Home Depot Is Correcting The Cycle Since The Company’s Inception

Home Depot (HD), is an American multinational home improvement retail corporation that sells tools, construction products, appliances, and services, including fuel and transportation rentals. Home Depot is the largest home improvement retailer in the United States.

The shares of the Home Depot HD company have entered a very interesting stage. After reaching all-time highs in December 2021, the price fell considerably. According to the Elliott Wave Principle, the stock price should continue to fall. The structure that is developing appears to be a zigzag correction, and if so, it still has a lot of things to say. (If you want to learn more about Elliott Wave Theory, please follow these links:

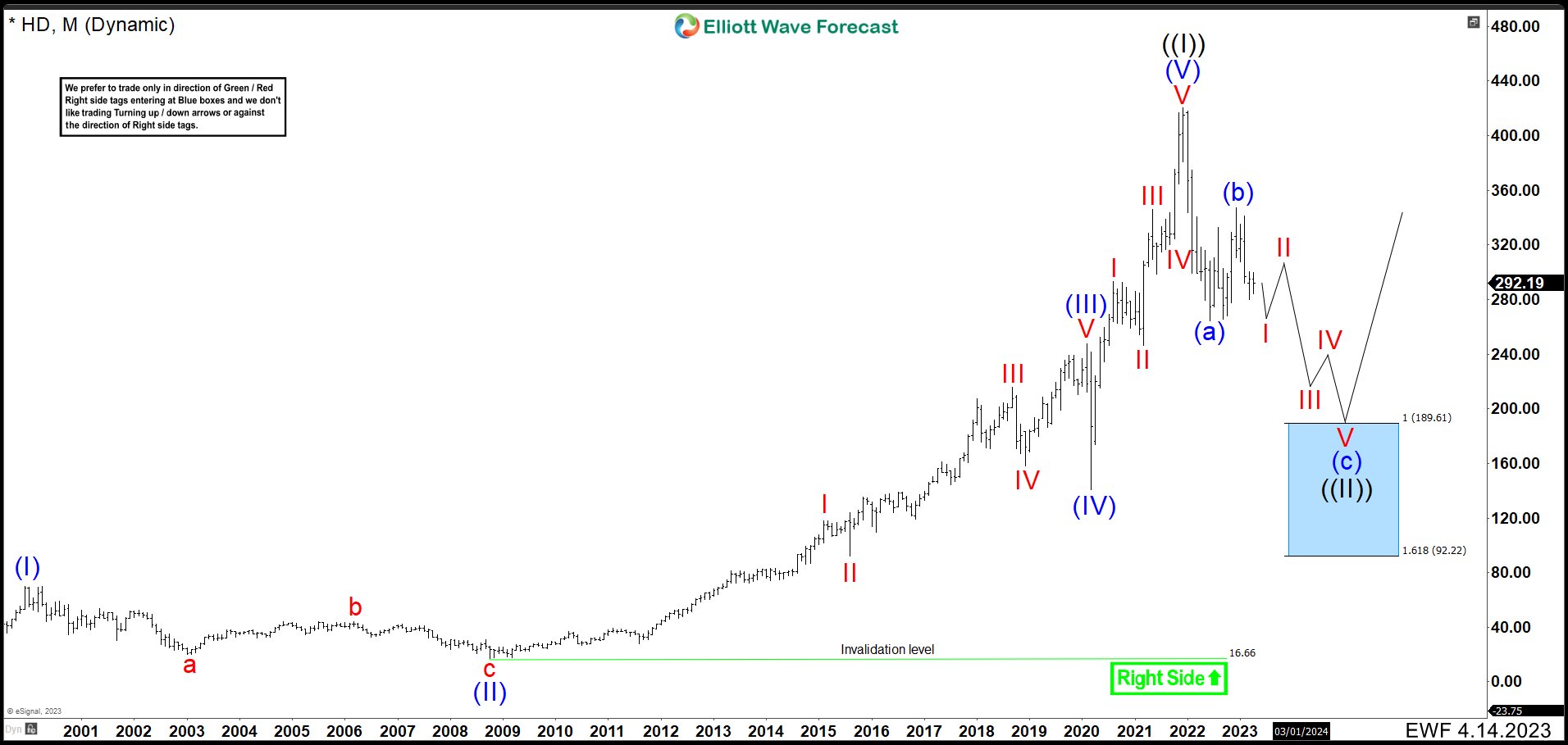

Home Depot HD Monthly Chart April 2023

(Click on image to enlarge)

As we can see above on the monthly chart, HD finished its first grand cycle since the company’s inception in late 1999, reaching $70.08. We called this movement the wave (I). At this price, it entered in a corrective phase that ended in 2008 recession at $16.66. We labeled it as wave (II). Since then, the price kept a strong bullish trend, rising as high as $247.70 to complete wave (III). Then, we clearly see the wave (IV) at the beginning of the COVID19 pandemic, in 2020, when the price fell to $139.84. From here, it had again a strong rebound creating a new impulse, being wave IV as a running flat, thus wave V is the shortest of the impulse. This completed wave (V) at $420.79 and wave ((I)) of the grand super cycle in December 2021.

The Correction Started in December 2021

Since 2021 high, the price of HD has remained bearish and to complete the corrective structure it should continue to decline further. This is because to complete a corrective structure is needed a minimum of 3 waves, where the third wave must break the end of the first wave at least marginally. This suggests further drops in the price of HD which should ideally hit the blue box, this is in the area of $189.61 – $92.22. If we see 5 waves down from wave (b) in this area, this is a good opportunity to look for longer-term buys. However, it is not 100% certain that HD will go as low as $189.61. If 5 waves marginally breaks the low of wave (a) at $263.85, wave (c) of ((II)) and wave ((II)) could be over to continue a new rally.

More By This Author:

BTCUSD Elliott Wave: Forecasting The Rally From Intraday Equal Legs Area

Elliott Wave Suggests Goldman Sachs Should See More Downside in 2023.

Technical Analysis Suggests A Short-Term Ceiling For Coca-Cola Stock

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more