High Dividend 50: Via Renewables

Via Renewables, Inc. (VIA) is a play on renewable energy. While waiting for renewable energy to start to be the primary source of energy, an investor in VIA can wait with a generous dividend yield of 8.5%.

As a matter of fact, Via Renewables is one of the high-yield stocks in our database.

This article will analyze if Via Renewables, Inc. is a good stock for dividend/income investors.

Business Overview

VIA Renewables, formerly Spark Energy, Inc., is an independent retail energy services company operating in 100 utility service territories across 19 states. On August 10th, 2021, Spark Energy (SPKE) changed its name to Via Renewables to reflect the company’s direction to renewable energy. The company sources power and gas.

VIA uses an asset-light model that allows the company to offer residential and commercial customers a competitive alternative for their electricity and natural gas supply.

Via Renewables is headquartered in Houston, Texas. Via Renewables has a market cap of $304 million and executed its initial public offering in 2014.

Source: Investor Presentation

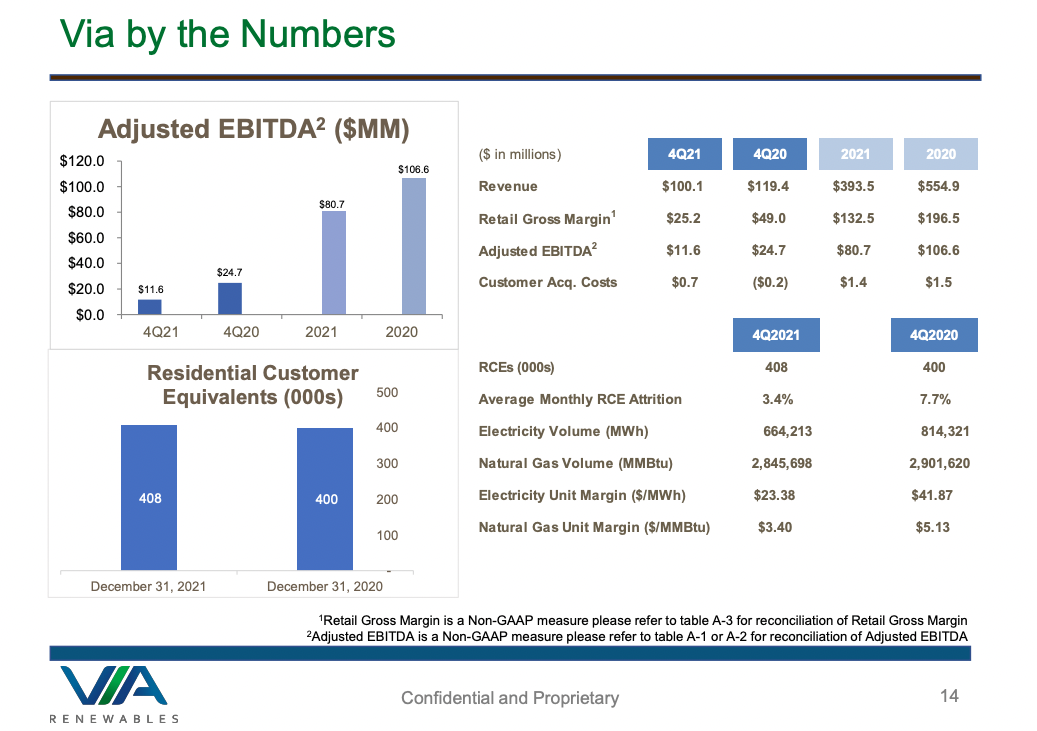

On March 2nd, 2022, the company reported fourth-quarter and full-year results for Fiscal Year (FY)2021. Revenue was down 16.2% for the quarter compared to 4Q2020. The company lost was $35.8 million, which was heavily impacted by record commodity prices. This compares to a net income of $8.8 million for the fourth quarter of 2020. The company reported an adjusted EBITDA of $11.6 million compared to $24.7 million for the quarter. The decrease was due to lower gross margin quarter over quarter.

For the year, the company generated $397.7 million in revenue, a 29.1% decrease compared to 2020, when the company generated total revenue of $554.9 million. Net income also came in at a loss for the year. VIA reported a net income of a loss of $3.9 million versus a profit of $15.7 million in 2020. The decrease compared to the prior year was primarily the result of a $64.4 million loss due to winter storm Uri.

