How To Invest In "Magic Mushrooms" (Psychedelics)

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

This article explores psychedelics as stock market investment opportunities and identifies alternative strategies on how to invest.

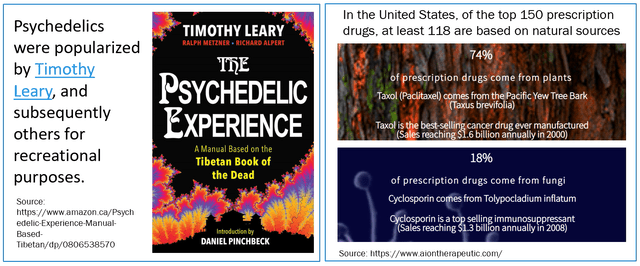

Magic mushrooms is the colloquial for mushrooms that contain hallucinogens. These psychedelics are mainly LSD (lysergic acid diethylamide), ketamine, psilocybin, psilocin, and MDMA (3,4-Methylenedioxymethamphetamine, commonly known as ecstasy, E, or molly).

Psychedelics are not new for either recreational or therapeutic purposes. They have been used for thousands of years, as described in The History of Psychedelics: A Timeline of Psychedelic Drugs.

They do not appear to be a replacement to alcohol or cannabis; rather, they are an additional option for people to self-medicate – with a specific result that is inconsistent with the use of the mentioned alternatives. From The most convincing argument for legalizing LSD, shrooms, and other psychedelics:

When people take a potent dose of a psychedelic, they can experience spiritual, hallucinogenic trips that can make them feel like they're transcending their own bodies and even time and space. This, in turn, gives people a lot of perspective — if they can see themselves as a small part of a much broader universe, it's a lot easier for them to discard personal, relatively insignificant and inconsequential concerns about their own lives and death.

That may sound like pseudoscience. And the research on hallucinogens is so early that scientists don't fully grasp how it works. But it's a concept that's been found in some medical trials, and something that many people who've tried hallucinogens can vouch for experiencing. It's one of the reasons why preliminary, small studies and research from the 1950s and '60s found hallucinogens can treat — and maybe cure — addiction, anxiety, and obsessive-compulsive disorder.

The legal status of psilocybin mushrooms varies world-wide. It has been legalized in Brazil, Peru, and some other countries; it is partially decriminalized in Canada and parts of Europe.

At this juncture, Oregon has led the decriminalization among the U.S. states. There has been progress in the use and legalization of psychedelics, and this is expected to be a major catalyst for growth.

In the U.S., a wave of state legalization (for at minimum, therapeutic purposes) is anticipated. From First, It Was Weed -- Now, Voters Have a Chance for Legal Psychedelics:

At this point, there’s no question: researchers, investors, and stakeholders agree that psychedelics will be legal as pharmaceuticals in the next decade. The FDA has already granted both MDMA, the base drug of Ecstasy, and psilocybin, one of the primary psychoactive components in magic mushrooms, “breakthrough therapy status,” putting them on the fast-track to legality as medications for mental health.

One of many examples is that there is a Bill to legalize psychedelics in California to get full Senate vote:

Sponsored by Sen. Scott Wiener (Dem.), SB519 would legalize personal possession and use of psychedelic medications such as LSD, ketamine, psilocybin, and MDMA for those 21 and over.

The “Globe and Mail” reported that Psychedelics are Gaining Traction as Therapies and Medicines:

NEW YORK , Feb. 11, 2021 /PRNewswire/ -- The psychedelic drug market continues to follow a similar path to the cannabis segment. It is now slowly getting more attention from investors as the stigma surrounding psychedelic drugs fades. In particular, the growing acceptance of using psychedelics to treat various mental disorders such as depression is actually fueling market growth. Recently, a total of three breakthrough therapy designations have been awarded by the FDA to psychedelic assisted therapy clinical trials for psilocybin and MDMA.

Celebrities have been endorsing the use of magic mushrooms (11 Celebrities Whose Lives Were Changed by Psychedelics), sharing how their lives were changed for the better.

