High Dividend 50: Southern Copper Corporation

Next on our list of high-yield stocks to review is Southern Copper Corporation (SCCO).

Southern Copper has a lumpy dividend history, likely due to the cyclicality of the business and its earnings. Even so, today the company is benefiting from significant commodity price increases.

The company is forecasted to pay a $4.00 dividend in 2022, which results in a 5.8% dividend yield.

Business Overview

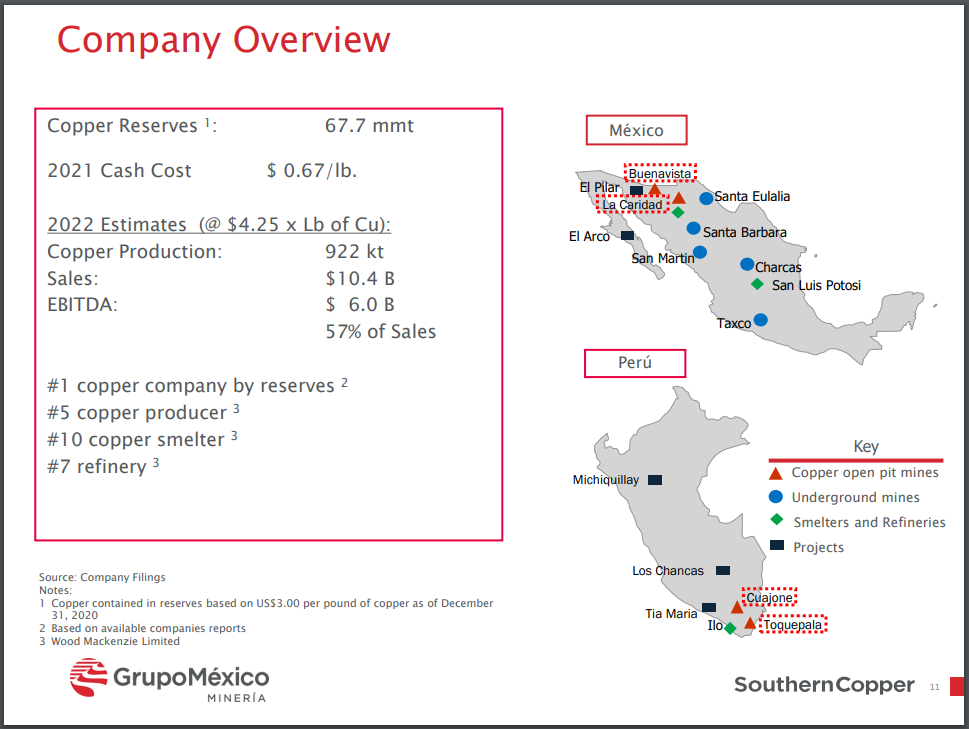

Southern Copper Corporation is one of the largest integrated copper producers in the world. The corporation produces copper, molybdenum, zinc, lead, coal, and silver.

All mining, smelting, and refining facilities are located in Peru and Mexico. Exploration activities are conducted in Peru, Mexico, and Chile.

Southern Copper is listed on the NYSE and the Lima Stock Exchange and has been since 1996. The company has a market capitalization of $53 billion.

Source: Investor Presentation

Southern Copper released Q4 and FY 2021 results on February 1st, 2022.

In 2021, net sales reached a record-high $10.9 billion, up 37% over 2020. This growth was primarily driven by a large increased in metal prices throughout the entire year for copper (+51%), molybdenum (+81%), and zinc (+32%).

For the full year, net income grew 116%, to $3.4 billion. Net income margin grew from 19.7% to 31.1% in 2021. Income per share grew 116% to $4.39 from $2.03 in the prior-year period.

