High Dividend 50: Manulife Financial Corporation

Manulife Financial Corporation (MFC) has increased its quarterly dividend annually for eight consecutive years.

But due to an overall lackluster performance throughout the years, specifically in that the stock has failed to break out from its historical trading range for 15 years, Manulife Financial has flown under the radar of most investors.

That said, Manulife Financial now offers a substantial dividend yield of 5.0%. Its price-to-earnings ratio of about 8.2 should be inviting for investors looking to start a position and hold the stock over the long run.

Manulife Financial is one of the high-yield stocks in our database.

In this article, we will analyze the prospects of Manulife Financial Corporation.

Business Overview

Manulife Financial Corporation is an international financial services group that supports individuals and corporations in making decisions through its wealth, asset management, and insurance businesses. The company also offers annuity products and services.

It operates as Manulife across its offices in Canada, Asia, and Europe and primarily as John Hancock in the United States.

The Toronto-based company has 38,000 employees, over 118,000 agents, and thousands of distribution partners, serving over 30 million customers.

Being a Canadian company, Manulife Financial reports in Canadian dollars, but all figures in this article have been converted to U.S. dollars.

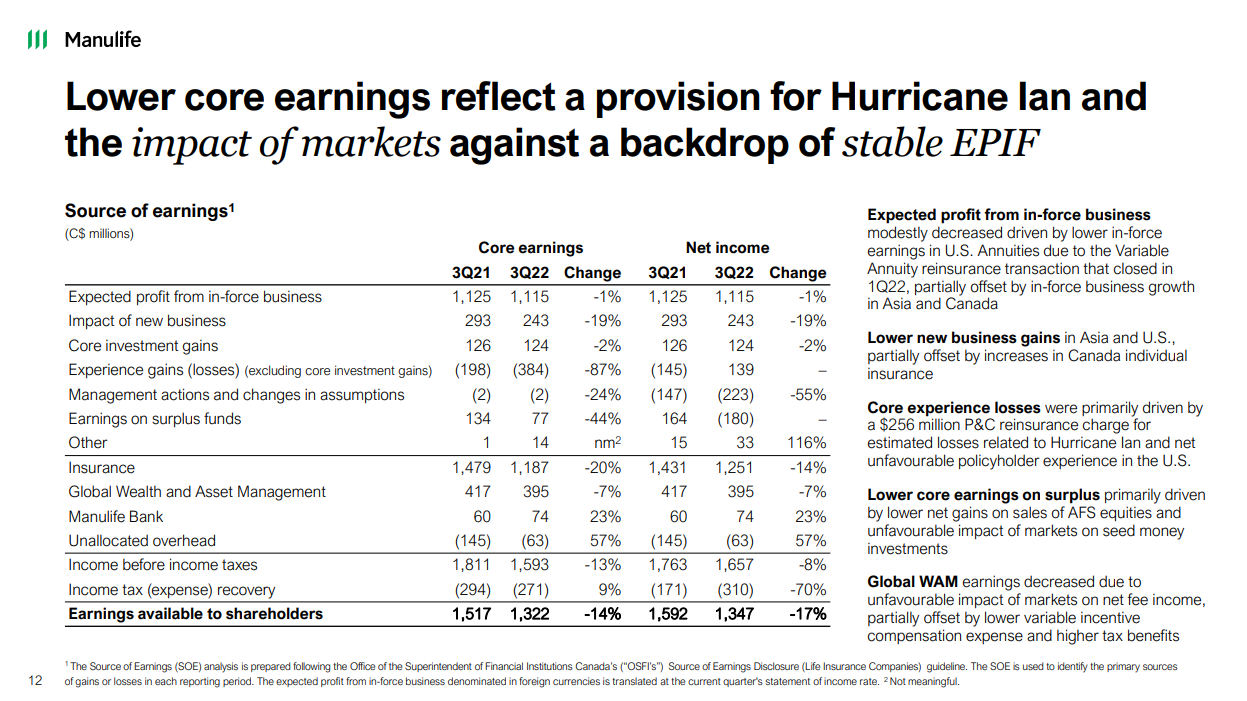

The earnings of insurers such as Manulife Financial can quickly fluctuate based on unique events, whether these are environmental disasters or a challenging capital market environment. This was the case in the company’s most recent Q3 results.

Core earnings for the quarter landed at $0.98 billion, down 14% compared to last year, mainly due to a $193 million charge in Manulife’s P&C Reinsurance business for estimated losses related to Hurricane Ian and lowered net gains on sales of equities and the unfavorable impact of markets on seed money investment.

Source: Investor Presentation

Accordingly, core EPS (excluding the major investment gains) for the quarter was $0.50, 11.9% lower year-over-year. For U.S. investors, the exchange rate of CAD against the USD fell slightly amid a stronger USD, negatively impacting the underlying numbers by a small margin.

Hence, we expect the company’s fiscal 2022’s earnings-per-share to land close to $2.31, implying a decline of about 17.8% compared to last year.

Growth Prospects

As mentioned, Manulife Financial shares have failed to break out from their traditional trading pattern for 15 years, with the stock trading between $10 and $22 during this period.

That said, the company has generated a growing net income over the past few years, powered primarily by growth in premiums and annuity revenues and higher interest and dividend income derived from its investments.

Earnings-per-share growth moving forward is expected to be driven by double-digit growth in its insurance segment in key Asian markets such as Japan and Hong Kong.

