High Dividend 50: Pinnacle West Capital

Today, Pinnacle West Capital has a higher-than-average dividend yield compared to the last decade. A high dividend yield can indicate an issue with a company, though not always. As a result, investors must perform their own detailed research before purchasing high-yield stocks.

In this article, we will analyze the owner of the largest nuclear plant in the U.S., Pinnacle West Capital (PNW).

Business Overview

Pinnacle West Capital is an electric utility holding company based in Phoenix, Arizona. The company was initially known as Arizona Public Service Company, then later reorganized as a holding company, AZP Group Inc., in February 1985. In 1987, it changed its name to what is now known as Pinnacle West Capital.

Arizona Public Service (APS) is the corporation’s main subsidiary and provides electricity service to nearly 1.3 million customers. APS also operates and co-owns the Palo Verde Generating Station, which is the largest nuclear plant and generator of carbon-free electricity in the U.S.

The company possesses 6,300 megawatts of generating capacity and employs almost 5,900 in Arizona and New Mexico.

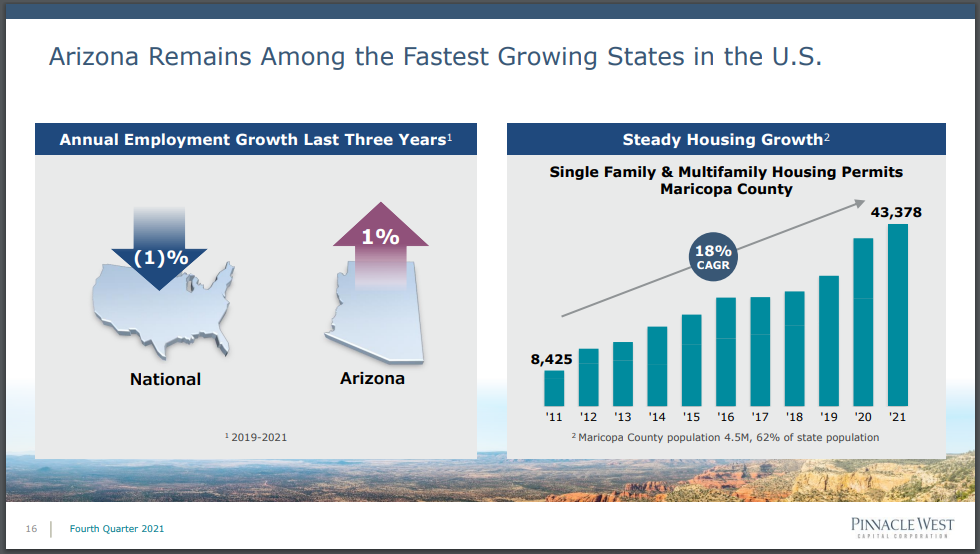

Pinnacle West reported Q4 and FY 2021 results on February 25th, 2022. The company grew operating revenue by 7.8% year over year for the quarter, from $741 million to $799 million. An increase in revenue was driven by higher customer usage and growth. And the stream of new people is making the company’s territory among the fastest growing in the nation.

For the full year, revenue was up 6.0% compared to 2020. Operating expenses rose by $200 million for the whole year, driven by fuel and purchased power. Net income saw a year-over-year increase, up 11.6%. And earnings per share increased 12.3% compared to the prior year. The 2021 results were positively impacted by an increase in revenue driven by higher customer usage and growth, and higher transmission revenues.

We expected PNW to generate earnings-per-share of $4.00 for 2022. This would represent a near 30% decline compared to 2021. This decrease will be the result of recent rate changes by Arizona Public Service Co. (APS).

Growth Prospects

We expect continued growth for PNW to be primarily driven by an increasing population in Arizona. The company itself anticipates retail customer growth in the range of 1.5% to 2.5% for 2022 and in the long-term, which is supported by housing and population growth.

Source: Investor Presentation

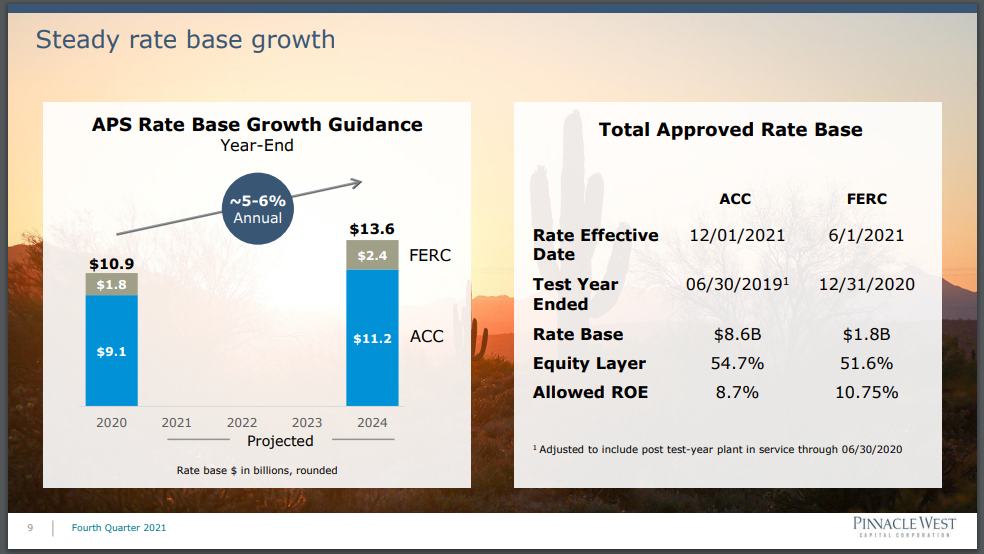

Additionally, rate base growth will fuel revenue growth and ultimately reach the bottom line. The company is forecasting 5% to 6% annual rate base growth at APS into 2024.

