High Dividend 50: Leggett & Platt - Thursday, March 24

Leggett & Platt may not be a well-known name, but it is likely that millions of consumers come in contact with the company’s products every day.

Despite being under the radar, Leggett has increased its dividend for 50 years in a row, meaning it is a Dividend King. The company currently has a high yield of 4.6%, which is 100 basis points higher than its trailing decade average.

Not all high-yielding businesses can sport payout ratios below 60% like Leggett is anticipated to in 2022, so deep analysis should be completed to verify the safety of high-yield stocks.

In this article, we will analyze a manufacturing Dividend King, Leggett & Platt (LEG).

Business Overview

Leggett & Platt is a diversified manufacturing company. It was founded in 1883 when an inventor named J.P. Leggett created a bedspring that was superior to the existing products at that time.

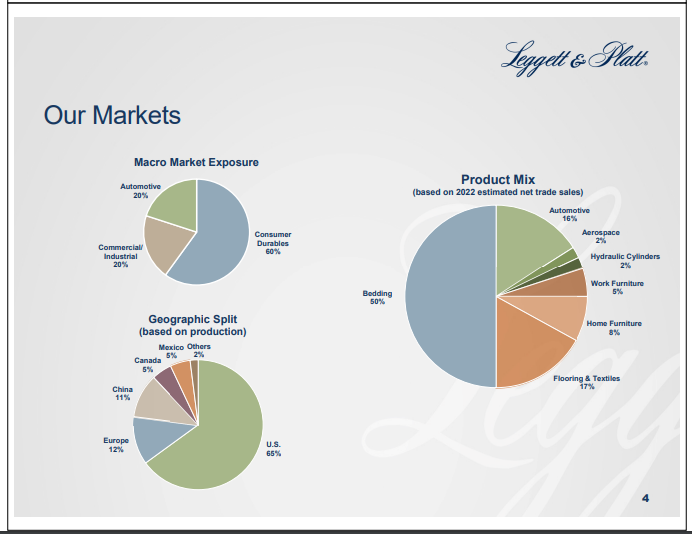

Today, Leggett & Platt is composed of three major segments.

First, the bedding products segment designs and manufactures bedding components such as bedding industry machinery, steel wire, adjustable beds, and mattress springs. This segment represents 50% of 2022 expected net trade sales.

Second, the specialized products segment revolves around automotive, aerospace, and hydraulic cylinder components. Some product examples would be seat support and lumbar systems, motors and cables, tubing, and hydraulic cylinders. This segment represents 20% of 2022 expected net trade sales.

And lastly, the furniture, flooring, and textile products segment focuses on home furniture, work furniture, and flood and textiles. This segment represents 30% of 2022 expected net trade sales.

Clearly, the company is running a diversified business, with a varied product mix and geographic split.

Source: Investor Presentation

Leggett & Platt reported Q4 and FY 2021 earnings results on February 7th. Revenue for the quarter of $1.3 billion rose 13% year-over-year. Adjusted earnings-per-share of $0.77 was down 3% from the same prior-year period.

For 2021, LEG reported record sales of $5.07 billion, a 19% increase from 2020. Organic sales rose 18% due to price hikes that added 13% to sales growth, volume growth of 4% from the recovery in COVID-19 impacts, and acquisitions (net of small divestitures) that added 1% to sales. Full-year adjusted EPS rose 29% to $2.78, in part due to the rebound from COVID-19 impacts.

Leadership has provided a fiscal 2022 outlook, and forecasts sales of $5.3 billion to $5.6 billion. Earnings-per-share is expected to be between $2.70 and $3.00.

Growth Prospects

Growth at Leggett & Platt will rely on a multi-faceted approach, including average annual revenue growth (both organic, and through acquisitions), new products and programs, expanding addressable markets, and making sure that acquisitions are strategic. Additionally, share repurchases and cost controls could also boost the bottom line.

Source: Investor Presentation

Leggett & Platt has a consistent policy of acquiring smaller companies to expand its market dominance in existing categories, or to branch out into new markets.

An example of this strategy was the $1.25 billion purchase of Elite Comfort Solutions. Elite Comfort Solutions’ foam bedding operations complement Leggett & Platt’s existing mattress capabilities and infrastructure. In 2021, LEG made three small acquisitions that expanded its capabilities in International Bedding, Aerospace, and Work Furniture.

Source: Investor Presentation

Another key component of Leggett & Platt’s earnings growth strategy is cost controls. The company continuously evaluates its portfolio to ensure it is investing in the highest-growth opportunities, and it is not afraid to divest low-margin businesses with poor expected growth.

For low-growth or low-margin businesses, it either improves performance or exits the category. The company also drives cost reductions across the business, including in selling, general, and administrative expenses, and distribution costs.

Leggett & Platt has been able to reach its long-term growth targets thanks in large part to its significant competitive advantages in the core industries in which it operates.

