Home Depot Vs. Lowe's Stock: Which Is The Better Investment As Q4 Results Roll Out?

Image Source: Pexels

Investors are getting more insight into the strength of the consumer and the home building market as Home Depot (HD - Free Report) released its Q4 results this morning with Lowe’s (LOW - Free Report) report scheduled for Wednesday, February 26.

Able to exceed Q4 expectations, Home Depot shares spiked nearly +3% in today’s trading session with Lowe’s stock up +2%.

Home Depot’s Q4 Results

Optimistically, Home Depot’s Q4 sales of $39.7 billion increased 14% year over year from $34.78 billion in the comparative quarter and topped estimates of $39.14 billion.

Still, Home Depot stated that during the quarter, higher interest rates and greater macroeconomic uncertainty pressured consumer demand more broadly, resulting in weaker spend across home improvement projects.

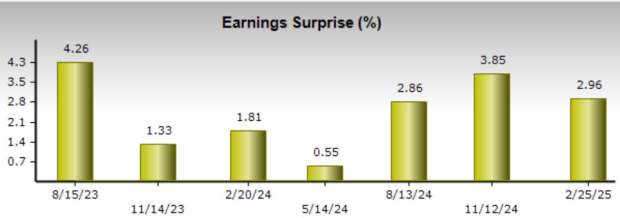

Able to navigate what it called a unique environment while executing at a high level, Home Depot’s Q4 EPS of $3.13 beat expectations of $3.04 by 2.96% and rose 11% from $2.82 per share a year ago. Furthermore, Home Depot has now exceeded the Zacks EPS Consensus for 19 consecutive quarters dating back to August of 2020.

Image Source: Zacks Investment Research

Lowe’s Q4 Expectations

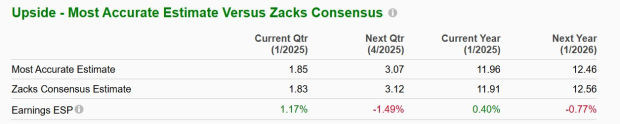

Based on Zacks estimates, Lowe’s Q4 sales are thought to have dipped 1% to $18.35 billion compared to $18.6 billion in the prior year quarter. However, Lowe’s Q4 earnings are slated to rise 3% to $1.83 per share from EPS of $1.77 in the comparative period.

More intriguing, Lowe’s has exceeded bottom line expectations for 22 consecutive quarters dating back to August of 2019.

Notably, the Zacks ESP (Expected Surprise Prediction) does indicate Lowe’s could once again surpass earnings expectations with the more recent analyst revisions and Most Accurate Estimate having Q4 EPS at $1.85 and 1% above the Zacks Consensus.

Image Source: Zacks Investment Research

Stock Performance & Valuation Comparison

Considering their leadership and consistency in the home improvement market, Home Depot and Lowe’s stock trade at reasonable forward earnings multiples of 24.4X and 18.9X, respectively.

While Home Depot’s top and bottom lines are more robust, Lowe’s trades beneath the benchmark S&P 500’s average of 22.5X forward earnings and at a nice discount to their Zacks Retail-Home Furnishings Industry average of 22.1X. Plus, Lowe’s trades under the optimum level of less than 2X sales with Home Depot at 2.4X.

Image Source: Zacks Investment Research

Over the last year, Home Depot stock is up +6% to edge Lowe’s +5%, although both have trailed the benchmark’s +19%. In the last three years, Home Depot’s +24% gains have noticeably trumped Lowe’s +9%, but these performances have been subpar to the S&P 500 as well.

Image Source: Zacks Investment Research

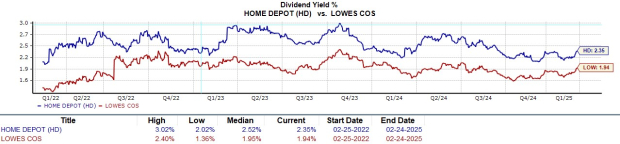

HD & LOW Dividend Comparison

Making up for their lagging price performances is that Home Depot stock has a 2.35% annual dividend with Lowe’s yield at 1.94%. These payouts top the S&P 500’s 1.21% average with it noteworthy that Home Depot’s yield is above their industry average of 2.13%.

Image Source: Zacks Investment Research

Bottom Line

At the moment, Home Depot and Lowe’s stock land a Zacks Rank #3 (Hold). Holding positions in either of these home improvement retailers could be rewarding for long-term investors. That said, there may still be better buying opportunities ahead amid recent market volatility and macroeconomic uncertainty.

More By This Author:

Will Nvidia's Q4 Results Lift Markets Back To New Highs?Buy Cheniere Energy Stock After Massive Q4 Earnings Beat?

Walmart Vs. Target Stock: Which Is The Better Investment As Q4 Results Roll Out

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more