High Dividend 50: Spire

In this article, we will analyze the prospects of Spire (SR), a utility stock that is currently offering a 3.9% dividend yield.

Business Overview

Spire is a public utility holding company based in St. Louis, Missouri. The company provides natural gas service through its regulated core utility operations but it also engages in non-regulated activities that provide business opportunities.

The company was previously known as the Laclede Group, which was one of the first 12 industrial companies that made up the Dow Jones Industrial average. In 2016, Laclede Group was renamed to Spire. The company has five gas utilities, serving 1.7 million homes and businesses across Alabama, Mississippi, and Missouri. It is the fifth-largest publicly traded natural gas company in the U.S.

Just like the vast majority of utilities, Spire has proved resilient throughout the coronavirus crisis. Even under the fiercest economic downturns, consumers do not reduce their consumption of natural gas, which is an essential commodity.

As a result, while many companies incurred a plunge in their profits in 2020, Spite grew its earnings per share 1% in that year, to a new all-time high. Even better, Spire accelerated its business momentum in 2021 and posted another record in its earnings, assisted by favorable weather.

In the first quarter of fiscal 2022, the company saw its earnings per share decrease 20% over the prior year’s quarter, from $1.42 to $1.14, due to unfavorable weather and increased expenses. Weather was 26% warmer than normal and 19% warmer than it was in the prior year’s quarter. Nevertheless, management maintained its guidance for the full year intact, expecting earnings per share of $3.70-$4.00.

Growth Prospects

The demand for natural gas is sensitive to the prevailing weather conditions, which are unpredictable. It would thus be natural to expect Spire to exhibit a somewhat volatile performance record.

However, the utility has consistently grown its earnings per share over the last decade. During this period, it has grown its earnings per share every single year, at an average annual rate of 6.4%. This growth has come from a sustained increase in the customer count as well as the reliable rate hikes that the utility has enjoyed thanks to its investment in the maintenance and expansion of its infrastructure.

We expect the same growth drivers to remain in place for many more years. Notably, Spire has decelerated in the last five years, as it has grown its bottom line by only 1.6% per year on average during this period. Nevertheless, it has promising growth potential ahead.

