High Dividend 50: International Paper

International Paper (IP) is a company that you may not hear of, but I am sure you use its products in some way in your everyday life. The company pays a healthy dividend yield with a proven dividend growth track record.

Thus, we will review International Paper for the following high-yield stocks in this series, with a current dividend yield of 4.0%.

Business Overview

International Paper is a leading global producer of renewable fiber-based packaging, pulp, and paper products. It has manufacturing operations in North America, Latin America, Europe, North Africa, Russia, and India, serving more than 25,000 customers in 150 countries and trades with a market capitalization of $17.4 billion.

The company operates primarily in two segments. The first segment, which accounts for 84% of the company’s total revenue in 2021, is the Industrial Packaging segment. The other segment, Global Cellulose Fibers, accounted for 14% of the company’s total revenue in 2021.

For the industrial packaging segment, some of the packaging items that the company produces are for eCommerce, protein, fruit and vegetable, distribution of processed food and beverage, and durable/non-durable goods. As for the Global Cellulose Fibers segment, International Paper produces absorbent hygiene products, paper grade, and specialty products.

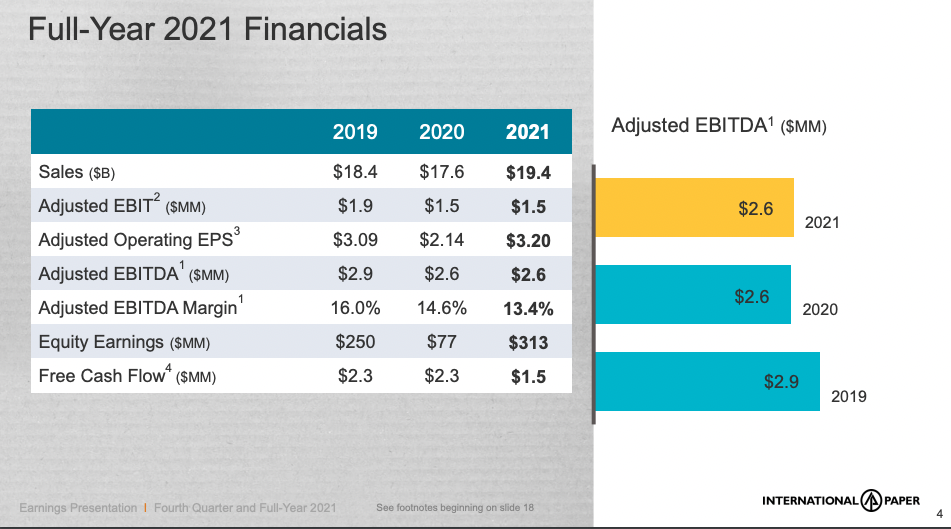

On January 27, 2022, the company reported fourth-quarter and full-year results for Fiscal Year (FY)2021. Revenue for the quarter was up 14.5% compared to the fourth quarter of FY2020. On a quarter to quarter basis, revenue is up 3.5% compared to 3Q2021. The industrial packaging and the Global Cellulose Fibers segment saw revenue increase of 12.8% and 19.7%, respectively.

Industrial Packaging’s operating profits were $414 million compared with $414 million in the third quarter of 2021. In North America, earnings increased, reflecting higher sales prices for corrugated boxes and containerboard. Sales volumes were stable for corrugated boxes and improved for containerboard. However, these were offset partially by increased distribution, wood fiber, recovered fiber, and energy costs.

Net income for the quarter was $107 million compared to $153 million the company made in 4Q2020. This is a decrease of 30.1% year-over-year. However, for the year, the company made a profit of $1,752 million compared to a profit of $482 million in FY2020. This is a 263% improvement.

Total revenue for the year was up 10.2%, from $17,565 million in Fy2020 to $19,363 million last year.

Source: Investor Presentation

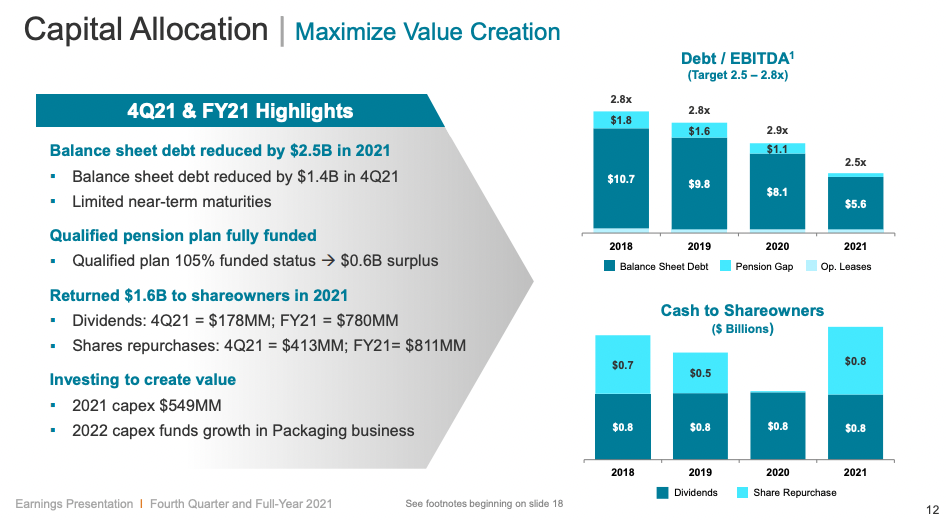

The company also made an effort to reduce its debt. It reduced its deficit by $1.4 billion, bringing the entire year to $2.5 billion.

Overall, on an Earning per-share basis, the company made $3.20 for FY2021, which is an increase of 49.5% compared to the $2.14 per share the company made in 2020. We expect the company will earn $4.60 per share for FY2022. This will represent an increase of 43.7% versus FY2021.

