Highly Ranked Stocks Poised To Move Higher In December

Image Source: Pixabay

Quite a few top-rated Zacks stocks are near or at their 52-week highs and may be able to lead what is hopefully an end-of-the-year rally among the broader market.

Belonging to the Zacks Rank #1 (Strong Buy) list here are three of these highly ranked stocks to consider as we get closer to rounding out 2023.

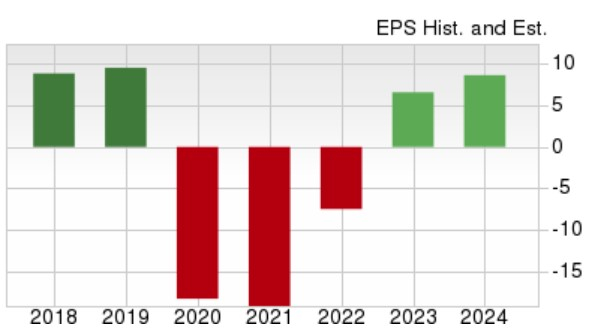

Royal Caribbean (RCL): Starting with Royal Caribbean, the post-pandemic recovery of the popular cruise operator is reaching new heights going into 2024.

With annual earnings now expected to climb swing to $6.59 per share compared to an adjusted loss of -$7.50 a share in 2022 projections of 37% EPS growth next year suggest Royal Caribbean’s immense probability is back. To that point, FY24 EPS projections of $9.05 a share would only be 5% below pre-pandemic earnings of $9.54 a share in 2019.

As you can imagine, Royal Caribbean’s stock has soared and is now up +139% this year after hitting 52-week highs of $119 a share on Wednesday.

Image Source: Zacks Investment Research

JPMorgan Chase (JPM): CEO Jamie Dimon’s wit stood out in today’s annual oversight meeting for the Senate Committee on Banking, Housing, and Urban Affairs.

Dimon appeared to have a lot of the right or rather correct responses to the Senate’s questions and there is strong reason to believe JPMorgan's stock may eclipse 52-week highs of $159 a share in July. Only 2% from its highs, JPM shares are up a very respectable +16% YTD and annual EPS estimates are nicely up over the last 60 days for fiscal 2023 and FY24.

JPMorgan’s stock also trades at a reasonable 9.3X forward earnings multiple and investors are collecting a generous 2.6% annual dividend yield.

Image Source: Zacks Investment Research

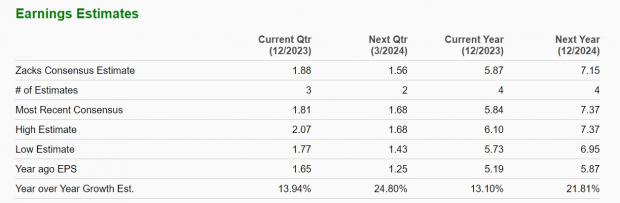

FirstCash (FCFS): FirstCash Holdings is starting to give investors the steady growth they look for in the portfolio as an operator of pawn stores and a provider of technology-driven point-of-sale payment solutions.

FirstCash shares briefly hit 52-week highs of $115 in today’s trading session and another move higher looks likely with annual earnings forecasted to be up 13% this year and climb another 22% in FY24 to $7.15 a share. Fiscal 2024 projections would also represent 137% EPS growth over the last five years with earnings at $3.01 a share in 2020.

Plus, total sales are expected to expand 16% in FY23 and climb another 8% next year to $3.4 billion. In correlation with such expansive growth, FirstCash shares have risen +65% over the last three years and have soared +30% YTD while offering investors a 1.23% annual dividend yield at the moment.

Image Source: Zacks Investment Research

Bottom Line

The plausibility of more upside looks likely for Royal Caribbean, JPMorgan, and FirstCash stock as we round out the year. They are shaping up to be viable investments for 2023 and beyond and now looks like a good time to buy with all three stocks on the cusp of higher 52-week highs.

More By This Author:

Top Apparel Stocks Hitting 52-Week Highs In DecemberBear of the Day: Floor & Decor (FND)

Bull of the Day: The Progressive Corp.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more