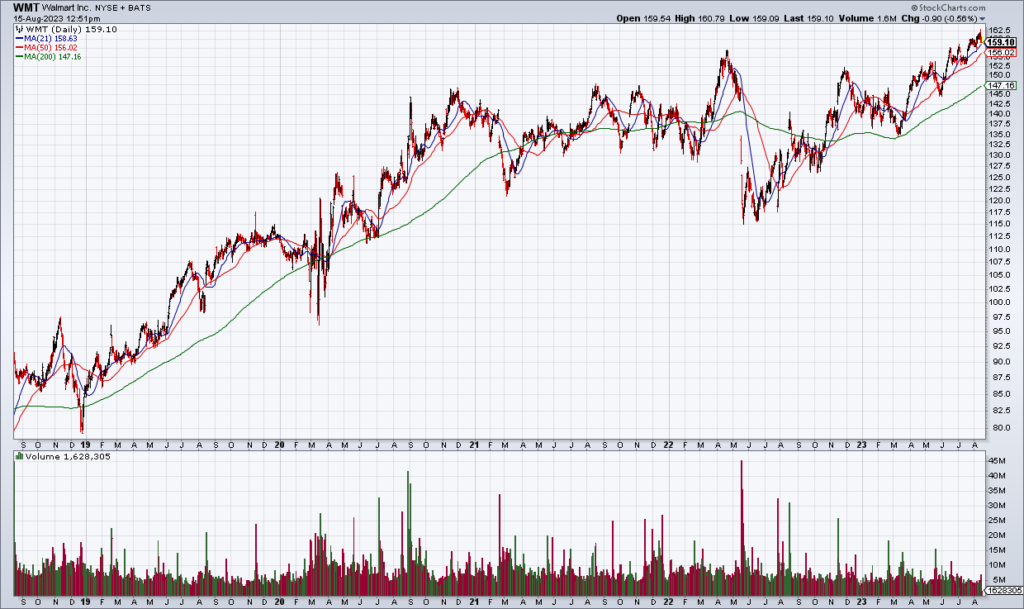

Hold WMT & DE Into Earnings

(Click on image to enlarge)

Walmart (WMT) and John Deere (DE) are two core holdings of mine that have performed well and I see no reason to do anything heading into their earnings reports later this week. WMT remains the go-to destination for the American middle class because of the value it provides. While the stock has gotten a little expensive at 26x current year guidance, I’m not a seller. WMT is still a foundational piece of the American economy and I don’t see that changing anytime soon. As I said at the time, the huge selloff in shares 15 months ago was a buying opportunity. I expect another solid quarter when it reports Thursday morning.

DE is an underfollowed stock in our tech-obsessed culture. Farming is so 19th century. And yet we all have to eat and DE is the leading provider of tractors and other capital equipment to farmers. It is also in a growth cycle with revenue +30% and EPS +42% in its most recent quarter. And yet the stock trades at less than 14x current year net income guidance. I don’t see any reason to sell the stock heading into its earnings report Friday morning.

#earnings for the weekhttps://t.co/lObOE0dgsr$HD $TGT $PANW (after the close on Friday) $WMT $SE $AMAT $CSCO $GP $ZIM $NU $DE $ONON $JD $XPEV $SU $BILL $FTCH $UGRO $SNPS $GOEV $EL $WOLF $STNE $HUT $JKS $CAH $NVTS $A $ERJ $BTAI $COHR $PSFE $SQM $RUM $MNDY $HRB $GLOB $ECC $TME… pic.twitter.com/NzlyRzkVis

— Earnings Whispers (@eWhispers) August 11, 2023

More By This Author:

Can TGT Hit The Mark?

DDOG And The Risks Of Growth Stock Investing

Long TLT, Short QQQ