High Dividend 50: Xerox Holdings

Xerox (XRX) has become a high-yield stock in recent months and it is currently offering a nearly 10-year high dividend yield of 5.4%.

However, investors should perform their due diligence before purchasing a high-yield stock. In this article, we will analyze whether income-oriented investors should purchase Xerox for its enticing yield.

Business Overview

Xerox traces its roots back to 1906 when The Haloid Photographic Company began manufacturing photographic paper and equipment. Since then, the company has gone through a series of mergers and spinoffs. In 2017, Xerox spun off its business processing unit and now focuses on design, development, and sales of document management systems.

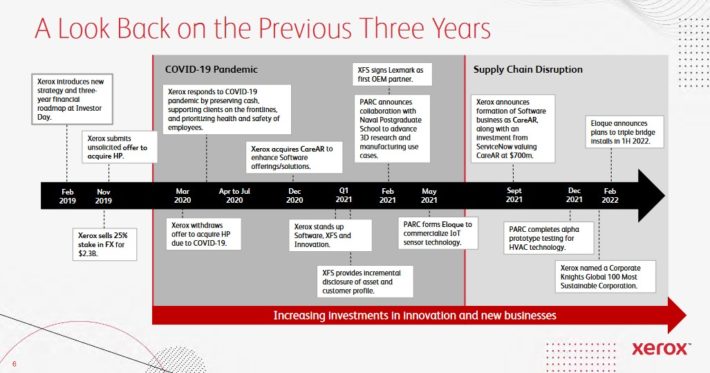

The past three years have seen many changes for Xerox.

Source: Investor Presentation

Xerox has been severely hurt by the coronavirus crisis, which has led many companies to adopt a work-from-home model or a hybrid work model. Due to this shift, demand for document management systems has significantly decreased.

In the fourth quarter, Xerox saw its revenues decline 8% and its adjusted earnings per share plunge 41% over the prior year’s quarter.

Even worse, the plunge in earnings per share materialized despite a 20% reduction in the share count of the stock. In other words, Xerox repurchased its shares at an extreme rate to mask its poor business performance but it did not manage to prevent a 41% decrease in its earnings per share.

It is remarkable that the company returned $1 billion to its shareholders via dividends and share repurchases in 2021. As this amount is 30% of the market capitalization of the stock, it is evident that management is doing its best to mask its poor performance via financial engineering.

Management attributed part of the disappointing results to disruptions of its supply chain due to the pandemic but the poor results and the focus of management on extreme buybacks raise a red flag for investors.

Moreover, management provided guidance for free cash flow of at least $400 million (~$2.50 per share at the current share count) in 2022. Such a high free cash flow may seem enticing on the surface, as it probably signals that the aggressive share buybacks will remain in place for at least another year.

On the other hand, we would prefer to see management invest in the business and make efforts to turnaround the company instead of focusing on financial engineering.

Growth Prospects

Xerox has exhibited a daunting performance record over the last decade. During this period, the company has reduced its share count by nearly 50% but its earnings per share have plunged 60%. In other words, its underlying earnings have plunged approximately 80% over the last decade.

The pandemic has begun to subside in recent months but Xerox has failed to show any signs of a promising recovery. Most companies that were hurt by the pandemic have fully recovered or have begun to recover at least. Unfortunately, this is not the case for Xerox.

The pandemic has led many companies to adopt a hybrid work model, which has significantly reduced the demand for the products of Xerox. As this secular trend is not likely to fade anytime soon, there is great uncertainty over the future growth prospects of Xerox.

In addition, we do not expect margins to improve significantly, given the shrinking end market of this business. Share repurchases will be a major growth driver for the bottom line but they are not sufficient to render the stock attractive, as its business model is under pressure.

Competitive Advantages

The primary competitive advantage of Xerox lies in its pure-play focus on document management systems and its very long history in the industry. In addition, the company has a highly diversified, global customer base.

On the other hand, its end market is continuously shrinking, as many companies shift to a hybrid work model. Given also the disappointing performance record of the company and the secular decline of its business, it is evident that the competitive advantages of Xerox are of little importance to the shareholders in the current business environment.

Dividend Analysis

Xerox is offering a nearly 10-year high dividend yield of 5.4%. However, it has paid the same dividend for five consecutive years. In addition, Xerox has an elevated payout ratio of 63% while its business model is under pressure due to the secular shift of companies towards a more digital work model.

Moreover, Xerox has greatly leveraged its balance sheet lately in order to execute its aggressive share repurchases. Interest expense consumes 23% of operating income while net debt currently stands at $5.8 billion. As this amount is nearly double the market capitalization of the stock, it is undoubtedly high.

Furthermore, Xerox is likely to continue buying back its shares aggressively this year but its balance sheet will not strengthen anytime soon. Overall, the 5.4% dividend of Xerox is not safe, particularly in a recession.

Instead, it is likely to come under pressure whenever the company faces a headwind, such as a recession. Therefore, investors should not purchase Xerox for its above-average dividend yield.

Final Thoughts

Xerox is offering a nearly 10-year high dividend yield of 5.4% and is trading at a forward price-to-earnings ratio of 11.2. Unfortunately, there are good reasons behind these seemingly attractive metrics of the stock. The company is facing a strong secular headwind, namely the shift of companies towards a more digital business model. Given the shrinking end market of Xerox and the intense competition in its business, it is only natural that the stock is trading at a low price-to-earnings ratio.

Moreover, instead of doing its best to invest in the business and turn the company around, management seems to be focused primarily on buying back shares aggressively in order to boost earnings per share artificially. As a result, we do not expect Xerox to enter a sustained growth trajectory anytime soon.

During the last decade, the stock has shed 37% whereas the S&P 500 has more than tripled. Overall, the 5.4% dividend of Xerox is insufficient to compensate investors for the high risk of the stock.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more