How Safe Is Your Portfolio?

Last week, we received some excellent feedback in response to Monday’s article on calculating a stock’s beta.

So today, I’m going to take this little-known metric one step further by showing you how to manage risk by calculating your portfolio’s overall beta.

You can determine the beta of your portfolio by multiplying the percentage of the portfolio of each individual stock by the stock’s beta and then adding the sum of the stocks’ betas.

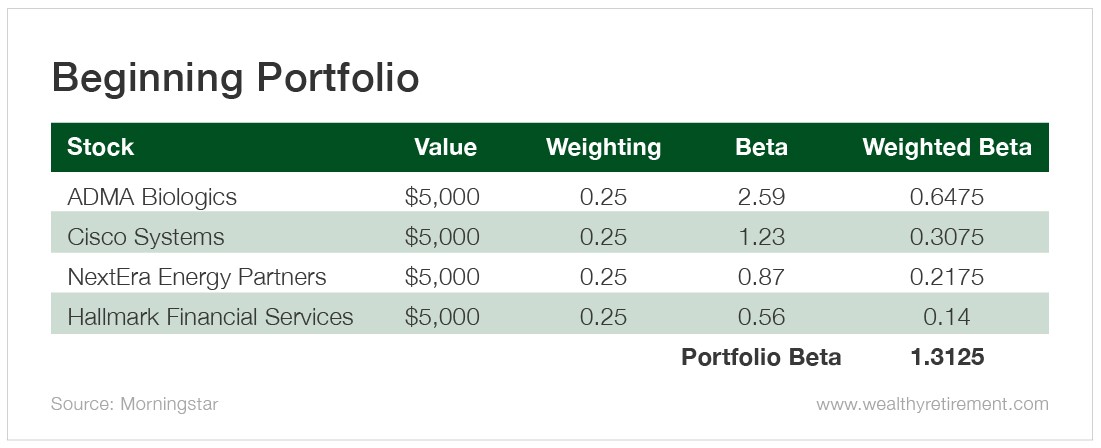

For example, imagine that you own four stocks.

You own ADMA Biologics (Nasdaq: ADMA), a small cap biotech with a 2.59 beta, and Cisco Systems (Nasdaq: CSCO), a networking giant with a 1.23 beta.

Let’s say you also own Oxford Income Letter-recommended NextEra Energy Partners (NYSE: NEP), which has a 0.87 beta, and insurance firm Hallmark Financial Services (Nasdaq: HALL), which sports a low 0.56 beta.

(Remember from last time, a stock’s beta compares its volatility with the overall market’s. The market’s volatility is always 1.)

You own $5,000 of each stock, giving each position a 25% weighting in your portfolio.

So your portfolio is about 31% more volatile than the S&P 500.

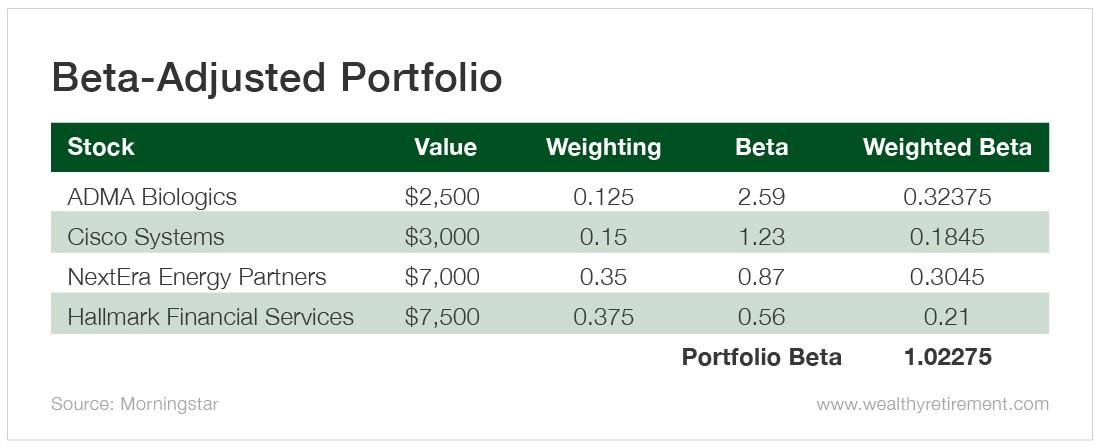

If you wanted to reduce the volatility in your portfolio to bring it more in line with the S&P, you could sell half of your ADMA Biologics and put that money into Hallmark Financial Services.

You could also move $2,000 of your Cisco holdings into NextEra Energy Partners. Let’s look at the portfolio after making those moves.

So you can use beta to reduce or increase your portfolio risk depending on market conditions and your risk tolerance.

A stock’s beta is easy to find. Most large free stock market sites on the internet list beta when you look up an individual stock.

So next time you start getting worried about a big market decline, check your portfolio’s beta to see just how worried you should be and if you need to make any adjustments.

Disclaimer: Nothing published by Wealthy Retirement should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not ...

more