How To Trade When The Wall Of Worry Is Up

When markets go higher during a time when they are not supposed to, they are said to be climbing a wall of worry. It’s an odd phenomenon to watch markets behave bullishly for no good reason. However, consider how uncertain the future is. If markets are going up, you will join (while managing risk appropriately). Making money is all that matters.

So here we are, well over a year into a bear market. Making money in a bear market is doable – but it is hard. It’s far easier to lose money in a bear market, simply because the markets suffer from such wild swings. So now you see the markets moving consistently higher – finally – and you want to be back in the game. I don’t blame you.

But then there’s reality.

This is why the wall of worry is up

It’s difficult to find the confidence to add money to your trading accounts when it appears the general consensus on the economy is bearish (or not positive). Higher inflation, higher interest rates, and global recessionary fears are weighing on the minds of investors around the world. This is why the wall is up.

Yet, when confronted with these potential and real problems the stock market continues to climb. And for those who have not accepted the principle of the wall of worry, the market goes up without them on board.

That can be problematic. When you finally realize it is time to get on board, it may be too late. As Murphy’s law states, “Anything the can go wrong, will go wrong.”

So how do you trade in this situation?

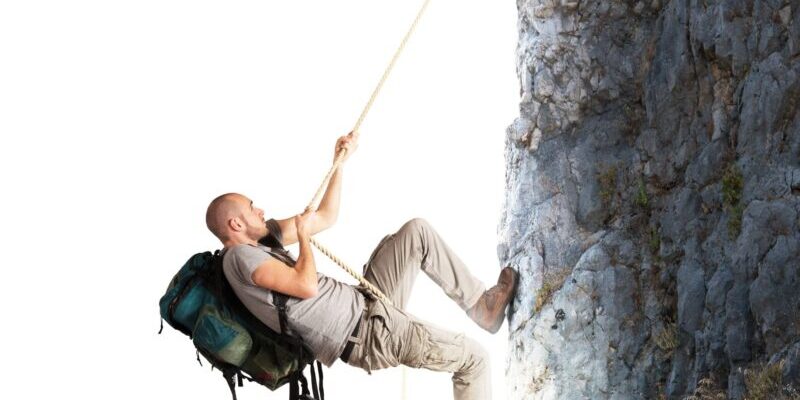

Nobody knows when the party may end. As Keynes once said, “Markets can remain irrational longer than you can remain solvent.” When the wall of worry is up, grab a rope and climb it. Be ready to take profits when you have them. When the music is over, you don’t want to be the one holding the bag.

More By This Author:

Resistance And Support Levels Can Help You Understand Trends

Netflix - Chart Of The Week

Beware Of Media Influence On Sentiment

Disclaimer: Explosives Options disclaims any responsibility for the accuracy of the content of this article. Visitors assume the all risk of viewing, reading, using, or relying upon this ...

more