How Bitcoin Hits $100,000 Next: Morgan Stanley Boosts Stake In Microstrategy, Opening The Floodgates

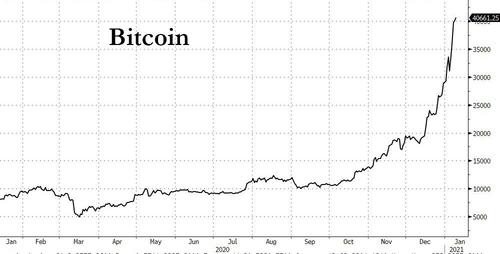

Back on August 11, when bitcoin was still trading just above $10,000, publicly traded business intelligence firm Microstrategy (MSTR) made a transformational announcement: the company said that it has purchased 21,454 bitcoins at an aggregate purchase price of $250 million, a purchase made "pursuant to the two-pronged capital allocation strategy" which - in addition to repurchasing $250 million of its stock in the open market - also called for investing up to $250 million in one or more alternative investments or assets. In doing so, MSTR became the first publicly-traded company to convert a substantial portion of its cash holdings to bitcoin.

“Our investment in Bitcoin is part of our new capital allocation strategy, which seeks to maximize long-term value for our shareholders,” said MSTR CEO Michael Saylor.

“This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash. Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions. MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.”

Saylor continued, “MicroStrategy spent months deliberating to determine our capital allocation strategy. Our decision to invest in Bitcoin at this time was driven in part by a confluence of macro factors affecting the economic and business landscape that we believe is creating long-term risks for our corporate treasury program ― risks that should be addressed proactively. Those macro factors include, among other things, the economic and public health crisis precipitated by COVID-19, unprecedented government financial stimulus measures including quantitative easing adopted around the world, and global political and economic uncertainty. We believe that, together, these and other factors may well have a significant depreciating effect on the long-term real value of fiat currencies and many other conventional asset types, including many of the assets traditionally held as part of corporate treasury operations.”

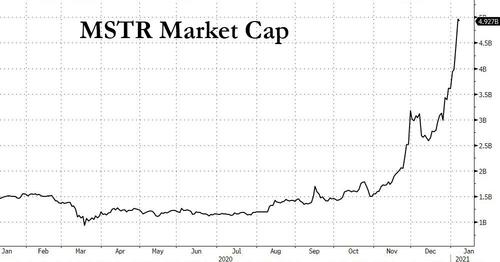

With this announcement, Saylor unleashed two things: a frenzy of public companies - including financial advisors such as the venerable, 169-year-old Mass Mutual - converting some (or more than just some) of their cash equivalents into bitcoin, and even eschewing stock buybacks instead opting to purchase bitcoin with their excess cash; more importantly Saylor has successfully unlocked tremendous value of MSTR shareholders, whose stock price has exploded alongside the record surge in bitcoin, which nearly quadrupled since August...

So has the market cap of Microstrategy, which went from a valuation of $1.25bn in August to a record $5 billion currently (MSTR is up 37% already in the first week of 2021 alone.)

Having seen its "bitcoin cash conversion" strategy validated - and generously rewarded - Saylor and Microstrategy proceeded to buy more bitcoin, much more. According to Michael Saylor's latest update, as of Dec 21, Microstrategy owned a whopping $1.125 billion worth of bitcoin ("an aggregate of 70,470 bitcoins purchased for $1.125 billion at an average price of $15,964 per bitcoin"), after purchasing roughly 30,000 bitcoins for $650 million with all the proceeds from a recent convertible bond offering. Incidentally, following the tremendous surge in bitcoin's price in just the past few weeks, the value of MSTR's bitcoin holdings is now over $2 billion.

MicroStrategy has purchased an additional 29,646 bitcoins for $650 million at an average price of $21,925 per #bitcoin and now #hodl an aggregate of 70,470 bitcoins purchased for $1.125 billion at an average price of $15,964 per bitcoin.https://t.co/j6wVLXIzoa

— Michael Saylor (@michael_saylor) December 21, 2020

To be sure, Saylor's approach, one where companies issue debt and use the proceeds not to repurchase stock but buy bitcoin, has been quickly catching on (most recently Malaysia's Greenpro Capital soared 130% in minutes after the investment company said it intends to start a Bitcoin fund), just as we said it would when we tweeted back in November that the new "cool" thing is for companies to convert their cash into bitcoin.

MicroStrategy Hits 20-Year High After Citron Call, Bitcoin Jump

— zerohedge (@zerohedge) November 25, 2020

Here comes the new "blockchain" bandwagon: Which company will convert its cash into bitcoin next?

This strategy had the added benefit of implicitly creating a Ponzi-like reinvestment structure, whereby new cash - which is generously sloshing around thanks to the central banks' continue injection of $1.3 billion in liquidity every hour - is used to purchase more bitcoin, lifting the price, making bitcoin even more attractive to other investors, who repeat this strategy, pushing the price even higher and so on (yes, one day the success of this strategy will come to an end but not before central banks start tapering their QE which as we noted last week, won't happen until 2022 at the earliest).