Still, growth has ebbed and flowed at times. From 2006 through 2013, the company had practically no growth in earnings-per-share. Then from 2013 to 2016, earnings-per-share rose 70%. However, revenue and EPS declined significantly in 2020 as a result of the coronavirus pandemic.

The company’s earnings for 2021 were terrific though. Overall, we forecast 5% annual EPS growth over the next five years.

Competitive Advantages & Recession Performance

Leggett & Platt has established a wide economic moat, meaning it has several operational advantages, which hold back competitors. The company enjoys a leadership position in its industry, which allows for scale.

Leggett & Platt also benefit from operating in a fragmented industry, which makes it easier to establish a dominant position. In most of its product markets, there are few, or no, large competitors. And when a smaller competitor does achieve significant market share, Leggett & Platt can simply acquire them, as it did with Elite Comfort Solutions.

Leggett & Platt also has an extensive patent portfolio, which is crucial in keeping competition at bay. The company has extraordinary intellectual property, consisting of over one thousand patents issued and nearly one thousand registered trademarks.

Together, these competitive advantages help Leggett & Platt maintain healthy margins and consistent profitability. That said, the company did not perform well during the Great Recession.

Earnings-per-share during the Great Recession are shown below:

- 2006 earnings-per-share of $1.57

- 2007 earnings-per-share of $0.28 (-82% decline)

- 2008 earnings-per-share of $0.73 (161% increase)

- 2009 earnings-per-share of $0.74 (1% increase)

- 2010 earnings-per-share of $1.15 (55% increase)

This earnings volatility should not come as a surprise. As primarily a mattress and furniture products manufacturer, it relies on a healthy housing market for growth. The housing market collapsed during the Great Recession, which caused a significant decline in earnings-per-share in 2007.

Leggett & Platt depends on consumer confidence, as roughly two-thirds of furniture purchases in the United States are replacements of existing products. When the economy enters a downturn, consumer confidence typically declines.

It also took several years for Leggett & Platt to recover from the effects of the Great Recession. Earnings continued to rise after 2007, but earnings-per-share did not exceed 2006 levels until 2012. The company saw another difficult year in 2020, due to the coronavirus pandemic. This demonstrates that Leggett & Platt is not a recession-resistant business.

Fortunately, the company maintains a strong financial position, which allows it to remain profitable and continue increasing dividends each year, even during recessions.

Dividend Analysis

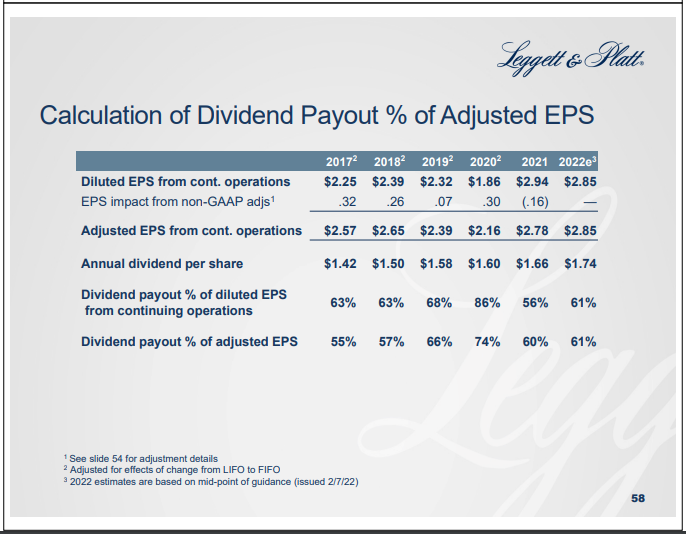

Leggett & Platt’s 2022 dividend is so far forecasted to be $1.68 based on the latest dividend paid. However, management anticipates the annual dividend per share in 2022 to equal $1.74 by the end of the year. Using the current $1.68 dividend, Leggett currently has a high yield of 4.6%. This high yield is an entire 100 basis points higher than the company’s trailing decade average of 3.6%.

Source: Investor Presentation

According to Leggett & Platt’s 2022 outlook, we anticipate the company will earn $2.85 in adjusted EPS for the year. Therefore, the company is forecasted to payout 59% of adjusted EPS out in dividends. This payout ratio is slightly favorable to the trailing decade average but is above the company’s 50% target payout ratio.

However, the company has demonstrated that they are committed to the dividend, and to grow it. After all, Leggett & Platt is a dividend king with a 50-year dividend growth streak. We expect dividend increases below the rate of earnings growth, which would see the payout ratio dip a little bit in the future.

Final Thoughts

Leggett & Platt has a strong and secure yield, which is even more impressive after considering that it has paid a higher annual dividend per share for the last fifty years straight.

While the payout ratio today is somewhat above the company’s target payout ratio, we expect the company will still grow the dividend. If the payout ratio begins to stretch, we anticipate the company would just apply token dividend increases. At times the company’s results have been very volatile, and so this may be a more prudent strategy for the company.

Leggett & Platt offers attractive total returns for both income and value investors at this price here, with high yield, earnings growth, and valuation expansion expectations.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more