High-Yield Stocks To Consider (Yes, Really)

Image Source: Pixabay

If you’ve followed me for a while, you know I’m a big fan of low-yield, high-growth stocks. I’d rather see a 2% yield with consistent dividend and earnings growth than a 7% yield about to implode.

However, sometimes high yield has its place.

When chosen carefully, a few high-yielders can complement your portfolio. They won’t outperform the market, but they can give you dependable cash flow—especially if you’re in retirement or shifting from accumulation to income.

So yes—there are high-yield stocks I’d consider. But they have to pass the sniff test.

What Counts as “High Yield”?

It’s fascinating how both complicated and straightforward investing can be at times.

The answer to a simple question, such as “What’s a high yield?” is a good example. For some, a high yield is defined as being above 10%. For others, it could be above 4%.

I would be tempted to consider anything above 4% as “high” based on my financial planner’s experience.

By definition, if someone withdraws over 4% of his or her portfolio (regardless of whether it comes from capital gains, dividends, or interest), he or she may increase the risk of outliving their portfolio.

For the purpose of this article, I start paying attention at 5% or more.

That’s high enough to move the income needle, but not so high that it automatically raises red flags.

Most stocks yielding 7–9%? They’re either in trouble or about to be.

What Makes a High-Yielder Okay?

Let’s be real—most high-yield stocks fall into one of two camps:

- Slow-but-steady cash generators, or

- Dividend disasters waiting to happen.

Your job is to figure out which is which.

You’re not looking for flashy. You’re looking for something that will pay you to wait, without crushing your capital over time. Here’s how I approach it.

What I Look For (Even Without DSR)

If you’re using Dividend Stocks Rock (DSR), I run these filters:

- Yield: 5%+

- Dividend Safety Score: 3 or higher

- 5-Year Dividend Growth: 1%+

- PRO Rating: 3+

But if you’re going DIY, here’s a checklist you can follow:

1. Start With the Dividend Triangle

- Revenue growth

- Earnings or FFO growth

- Dividend growth

You want at least 2 out of 3 going in the right direction. All 3? Even better.

2. Check the Payout Ratio Trend—Not Just the Number

Forget looking for a “perfect” payout ratio like 60% or 80%. That’s too simplistic.

Instead, watch the trend over several years. A healthy company will usually show a consistent, stable payout ratio. It might fluctuate a bit with earnings, but overall, it holds within a reasonable range.

If the payout ratio is jumping all over the place—or creeping higher year after year—that’s your red flag.

A rising payout ratio without matching earnings or FFO growth means the company is using more of its profits (or worse, debt) to pay dividends. That’s not sustainable.

For REITs or pipelines, be sure to use AFFO (Adjusted Funds from Operations) or DCF (Distributable Cash Flow) instead of EPS. These business models rely heavily on non-cash expenses, such as depreciation, so traditional payout metrics don’t apply.

The bottom line: consistency signals control. Spikes or sudden drops? Time to dig deeper and figure out why.

3. Look at How They Grow

- Organic growth (i.e., attracting more tenants and customers) is beneficial.

- Built-in rent escalators (like those in REITs) are also beneficial.

- Debt-fueled acquisitions = use with caution

If earnings are flat but the dividend continues to rise, something is off.

4. Check the Balance Sheet

- Is debt climbing faster than cash flow?

- Are interest payments eating away earnings?

Rising rates exposed many weak businesses. Don’t get caught holding one.

5. Ask: Would I Own This Without the Yield?

If the answer is no—walk away.

High yield should be a bonus, not the only reason to buy.

Examples of High-Yielders That Pass the Test

Here are a few that caught my attention recently. These aren’t home runs—but they’re worth considering if you’d like to increase your income.

