How Long Can You Defer Taxes?

Image Source: Pexels

Although Benjamin Franklin was correct to say “Don’t put off until tomorrow what you can do today“ when it comes to accomplishing great goals, the same logic does not apply to paying taxes. Deferring taxes can lead to substantial benefits that compound over time. And in some cases, you may be able to defer taxes forever.

Consider the difference between a short-term trading strategy and a long-term strategy. Suppose you invested in a hedge fund that earned 8% annualized returns.

Hedge funds typically employ short-term trading strategies. If you’re in a high tax state, your marginal tax rate is probably around 50%. That means your 8% pre-tax return would be more like 4% after tax. Barely above inflation.

So what are your options?

Of course, you want to maximize tax deferred accounts when available. These would include things like 401Ks, IRAs, Roth IRAs, Defined Benefit Plans, etc.

However, if you’re selling a business or realizing a large executive compensation package, most likely you’re going to have a lot of money in taxable accounts. But even there, you have good tax management options.

Suppose you built a diversified portfolio of individual stocks. For wealthy individuals, individual stocks have a significant tax advantage compared to owning funds. The 30-year return of the S&P 500 has been around 10%. If you bought a fund that invested in S&P 500 stocks, you would have had a large gain over time. However, you also would have had a large tax liability.

If instead, you bought a diversified portfolio of individual stocks, some of those stocks would do well and some wouldn’t. Even if the total return were the same, market returns tend to be driven by a small number of big winners. A portfolio of individual stocks gives you the flexibility to sell the losers or mediocre performers to fund your needs rather than sell across the board. Even if there is a gain, you could choose investments that have long-term gains, which is taxed at a lower rate. This minimizes your tax liability.

If you’ve been tax managing an account for a while, eventually you’ll sell your losers and mediocre performers and will be left with positions that have large unrealized gains. However, even there you have options to minimize tax impact and reduce concentration risk.

For example, you could use securities based lines of credit to tap a portion of your equity. This is how many billionaires fund their lifestyle without selling their stock. You could take out a line of credit secured by the stock, letting it continue its potential growth. This could make sense if it were a small portion of your equity and you believe the return potential and tax deferral is greater than the interest rate on the line of credit.

You could also do a variable prepaid forward. This could also be good for reducing concentration risk. A variable prepaid forward allows you to take out an amount of cash now in exchange for a commitment to deliver shares or cash in the future. If it meets the requirements, the cash upfront would not be taxed and the tax can be deferred until the shares are actually sold. And if you pay it back in cash rather than shares, then there is no tax either since there is no sale. You may also have the option to either extend the old contract or do a new contract when the previous one is due, effectively further deferring the tax.

Finally, whether you ultimately pay tax depends on whether you use the money for yourself or pass it on to children or charities. If you ultimately spend your wealth, you can defer taxes and thereby maximize growth, but you cannot avoid them altogether. However, if you pass on your assets, then your heirs get a stepped up basis and you’ve avoided capital gains taxes altogether. For example, you could have held a stock for 30 years, had a massive gain, and owe no capital gains tax as it gets a stepped up basis on death. Likewise, donating appreciated positions to charity also avoids taxes.

Not everything is about taxes though. If you think a company’s fortune has changed and its investment value is going to be impaired, it’s better to pay the taxes and sell at the high value. If you plan to use all your assets for your own enjoyment, then some taxes are unavoidable. It is your money, after all, and using it for your own enjoyment is perfectly reasonable.

Finally, capital gains tax management is a small part of your overall estate planning, tax planning, and financial planning strategy. You will want to make sure everything is aligned to accomplish your goals, concerns, liquidity needs, and risk exposure.

