High Dividend 50: United Bankshares

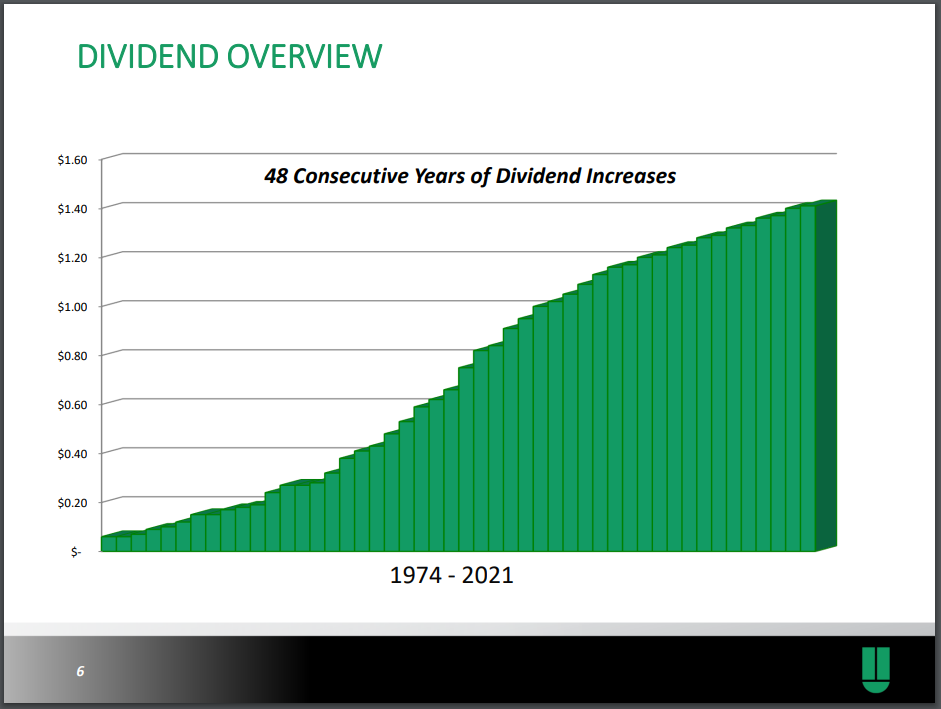

United Bankshares (UBSI) has raised it’s dividend for forty-eight years, even throughout the Great Recession and the COVID-19 pandemic. However, dividend growth is very slow, at about 1.5% per year over the trailing ten years.

Still, these increases have led the company to a high dividend yield of 4.2% today. And the dividend appears fairly covered and primed for further increases. However, the company may not be so attractive right now for total return investors.

Business Overview

United Bankshares, formed in 1982, is the parent company of its banking subsidiary United Bank. The bank has 222 full-service banking offices and 22 loan origination offices across Virginia, West Virginia, Maryland, North Carolina, South Carolina, Ohio, and a few other U.S. states. United Bankshares recently completed its 33rd acquisition and has successfully grown its presence in the Mid-Atlantic region.

The company has more than $27 billion in total assets and annual revenue of roughly one billion dollars. The company has a fantastic dividend history, with 2021 marking the 48th consecutive year of dividend increases. Only one other bank has grown its dividend for so many years, even through the great recession.