And now, a new benefit has emerged as a result of Microstrategy's novel business strategy.

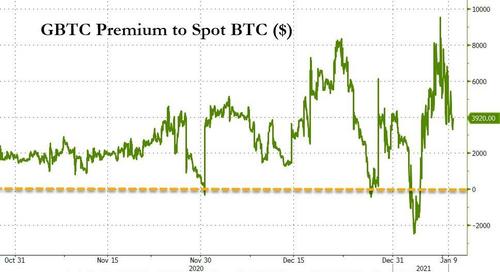

With MSTR having gradually "pivoted" away from its legacy business model to become what is essentially a publicly-traded bitcoin investment pool, the company has become a de facto bitcoin proxy (cash flow positive at that) for all those investment managers who are limited in their exposure to bitcoin. As a reminder, one of the reasons why the Grayscale Bitcoin Trust (GBTC) has not only exploded in recent months, but is also trading at a huge premium to NAV is that many institutional investors are only allowed or prefer to invest in bitcoin in fund format - not in bitcoin itself or in bitcoin futures - for regulatory or other reasons.

In fact, as JPM explains, many of them are not even allowed to hold restricted shares of the Grayscale Bitcoin Trust via private placements given the 6-month lock up period, and are thus forced to pay a premium by buying these shares in the secondary market.

But what if they can effectively have exposure to bitcoin without spending up to 15-20% for a premium, which amounts to $4,000 per bitcoin as of this moment that could disappear at a moment's notice?

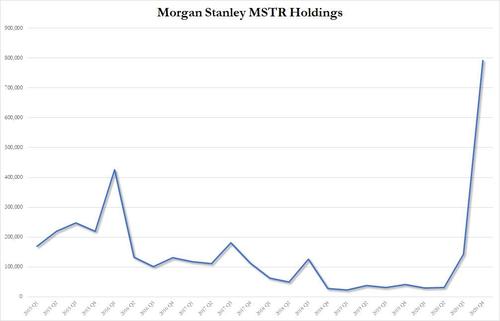

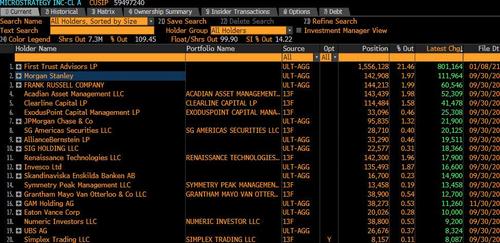

That's precisely what Morgan Stanley's investment management arm has done by not buying GBTC, but by investing directly into the bitcoin proxy that is Microstrategy, and clearly happy with the company's "pro-bitcoin" strategy, boosted its stake by a whopping 455% in the 4th quarter, from 142.9K shares to a record 792.6K, representing more than 10% of MSTR total outstanding shares.

What explains Morgan Stanley's enthusiasm for Microstrategy, which has emerged as the best publicly-traded proxy for the world's best performing asset? Simple: as Coindesk notes, "Morgan Stanley views its investment as a way to benefit from bitcoin's historic run without actually being a HODLer."

More importantly, MSTR is now seen as an acceptable - to regulators and shareholders - way to access the bitcoin space without having to buy the actual tokens or spending as much as 40% in Grayscale premium. Indeed,

The implications are groundbreaking, because not only does this approach obviate the need for bitcoin ETFs - after all with Microstrategy's success there will be dozens if not hundreds of copycat publicly-traded "shell" companies that will quickly convert all of their cash into bitcoin to become attractive investment allocation vehicles for big asset managers - opening up an even greater portion of the market to companies who have wanted to invest in bitcoin but were unable to do so, but it also allows companies to buy crypto effectively at market without paying a substantial NAV premium to a trust which due to its monopoly presence, could extract a pound of flesh from all institutional investors who wanted bitcoin exposure.

What this means is that:

- not only will MSTR now scramble to get access to even more cash (expect many more convertible and bond offerings) and quickly convert it into bitcoin, but

- countless other publicly-traded firms will now rush to convert all their cash (and more) into bitcoin, while abandoning existing operations in hopes of becoming bitcoin investment pools and having their shares similarly snapped up by whale investors such as Morgan Stanley. First Trust, JPMorgan, Alliance Bernstein, and all the other institutions which are currently long and adding to their Microstrategy holdings.

One such company which we are convinced will announce it is converting billions of its existing cash into bitcoin, is none other than Tesla, whose CEO Elon Musk was urged by MSTR CEO Saylor to make a similar move with Tesla’s money. And since Musk, already the world's richest man thanks to the most aggressive financial engineering on the planet, has never been one to shy away from a challenge, we are absolutely confident that it is only a matter of time before Tesla announces that it has purchased a few billion bitcoin.

In short, Morgan Stanley's aggressive expansion of its Microstrategy holdings may be the catalyst that unlocks Bitcoin's door to rapidly crossing the psychological $100,000 level next.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more