With the positive trend of recreational and medical cannabis use, there is a parallel growing acceptance for the use of restricted, non-traditional drugs for therapeutic and non-medical use. Psychedelics appear to be the next cannabis growth opportunity in the stock market. There are various articles and estimates, with some variation in the numbers, and Psychedelic Drugs Market Projected to Reach $6.85 Billion by 2027 is a good example:

The psychedelic drugs market is projected to grow at a CAGR of 16.3% over the next eight years to reach $6.85 billion by 2027, according to Data Bridge Market Research. The key factors that will fuel this growth include the increasing prevalence of depression and other mental health disorders in the U.S. and a growing acceptance of psychedelic drugs for the treatment of depression.

The question for investors is how to participate in this emerging trend. We will explore 4 alternatives:

- North American Psychedelics Index

- Magic Mushroom Stocks

- Abbvie and/or Johnson & Johnson

- Buy an industry leader - Mind Medicine and/or Compass Pathways

Option 1: North American Psychedelics Index

The North American Psychedelics Index is not a "pure play" for psychedelics. It includes Abbvie (ABBV); Johnson and Johnson (JNJ) – which are obviously not exclusively psychedelic stocks; some technology-oriented psychedelic companies; a hashish stock, a drug repurposing stock, Algernon (AGNPF), which does have some psychedelics exposure, but it is not exclusively so; among others.

The holdings and proportions of the Index:

Source: Solactive | Indices

It can be purchased through HORIZONS PSYCHEDELIC STOCK INDEX ETF (Horizons ETFs - PSYK) (HPSYF) (Canada: PSYK) - which tracks the NA Psychedelics Index.

The advantage is the lower risk associated with larger-capitalization stocks; diversity of business models of the companies in the fund; and diversification of investment. The disadvantages include the very-small capitalization of the fund ($60M CAD; note: the market price at the time of writing is approximately equal to the NAV); it includes securities that may not interest investors; and, the fund price may not move in a correlated way with the improving prospects of magic mushrooms. For example, the legalization of recreational psychedelics may have little impact on Abbvie’s share price, but hugely impact that of some of others.

I thought that it may be useful to examine HORIZONS PSYCHEDELIC STOCK INDEX ETF vs. the pure play components of the fund starting from the fund's early 2021 inception. Although the fund performance is -12%, it is hard to tell if there is a direct correlation with the underlying 7 pure play psychedelic stocks.

Option 2. Magic Mushroom Stocks

Identified in the following table, are many of the pure play magic mushroom stocks with a brief description. It is possible that some investor favorites are absent – my apologies, but it was difficult to define a comprehensive list of exclusively psychedelic stocks. Please feel free to identify others in the comments (with supporting additional information and your disclosure), for everyone to benefit.

The strategy is that one could buy a few small positions, in areas that have great potential.

|

Company/(US Ticker) |

CDN Ticker |

Description (from various public sources and CIBC Investors Edge) |

|

Aion Therapeutic (OTCPK: ANTCF) |

AION |

A life science company focused on the research and production of medical cannabis and psychedelic-based therapies made from natural plants including mushrooms and fungi. |

|

Champignon Brands - Braxia Scientific (BRAXF) |

BRAX |

The Company focuses on owning and operating multidisciplinary clinics providing treatment for mental health disorders and research activities related to discovering and commercializing drugs and delivery methods. The Company develops ketamine and psilocybin derivatives and other psychedelic products from its Internet protocol (IP) development platform. It also operates multidisciplinary community-based clinics offering treatments for depression. Its treatments include Intravenous (IV) Ketamine, Intranasal (IN) Esketamine and Oral Ketamine Tablets. |

|

COMPASS Pathways PLC (Nasdaq: CMPS) |

No CDN ticker |

The Company is focused on developing treatments for people suffering with mental health challenges. It is initially focused on treatment-resistant depression (TRD). It is developing COMP360, a polymorphic crystalline formulation of psilocybin. Its COMP360 psilocybin therapy comprises administration of its COMP360 with psychological support from specially trained therapists. |

