High Dividend 50: Newell Brands Inc.

Even though the Fed is raising rates, we are still in a low-interest-rate environment compared to past history. Thus, companies like Newell Brands Inc. (NWL) attract investors looking for high yields.

This article analyzes high-yield stock Newell Brands Inc. in detail. While it doesn’t have a 5.0%+ yield currently, its dividend yield of 4.2% is still high compared to the low-interest-rate environment and the broader Market.

Business Overview

Newell Brands traces its roots back to 1903, when Edgar Newell purchased a struggling curtain rod manufacturer. However, today, Newell Brands is an American global consumer goods company. The business activities of the group function through five segments, namely, Commercial Solutions, Home Appliances, Home Solutions, Learning and Development, Outdoor, and Recreation. The learning and Development segment generates most of the revenue for the company, which offers baby gear and infant care products; writing instruments, including markers and highlighters, pens, and pencils; art products; activity-based adhesive and cutting products, and labeling solutions.

Source: Investor Presentation

On February 11, 2022, the company reported fourth-quarter and full-year results for Fiscal Year (FY)2021. Total sales for the quarter increased by 4.3% to $2.8 billion compared with the prior-year period. This increase was due to elevated demand across many of the company categories. Core sales grew 5.8%compared with the prior-year period. Six of eight business units and every major region increased core sales compared with 4Q2020.

However, the increase in sales saw a decrease in gross profit of 5.5% for the quarter compared to the fourth quarter of 2020. This was due to the higher cost of products sold. Thus, net income for the quarter was 24.4% less than in 2020. The company reported a net income of $96 million compared to $127 million in 4Q2020.

Reported earnings per share were $0.22 compared with $0.30 per share for the same quarter in 2020, or a decrease of 26.6%. This resulted from year-over-year change mainly reflecting the decline in reported operating profit and a change in the tax provision due to a reduction in discrete tax benefits.

However, for the year, the company performed much better. Total sales were 12.8% higher compared to FY2020. The company reported net sales of $10,589 million in FY2021 compared to $9,385 million in FY2020. This was due to the 12.5% core sales growth that the company said for the year. Total net sales saw increase across all five operating segments for the year.

Operating income was $946 million, or 8.9% of sales, compared with an operating loss of $634 million, or negative 6.8% of sales in the prior year, which reflected a significant non-cash impairment charge.

Overall, net income was a positive $572 million compared to a net income loss of $770 million in 2020. Thus, the company made a 2% increase in earnings of $1.82 compared to $1.79 for 2020.

Source: Investor Presentation

We expect the company to make $1.85 per share for FY2022. This would represent an increase of 1.6% year-over-year growth compared to FY2021.

Growth Prospects

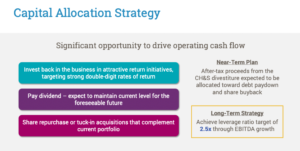

The company has divested many of its lower profit margin brands. This will help the company management team to focus on the core and most important brands. This will help the company reduce complexity and thus drive free cash flow.

Another growth driver for the company would be to grow its eCommerce. This can be done with a better marketing campaign. This will also help the company to expand internationally, which in turn increases revenue.

Source: Investor Presentation

Competitive Advantages & Recession Performance

Newell’s competitive advantage is its position in several niche consumer markets that are small but necessary and profitable. Its willingness to buy and sell assets has helped it prepare for future recessions as well, building upon significant earnings growth that occurred during the Great Recession, illustrating the staying power of the model.

The company performed decently during the Great Recession of 2008-2010. However, the stock price saw a decrease of over 80.7% from the high of 2007 to the low in 2009, but earnings did not decrease at that same level.

NWL’s earnings-per-share throughout the Great Recession:

- 2007 earnings-per-share of $1.82

- 2008 earnings-per-share of $1.22 (33% decrease)

- 2009 earnings-per-share of $1.31 (7% increase)

- 2010 earnings-per-share of $1.52 (16% increase)

As you see, the company did not do so terribly during this period. However, the company cut the dividend by 69.6% in 2009 and again in 2010 by 21.5%. This was unfortunate because the company earnings covered the dividend very well during those years.

Dividend Analysis

Newell Brands pays an attractive dividend yield of 4.2% compared to the broader market. However, the company has not increased its dividend since 2018. We do not expect any dividend increase in the foreseeable future. However, if we look at the dividend payout ratio, the company has plenty of room to grow its dividend.

For example, based on the $1.82 per share the company earned in FY2021, the company paid out a dividend of $0.92 per share for the year. This would represent a dividend payout ratio of 50.5%. Even during the COVID-19 pandemic, the company’s earnings increased by 5%. The company paid out the same $0.92 per share for the year, a dividend payout ratio of 51.4%.

For FY2022, we expect the company to make $1.85 per share, which will provide a dividend payout ratio of 49.7%. As you can see, the dividend is very well covered, and we feel that the company can start to increase the dividends at a modest rate.

The freeze of the dividend at $0.92 per share over the past three years is the result of the company’s focus on reducing leverage.

We also expect the company to conite to grow earnings at a 3% annual rate. This will help make the dividend much safer as the years move forward. Overall, we think the dividend is secure.

Source: Investor Presentation

The company also has a respectable balance sheet. The company has a 1.3 debt-to-equity ratio, which aligns with its history. The company’s financial leverage ratio is 3.5, a fair level. Furthermore, Newell Brands has an S&P Credit Rating of “BBB-.” This credit rating is an investment-grade rating from S&P.

Thus, the balance sheet is in good condition, and investors trust that the company is running well.

Final Thoughts

Overall, Newell Brands is a company in the process of turning it around. The company is doing the right thing by devesting on non-core brands and by focusing on reducing its leverage. Because of this, the dividend is safe and should be able to withstand a recession much better than it did in The Great Recession. Investors should start to see dividend increases in the next two to three years as the company would be in a much better position financially.

In the meantime, the current dividend is attractive, and the company looks to be undervalued at today’s price.