How To Manage A Profitable Stock Trade That Suddenly Reverses Lower

Knowing the correct point to buy a stock is obviously an important factor for your trading success.

But having a rule-based strategy for taking profits is even more crucial.

Without such a firm plan, profitable trades can quickly turn to losers and big winners can be sold too quickly.

Silvergate Capital (SI) Trade Review: The Buy Setup

Silvergate Capital (SI), a bank focused on cryptocurrencies, first caught our attention when it broke out from a five-month base of consolidation back in October.

After moving above resistance of the consolidation high, a strong rally pushed the price above the 10, 20, and 50-day moving averages on increasing volume (bullish).

As such, the powerful price and volume action during the advance made it a no-brainer to add SI to our portfolio Watchlist to monitor for a low-risk buy point.

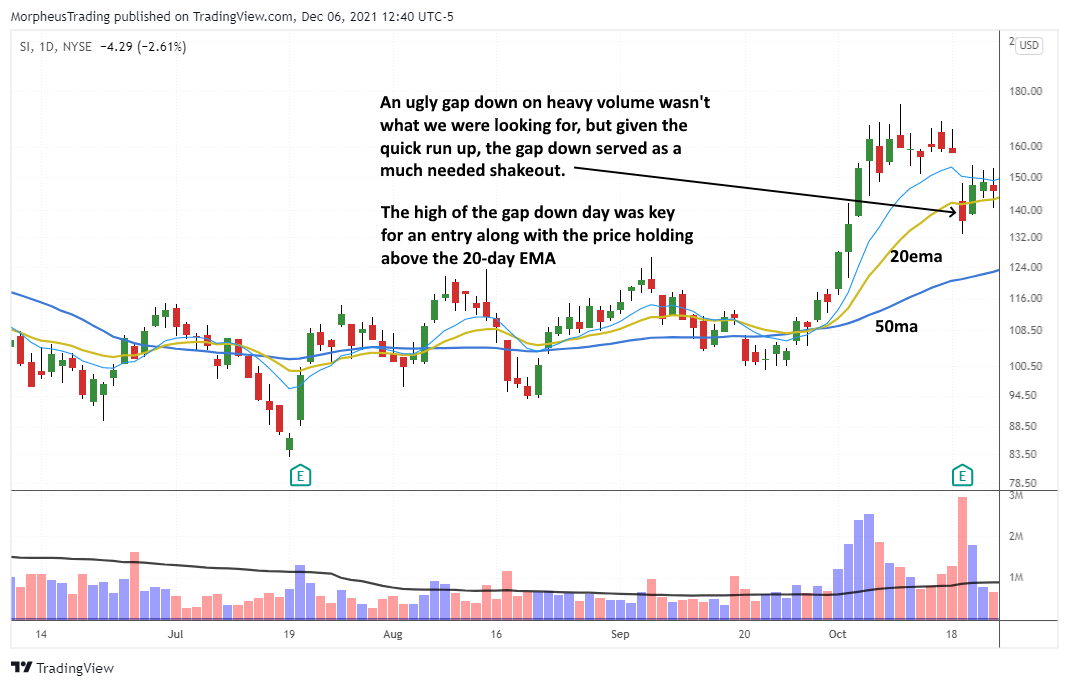

The daily chart below shows the initial breakout above the base on higher volume:

(Click on image to enlarge

After the initial breakout, SI entered into a choppy, sideways range for a week, then gapped significantly lower with higher volume on October 19.

The gap down also put the price back below support of the 10 and 20-day exponential moving averages.

Overall, this was not the type of constructive price action we look for with a pullback entry.

However, the gap down absorbed overhead supply by shaking out the bulls who caught the initial run-up and pause below 170.

After the pullback, we closely followed the price action over the next few days to see if SI would be able to reclaim its 20-day EMA (a sign of strength).