|

Clearmind Medicine Inc. (No U.S. ticker) |

CMND |

Clearmind Medicine Inc is a psychedelic medicine biotech company focused on the discovery and development of novel psychedelic derived therapeutics to solve widespread and under-served health problems including alcohol use disorder. |

|

Cybin Inc. (CLXPF) |

CYBN |

Cybin is focused on progressing psychedelic therapeutics by utilizing proprietary drug discovery platforms, innovative drug delivery systems, novel formulation approaches and treatment regimens for psychiatric disorders |

|

Nutritional High International (OTCPK: SPLIF) |

EAT |

The Company is focused on developing and manufacturing products in the cannabis industry, with a specific focus on edibles and oil extracts for medical and adult recreational use. It is focused on identifying, acquiring and developing brands for its cannabis infused product lines. The Company offers FLI branded products, including cannabis oil vape cartridges, syringes, and other oil products, as well as FLI branded cannabis infused chocolates. The Company, through Psychedelic Science Corp, develops health and wellness products and performs research on the therapeutic effects of psychoactive and non-psychoactive plant-based compounds. The Company operates manufacturing facility in Oregon. |

|

Entheon Biomedical Corp (ENTBF) |

ENBI |

Entheon Biomedical Corp is a biotechnology research and development company committed to developing and commercializing a portfolio of safe and effective Dimethyltryptamine based psychedelic therapeutic products (DMT Products) for the purposes of treating addiction and substance use disorders. |

|

Field Trip Health (OTCQX: FTRPF) |

FTRP |

Through its Field Trip Discovery, the Company develops psychedelic molecules and conducts research on plant-based psychedelics. Field Trip Discovery focuses on developing medicines targeting the serotonin 5HT2A serotonin receptor. It is also focused on developing Field Trip Health hubs for psychedelic therapies. Field Trip Health hubs are psychedelic-assisted psychotherapy centers across North America. Through its Field Trip Digital, it builds the digital and technological tools to support psychedelic experiences and consciousness expansion. The Company provides Trip, which is an iOS and Android application for consciousness expansion. |

|

HAVN Life Sciences (OTCPK: HAVLF) |

HAVN |

The Company is engaged in the business of the research and development of psychopharmacological products, including the formulation of standardized psychoactive compounds derived from fungi. It operates through two divisions: HAVN Labs and HAVN Retail. HAVN Labs division is focused on development and formulation of regulated and novel psychoactive compounds. HAVN Retail division is focused on formulating and selling natural health products (NHPs) using compounds. The product lines of HAVN Retail include HAVN Immunity, HAVN Cognitive, HAVN Stress and HAVN Energy. Its formulations are being designed to target receptors and enzymes to support immune regulation, support the regulation and release of neurotransmitters that support mental cognition, to reduce stress response and to support mental energy. |

|

Lobe Sciences (OTCPK: GTSIF) |

LOBE |

The Company focused on the application of psychedelic medicines for mental health treatments. It is engaged in the development of transformational medicines and devices as its build a portfolio of intellectual property to support wellness and improve mental health. It focuses on clinical development of devices and the use of psychedelic medicines to treat specific indications and brain traumas. |

|

Mind Cure Health Inc. (MCURF) |

MCUR |

Mind Cure Health Inc is a mental health and wellness company. The company is focused on the development, manufacture, and distribution of a branded line of organic, functional mushroom extracts. Its products are marketed under the Moonbeam Brand. |

|

Mind Medicine (MNMD) |

MMED |

The Company discovers, develops and deploys psychedelic inspired medicines to improve health, promote wellness and alleviate suffering. The Company addresses the opioid crisis by developing a non-hallucinogenic version of the psychedelic ibogaine. |

|

Mydecine Innovations Group (OTCPK: MYCOF) |

MYCO |

The Company is focused on the research, development and acceptance of alternative nature-sourced medicine. Its portfolio of companies includes Mydecine Health Sciences (MHS), Mindleap Health Inc. (Mindleap) and NeuroPharm, Inc (NPI). MHS is focused on developing fungtional mushroom products and psychedelic medicines for the consumer and professional healthcare market. NPI is a veterans-focused healthcare company that is developing pharmaceutical and natural health products for mental wellness in vulnerable populations, including veterans, emergency medical services (EMS) personnel and other high-risk constituencies. NPI is developing psilocybin-assisted psychotherapy to treat chronic post-traumatic stress disorder (PTSD). Mindleap offers a digital health platform that enables people connect with mental health specialists, who can help them to develop habits for a healthy mind. |