Source: Investor Relations

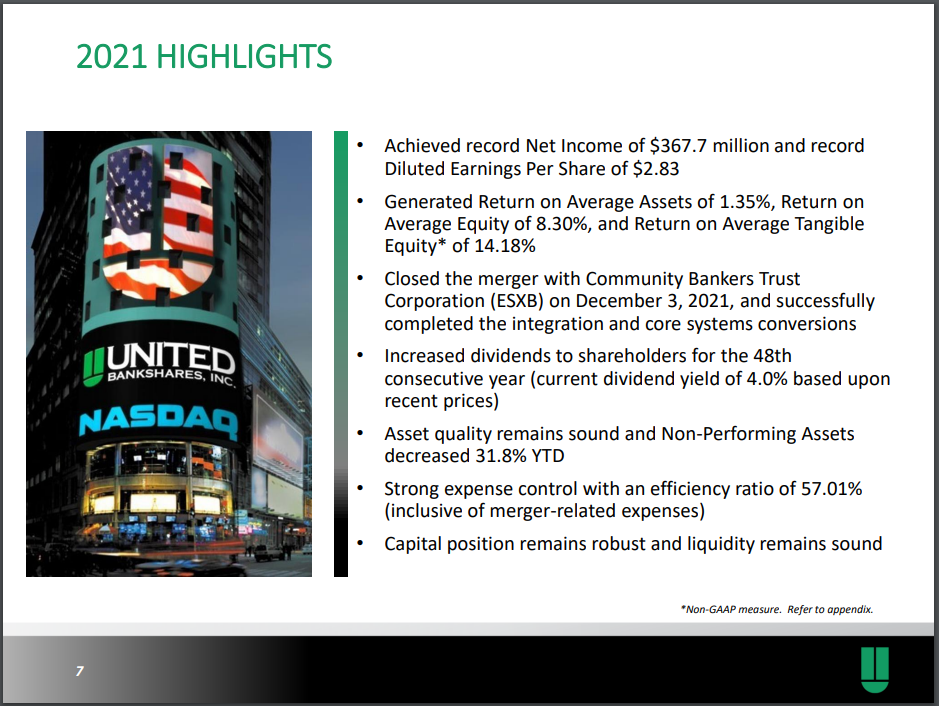

United Bankshares reported Q4 and FY 2021 earnings on January 27th, 2022. Fourth-quarter earnings were $74 million, or $0.56 per diluted share. Results were down from $92 million and $0.71 per diluted share. For FY 2021, earnings were $368 million, a 27% increase from $289 million in 2020.

The bank completed its 33rd acquisition in its history in December 2021 with the Community Bankers Trust Corporation. As a result, the fourth quarter included merger-related expenses of $20.4 million.

Net interest income was $184 million in the fourth quarter, down 4%, from the year-ago period. The decline was due primarily to lower accretion on acquired loans, and lower fee income from the Paycheck Protection Program.

For the year, net interest income was $743 million, up 8% year-over-year. Net interest margin was 3.09% for the year, down 15 basis points from 2020’s level of 3.24%.

Growth Prospects

United Bankshares has grown primarily through acquisitions. The company has completed 33 acquisitions since 1982.