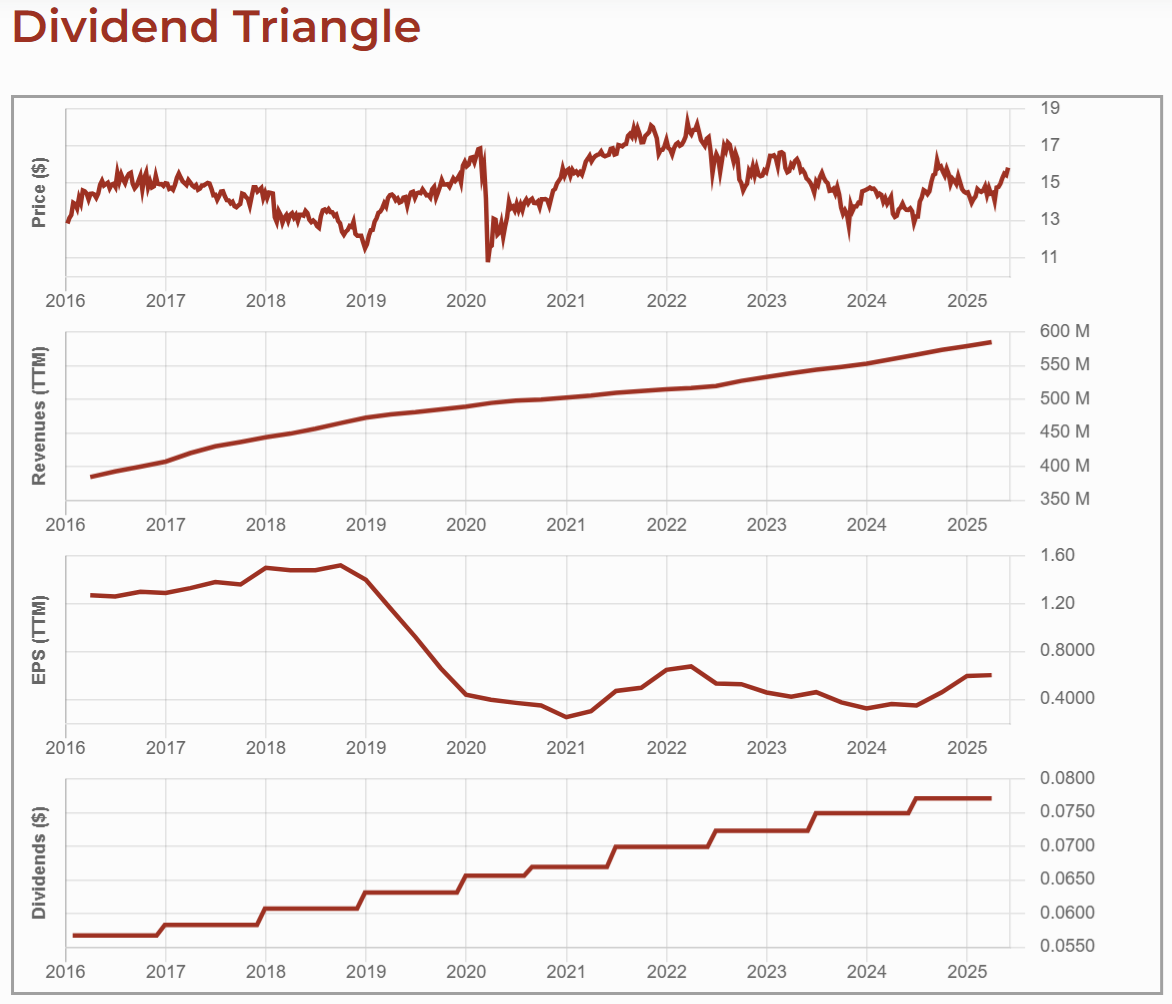

CT REIT (CRT.UN.TO)

Yield: ~6.2%

What it is: A retail REIT, 90%+ leased to Canadian Tire.

(Click on image to enlarge)

CT REIT (CRT.UN.TO) 10-Year Dividend Triangle.

Bull case: CT REIT generates revenue by leasing commercial properties primarily to its parent company, Canadian Tire. The REIT operates a portfolio of 375 properties, covering 30 million square feet of Gross leasable area (GLA). Its revenue model is built around triple-net leases, meaning tenants (primarily Canadian Tire) cover operating costs, property taxes, and maintenance, ensuring predictable cash flows.

Bear case: Heavy dependence on Canadian Tire: Over 90% of GLA is leased to CTC, meaning any downturn in Canadian Tire’s business or strategic shift in store footprint could negatively impact CT REIT. If you hold CT REIT, you should also monitor Canadian Tire (CTC.A.TO).