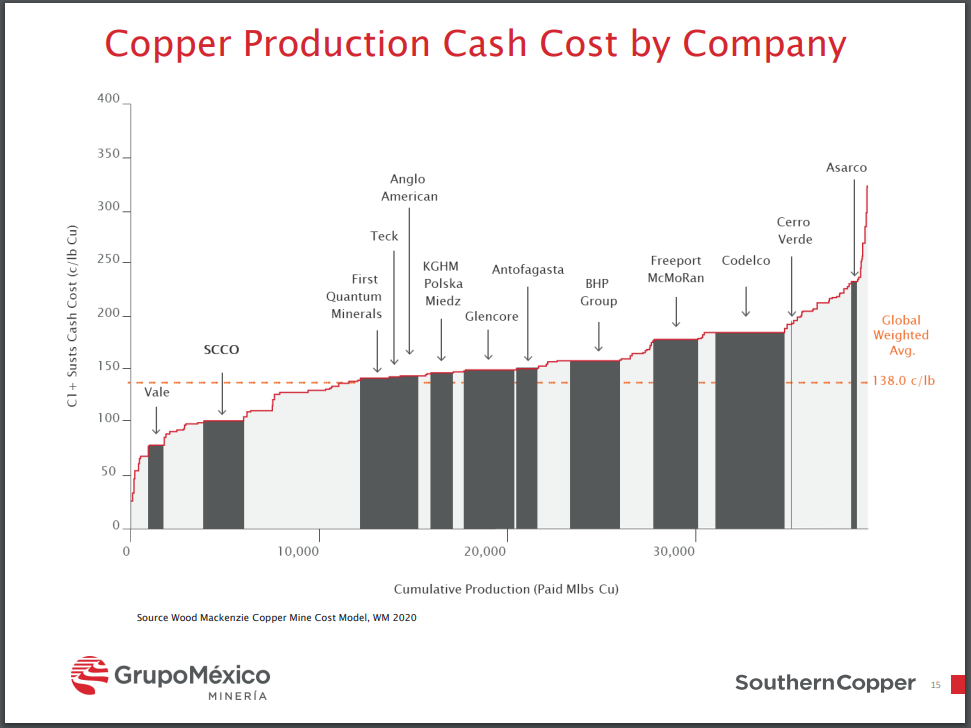

Impressively, the operating cash cost per pound of copper was $0.67 in 2021, compared to $0.69 in 2020. The 3.0% decrease was due to a significant increase in by-product revenue credits.

Growth Prospects

Southern Copper Corp has a lumpy earnings history as their growth is highly dependent on ever-shifting commodity prices. It is primarily exposed to copper prices, but also silver, zinc, and others. Regardless of commodity prices, the company expects that the quality of the assets they operate and develop will fuel growth over the long term.

The business is largely cyclical. A significant increase in precious metals prices has caused massive growth in earnings in recent quarters, which led to blowout results in 2021.

We are forecasting a minor earnings reduction in 2022, but still a very strong $4.15 per share.