|

NeonMind Biosciences (NMDBF) |

NEON |

Engages in the discovery, development, and commercialization of medicinal and psychedelic mushrooms for mental illnesses. It is developing psilocybin-based products comprising mushroom-infused products and other mushroom-infused products to treat weight loss and management. It manufactures Medicinal Mushroom products under the brand NeonMind which are for sale through e-commerce on its website. It is also in the early stages of development of a product with the goal of using such product to promote and cause weight loss using a compound found in psychedelic mushrooms. |

|

Numinus Wellness (OTCPK: LKYSF) |

NUMI |

The Company, through its subsidiary Salvation Botanicals Ltd, has a Health Canada cannabis testing license and dealer’s license. The testing license allows the Company to test and analyze cannabis products from licensed producers, and the dealer’s license allows the Company to test, possess, buy and sell methylenedioxymethamphetamine (MDMA), psilocybin, psilocin, dimethyltryptamine (DMT) and mescaline. Numinus also operates a stand-alone center offering patients integrative health solutions. |

|

PharmaTher Inc (PHRRF) |

PHRM |

PharmaTher Inc. is a specialty life sciences company focused on the research and development of psychedelic pharmaceuticals. PharmaTher repurposes psychedelic pharmaceuticals, such as ketamine and psilocybin, for FDA approval to treat disorders of the brain and nervous system. |

|

Better Plant Sciences (OTCQB: VEGF) |

PLNT |

Develops and acquires intellectual property and other assets related to plant-based products and therapeutics, and develops, manufactures, markets, sells and distributes plant-based products. Its subsidiary, NeonMind Biosciences Inc., offers a line of medicinal mushroom products and is engaged in developing intellectual property in the area of psychedelic medicine. The Company has approximately 200 wellness formulas. Its subsidiaries include Urban Juve Provisions Inc., Wright & Well Essentials Inc., UJ Beverages Inc., Yield Botanicals Inc, Thrive Activations Inc, W&W Manufacturing Inc. and Jack n Jane Essentials. |

|

Seelos Therapeutics (Nasdaq: SEEL) |

SEEL |

Clinical-stage biopharmaceutical company. The Company is focused on developing technologies and therapeutics for the treatment of central nervous system, respiratory disorders. The Company is engaged in developing its lead programs SLS-002 and SLS-006. The Company is also engaged in developing several preclinical programs, which include SLS-008, SLS-007 SLS-010 and SLS-012. SLS-002 is intranasal racemic ketamine with two investigational new drug applications (INDS), for the treatment of suicidality in post-traumatic stress disorder (PTSD), and in depressive disorder. SLS-006 is engaged in advancing their product candidate into late stage trials as a monotherapy in early stage Parkinson's disease patients, and as an adjunctive therapy with reduced doses of Levodapa (L-DOPA). SLS-007 is a peptide-based approach, targeting the nonamyloid component core (NACore). |

|

New Wave Holdings (OTCPK: TRMNF) |

SPOR |

The Company’s psychedelic sector is focused on active psychedelic compounds, functional mushroom product lines, and to develop a portfolio focusing on psilocybin, lysergic acid diethylamide (LSD), methylenedioxymethamphetamine (MDMA), and ketamine derived treatments for neuropsychiatric diseases. |

