The analysis helps to understand the impact of each item in the financial statement and its contribution to the resulting figure.”

Creating common size financial statements allows investors to make it easier to analyze Visa (V) over time and compare it to Mastercard (MA). Using common size financials helps point out trends we might not see when looking at raw financial statements. Common size analysis allows the use of all three major financial statements in this format:

- Income statement.

- Balance sheet.

- Cash flow statement.

The easiest way to do this is by using spreadsheets that can easily convert the statements into percentages based on each separate line item or the ones you want to analyze.

The two most common uses of common-size analysis are on the income statement and balance sheet. For example, when comparing line items on the income statement, it is most common to compare them to the company’s revenue. Likewise, it is common to compare them to assets, liabilities, or shareholder’s equity on the balance sheet.

How Do You Calculate Common Size Analysis?

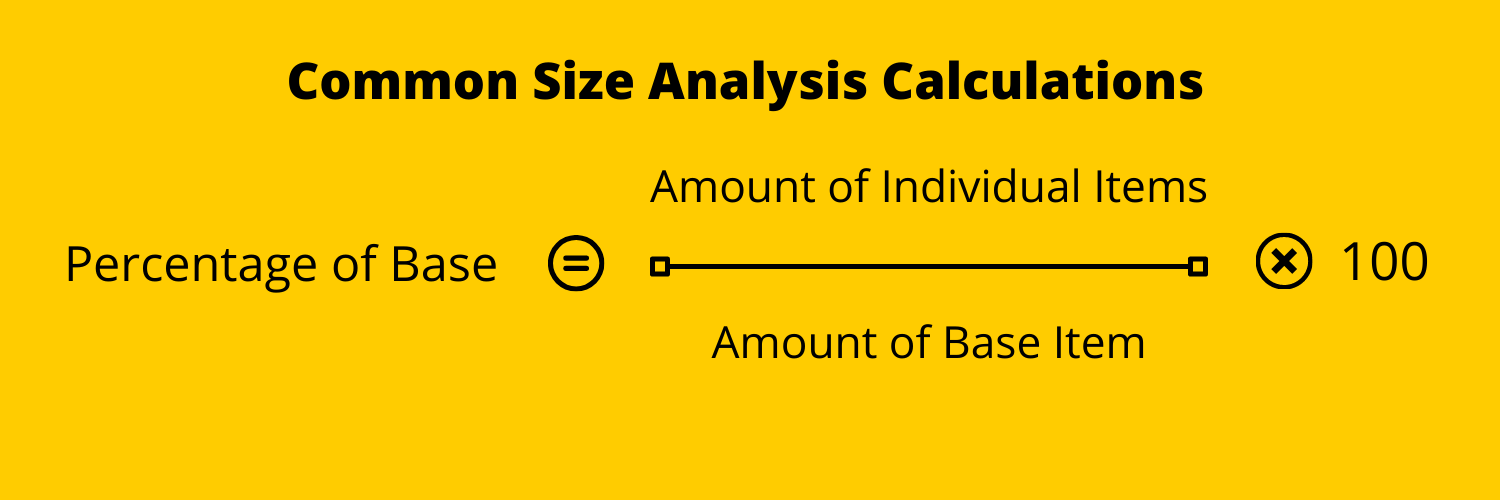

To calculate a common size analysis, we need to convert the income statement’s financial data, for example, into percentages. The way we do this is simple:

To put that into practice, let’s use the latest quarterly report for Visa:

- Revenue – $5,687.

- Gross Profit – $4,533.

Percentage of Base = $4,533 / $5,687 x 100 = 79.71%. Pretty simple, huh? Common size analysis can be done in several ways:

- Vertical analysis.

- Horizontal analysis.