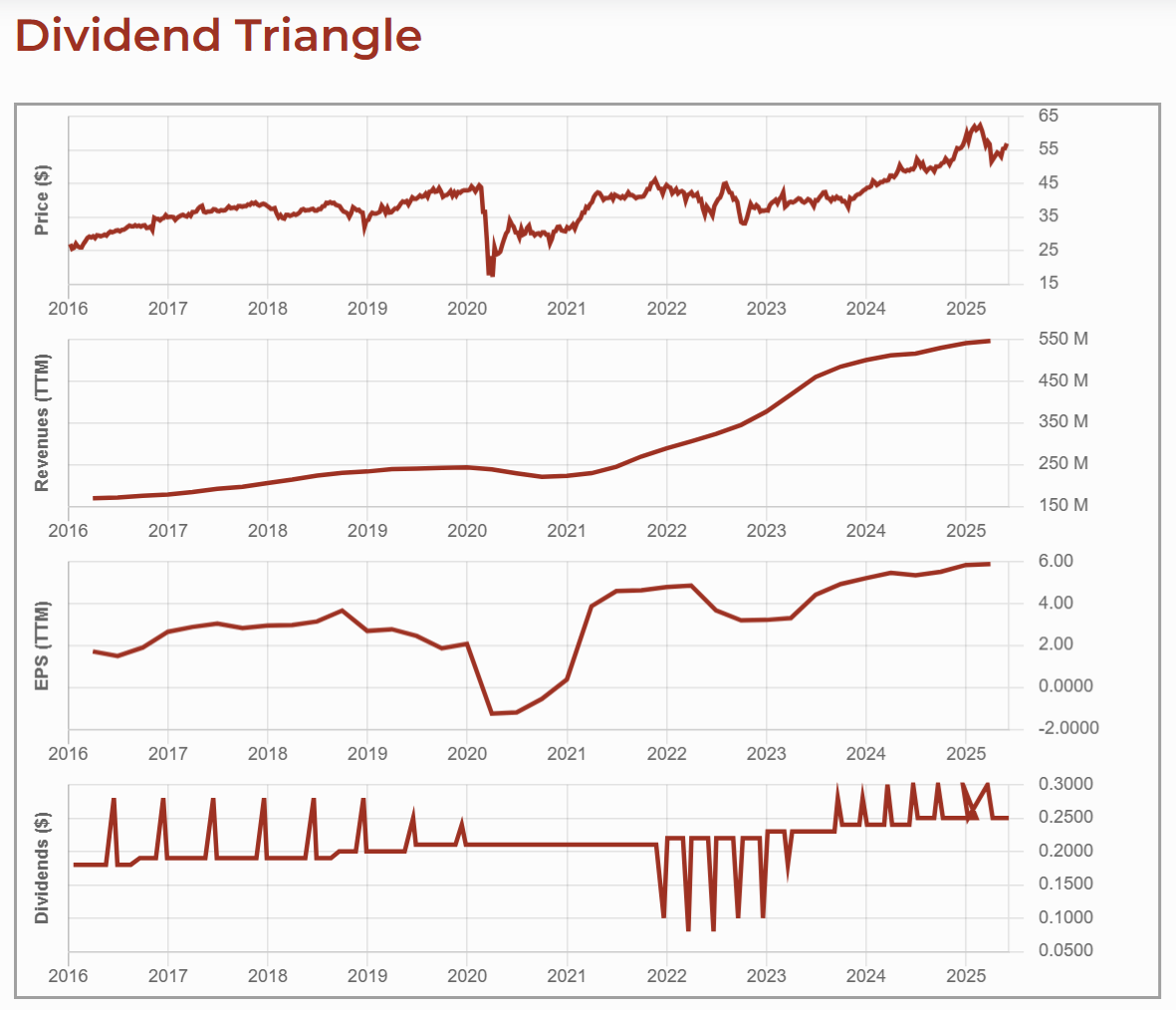

Main Street Capital (MAIN)

Yield: ~5.7%

What it is: A business development company (BDC) lending to smaller U.S. businesses.

(Click on image to enlarge)

Main Street Capital (MAIN) 10-Year Dividend Triangle.

Bull case: This BDC is among the most respected and well-run businesses in its industry. MAIN focuses on providing debt and equity capital to lower-middle-market companies, a niche market that offers attractive returns. The company’s conservative investment strategy and diversified portfolio contribute to its resilience and consistent performance. An interesting fact is that MAIN has outperformed the S&P 500 over the past 10 years.

