High Energy Momentum: 3 Oil Stocks Breaking Out Now

Image: Bigstock

It seems the bull market in oil is back. In just the last two months, the price of oil has rallied an astonishing 30%, and it doesn't seem to be slowing down. After putting in a bottom earlier this year, and more recently breaking above a major level of resistance, the trend is clearly pointing higher. The energy sector has led the market over the last week, the last month, and the last three months, indicating considerable relative strength.

Higher oil prices mean more profit for oil and energy adjacent companies. Enerplus (ERF - Free Report), Valero Energy (VLO - Free Report), and Par Pacific (PARR - Free Report) are three stocks that are likely to benefit from higher oil prices. Furthermore, all of these stocks enjoy reasonable valuations and extremely compelling technical chart setups.

Image Source: TradingView

Enerplus

Enerplus Corporation is a Canadian energy company engaged in the exploration, development, and production of oil and natural gas resources. With a diversified portfolio of assets across North America, Enerplus focuses on optimizing production and capitalizing on growth opportunities in both conventional and unconventional resource plays.

The company's strategic approach, combined with its commitment to operational efficiency and sustainability, positions it as a significant player in the energy sector that is poised to leverage evolving market dynamics.

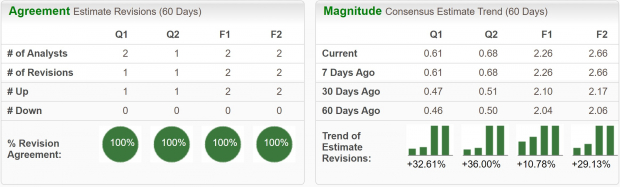

Enerplus has recently seen some significant increases in its earnings estimates, giving it a Zacks Rank #1 (Strong Buy) rating. Current quarter earnings estimates have been revised higher by 33% over the last month, while FY23 estimates have been boosted by 11%.

Image Source: Zacks Investment Research

Last week, Enerplus broke out from a standard bull flag following another leg higher in the price of oil. Then on Thursday’s trading, the price retested the breakout level and reversed hard. This is very bullish price action, and it could provide a very asymmetric trading opportunity.

If ERF stock trades above $17.50, which was Thursday’s high, the next leg higher should begin. However, if it trades below the $17 level, investors may want to steer clear as the setup will be invalidated.

Image Source: TradingView

Enerplus has recently been seen trading at a one-year forward earnings multiple of 7.7x, which is below the industry average of 10.4x and below its 10-year median of 9.2x. Furthermore, the company pays a dividend yield of 1.4%.

Valero Energy

Valero Energy is one of the largest independent petroleum refiners and marketers in the United States. Headquartered in San Antonio, Texas, Valero operates several refineries across the U.S., Canada, and the Caribbean. The company produces a variety of products, including gasoline, diesel fuel, distillates, jet fuel, asphalt, petrochemicals, and more. Apart from refining operations, Valero also has a significant presence in the ethanol industry.

VLO today has a Zacks Rank #3 (Hold) rating, but its style scores indicate that improvements may be just around the corner. The stock boasts an ‘A’ grade across the Value, Growth, Momentum, and VGM style scores. Furthermore, EPS are forecast to grow by 6% annually over the next three to five years.

Like the others, Valero Energy stock has been building a compelling technical chart pattern. Just this week, VLO stock cleared the $134.70 level, signaling a breakout. So long as the stock doesn’t reverse back below that level, it should continue to rally significantly.

Image Source: TradingView

Par Pacific

Par Pacific manages and maintains interests in energy and infrastructure businesses. The company's operating segment consists of refining, retail, and logistics. It also markets and distributes crude oil from the Western United States and Canada to refining hubs in the Midwest, Gulf Coast, East Coast, and Hawaii. Par Pacific Holdings, Inc., formerly known as Par Petroleum Corporation, is headquartered in Houston, Texas.

Although PARR currently has a Zacks Rank #3 (Hold) rating, the company’s quarterly earnings were above the expectations. At the most recent quarterly meeting, Parr Pacific reported EPS of $1.73 per share, which was 44% above analysts' expectations.

But what really drew me to PARR stock is the picture-perfect technical pattern. Par Pacific stock has formed an extremely tight bull flag from which the price looks like it is about to launch higher from. If the stock can break out above the $36.30 level, it should push to another new all-time high. Alternatively, if it loses the level of support and trades below $34.30, the setup is invalid and investors should look elsewhere for opportunities.

Image Source: TradingView

Bottom Line

It looks like the energy market may be in the midst of another major bull run, and thus investors should consider reloading their portfolios with oil and gas stocks. Of course, even the best trading setups can fail, so investors should always keep risk management in mind and stick to a trading plan.

More By This Author:

Bull Of The Day: CamtekBear of the Day: Dollar General

3 Energy Stocks Suited Nicely for Income Investors

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more