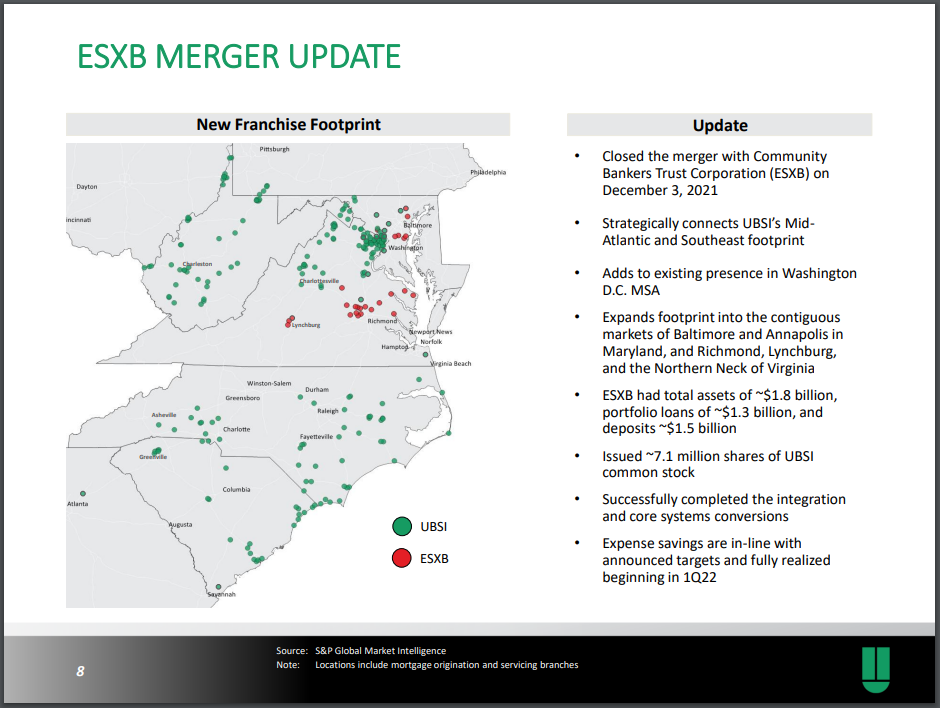

Its latest acquisition of Community Bankers Trust Corp. (ESBX) largely expanded the bank’s new franchise footprint into markets in Maryland, Lynchburg, and Northern Virginia. It also added strong total assets of roughly $1.8 billion to United, with portfolio loans of about $1.3 billion and deposits of $1.5 billion.

Source: Investor Relations

The company is likely to continue growing its asset base and expanding geographically through further acquisitions. The company aims to be one of the most valuable banking companies in the Southeast and Mid-Atlantic. It is the #1 regional bank in the Washington D.C MSA, #2 in West Virginia, #17 in North Carolina, and #10 in South Carolina.

Lower earnings-per-share are expected in 2022 compared to 2020 and 2021, as one-time gains from the Paycheck Protection Program (PPP) and the significant credit provision recoveries are in the rearview.

In 2022, United is anticipating further loan growth to be in the mid-single digits (excluding PPP loans and loans held for sale). The company will also opportunistically increase its investment portfolio balances.

The company’s net interest margin should increase throughout 2022, and net interest income will generally grow along with interest rates. However, a lack of corresponding gains in lending yields have seen NIM deteriorate over the last four quarters as the company has been faced with higher funding costs.

United also anticipates repurchasing common stock in 2022. The share count has been increased frequently so that the company can afford their numerous acquisitions. Therefore, we don’t see the share count trending down in the long-term, even with share repurchase efforts.

The company has fully realized expense savings from the Community Bankers Trust merger. If further acquisitions were made, the company can also continue to eke out cost synergies.

Competitive Advantages & Recession Performance

United’s main competitive advantage is its strong market position in its regions. It continues to expand into more densely populates areas like northern Virginia. The company has also successfully broken into more markets and regions through acquisitions.

United Bankshares is fairly recession-resistant, especially for a bank company. The company performed well enough in 2008 and 2009 to continue increasing its dividend per share. Even further, the company held up well during the pandemic and even thrived in the last year.

While the company has diluted shareholders with an increasing share count, the company has been able to grow earnings and dividends on a per share basis. This indicates that the company has made intelligent and well-thought-out acquisitions, which were favorable to shareholders.

Dividend Analysis

United has increased its annual dividend for an impressive 48 consecutive years. The dividend has grown fairly slowly, with a compound annual growth rate of 1.5% in the last decade.

Source: Investor Relations

United’s currently quarterly dividend payout of $0.36 equates to an annual dividend of $1.44 in 2022. At the current UBSI share price, the company has a high dividend yield of 4.2%. The current dividend yield is only 20 basis points above the trailing decade average. This does not indicate any real discount to the average yield.

With anticipated earnings per share of about $2.50 for the year, the company has a fair payout ratio of 58%. The company will likely continue to grow the dividend slowly so that they can continue their impressive dividend growth streak without issue.

The company’s dividend, as it is, appears to be safe and will likely survive an economic downturn, as it did during the great recession and the pandemic. Also, to keep in mind, as the company increases its share count to fund acquisitions, it must pay more dividends out as a whole.

Final Thoughts

United Bankshares has one of the greatest track records in the banking sector when it comes to dividend increases. The bank holding company has increased its dividend for 48 years straight. While this dividend growth has slowed a lot, this allows for the dividend to remain in safe territory and for the payout ratio to not run off.

The company’s prudence and regional focus allowed it to come out of the great recession and the pandemic with its dividend streak intact. From a pure income standpoint, United is an attractive option. However, projected earnings growth is fairly anemic, and the company is trading above our fair value estimate at this time.