Home Depot Vs. Lowe's: What's The Better Buy?

Image Source: Pixabay

Many famous peers are in the market, with Lowe’s (LOW - Free Report) and Home Depot (HD - Free Report) reflecting one of those notable pairings. We’ve recently received quarterly results from each, with both stocks seeing fair reactions post-earnings.

Both companies have operated in a challenging environment over recent periods, with mortgage rates remaining sticky despite the Fed’s easing. As a result of the higher rates, consumers have pulled back big on big-ticket items and other expensive materials needed for home improvement.

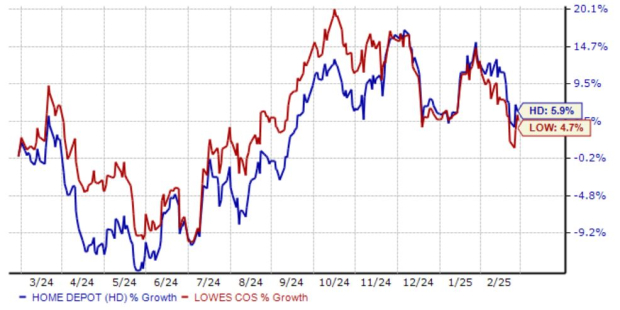

Both stocks have loosely tracked each other over the past year, with HD shares marginally outperforming.

Image Source: Zacks Investment Research

But with both companies posting positive year-over-year comps concerning comparable sales for the first time in eight periods, is the tide finally changing for the pair? Let’s take a closer look at each and see which looks better positioned to ride a potential recovery.

Quarterly Results

As mentioned above, both companies delivered positive YoY comparable store sales growth in their releases for the first time in many periods, reflecting that things are ‘picking up’ in their existing locations.

Concerning Home Depot, comparable store sales climbed 0.8% YoY, with comparable sales in the U.S. increasing by 1.3%. On the Lowe’s front, comparable store sales inched 0.2% higher from the year-ago period.

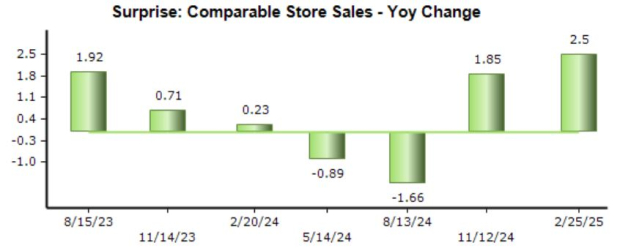

Concerning Lowe’s, the +0.2% move in comparable store sales beat our consensus estimate of a -1.4% decline, also reflecting the second consecutive beat on the metric. The company has primarily positively surprised on the metric, as shown below.

Image Source: Zacks Investment Research

On the Home Depot front, the +0.8% move higher in comparable store sales also beat our consensus estimate of a -1.7% decline handily, also reflecting the second consecutive positive read on the metric.

Image Source: Zacks Investment Research

Just from this metric alone, it seems that HD is enjoying more momentum concerning the consumer in its existing locations relative to LOW, a key factor.

Valuation

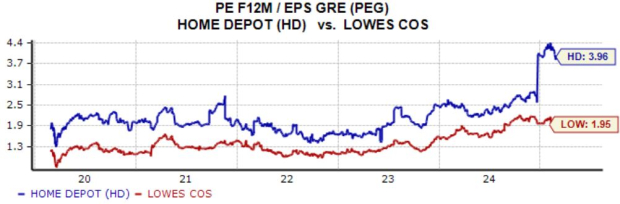

Concerning the valuation picture for both stocks, LOW shares trade at a smaller forward 12-month earnings multiple than HD, with a significantly lower PEG ratio. LOW is projected to see 4.3% YoY EPS growth this fiscal year, compared to HD's 1.6%.

Given the current PEG ratios, LOW's valuation currently appears more attractive.

Image Source: Zacks Investment Research

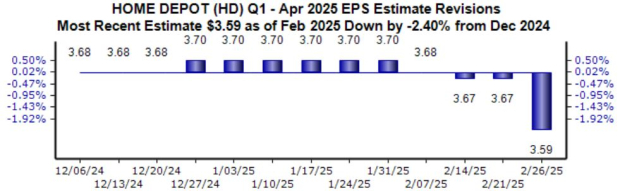

Estimate Revisions

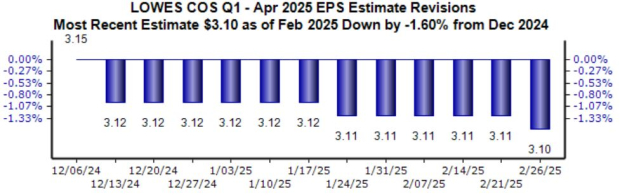

Perhaps most importantly are analysts’ revisions to EPS expectations following the latest releases, helping cut through the ‘noise.’ From a near-term standpoint, analysts revised HD’s EPS expectations for its next release notably harsher relative to LOW, as shown below.

LOW Revisions –

Image Source: Zacks Investment Research

HD Revisions –

Image Source: Zacks Investment Research

The greater stability in the earnings picture from LOW is a big positive, with the downward revisions for HD much more concerning. It’s worth noting that top line revisions for both companies’ upcoming prints have been marginally positive for both companies.

Putting Everything Together

Despite both companies - Home Depot (HD) and Lowe's (LOW) - speaking on near-term cloudiness concerning the home improvement market, the positive change in comparable sales for both bodes well for upcoming periods, with a bit of momentum finally breaking through.

Both companies will look to ride a recovery in the space, but LOW shares appear to be the better buy currently based on valuation, forecasted EPS growth, and a much more positive earnings picture following the release of the latest set of results.

More By This Author:

Nvidia Shares Face Pressure: Were Earnings Bad?Restaurant Earnings Roundup: MCD, CAKE, TXRH

Ride The AI Infrastructure Buildout With These 2 Stocks: Super Micro Computer, Vertiv

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more