Highly-Ranked Growth Tech Stocks To Buy And Hold As The Bulls Fight Back

Technology stocks drive the market, with the last several years serving as an excellent example. Meta, Salesforce, Nvidia, and many other giants helped tank the stock market in 2022, with their current comebacks driving the market higher in 2023.

Wall Street had been sitting on its hands until the biggest names in tech finally reported and offered guidance this week. The early reactions to Microsoft, Meta, and other titans of tech have been bullish.

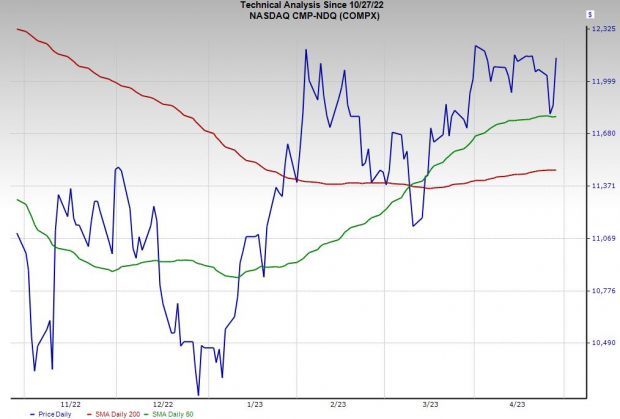

The Nasdaq’s roughly 2.4% surge on Thursday helped it bounce right back above its 50-day moving average just when it looked as though the bulls might have finally started to let go of the rope.

Image Source: Zacks Investment Research

Many have been worried for months that earnings revisions would continue to plummet, even though they are already down big compared to this time last year. The early indications are that tech guidance, which holds huge sway over the market and accounts for 25% of total S&P 500 earnings, is looking relatively resilient.

Therefore, investors who can handle some near-term risks might want to consider buying tech stocks amid the busy part of earnings season.

The two highly-ranked tech stocks we explore today operate in critical areas of the economy and boast strong growth outlooks to extend impressive streaks. And neither stock is bloated in terms of valuation.

Fortinet (FTNT - Free Report) – Reports Q1 FY23 Results on Thursday, May 4

Fortinet is a cybersecurity standout with an integrated portfolio of over 50 enterprise-grade products that are utilized by more than 600K customers. FTNT’s product categories include network security, cloud security, endpoint security, and more with offerings such as next-generation firewalls, zero trust access, and nearly anything else imaginable.

Fortinet helps protect companies, enterprises, and beyond across technology, healthcare, financial services, manufacturing, and really the entire economy. The company said when it posted strong Q4 and full-year 2022 results that it grew its market share because of its “integrated and single platform approach to cybersecurity combined with FortiASIC technology, which lowers the management costs and the total cost of ownership for organizations.”

Image Source: Zacks Investment Research

Cybersecurity threats can’t be ignored, even by the smallest companies as our economy grows more digitally connected and dependent. Fortinet’s growth backs up the vital role cybersecurity plays, having expanded its revenue by an average of 25% in the trailing five years, including a 32% jump in 2022. The company also grew its adjusted earnings by nearly 50% last year and its free cash flow hit a record $1.45 billion.

Zacks estimates call for Fortinet to post another 22% sales growth in 2023 and 19% higher in FY24 to help boost its adjusted earnings by 19% and 17%, respectively. FTNT’s upbeat earnings revisions also help it land a Zacks Rank #1 (Strong Buy) right now, and it has topped our EPS estimates for five years running

Image Source: Zacks Investment Research

FTNT shares have destroyed the Zacks Tech sector over the last decade, up 1,600% vs. 202%. This outperformance includes a 200% run in the past three years vs. tech’s 41%.

Fortinet has surged 28% YTD, yet it currently trades around 8% below its recent highs and 14% beneath its average Zacks price target at roughly $63 a share. FTNT is testing its 50-day moving average at the moment and its recent pullback has seen it fall from overbought RSI levels to well below neutral.

Fortinet’s valuation might still be a bit rich for many investors, with it trading at 52.5X forward 12-month earnings vs. Tech’s 22.4X. But compared to its own history, FTNT is extremely cheap, trading over 70% below its decade-long highs and at a 25% discount to its own its median.

Some investors might want to wait for Fortinet’s results and guidance and hope for a pullback to possibly grab a better entry point, while others with buy-and-hold styles might not want to play the market-timing game.

Arista Networks (ANET - Free Report) - Reports Q1 FY23 Results on Monday, May 1

Arista Networks boasts that it helped pioneer software-driven, cognitive cloud networking for enterprise-level data centers and campus environments. ANET’s Extensible Operating System is at the heart of its cloud networking solutions. And its tech must be some of the best in the industry because Microsoft (MSFT - Free Report) and Meta (META - Free Report) are two of Arista's largest clients.

The networking-infrastructure provider posted 49% revenue growth in 2022, which came on top of 27% sales expansion in 2021. Arista has posted booming growth for most of the last decade outside of a tiny 2020 pullback and the long-term outlook for cloud computing remains impressive, even though some of the giants like Amazon and Microsoft are facing slowing growth on a YoY percentage basis.

Image Source: Zacks Investment Research

Zacks estimates call for its revenue to surge 25% in 2023 to $5.48 billion and another 11% in FY24 to reach $6.1 billion. Arista’s adjusted earnings are projected to climb 27% this year and 11% next year, which are made more impressive considering the wider earnings decline and its tough-to-compete against periods.

Arista, like its peer on our list today, has boosted its EPS outlook consistently even as the wider earnings picture gets trimmed, and it has topped our quarterly estimates for five straight years. ANET’s positive bottom-line revisions help it capture a Zacks Rank #2 (Buy) right now.

Image Source: Zacks Investment Research

ANET shares are up 30% in 2023 to double the Zacks Tech sector. The stock has spared roughly 1,000% since its 2014 IPO vs. tech’s 156% run. Arista shares have dipped around 8% from their record highs and it trades 10% below its average Zacks price target. ANET also just popped back up above its 50-day.

Arista stock trades 18% below its all-time median at 28.9X forward 12-month earnings and 70% under its peaks. ANET’s valuation levels look just as attractive over the short term. As always, buying stocks right around earnings comes with risks and rewards, but those looking to hold Arista for the long haul don’t need to be overly concerned about timing their entry points.

More By This Author:

Defined Outcome ETFs For Uncertain Markets

Best & Worst Performing ETF Areas Of Q1 2023

ETF Winners & Losers From The Banking Crisis

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more