Growth Prospects

The company’s growth prospects will come from changes that the company can make within. For example, Industrial Packaging benefits from a full year of previously published price increases. This will help grow profits thus earnings. It also expects $200 to $225 million of gross benefits from building better IP initiatives to help improve margin. Another growth driver will come from optimization. The company mill and box system has been optimized from prior-year disruptions.

Also, containerboard sales have boosted thanks to increased sales in grocery channels and e-commerce. However, it is interesting that the company’s earnings decreased from 2019 – to 2020 during the COVID-19 pandemic since everyone was home ordering online. But, the company stock price increased over 102% from March 2020 lows to June high 2021. Investors who thought the company would grow its earnings substantially because of the pandemic drove the stock price higher.

We expect the company to grow earnings by about 4% over the next five years. This will give the company an earning per share of $5.60 for 2027.

Competitive Advantages & Recession Performance

We think the company does not necessarily have an economic moat. However, we believe that it does a competitive advantage. The company benefits from scale and reliable brands. The company can increase prices and optimizes its production to minimize costs.

The company performed terribly during the Great Recession of 2008-2010. The stock price saw a decrease of over 68% from 2007 to the low in 2009, and earnings decreased in that same period.

IP’s earnings-per-share throughout the Great Recession:

- 2007 earnings-per-share of $2.10

- 2008 earnings-per-share of $1.90 (9% decrease)

- 2009 earnings-per-share of $0.83 (56% decrease)

- 2010 earnings-per-share of $1.94 (133% increase)

As you see, the company did not do well during the 2008-2009 Great Recession. Earnings and the stock price decreased in those years. Also, the company had to cut its dividend from $0.93 per share year to $0.30 per share for the year. This was a dividend cut of 67.5%.

Dividend Analysis

Since the Great Recession, the company has had to cut its dividend. However, the company has been growing its dividend by a 16.6% compounded annual rate since that time. This is a very impressive dividend growth rate over a ten-year period. However, on October 12, 2021, the company announced a slight dividend cut of 9.8%. This dividend cut is that the company announced a spin-off of its printing papers business late last year.

The company management team is committed to a competitive and sustainable dividend of 40% to 50% of free cash flow. The dividend adjustment is consistent with its dividend policy and is well below the 15% to 20% adjustment the management team anticipated.

In this same announcement, the company board authorized a share repurchase program to acquire up to $2 billion of its stock. The new authorization is in addition to $1.3 billion remaining as of Q3 end from a previous repurchase authorization.

Currently, the dividend payout ratio is 62.5% for FY2021. We expect the company to make $4.60 per share for FY2022, which provided a dividend payout ratio of 40.2%. This is a very safe dividend payout ratio of a company that pays out a high dividend yield.

(Click on image to enlarge)

Source: Investor Presentation

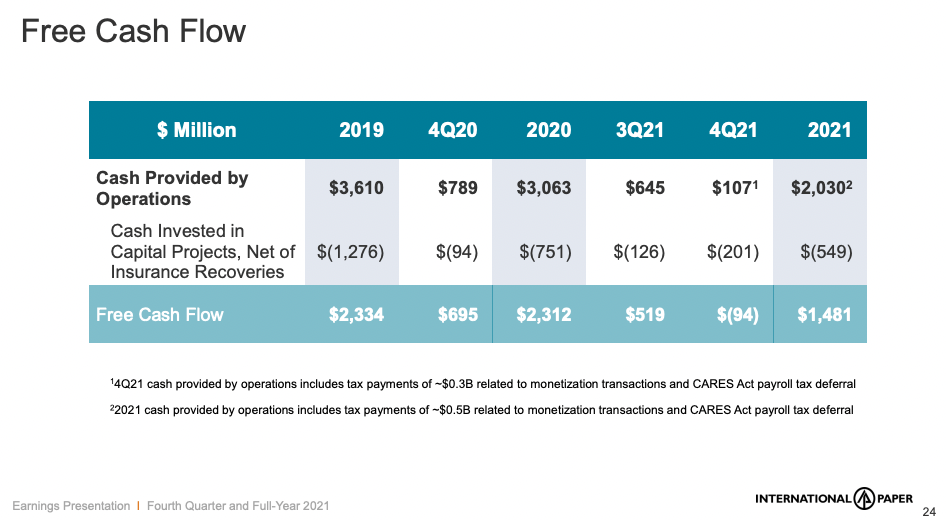

Free cash flows also cover the dividend very well. For 2021, the company reported a free cash flow of $3.77 per share. This provided a well-covered dividend payout ratio of 50.9%. For FY2022, we expect the company to greater a free cash flow per share of $3.63, which will give us a dividend payout ratio of 51.3%.

Overall, the dividend looks safe on an earning basis and a free cash flow basis.

Source: Investor Presentation

The company also has a respectable balance sheet. The company has a 0.9 debt-to-equity ratio, which is decent, and an interest coverage ratio of 3.3. Furthermore, International Paper has an S&P Credit Rating of “BBB.” The “BBB” credit rating is an investment-grade rating.

Thus, the balance sheet is in good condition and should help the company withstand a recession without a dividend cut. During the 2008-2009 Great recessions, the company had a poorer balance sheet than its current conditions. Therefore, we think the dividend is very safe.

Final Thoughts

International Paper is a company that not many investors know, but we are sure you have used its products before without knowing it. This is the type of company that dividend growth investors look for and love to invest in. The high dividend yield is desirable and safe for the foreseeable future. The company has a respectable balance sheet that should help it perform much better than during the last recession. Overall, we think the dividend is safe right now.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more