Key Wealth Principles

- A foundation of good habits is more important than fancy techniques

- Invest in quality businesses at an attractive price

- Build a portfolio of good businesses in different industries

- Maintain appropriate reserves and income sources

- Consider your financial circumstances, liquidity and timing needs, goals, tax considerations, and risk exposure

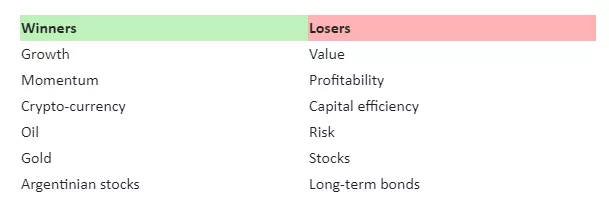

Last Month’s Winners and Losers

Last month saw a rise in long-term interest rates, which hurt the value of long-term bonds as well as stocks. Commodity-like assets such as oil, gold, and crypto were positive while growth and momentum did better than other styles within the realm of stocks. Overall, this would suggest fears of persistent inflation.

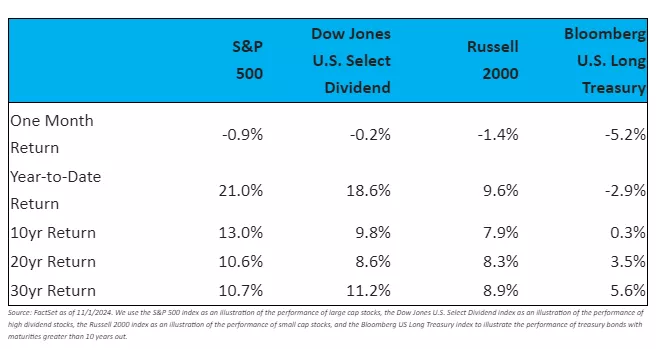

Stocks

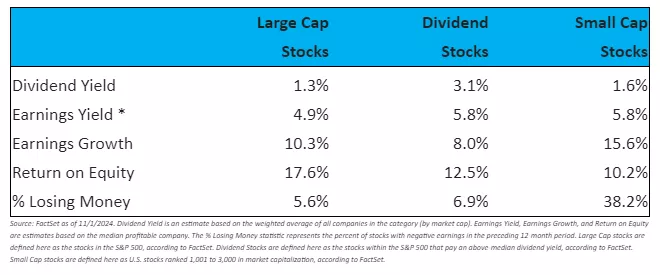

Despite all the worries over the last couple years, the stock market has been well above the long-term average return of 8-10% this year, at least among the large U.S. companies that dominate the S&P 500. Small cap stocks have been more in line with the historical averages. Stocks have done notably better than long-term bonds due to the rise in long-term interest rates hurting the value of bonds.

Going forward, returns depend on a combination of economic growth, corporate profitability, and valuation. Valuation is reasonable for most stocks, but in bubble territory for large cap growth stocks. It would be prudent to take that into account in your allocations between different classes of stocks.

It’s hard to know what, if any, effect the election results will have on long-term returns, despite the vast quantity of noise generated during political seasons. In the near-term, it has had a modestly positive impact. Looking to the past, it seems that there is no clear lasting market impact, regardless of the winner. The big risks tend to be things beyond the control of the president, such as pandemics, the global financial crisis, the Dot.com bust, etc.

Rather than trying to jump around political events beyond our control, asset allocation should be a balance of benefiting from long-term growth potential, meeting liquidity needs for the next several years, providing resilience to major and minor recessions that periodically come along, and having a risk profile that lets you stick with your strategy no matter what happens in the market.

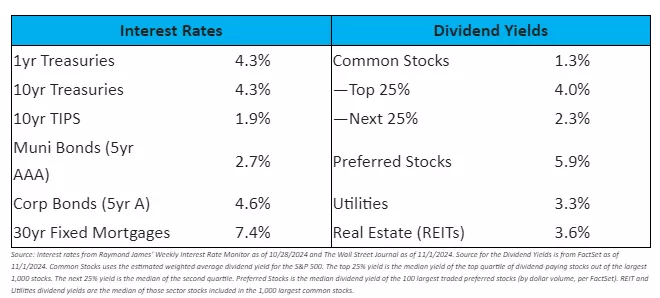

Income Investing

Long-term interest rates have increased on rising inflation concerns. While there has been improvement this year, further improvement will be difficult given ongoing government deficits. I have not yet seen a realistic plan to rein these in, so I would expect ongoing pressure for elevated interest rates. While we’ve gotten used to low interest rates over the last 20 years, the average long-term rate over the last 100 years has been in the 5-6% range, so we’re still somewhat low compared to history.