Source: Investor Presentation

We expect Pinnacle West Capital to grow earnings at a 2% rate for the next five years. The expected 2% growth rate is lower than the trailing decade average growth rate of 5.1%. PNW’s net margin has been improving over the past decade, growing from a low of 10.5% in 2011 to 15.4% last year. This could continue to be a growth driver as well.

Still, long-term, the company anticipates that they can grow earnings per share by 5% to 7%.

Competitive Advantages & Recession Performance

Pinnacle West Capital’s advantage is its monopoly-like utility, which provides a necessity to its customers in its region. People will always need to power their homes and businesses. Investors often hold utility stocks for their defensive nature.

Still, Pinnacle West’s earnings can fall in a prolonged recession. For example, during the Great Recession from 2008-2009, PNW’s earning per share fell from $2.96 in 2007 to $2.12 in 2008. Earnings did recuperate in 2009 and then surpassed their previous earnings in 2010 to $3.08. During the COVID-19 pandemic, however, Pinnacle West was virtually unscathed. In fact, the company experienced year-over-year growth in 2020.

Even though the company faced challenges during the Great Recession, they did not cut the dividend and instead chose to maintain it. Dividend growth resumed in 2012 and has continued up to now. This demonstrates Pinnacle’s dedication to the dividend.

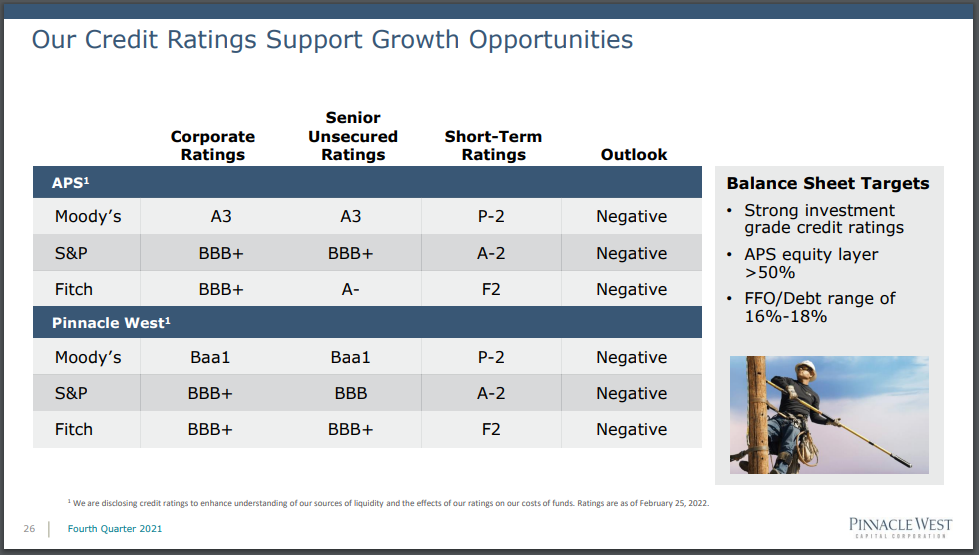

Source: Investor Presentation

The company currently has an S&P credit rating of BBB+, which is still investment-grade quality. Also, PNW has an interest coverage ratio of 4.2. Thus, the company has a fairly healthy balance sheet.

Dividend Analysis

Pinnacle West is so far scheduled to pay an annual dividend of $3.40 in 2022. At Pinnacle’s current share price, the company has a dividend yield of 4.6%. This is a fair bit higher than the company’s trailing decade average yield of 3.7%.

PNW has been paying a dividend for 27 years and growing the dividend every year for the past ten years. The dividend growth rate has been 4.8% for the past ten years and 5.2% for the past five years. We expect PNW to grow its dividend at a 2% yearly rate, roughly in-line with anticipated growth in the medium term.

The company’s payout ratio has been very consistent in the past decade and has an average payout of 62%. In 2022, we anticipate a payout ratio far above its average at 86%, due to the expectation for significant earnings decrease. Still, utilities are stable businesses that can tough out higher payout ratios, as long as it normalizes and decreases from this decade high.

Final Thoughts

Pinnacle West has grown its dividend for ten straight years, after maintaining it following the Great Recession. At today’s share price, the company has a high yield of 4.6%, well above its trailing decade average.

Today the company’s payout ratio is elevated, which may indicate a risk. However, the company so far has demonstrated their devotion to the dividend. And utilities business can sometimes navigate higher payout ratios, as long as it’s not for a prolonged period of time.

Shares today appear overvalued, despite a higher-than-average dividend yield. Additionally, the company is expecting to post large earnings decrease this year. The company does not appear overly compelling, but the dividend appears to be secure for the time being but should be monitored.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more