Bear case: As a business development company (BDC), MAIN’s performance is tied to the health of its portfolio companies, which are often sensitive to economic downturns. A recession could lead to increased defaults and reduced investment income. Additionally, higher interest rates can increase borrowing costs for MAIN and its portfolio companies, potentially squeezing margins and affecting profitability.

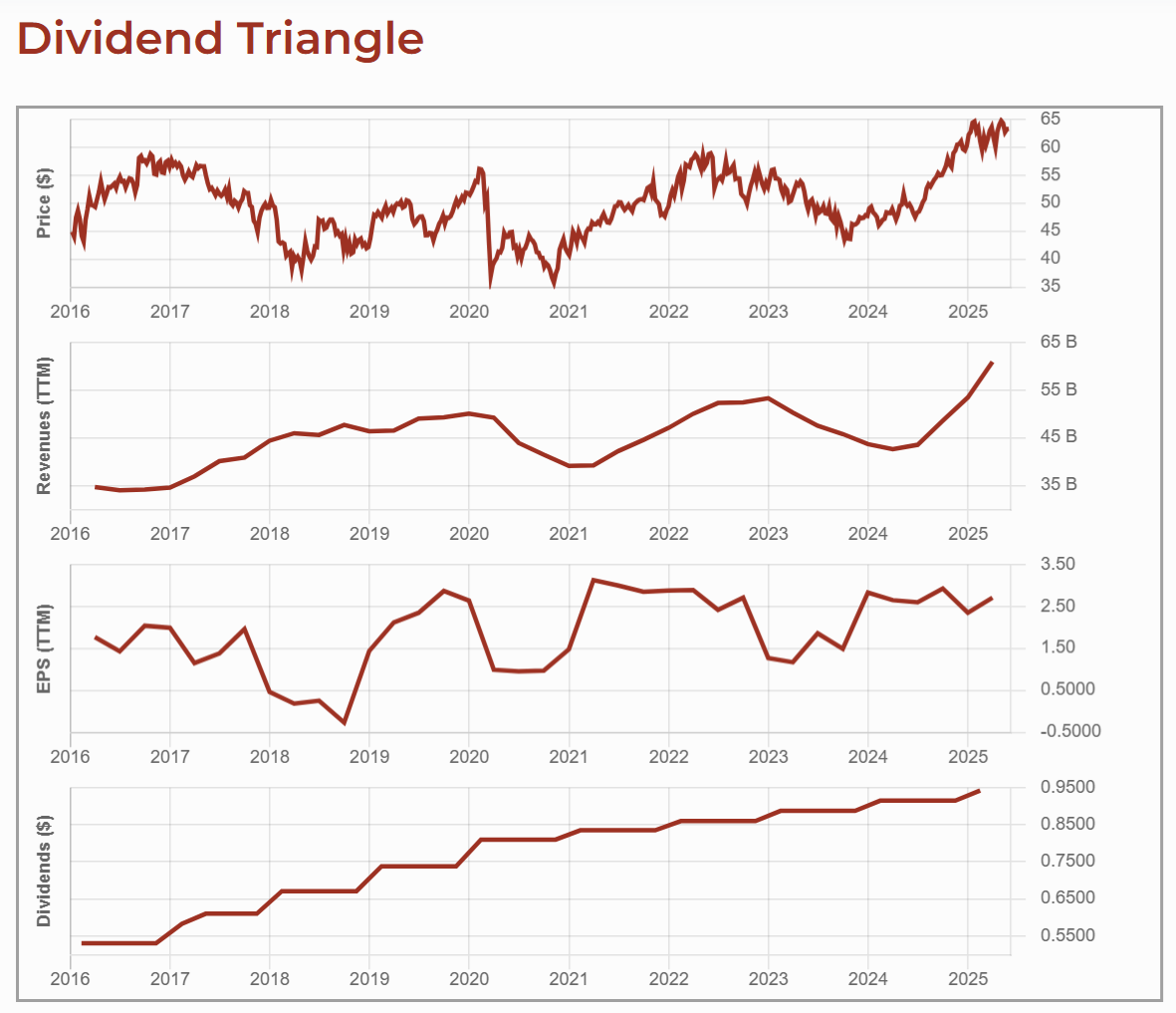

Enbridge (ENB.TO) (ENB)

Yield: ~6%

What it is: A pipeline play that uses Distributable Cash Flow (DCF) to cover its dividend. The payout ratio is tight but manageable. The business is capital-intensive, so debt is always a concern. Just know what you’re buying: income, not growth.

