How Safe Is Capital Southwest’s 10% Dividend Yield?

Image Source: Pixabay

It’s been a while since we last looked at Capital Southwest (CSWC) in this column. Four years ago, the stock yielded 8.9% and it was rated “C” for dividend safety. The good news is that the dividend was not cut.

Today, because of dividend increases and a slightly lower stock price, Capital Southwest yields 10%.

Let’s find out whether investors can continue to rely on the double-digit yield.

Capital Southwest is a business development company, or BDC. It lends money to companies that generate between $3 million and $25 million in EBITDA (earnings before interest, taxes, depreciation, and amortization).

Its portfolio companies include…

- Giving Home Health Care, a 13-year-old company that provides care to people who became sick while working for the U.S. Department of Energy

- Intero Digital, a digital marketing company

- Digs Dog Care, which provides boarding and other pet services.

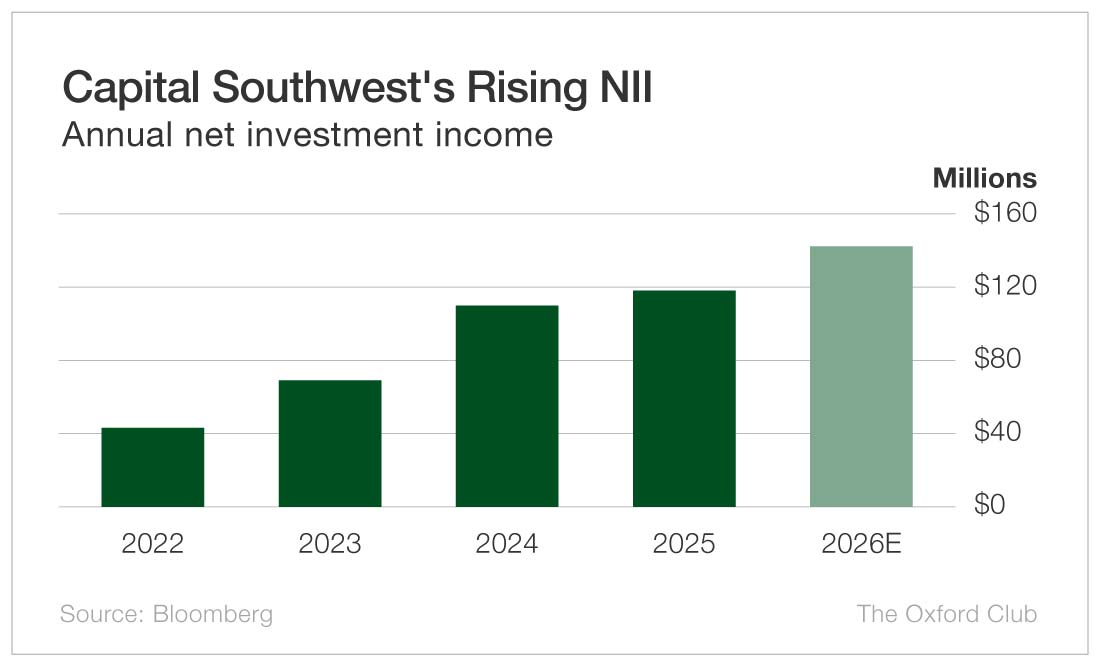

Because Capital Southwest is a BDC, we look at net investment income (NII) as our measure of cash flow.

NII has been steadily increasing for several years and is forecast to continue growing past 2025 as well.

The company’s fiscal year ends in March, so fiscal 2025 numbers are complete. The company generated $118 million in NII in fiscal 2025. The problem is it paid out $125 million in dividends. In other words, it did not generate enough cash flow to pay the dividend.

In fiscal 2026, NII is forecast to rise to $142 million. But the company is forecast to pay $143 million in dividends.

BDCs typically pay out most or all of their NII in dividends – and that’s fine. But when the amount of dividends paid exceeds NII, it’s a problem. That means the company has to dip into cash on hand or raise money to pay the dividend.

We never want to see a company pay out more than 100% of its cash flow in dividends.

Capital Southwest recently switched from a quarterly dividend to a monthly dividend. Additionally, it often pays a special dividend. For the purposes of analyzing the dividend safety, we only look at the regular dividend, because the special dividend is not promised. It’s… well, special.

The monthly dividend is $0.193 per share, which comes out to 10% a year. This was the first time in 10 years that Capital Southwest did not raise the dividend.

Because the company paid out more in dividends than it took in during its last fiscal year and is expected to do so again in fiscal 2026, its dividend has moderate risk.

If Capital Southwest’s total dividend payout comes in below NII when the company reports its full fiscal year results in March, it will receive an upgrade.

Dividend Safety Rating: C

More By This Author:

Did Main Street Capital Keep Its Perfect Rating?Rate Cuts Are Coming… And So Is Inflation

OneMain Financial: A Fresh Look At A Popular 7.3% Yielder