The Long View

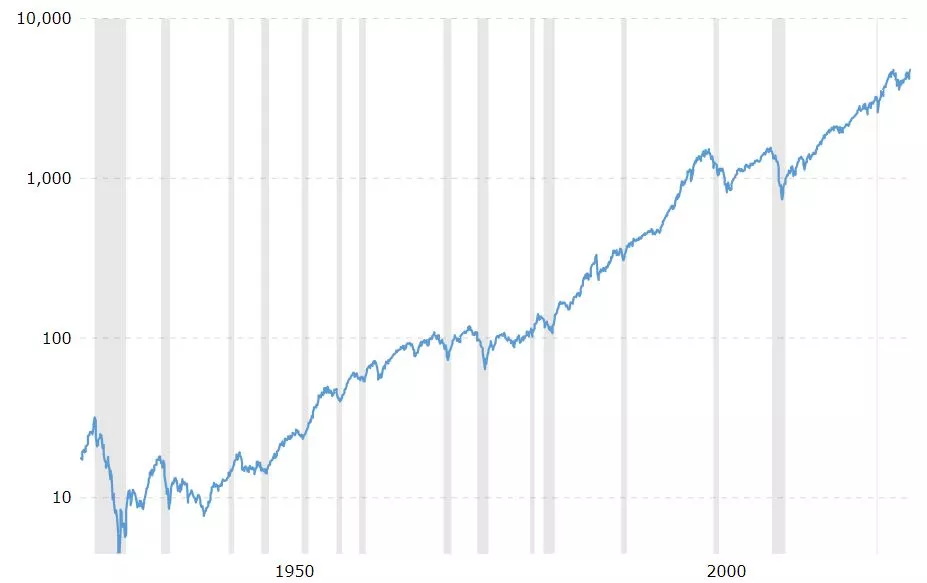

S&P 500, Jan. 1928 to Dec. 2023

Source: MacroTrends.net

For the last 20, 30, and 100 years, stocks have averaged around an 8-10% return, driven by dividend yield, reinvestment of earnings, and earnings growth. Long-term bonds have yielded about 5% on average over the last century while inflation has been about 3%.

Throughout this period, there have been major upheavals, such as the Great Depression, World War II, The Korean War, The Vietnam War, dropping the gold standard, 1970s high inflation, 1987’s Black Monday Crash, the Dot.com bust, the 9/11 terror attacks, the Global Financial Crisis, and the Covid Crash, among others.

These events led to severe market downturns about once every decade, with a median price decline of 33% and a median time to recover back to the previous high of 3.5 years. If we were to include dividends, the recovery to previous highs is actually a little faster. *

Meanwhile, a 3% inflation rate results in a 59% decline in the value of a dollar over 30 years. Meaning that people who retire at 60 years old on a fixed income face a high risk of a lower quality of life as they get further into retirement. *

The Price of Market Returns: Significant Volatility

_638666543743803901.webp)

S&P 500 Yearly Returns, 1928 to 2023. Source: MacroTrends.net

* Source: Morningstar Direct via cfainstitute.org, FactSet. Past performance is not necessarily indicative of future performance. Depreciation of the dollar: $1 / (1 + 3%)^30 = $0.41 real value 30 years later.

Market Outlook

Now I’ll put on my “Nostradamus Hat” and make some predictions, for whatever they’re worth:

- Inflation will average 2-5% over the next 10 years.

- Interest rates will fall in the 3-6% range for 10yr Treasuries over the next several years, in line with inflation and historical experience.

- The economy will grow 2-3% in real terms over the next several years.

- Stocks will average an 8-10% return over the next 10+ years. After subtracting inflation, this will translate into about a 5% real return. There is likely to be at least one big decline every decade or so.

From the standpoint of where you and your family will be in 30 years, none of this matters. What matters is finding good quality investments that are likely to grow over the decades. For this reason, I largely ignore my own general market forecast and invest whenever I find a business that I am confident in and that trades at an attractive valuation.

More By This Author:

Is Your Business Ready to Run Without You?Sound Decisions Vs. Monday Morning Quarterbacking

Finding Good Quality Investments

Disclosures: Raymond James financial advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request ...

more