(Click on image to enlarge)

Enbridge (ENB.TO) 10-Year Dividend Triangle.

Bull case: Enbridge operates the classic pipeline playbook. Enbridge’s revenue is primarily generated through transportation fees on its pipeline networks. The Mainline system is the backbone of its operations, while the recent acquisition of gas utilities diversifies the business. The company also has a growing portfolio of renewable energy projects, although these account for only a small portion of its overall operations.

Bear case: While returns seem good from time to time, the real potential of ENB is found in its dividend. The stock price will drop and then recover, which makes you think it will soon skyrocket, but it doesn’t. As the company continues to borrow money for new projects, you must track the distributable income per share to ensure the dividend remains safe. The 3% increase is far from the previous 10% increase/year we saw before 2019, but it beats the current rate of inflation.

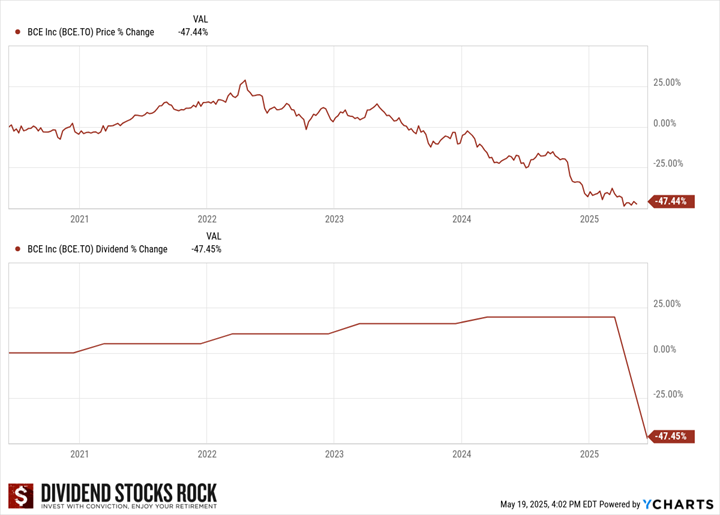

What to Avoid (or Handle with Caution)

I can’t stress this enough: high-yield stocks are more likely to cut their dividend—and when they do, you get hit twice:

- Your income drops

- Your capital shrinks (fast)

Just look at BCE: it lost ~50% of its market value in 5 years and then slashed its dividend by 56%.

A high-yield “safe bet” became a retirement liability.

(Click on image to enlarge)

BCE 5-year Price and Dividend % Change.

I’ve made that mistake too—Algonquin taught me the hard way in 2022. I chased the story, ignored the numbers, and paid for it. Lesson learned.

A quick guide to avoid dividend cuts

Here’s a quick checklist to avoid dividend cuts amongst your generous payers:

- Make sure your investment thesis is backed by numbers

A story about why you love a stock is excellent, but having numbers in line with your story is a lot better.

- Get rid of stocks with a poor dividend triangle

A high yield with no revenue, EPS growth, or dividend growth can’t stay in your portfolio.

- Avoid high payout ratios.

If payout ratios are above 100%, it’s time to seriously investigate and understand the issue.

- Minimize the weight of your High-Yield stocks.

Review your stock weight and dividend income weight using the DSR PRO dashboard to diversify your portfolio and your sources of income.

- Avoid holding too many stocks in the same sector or with the same business model.

If you have 4 office REITs, you have exposed yourself to significant damage in your portfolio.

- Avoid a concentration in interest rate-sensitive sectors

Capital-intensive businesses (read heavy investments in projects) are more exposed to higher interest rates. They will be the first ones to fail their shareholders.

You won’t avoid every dividend cut. But with a bit of due diligence, you can prevent most—and limit the damage from the rest.

Final Take: A Role But Not the Foundation

High-yield stocks can play a role—but they’re not the foundation of a long-term dividend strategy.

If you’re retired and need income? Sprinkle in a couple.

If you’re still building wealth? Stick to dividend growers, and let compounding do the work.

But whether you’re 35 or 65, always ask:

“Can this company keep paying me for the next 5 years without blowing up?”

If the answer is yes—you just might have a high-yielder worth holding.

More By This Author:

Steady Growth, Sticky Customers, And A Dividend That Creeps UpTry Replacing This One—We’ll Wait

The 2025 Half-Time Report: Who’s Beating The Market?