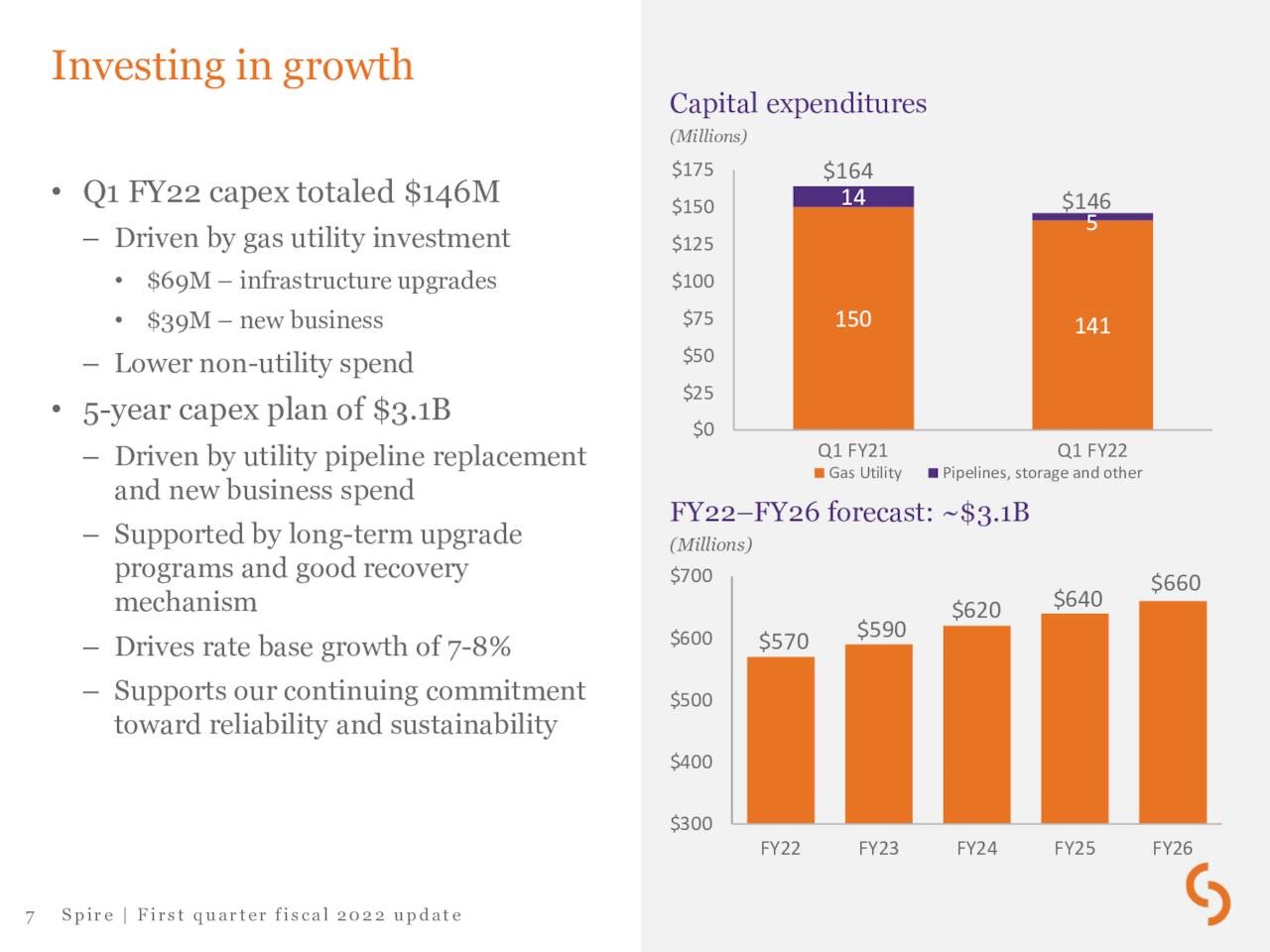

Spire has a 5-year capital plan of $3.1 billion, which includes investment in the maintenance of the infrastructure of the company as well as in the expansion of its business.

Source: Investor Presentation

Management expects the rate base to grow 7%-8% per year thanks to this capital plan. This is certainly an attractive growth rate for a utility.

As the investment amount is 86% of the current market capitalization of the stock, it is evident that the utility is heavily investing in its future growth. Therefore, it is reasonable to expect Spire to accelerate its business momentum in the upcoming years. Indeed, management recently reiterated its bright long-term outlook.