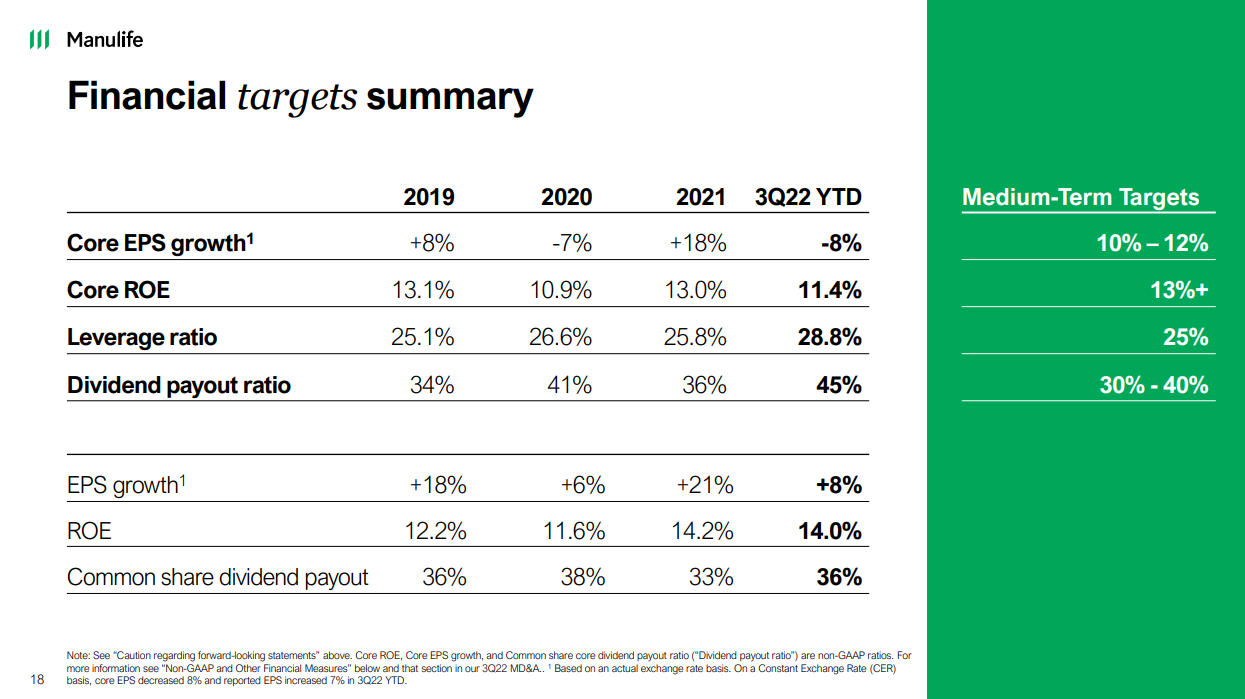

Source: Investor Presentation

Higher wealth management fees follow consistent net inflows in its wealth management segment should also fuel growth. During Q3, for instance, the company achieved net inflows of $2.3 billion, despite the ongoing challenges in the capital markets. Specifically, the company recorded inflows of $1 billion from Retirement, $0.5 billion from Asset Management, and $0.8 billion from retail.

That said, the company’s future earnings growth prospects remain somewhat speculative as well, as the insurance industry can be quite unpredictable, and companies in the space, such as Manulife Financials, can be highly susceptible to economic downturns.

Competitive Advantages

Manulife Financial is a force to be reckoned with in the industry, thanks to its unwavering commitment to customer satisfaction which has resulted in strong brand value –a great competitive advantage.

The company also has a clear long-term underwriting strategy that has shifted smoothly online, while its balance sheet is rather healthy, featuring a financial leverage ratio of 28.8%. This is quite close to the company’s target of 25%.

The ongoing rise in interest rates should not have a negative effect on the company’s financials, as a 50 basis point increase in corporate spreads could positively affect the bottom line by around C$100 million.

That said, Manulife Financial’s performance is subject to several risks, as the insurance industry is quite competitive in general. Disruptive up-and-coming companies like Lemonade (LMND) are actively fighting to capture market share.

Finally, during a recession, the company may experience negative consequences such as delayed payments, defaults on debt investments, and decreased investment income.

Dividend Analysis

Manulife Financial has grown its dividend-per-share annually since 2014 in its local TSX listing. However, the growth payouts have not been as consistent for U.S.-based investors, whose payments have been modestly affected by currency effects.

Despite the company declining earnings-per-share this year, the dividend should remain covered by the underlying income. Based on our earnings projections for fiscal 2022, the payout ratio currently stands at a comfortable 43%.

Still, Manulife’s dividend is not immune to an economic downturn. Delayed payments, defaults on debt investments, and decreased investment income could notably affect earnings forcing the company to cut its dividend.

This was the case during the Great Financial Crisis when the company was forced to cut its quarterly dividend from C$0.26 to C$0.13.

Based on our current outlook for the company, we expect the dividend to grow in the mid-to-high single digits over the medium term.

Final Thoughts

Manulife Financial’s stock performance has been nothing short of disappointing for more than a decade now. That said, the company is a quality insurer with healthy financials.

While one-off events could easily sway its performance in the future, Manulife Financial has enough catalysts to grow its earnings moving forward and, thus, its dividend.

With the stock’s yield currently hovering at an above-average rate of about 5% and the stock appearing more or less fairly valued at a P/E of 8.2, income-oriented investors are likely to appreciate the stock’s investment case.

Still, remain mindful of the risks attached to an insurer and the possibility of a dividend cut if a prolonged recession occurs.

More By This Author:

High Dividend 50: TC Energy Corporation

High Dividend 50: Canadian Imperial Bank Of Commerce

High Dividend 50: Hanesbrands Inc.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more