Source: Investor Presentation

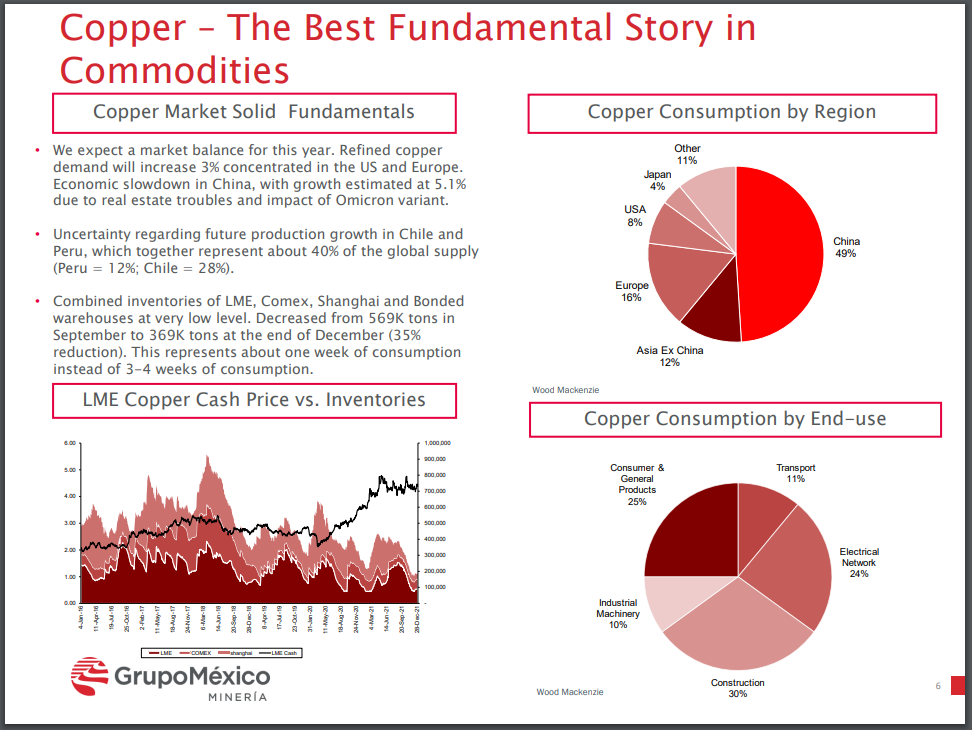

Southern Copper’s growth is predicated by solid fundamentals in the copper market. The automobile industry’s global recovery was part of the cause for a significant increase in copper production in 2021. Additionally, government infrastructure packages may cause increases in copper demand, as it’s a fundamental component to green energy.

The company has long-term projects in place, such as starting up new mines and expanding existing ones. It also has a total investment program of $7.9 billion for projects in Peru. So far, $1.6 billion has already been invested.

Its current large projects are Michiquillay ($2.5B) and Los Chancas ($2.6B).

Michiquillay is expected to produce 225,000 tons of copper per year (and by-products) for more than 25 years with a start-up date by 2028.

Los Chancas is anticipated to start producing 130,000 tons of copper and 7,500 tons of molybdenum annually in 2027.

Southern also has some of the lowest cash cost for producing copper. Still, they have continued to lower this and fuel bottom-line growth.

The company is also investing into increasing production at their existing mines.

Competitive Advantages & Recession Performance

Southern Copper is a power player in the copper mining, smelting, and refining businesses. SCCO has the world’s largest copper reserves, with over 65 million tonnes (Mt).

Southern also has the #1 mine life among copper producers and is one of the world’s largest producers of mined copper.

Additionally, The corporation has one of the lowest cash cost for produced copper among its peer group, which is yet another advantage.

Source: Investor Presentation

SCCO was negatively affected by the great financial crisis, and earnings dropped in half from 2007 to 2009, which forced a reduction in the dividend from $2.24 to $0.44.

While precious metals prices may increase during tough economic conditions, demand for the metals are likely to decrease.

Dividend Analysis

Southern Copper is paying a large $4.00 dividend in 2022, based on its latest $1.00 quarterly payout. Shares of SCCO currently trade at $69.53. Due to the high dividend payment, the company currently yields 5.8%. The current yield is significantly higher than the trailing decade average of 3.3%.

With 2022 earnings-per-share expectations of $4.15 and the annual dividend of $4.00, the company is anticipated to payout 96% of EPS in dividends. This indicates that, after massive increases, the dividend could be at risk if EPS were to fall.

If the company can maintain and grow their spectacular earnings levels of 2021, the payout ratio could moderate. However, the company appears to be approaching a cyclical high.

The company has cut the dividend in about five out of the ten trailing years. The company does not appear to be committed to paying higher dividends year after year. The dividend has risen and fallen frequently, but we estimate the company can continue growing it by low single digits from this high point. Still, the dividend payout ratio is in dangerous territory for 2022.

Final Thoughts

Southern Copper Corporation’s high dividend yield of 5.8% is significantly above its historical average of 3.3%. The company today is enjoying a cyclical high. However, they are paying out nearly all of their earnings.

This, in addition to the frequent dividend cuts in it recent past, leads us to rate the dividend at a high risk of being cut in a recession or industry downturn.

Southern Copper Corp. is a high-yield mining stock, but the dividend cannot be considered reliable during a full business cycle.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more