How To Spot The Market Bottom Using Wyckoff Method And Market Breadth

Image Source: Unsplash

There has been a lot of speculation about a market capitulation in the last three weeks since S&P 500 Futures (ES) fell below the key support at 4100. Based on the market rotation out of the most defensive sector in 2008, this could certainly be one of the scenarios for establishing a market bottom.

However, a trader should always listen to the market and act accordingly no matter what opinion he/she has because the market has the final say.

Based on the price action from the past 2 weeks, S&P 500 exhibited bullish characteristics as there was accumulation on the way down stopping the downward movement. The final confirmation was on last Thursday and Friday when S&P 500 had bullish momentum committed above the key level at 4150, as shown below.

(Click on image to enlarge)

S&P 500 broke out from the down channel and this was considered as a Wyckoff change of character, which signaled a change in the trading environment from the downtrend from April 2022 to at least a trading range (or a reversal to the upside). Since S&P 500 is no longer in a downtrend, a capitulation scenario is not anticipated (at least for now). So far, threatening supply was not observed hence S&P 500 is expected to trend higher to test the supply zone near 4300 (annotated in the green circle).

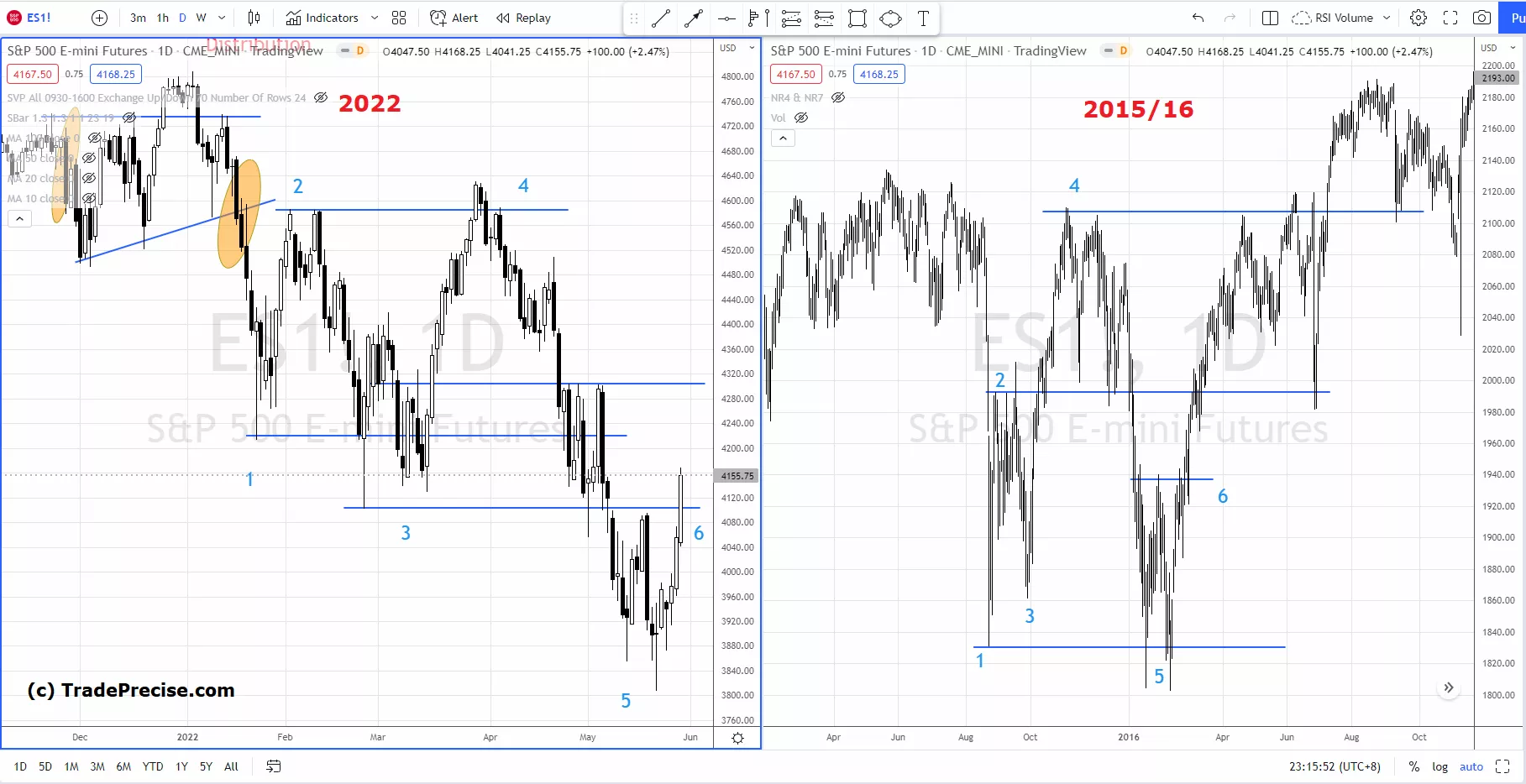

Could the low from May 2022 mark the market bottom? Since there is no capitulation, it is useful to refer to the analog from 2015/2016 where there is a similarity to the current market in 2022, as shown below:

(Click on image to enlarge)

Watch the video below to find out what the price structure of the S&P 500 could look like if the low in May 2022 marked the market bottom without the market capitulation based on Wyckoff trading method using an analog comparison from 2015/2016. Apart from the price structure, a key level is to be established in the market breadth for a healthy and sustainable uptrend, as shown in the video below.

Video Length: 00:26:01

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.

Thanks, this was helpful.