High Dividend 50: OGE Energy

Inflation has surged to a 40-year high this year due to the immense fiscal stimulus packages offered in response to the pandemic and the ongoing war between Russia and Ukraine. The surge of inflation has caused an exceptionally challenging investing environment for income investors, who are struggling to protect the real value of their portfolios from eroding.

In the current environment, high-yield stocks are great candidates for the portfolios of income-oriented investors, but due diligence is required to ensure for the safety of their dividends.

In this article, we will analyze the prospects of OGE Energy (OGE), a utility that is somewhat different from most typical utilities and is currently offering a 4.1% dividend yield.

Business Overview

OGE Energy is the parent company of Oklahoma Gas and Electric Company (OG&E), a regulated electric utility that serves more than 860,000 customers in Oklahoma and western Arkansas. OGE Energy also owns approximately 3.0% of Energy Transfer (ET), which is an MLP that owns and operates one of the largest midstream portfolios in the U.S.

Energy Transfer owns immense pipeline networks and storage tanks of natural gas, crude oil and natural gas liquids (NGLs). OGE Energy is characterized by high seasonality, as it generates 80%-85% of its annual utility earnings in the second and third quarter.

Just like most utilities, OGE Energy has proved resilient throughout the coronavirus crisis thanks to the essential nature of its business. Even under the roughest economic conditions, consumers do not reduce their electricity consumption.

Even better for OGE Energy, its natural gas business has proved equally defensive during the coronavirus crisis, as the demand for natural gas has hardly been affected by the pandemic.

Thanks to its defensive business model, OGE Energy posted just a 4% decrease in its earnings per share in 2020, which was marked by unprecedented lockdowns and a fierce recession. Moreover, the company recovered strongly in 2021 thanks to strong load growth and rate hikes in its utility business.

In addition, the natural gas business benefited from higher prices of natural gas and natural gas liquids. As a result, OGE Energy grew its adjusted earnings per share 13% over the prior year, achieving 9% growth over the pre-pandemic level.

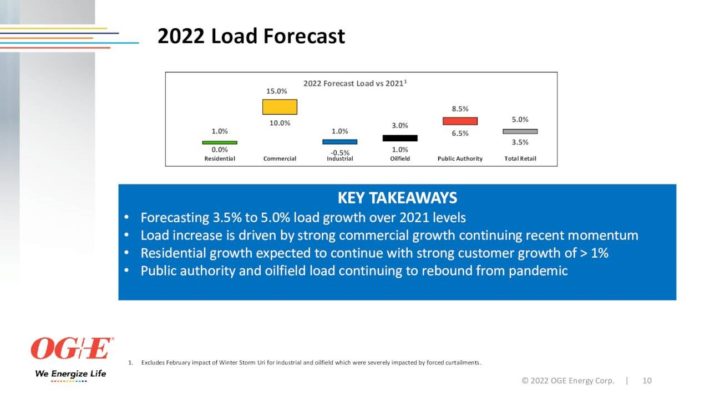

Moreover, OGE Energy provided positive guidance for 2022. It expects 3.5%-5.0% load growth, primarily thanks to sustained momentum of commercial consumption. Management also expects residential customer growth above 1%.

Source: Investor Presentation

As a result, OGE Energy expects its utility division to achieve earnings per share of $1.87-$1.97 in 2022. At the mid-point, this guidance implies 7% growth over the prior year. Investors should be aware that OGE Energy does not provide guidance for its natural gas segment due to the sensitivity of this segment to the prices of natural gas and natural gas liquids.

Growth Prospects

OGE Energy is different from most utilities, as it has a non-regulated segment, namely its natural gas division. This segment is supposed to offer higher growth potential than the typical mid-single-digit growth rate of most utilities, but this has not proved to be the case so far.

OGE Energy has exhibited a much more volatile performance record than a typical utility, mostly due to the high cyclicality of its natural gas business. During the last decade, the company has grown its earnings per share by only 3.1% per year on average. This growth rate combined with the lack of consistency is certainly disappointing for a utility stock.

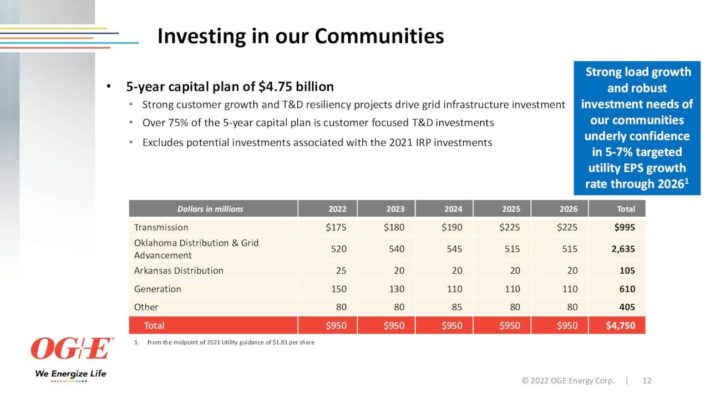

On the other hand, the future of OGE Energy looks much brighter than its past. The company has invested $3.3 billion in growth projects in the last five years. In addition, it has a 5-year capital plan of $4.75 billion. The strong economy in Oklahoma and Arkansas is likely to help OGE Energy achieve meaningful organic growth in the upcoming years.

Thanks to the recent completion of some growth projects and the focus of management in growing the utility business, the company is likely to grow its adjusted earnings per share by at least 5% per year on average in the upcoming years.

This is in line with the guidance of management for 5%-7% annual growth of earnings per share in the utility segment until at least 2026.

Source: Investor Presentation

Investors should also be aware of a potential future catalyst for the stock. OGE Energy has stated that it will divest its natural gas business at an opportune moment in order to shed the cyclical part of its business and become a consistent, pure play utility.

Whenever the company decides to sell its midstream business, its stock will probably be rewarded with a premium by the market, as is usual in such instances.

Competitive Advantages

OGE Energy does its best to maintain its electricity rates as low as possible. Its rates are currently much lower than the national average which result in high customer satisfaction rates, which enable the company to grow its customer base at a fast pace. This is a major competitive advantage.

The other competitive advantage of OGE Energy is the immense investment required from potential new entrants to build the infrastructure of the regulated business. This poses high barriers to entry and protects OGE Energy from potential new competitors.

Dividend Analysis

OGE Energy has raised its dividend for 15 consecutive years. It is also worth noting that the stock is currently offering a nearly 10-year high dividend yield of 4.1%. The payout ratio is somewhat elevated, at 75%.

The company has a fairly leveraged balance sheet, with interest expense consuming 30% of operating income and net debt of $8.3 billion, slightly above the market capitalization of the stock.

Conservative investors may be alarmed by these metrics and may conclude that the dividend is not safe. However, these metrics are decent for a utility, which has much more reliable earnings than most companies out of this resilient sector.

It is also important to note that OGE Energy seems poised to grow its earnings per share by 5%-7% per year on average until at least 2026. As a result, the company can easily continue raising its dividend for many more years.

This is in line with a previous guidance of management, which has stated that it will keep raising the dividend while maintaining a decent balance sheet and a flatshare count.

Final Thoughts

OGE Energy passes under the radar of most investors due to its mundane business model and its lackluster performance record. However, the company has promising growth prospects right now.

Given also its nearly 10-year high dividend yield of 4.1% and the potential catalyst from the divestment of the midstream segment in the future, the stock is likely to highly reward those who purchase it around its current price.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more