For the year, Via reported an adjusted EBITDA of $80.7 million compared to adjusted EBITDA of $106.6 million in 2020. The decrease was primarily due to reductions in both power and gas usage, partially offset by higher gas margins.

(Click on image to enlarge)

Source: Investor Presentation

Overall, the company had a diluted earning loss of $0.17 per share for 2021 compared to a diluted earning gain of $1.48 per share in 2020.

Growth Prospects

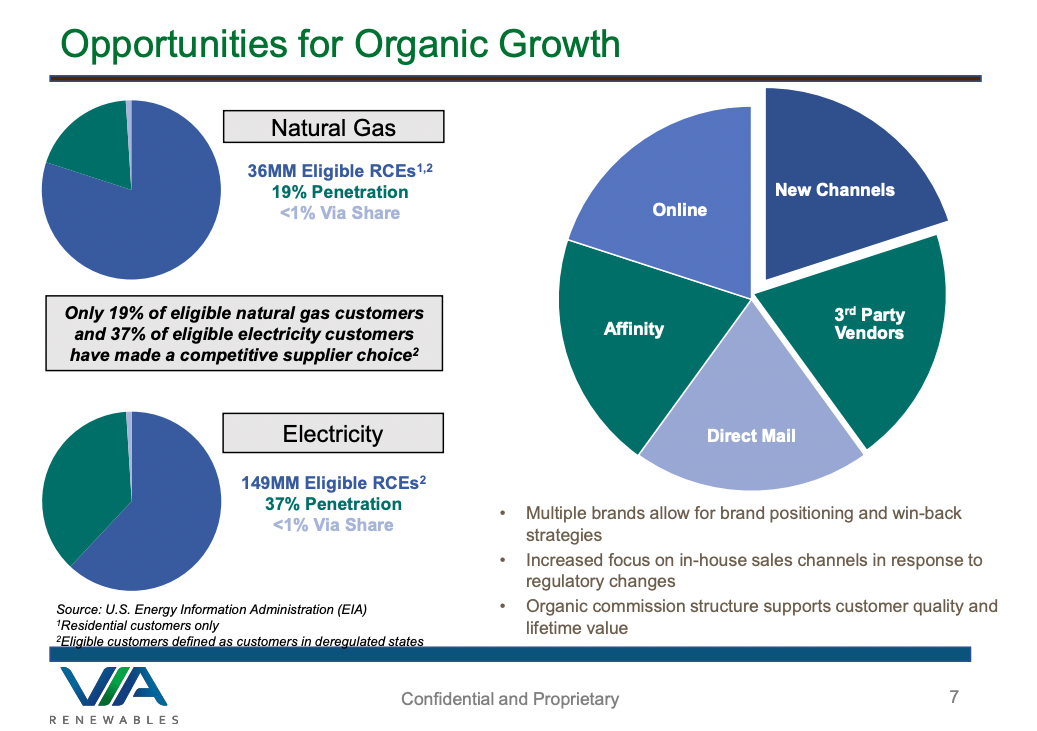

The biggest growth driver for the company will come from organic growth and acquisitions. For example, of the eligible nature gas customers and eligible electricity customers, only 19% and 37%, respectively, have made a competitive supplier choice. This leaves the company with a great deal of headroom to go after these customers to increase its growth.

For example, the company can advertise better to these customers or give a better incentive to these customers to switch to VIA Renewables.

(Click on image to enlarge)