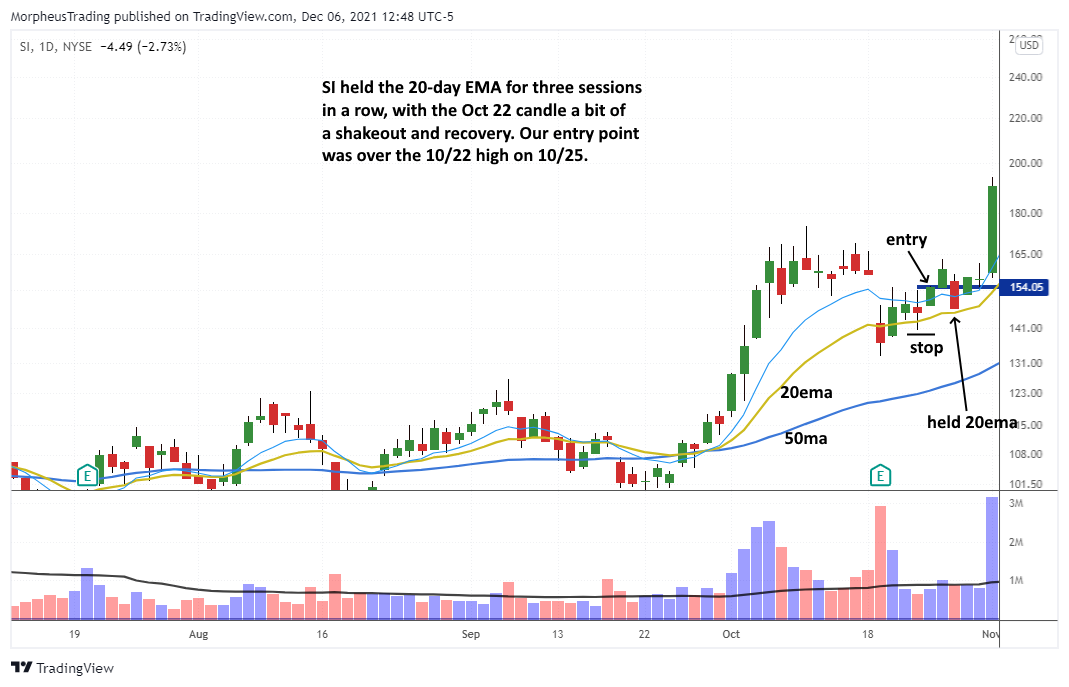

The October 19 gap down and subsequent reversal back above the 20-day EMA is shown below:

(Click on image to enlarge)

As shown above, SI closed back above its 20-day EMA just one day after breaking below it on the gap down.

Then, the price convincingly held above the 20-day EMA (on a closing basis) over the next few days.

Entry Strategy

Based on this swift recovery from the pullback, we alerted subscribers of our stock trading report on October 22 that we were buying Silvergate shares above the prior day’s high.

Our protective stop was placed beneath the the October 22 low–about 8% below our entry price (not too wide for a fast mover like SI)

Our trade initially ran into a bit of trouble when the price reversed lower three days after entry, but Silvergate held above its 20-day EMA on October 27.

Then, SI reclaimed the 10-day EMA the very next day–a bullish sign:

(Click on image to enlarge)

Bullish momentum started kicking in in early November, causing SI to explode higher above our buy point.

With the broad market also in rally mode, we believed Silvergate had a decent shot of running to the 300 area.

Exit Strategy

After a few days of light volume chop from November 4 to 8, a failed breakout attempt on November 9 caused SI to close with an ugly reversal candlestick.

Because the November 9 closing price was so close to the 10-day EMA, we decided to use a break below the 10-day EMA as our selling guide (since we were looking to ride SI for a bigger gain).

SI subsequently closed below its 10-day EMA the next day, causing us to exit the position with a solid +23% gain over a three-week holding period.

The combination of the price closing below the 10-day EMA and our desire to protect a +20% gain factored heavily into our decision to sell.

The chart below shows the bearish reversal that prompted us to sell and lock in the +23% gain:

(Click on image to enlarge

Analysis: The Takeaway

In hindsight, our exit point was not ideal because we were forced to make a tough decision–give an explosive mover enough breathing room to run vs. giving back too much of our gain.

As a general guideline, we do not want to give back more than 50% of our maximum percent gain when holding a position for a bigger advance (not a short-term swing).

In this case, our maximum gain in SI was +40%.

Accordingly, we followed our proven trading strategy and sold to lock in the +20% gain.

Over the years, we have found this trading rule helps us avoid becoming so caught up in price action that we forget to protect profits.

If this has ever happened to you, now is the perfect time to establish a similar rule for taking profits and follow it.

Ideally, we aim to sell into strength and/or use a trailing stop to maximize gains before giving back 50% of our maximum profit.

Still, sometimes it’s easy to get caught up in a sharp pullback–especially with fast-moving stocks.

Simple rules for profit taking consistently keep you out of trouble and position you for long-term trading success.

Disclaimer: Past results are not necessarily indicative of future results. There is a high degree of risk for substantial losses in trading securities. All data and material on this website ...

more