How To Profit From The AI Revolution

Artificial Intelligence (AI) is the current major theme for the markets. With economically related companies (TGT, X, etc) showing lower returns, investors are piling into AI as the next major source of growth for corporate top lines (revenues) and profit margins (presumably AI will replace many employees which will lower operating costs).

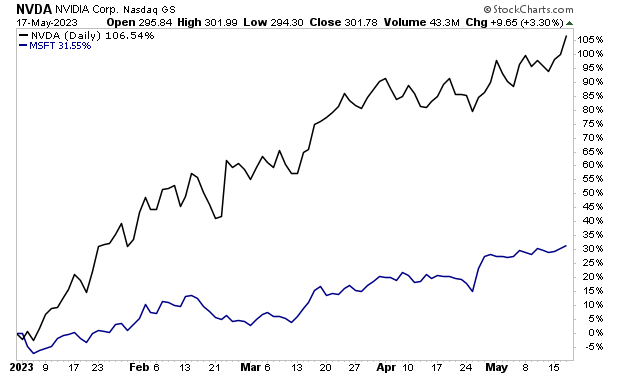

As far as market price action is concerned, anything associated with AI is in a strong uptrend. The most notable example is Nvidia (NVDA) which has more than doubled year to date. Even the multi-trillion dollar market cap giant Microsoft (MSFT) has caught a bid due to its exposure to AI. MSFT is up 30% year to date.

AI is THE market mover for 2023. Societe General has noted that AI-associated stocks account for ALL of the gains in the broader stock market this year. Put another way, without the influence of AI as an investment theme, the S&P 500 would be DOWN this year.

Indeed, things are becoming so frothy as far as AI is concerned that executives are mentioning AI as frequently as possible during earnings calls… even if their company has little if any exposure to the new technology!

What does this all mean?

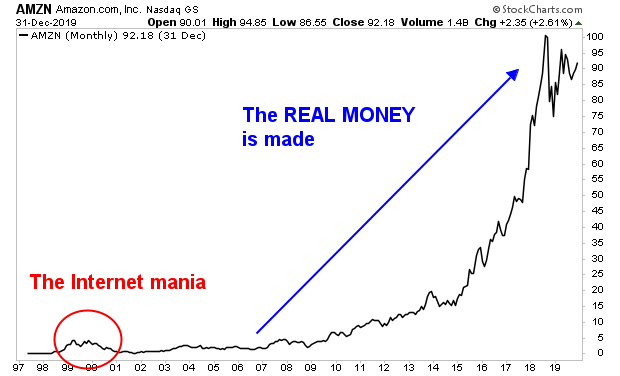

AI is yet another “game changer” technology being touted by Wall Street. It, like the internet in the ‘90s, the “cloud” in the mid 2010s, and even crypto in the last five years is a novel item, the impact of which is difficult to quantify. We are currently in the “froth” stage in which everyone is manic about this idea. The REAL money will appear when the key players who will go on to dominate this trend emerge.

Consider what happened with the internet bubble in the 1990s.

At that time, anything associated with e-commerce or internet exposure exploded higher. However, the REAL money came in the years AFTER the bubble burst as Amazon (AMZN), and other internet market leaders emerged.

See for yourself.

So if you feel like you’ve “missed the boat” in AI, do not be alarmed. This is the mania phase: the phase in which everyone is trying to align themselves with a trend in order to score some easy price appreciation.

The REAL money will appear when this passes and the true market leaders in AI emerge.

More By This Author:

Signs Of A Recession Are GrowingHow To Tell If Your Bank Is In Trouble

What Happened Yesterday… And Why Regional Banks Are In Trouble

The $NVDA profits are already pretty much baked in - already up 161% from 52-wk low.