Home Depot Beats On Earnings In Q4, Dividend Raised

Home Depot, Inc. (HD - Free Report) posted fourth-quarter fiscal 2022 results, with the top and bottom line increasing year over year. Earnings surpassed the Zacks Consensus Estimate while sales missed the Zacks Consensus Estimate

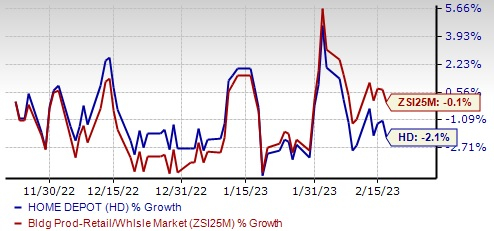

The company’s stock has lost 2.1% in the past three months compared with the industry's decline of 0.1%.

Results in Detail

Home Depot's earnings of $3.30 per share increased 2.8% from $3.21 registered in the year-ago quarter. The bottom line surpassed the Zacks Consensus Estimate of $3.27 and our estimate of $3.19.

Net sales inched up 0.3% to $35,831 million from $35,719 million in the year-ago quarter. The metric missed the Zacks Consensus Estimate of $35,905.8 million but surpassed our estimate of $35,761.2 million.

Comparable sales inched down 0.3% in the reported quarter. The company’s comparable sales in the U.S. also went down 0.3%.

The Home Depot, Inc. Price, Consensus, and EPS Surprise

The Home Depot, Inc. price-consensus-eps-surprise-chart | The Home Depot, Inc. Quote

Home Depot's customer transactions declined 6% year over year. The average ticket rose 5.8%, while sales per retail square foot fell 0.1%.

In dollar terms, the gross profit increased 0.5% to $11,926 million from $11,862 million in the year-ago quarter. The operating income fell 1.5% to $4,752 million.

Selling, general and administrative expenses came in at $6,549 million, up 1.8% from $6,431 million reported in the year-ago quarter.

Other Updates

The Zacks Rank #3 (Hold) company ended fourth-quarter fiscal 2022 with cash and cash equivalents of $2,757 million, long-term debt (excluding current installments) of $41,962 million, and shareholders' equity of $1,562 million. For the fiscal year ending Jan 29, 2023, the company generated $14,615 million of net cash from operations.

The company approved a 10% hike in its quarterly dividend to $2.09 per share, which equals an annual dividend of $8.36 per share. The dividend is payable on Mar 23, 2023, to shareholders of record as on Mar 9. This marks the company’s 144th consecutive quarter of dividend payments.

Starting in the first quarter of fiscal 2023, the company will invest an incremental $1 billion in annualized compensation for frontline, hourly associates.

Image Source: Zacks Investment Research

Fiscal 2023 View

Home Depot anticipates sales growth and comparable sales growth to be roughly flat year over year in fiscal 2023. The operating margin rate is estimated to be 14.5%. It expects an effective tax rate of 24.5%. HD estimates earnings per share decline in the mid-single digits for fiscal 2023.

More By This Author:

Earnings Preview: Zoom Video Communications Q4 Earnings Expected To DeclineHere's What You Should Expect From Fluor's Q4 Earnings

Bull Of The Day: Airbnb

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more