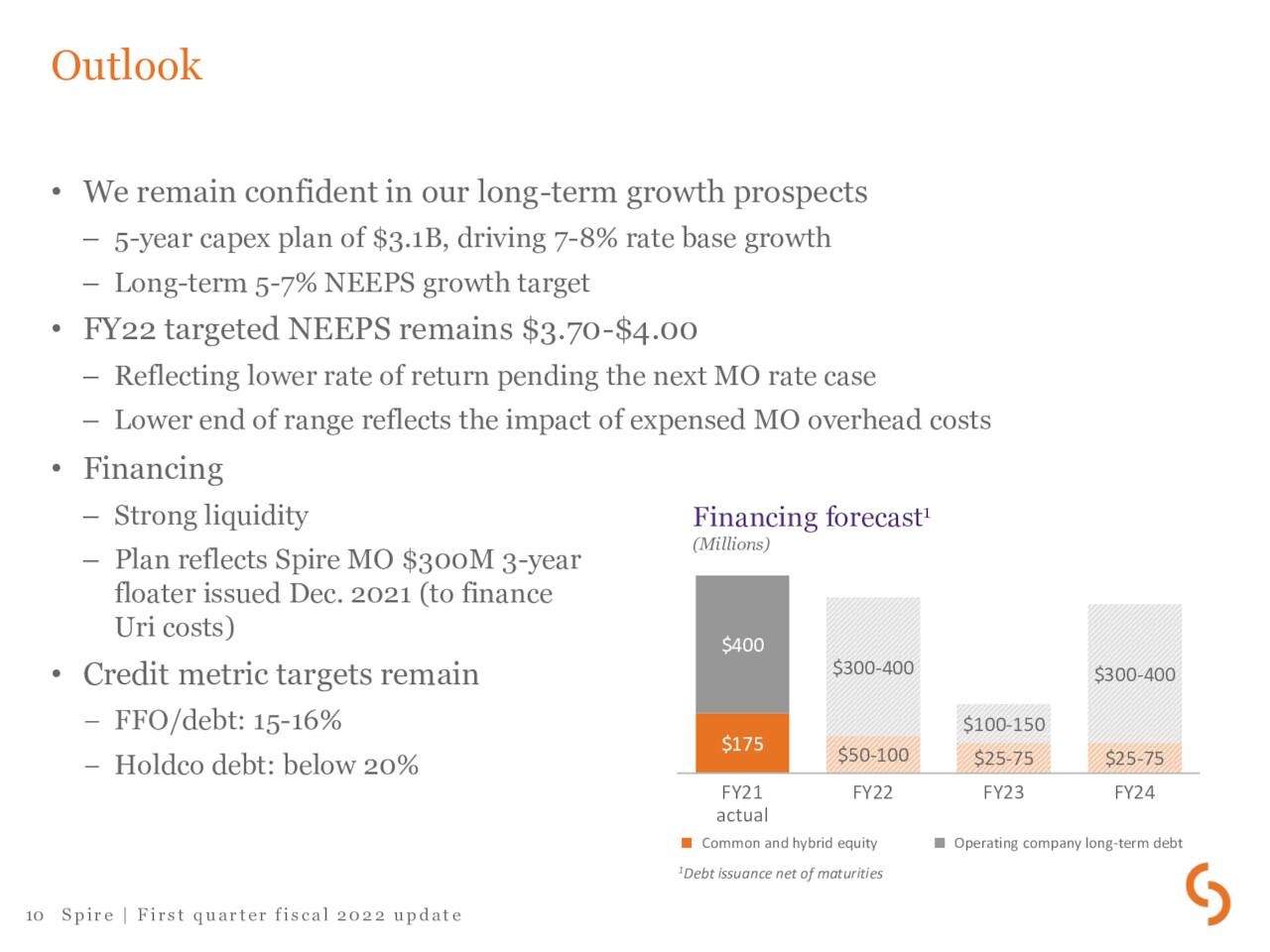

Source: Investor Presentation

Thanks to its ambitious capital plan, Spire expects to grow its core earnings per share by 5%-7% per year on average in the long run. Given the reliable rate hikes Spire enjoys from regulators, who want to encourage the company to keep improving its infrastructure to increase customer satisfaction, one can reasonably expect the utility to grow its earnings.

Competitive Advantages

The competitive advantage of Spire lies in its state-regulated utility business, which requires excessive capital expenses for infrastructure and thus poses high entry barriers to potential competitors in the area. Just like most utilities, Spire enjoys a wide business moat, with reliable earnings growth in the long run.

Dividend Analysis

Spire has raised its dividend for 19 consecutive years. The company has grown its dividend at a 5.0% average annual rate over the last decade. This growth rate is slightly higher than the median growth rate of 4.5% of the utility sector.

The stock is currently offering a 3.9% dividend yield, with a payout ratio of 71%. While the payout ratio may seem somewhat high to conservative investors, it is reasonable for a utility stock, which enjoys much more reliable earnings growth than the vast majority of stocks.

Notably, the company has an interest coverage ratio of 3.7 but a leveraged balance sheet, with net debt of $6.2 billion, which is 172% of the market capitalization of the stock. Nevertheless, thanks to the healthy payout ratio of Spire, its reliable growth trajectory and its resilience to recessions, we view its dividend as safe.

During the Great Recession, when most companies incurred a collapse in their earnings, Spire grew its earnings per share by 14% in 2008 and by another 11% in 2009. This is a testament to the defensive nature of the stock.

Final Thoughts

Due to its “boring” business model and its lackluster business performance in the last five years, Spire passes under the radar of most investors. However, the company is likely to accelerate its growth momentum in the upcoming years thanks to its promising capital plan. Moreover, the stock is offering a 3.9% dividend, with a meaningful margin of safety. It is thus a suitable candidate for the portfolios of income-oriented investors.

The only caveat is the leveraged balance sheet of the company. Given the reliable growth trajectory of Spire, the company is not likely to face any problem servicing its debt. Nevertheless, we prefer a healthy balance sheet, as a testament to the strength of the business model and the quality of management.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more