|

Thoughtful Brands (OTCQB: PEMTF) |

TBI |

The Company is focused in the cannabidiol (CBD) and psychedelic medicine sectors. It is an electronic commerce technology company that researches, develops, markets and sells natural health products in North America and Europe. Through its direct-to-consumer digital platform, the Company offers hemp-CBD brands, including Nature’s Exclusive and Sativida. The Company sells a CBD hemp-oil formulation derived from hemp grown and formulated in the United States through its Nature’s Exclusive brand. Nature’s Exclusive offers a range of products using CBD hemp-oil, which include CBD oil drops, CBD gummies, CBD pain relief cream and CBD skin serum. In Europe, its Sativida brand of organic CBD oils and cosmetics are sold throughout Spain, Portugal, Austria, Germany, France, and the United Kingdom. |

|

Red Light Holland (OTCPK: TRUFF) |

TRIP |

The Company is engaged in the production, growth and sale of its brand of magic truffles to the legal, recreational market within the Netherlands. |

|

HORIZONS PSYCHEDELIC STOCK INDEX ETF (HPSYF) |

PSYK |

The ETF seeks to replicate, to the extent possible and net of expenses, the performance of a market index that is designed to provide exposure to the performance of a basket of North American publicly listed life sciences companies having significant business activities in, or significant exposure to, the psychedelics industry. Currently, the ETF seeks to replicate the performance of the North American Psychedelics Index, net of expenses. |

Source: Various publicly available descriptions and CIBC Investors Edge (subscription based)

Vancouver, Canada is the psychedelics research and development hub, so most U.S. exchange listings are Over the Counter (OTC), except for Seelos Therapeutics (Nasdaq: SEEL), Compass Pathways PLC (Nasdaq: CMPS), and Mind Medicine (MNMD), which trades on both Canadian and U.S. markets. As most stocks are primarily Canadian listed, all values, charts, and other info that follows are in Canadian Dollars (CAD) – except for Seelos and Compass Pathways, which are in USD.

One cannot easily assess these stocks by typical measures, such as Price/Earnings ratio or EBITA, as there is a near-universal absence of Earnings. These (microcap) stocks are in their formative stage, with assets described by Goodwill and Intellectual Property (which for psychedelics, are molecules).

There may be profit opportunity, but it would not be from a traditional business model, with sales and cashflow – none of these companies saw material positive cash flows, operating income, or net income.

Source: Author

Although this table is sorted by 1-year relative performance, and there are gaps in the data (in fact, many of these missing ratios are infinite positive or negative values), we can reach a few conclusions:

- Bigger is better

- Being a member of the index is better

- No stock is profitable

- Few stocks have any revenue, and if so, they are miniscule values

Another view is the security price relative to 52-week lows and highs. Again, the market cap is highly correlated with increase over the low, and proximity to the high.

Source: Author

Investors may want to focus on the top-tier companies (in this case, market caps greater than $50 million are in the top 50%). It is hard to compete against those which have scale. As with any sector, winners will probably continue winning.

Small companies will be challenged to succeed and grow, from at least a recreational drug perspective, and probably for prescription drugs, as well. With a few exceptions (notably, Red Light Holland), there has been little branding and brand recognition. This makes it difficult to create an image associated with lifestyle, quality, and consistency.

Option 3: Abbvie and/or Johnson & Johnson

Currently, J&J and Abbvie are participating, but have not committed substantially to psychedelics. Abbvie gained a stake in the psychedelic drugs market through the acquisition of Allergan PLC, and J&J pursues development through their Janssen subsidiary. Should these or other Consumer-Packaged Goods and Pharma behemoths become serious about owning the (recreational and/or pharma) psychedelics market, the Canadian companies would be challenged to compete.

Johnson & Johnson provides a compelling example – it has a huge array of brands in consumer, food, medical, and cosmetic, products. J&J brands include many household names.

Source: https://www.veganrabbit.com/brands/johnson-and-johnson/

As reported in Psychedelic Drugs: Lessons From Ketamine and Psilocybin - Psychiatry Advisor, on March 5, 2019, about Janssen Pharmaceuticals - a subsidiary of Johnson & Johnson (JNJ):

… esketamine nasal spray became the first Food and Drug Administration (FDA) approved psychedelic treatment for a psychiatric disorder. The approval of intranasal esketamine has been widely heralded as one of the most exciting developments in psychiatry, opening up a new potential treatment for patients with refractory depression.