Source: Investor Presentation

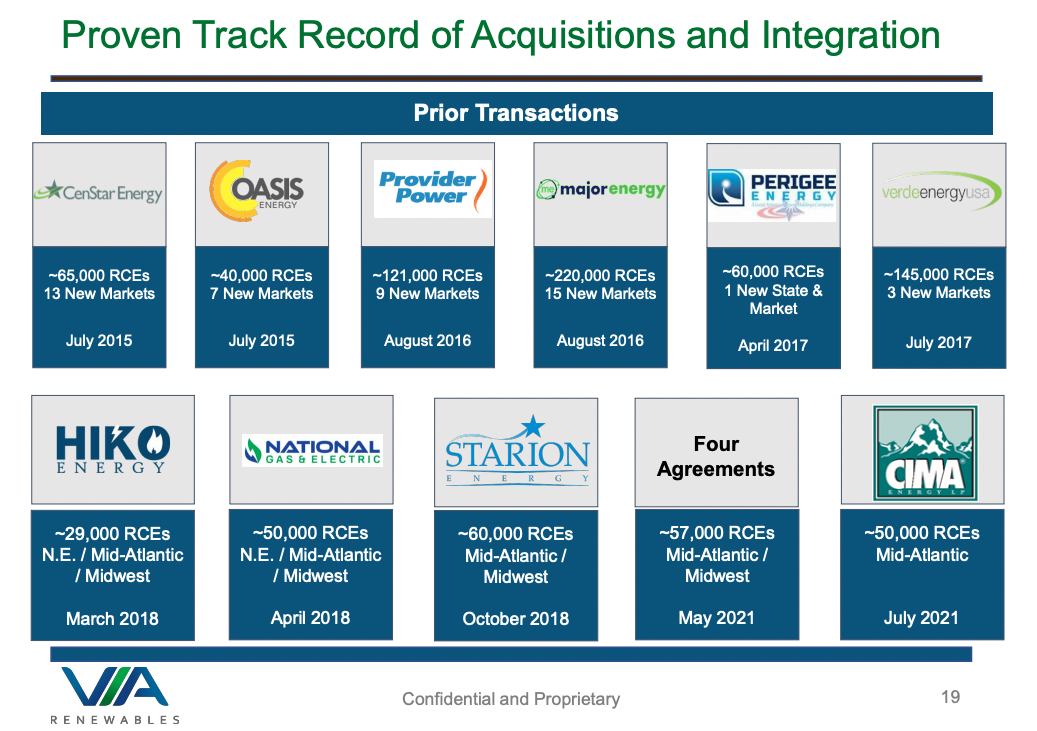

Another form of growth is through acquisitions and seamlessly integrating the newly acquired companies. For example, CIMA’s most recent acquisition brought in approximately 50,000 Residential Customer Equivalents (RCEs). The last significant addition was in 2017 with the acquisition of Verde Energy USA, which brought in about 145,000 RCEs and three new markets.

(Click on image to enlarge)

Source: Investor Presentation

Competitive Advantages & Recession Performance

VIA’s most significant competitive advantage is the company’s assets. The company has assembled a set of energy infrastructure assets that we believe would be very difficult to replicate.

As for recession performance, the company was not around during the 2008-2009 Great Recession. Thus, we will look at how well the company did during the COVID-19 pandemic.

VIA’s Earnings-Per-Share (EPS) per share throughout the COVID-19 pandemic:

- 2019 earnings-per-share of $0.02

- 2020 earnings-per-share of $1.48 (7300% increase)

- 2021 earnings-per-share of $(0.17) (101.1% decrease)

As you can see, the company was unpredictable during the COVID-19 pandemic. However, we expect EPS to increase to $0.70 per share for 2022. This will represent a substantial increase compared to 2021.

Dividend Analysis

The company pays a high dividend yield of 8.5%. The dividend is paid quarterly at $0.1812 per share for a total yearly dividend of $0.7248 per share. VIA has been paying the same quarterly rate since 2015. Before that time, the company was paying a dividend of $0.075 per quarter per share. Thus, in 2015, the company increased its dividend by 141.6%.

This increase was well covered with earnings during that time. In 2016, the company earned $1.19 per share while only paying out $0.7248 in dividends. This was a dividend payout ratio of 61%. However, over the last four years, earnings have been very volatile. For instance, the dividend payout ratio from 2018 through 2021 was negative in 2018 and 2019, 49.3% in 2020, and negative for 2021.

As mentioned above, we expect the company to make $0.70 per share for 2022. Based on this, it will give the company a dividend payout ratio of 104%. It is making the dividend unsafe at this level.

In addition, the company has an undesirable balance sheet, with an interest coverage ratio of 0.9 and a debt-to-equity ratio of 2.5. Both ratios are at concerning levels. Also, the company does not have an S&P credit rating.

As a result, we view the dividend of Via Renewables inc. as not safe for the foreseeable future. This is due to its high dividend payout ratio and unfavorable balance sheet.

Final Thoughts

The pandemic has begun to subside, but Via Renewables is now facing another strong headwind, namely the high fuel costs, which have resulted from the tight global supply of oil and gas. Also, given the markedly volatile performance record of Via Renewables, the stock is highly speculative.

Moreover, retirees should note that Via Renewables earns a poor rating for Retirement Suitability, primarily due to its short dividend history and excessive payout ratio. Also, the dividend could be at risk of being cut whenever an unforeseen downturn shows up.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more