Vertical analysis is analyzing specific line items to a base item within the same financial period. For example, one can compare when looking at the gross margin, operating margin, and net income margin of the first quarter of 2020 for Visa.

|

Gross Margin |

80.82% |

|

Operating Margin |

67.17% |

|

Net Income Margin |

52.68% |

The horizontal analysis takes the same line items and looks at the results over a longer period, such as multiple years or quarters. Below is an example of looking at Visa’s profit margins over five years.

|

Gross |

Operating |

Net |

|

|

2017 |

82.31 |

66.25 |

36.49 |

|

2018 |

81.29 |

65.8 |

49.98 |

|

2019 |

81.87 |

67.03 |

52.57 |

|

2020 |

79.35 |

64.51 |

49.74 |

|

TTM |

79.04 |

64.81 |

49.91 |

As we can see from above, looking at a more focused period can tell us some information, but looking at longer periods allows for greater analysis. It can help give you questions to investigate: why did Visa’s gross and operating margins fall while the net income margin was growing? It may be a simple answer, but we would never think to look if it wasn’t for the above chart.

How to Perform Common Size Analysis

Let’s perform some common size analysis using both the income statement and balance sheet—the company I would like to use is PayPal (PYPL) as our guinea pig. The first analysis we will do is for the year ending 2020.

|

Revenues |

21,454 |

100% |

|

Cost of Goods Sold |

11,453 |

53.38% |

|

Gross Profit |

10,001 |

46.61% |

|

SG&A |

6,573 |

30.63% |

|

R&D |

0 |

0% |

|

Other |

0 |

0% |

|

Operating Income |

3,428 |

15.97% |

|

EBIT |

5,274 |

24.58% |

|

Income Tax Expense |

863 |

4.02% |

|

Net Income |

4,202 |

19.58% |

The great takeaway from researching above is the ability to see each line item’s impact on the company’s performance. For example, most would consider PayPal a tech company as it operates in the fintech sector, but the company spent zero dollars on R&D in 2020, which is remarkable. You also see higher net income margins related to operating margins, which would lead you to find out how that occurred.

Let’s do the same with the balance sheet of PayPal.

|

Cash & equivalents |

13,083 |

18.58% |

|

Receivables |

36,374 |

51.68% |

|

Current Assets |

50,995 |

72.45% |

|

Investments |

6,089 |

8.65% |

|

Net PPE |

1,807 |

2.56% |

|

Goodwill |

9,135 |

12.98% |

|

Total Assets |

70,379 |

100% |

|

Accounts Payable |

38,447 |

76.41% |

|

Current liabilities |

38,447 |

76.41% |

|

Long-term debt |

8,939 |

17.76% |

|

Long-term liabilities |

11,869 |

23.59% |

|

Total Liabilities |

50,316 |

100% |

|

Retained Earnings |

12,366 |

61.77% |

|

Paid-in capital |

16,644 |

83.24% |

|

Treasury Stock |

8,507 |

42.49% |

|

Shareholder equity |

20,019 |

100% |

From the above analysis, we can see that receivables make up most of the current assets of PayPal and a large part of the company’s total assets. Also, notice that goodwill is a smaller portion of the assets and the large portion of liabilities coming from accounts payable.

As we work through these common size analyses, it is good to look through these statements and ask questions. Those questions lead to a better understanding of the company’s financials, and that is what we are all here to learn. Next, let’s work through a common size analysis of PayPal’s income statement over many years.

| 2017 | 2018 | 2019 | 2020 | |

| Revenues | 100% | 100% | 100% | 100% |

| Cost of Goods | 51.13% | 53.47% | 55.06% | 53.38% |

| Gross Margin | 48.87% | 46.53% | 44.94% | 46.62% |

| SG&A | 31.62% | 30.32% | 29.24% | 30.63% |

| R&D | 7.27% | 6.93% | 0% | 0% |

| Operating Margin | 17.3% | 16.2% | 15.7% | 16% |

| Taxes | 3.09% | 2.06% | 3.03% | 4.02% |

| Net Margin | 13.7% | 13.3% | 13.8% | 19.6% |

Looking at longer periods of financials is always a revealing exercise. Look at the lack of R&D for the last two years. Also notice that both costs of goods sold and administration costs have all remained the same over the four years.

