High Dividend 50: PetMed Express, Inc.

If you have a furry friend in your family, there is a high likelihood that you have bought some kind of medication from PetMed Express, Inc. before.

Image Source: Pexels

PetMed Express, Inc. (PETS) is a high-yield dividend stock with no debt on its balance sheet. We also cover a lot of other different high-yield stocks in our database.

Business Overview

PetMed Express was founded in 1996 by Marc Puleo. PETS originally grew through word of mouth, television commercials, and catalogs. The company is America’s most trusted pet pharmacy, delivering prescription and nonprescription pet medications and other health products for dogs, cats, and horses at competitive prices, all directly to the consumer through its toll-free number and its website.

The company headquarters is in Delray Beach, Florida. PetMed Express, Inc. trades hands in the Nasdaq using the ticker symbol PETS. PETS has been growing its dividend for over thirteen years, and it made $309 million in sales for Fiscal Year (FY) 2021. Currently, PetMed Express has a market cap of $555.7 million.

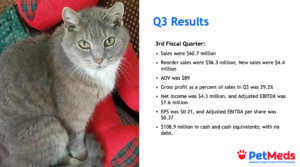

Source: Investor Presentation

On Jan. 24, 2022, PetMed Express reported third-quarter results for the Fiscal Year 2022. The company's fiscal year ends on the last day of March every year. Sales were down 7.9% for the quarter compared to the third quarter of FY2021. For the quarter, the company generated sales of $60.7 million, lower than the total sales of $65.9 million in Q3 2021.

Net sales are down 12.7% for the first nine months of the fiscal year, from $237.5 million in FY2020 to $207.4 million this fiscal year. Net income for the quarts was $4.3 million, or $0.21 diluted per share, compared to net income of $7.6 million, or $0.38 diluted per share, for Q3 2020, a 44% decrease year-over-year.

For the nine months of the fiscal year, net income is down 37% year-over-year. This was a unique quarter because the company was coming off of a solid quarter during the pandemic. The third quarter of FY2021 was driven by increased online buying because many stores and vets were closed. We expect PetMed Express to make $1.17 per share for FY2022. This would represent a decrease of 23% compared to the entire fiscal year of 2021.

Source: Investor Presentation

Growth Prospects

The most significant growth prospects for PedMed Express are through online advertising and reorder sales. E-commerce demand increased due to COVID-19, so the management team is hopeful that this will continue to expand its reorder sales. We expect a 6% earnings growth for the next five years as e-commerce grows and more people include pets as family members. This growth rate is slightly lower than its ten-year average of 7.4%.

Other growth prospects would be that customers are increasingly seeking pet-health services. As more and more people become health-conscious, they are also becoming more health-conscious of their pets. This should help to continue to drive growth for the company.

The company works with 70,000+ veterinarians and vet clinics around the country. Working with these animal medical professionals should continue to grow the company. This will allow these professionals to recommend and prescribe medical treatments that PetMed Express sells.

As you see, the overall pet market is a $107 billion industry, and we believe that this is an industry that will continue to grow.

Source: Investor Presentation

Competitive Advantages & Recession Performance

PetMed Express does not have a substantial competitive advantage today. We think the company has a narrow moat currently. The company is an online business that is easy for competitors to get into. However, the company does have a slight advantage, as it has been in business since 1996 and PetMed Express is a very well-known company for pet lovers.

During the Great Recession of 2008-2009, the company continued to grow its earnings from $0.82 per share in FY2008 to $0.98 per share in FY2009. Coming out of the Great Recession, PetMed Express made $1.14 per share in FY2010. Thus, the company looks resilient during the Great Recession and the COVID-19 pandemic.

PETS’s earnings-per-share throughout the Great Recession:

- 2007 earnings-per-share of $0.60.

- 2008 earnings-per-share of $0.82 (37% increase).

- 2009 earnings-per-share of $0.98 (20% increase).

- 2010 earnings-per-share of $1.14 (16% increase).

As you can see, the company did very well during the 2008-2009 Great Recession, almost like the recession was not even there. We do not know how the dividend would have performed as the company was not paying a dividend during that time. However, it is safe to assume that the company would have no issues paying the dividend, as earnings were increasing at double-digit rates in the period

Source: Investor Presentation

Dividend Analysis

The company has had a dividend growth history of 13 years. In those 13 years, the company has had a dividend growth rate of 9.0% in the last ten years and a dividend growth rate of 9.5% during the previous five years. However, the dividend growth rate has been slowing down in recent years. Yet the most recent increase was 7.1%.

The upcoming dividend announcement should be another dividend increase as the company has been paying the same dividend rate of $0.30 per share per quarter over the last four quarters. However, we think it should be a much smaller increase because of the elevated dividend payout ratio.

The company paid a total dividend of $1.12 per share for FY2021. In 2021, the company Earning-Per-Share (EPS) was $1.52. This gave a dividend payout ratio of 73.7%, which is high but not dangerously high. However, we expect the company to make $1.02 EPS for FY2022. This would bring the dividend payout ratio above 100%.

However, we think the dividend will be safe because the company has a great Free Cash Flow (FCF) expectation for FY2022. We expect the company to make FCF per share of $1.81, covering the dividend with a payout ratio of 66.7%.

The company has an outstanding balance sheet. The only debt PetMed Express has is $27.5 million. This gives the company an asset to liabilities ratio of 0.2. The dividend payout ratio is high but not concerning, considering the company does not have debt. Thus, we think the dividend is reasonably safe.

Final Thoughts

PetMed Express is a solid company with many things to like. The outstanding balance sheet is top-rated. Also, the company has had Free Cash Flow growth year in and year out.

The only risk is that it has a narrow moat and is accessible for a competitor to get into the pet medication business. However, PetMed Express is a well-known brand that should help the company continue growing. The dividend is reasonably safe and it looks to have dependable dividend growth for the foreseeable future.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more