A market cap of $432 billion USD provides J&J with an insurmountable advantage of cash, global reach, brand recognition, and experienced talent, to compete with Canadian $100 million market cap companies. Their ability to build brands and dominate markets can easily be extended to psychedelics.

This suggests that there is great urgency for the incumbents to gain product approval and occupy their own niches. They will not have the capital, resources, time, or the brands to compete in the U.S. market, so must be first to establish a reputation in their respective spaces. The Canadian companies will need a U.S. strategy and/or partnerships with U.S. players, and the mega-caps can afford to wait until winners emerge, and supportive legislation is in place.

History dictates that the investor base is awaiting recreational and broader therapeutic legalization, and institutional capital, to help identify the winners in the psychedelics space. This is what happened with cannabis. If magic mushrooms remain illegal in many states, there will be strong barriers to entry in the U.S., which will permit the Canadian R&D-oriented companies to flourish.

Should investors choose to buy the smaller psychedelic stocks, the implication is to identify the stocks with smart management, implementing effective strategies to occupy target markets niches. The profit opportunity associated with the smaller competitors is likely much greater than that for the established mega-caps, but the larger companies are a safer investment.

3. Option 4: Buy an industry leader - Mind Medicine and/or Compass Pathways

There are two, 800-pound gorillas - Mind Med and Compass Pathways. Their relatively giant market caps (each representing 1/3 of the $4.5B CAD total market capitalization of these 21 shroom stocks) merits special mention and consideration.

Source: Author

Mind Med has everything going for it: market leader; best in class; focused on a big societal issue of addressing the opioid crisis; strategic management; and excellent communication and promotion.

The share price growth, and promotional success, has led the industry. A well-known investor, Kevin O’Leary, has popularized this security. He was an early investor in Mind Med, so for other investors, the concern may be that much of the Alpha has already been realized.

I suggest that the promoters, early investors, and insiders, have already made the easy money with Mind Med. I am not sure if there is another 7 bagger for this stock in the next year (there was a 700% increase in the last year), or for any other company in the psychedelics line-up. That said, the FDA (U.S. Food and Drug Administration) approval for drugs could provide more lottery-win-sized gains for the shareholders; Mind Med is on the forefront.

Compass Pathways PLC appears to be a more complex story – they provide a complete solution – drug development, treatments, and therapy. With clinics and psychological support from trained therapists, they provide much more than a packaged drug for consumption. This approach – making it a relative giant in the psychedelic medical treatment field – may not be easily transferred to the recreational market. However, their strategy and implementation have placed them in the clinical forefront.

The share price growth has not been as meteoric as for Mind Medicine, but the volatility is much lower.

With an established medicinal therapy beachhead, either Mind Med and/or Compass may want to build additional solutions to other health disorders. Compass Pathways appears better-positioned to introduce complementary medicinal and treatment-oriented solutions, with a network of clinics. It is hard to assess if either is positioned to credibly expand into recreational usage (most likely through acquisition).

Conclusion

Good companies are about strong management working from a foundation of great people and assets, supported by a good business model. Many of these “shroom” companies are a small team of smart scientists with great ideas (encapsulated in Intellectual Property of a few molecules). We have witnessed in other industries that the best technology/idea does not win. Rather, the winners are created by top management assembling the best solution. Some will become huge winners, and most will not. Unfortunately, it is impossible to gauge the management effectiveness of such small and embryonic companies.

From a timeline perspective, this is an industry in its infancy; it will take a few years to be able to differentiate the winners from the losers.

Therefore, how to choose is a question of where you want to be on the risk/return continuum; generally, the higher the risk, the greater the potential return:

Personally, I have followed a higher risk (targeting a higher return), hybrid strategy; Mind Medicine plus two other psychedelic stocks (identified in the Disclosure). All were purchased in the last 6 months, so the results are too soon to tell.

Please share your observations and opinions in the comments section.

Disclosure:

Long ANTCF, TRUFF, MNMD - purchased on Canadian Stock Exchanges.

Also long: Plant-Based Investment Corp. CWWBF (Canadian ticker: PBIC) ...

more