Using this type of analysis will give you a better idea of the company’s performance and any additional investigation areas we might need to dive deeper into. Another great example of this type of analysis is to look at competitors to get a sense of how PayPal is doing relative to its peers.

|

PYPL |

MA |

V |

SQ |

FIS |

FISV |

|

|

Rev |

100 |

100 |

100 |

100 |

100 |

100 |

|

Costs |

53.38 |

24.75 |

20.96 |

71.10 |

66.51 |

52.6 |

|

Gross |

46.42 |

73.25 |

79.03 |

28.90 |

33.49 |

47.40 |

|

SG&A |

30.63 |

18.10 |

10.58 |

19.65 |

28 |

38.05 |

|

R&D |

0 |

0 |

0 |

10.48 |

0 |

0 |

|

Operating |

15.98 |

53.34 |

64.97 |

-0.20 |

12.32 |

9.35 |

|

Taxes |

4.02 |

8.81 |

13.24 |

0 |

0.7 |

1.31 |

|

Net |

19.59 |

41.90 |

49.91 |

2.24 |

1.26 |

6.45 |

As we can see from the chart above, using common size analysis allows investors to identify sharp changes in their income statement or balance sheet. The drastic changes become much clearer when the comparison of financials is over longer periods. Any discernable movements in the income statement, for example, can help investors figure out whether or not to invest in Square (SQ).

For example, comparing the net income margins of all the PayPal peers gives you an idea of the company’s overall profitability. The chart above is only for the TTM (trailing twelve months) and is only a snapshot. A much deeper dive would require looking at longer periods, such as three to five years, to detect any trends. Those longer snapshots can tell you if the company is going through some financial struggles or a rare event.

Of course, suppose you see increases in income or profitability increases across the board. In that case, that might indicate the company is expanding its operations and taking market share from its peers. They are making it more attractive to investors.

Common size analysis is also a great tool to use across companies of different sizes in the same industry, like the chart we created above. Looking at the financials can reveal their strategy and their highest costs that might give them a competitive edge over their peers.

For example, Square might be sacrificing margins to gain more market share, which would increase its revenues at the expense of profits. Many companies embrace this strategy to attract investors to the big revenue increases, which helps increase their market size. At some point, they will have to move towards profitability, but the growth strategy does work.

A great exercise to see how a company grows from a growth strategy to profitability is to look at the early days of Amazon (AMZN). Looking at the company’s common size analysis will give you insight into the company moving from serious growth to merely amazing growth. Kidding aside, you can see them move from gross profits to operating profits to bottom line profits. It is an amazing journey.

Pros and Cons of Common Size Analysis

Common size analysis is a great tool to analyze any company, but there are some pluses and minuses to this analysis. Let’s look at a few of them, starting with the pros:

- Easy to understand – it is easy to identify different aspects of a business and create a model to understand how efficiently the business creates operating profit.

- Helpful for analysis over time – it helps investors analyze performance over time and pick out any trends, good or bad.

- Comparisons at a glance – investors can quickly scan a company’s financials and see any trends, plus how the company is executing its operations.

- Helpful in comparing across financial statements – using common size analysis helps investors see how efficiently the company uses its assets to create revenue or how its liabilities drive its costs.

Now, let’s move on to some cons of using common size analysis:

- Changes in prices – Common size analysis doesn’t account for any changes in prices and its effect on price-based ratios such as P/E. Or the impacts on inflation or historical changes in pricing and market cap.

- Consistency – any changes in accounting or not using the same terminology, can make the use of common size analysis more difficult or unclear.

Investor Takeaway

Using common size analysis helps investors pick out any trends, good or bad, and further investigate to uncover what is driving those trends. It is a great practice to create a spreadsheet that allows you to conduct a common size analysis on your investigation.

Remember that, like any analysis, common size analysis is not perfect. Common size analysis is not likely to give us a complete, clear picture of a company. Rather, it is a tool in our toolbox to help us find a clearer picture. Investors should use common size analysis in the context of complete financial statement analysis, such as we tried to do with PayPal, excluding the cash flow statement.

Bottom line, common size analysis helps investors and analysts make better decisions.

Disclosure: Intrinsic Value Formula is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of ...

more