High Dividend 50: Huntington Bancshares

Huntington Bancshares has raised it’s dividend for eleven years following the Great Recession. However, the dividend was only a penny a quarter at the time, making it a conservative base to work off.

Still, these increases have led the company to boast a high dividend yield of 4.3% today. This is a fair bit higher than the company’s ten-year trailing average yield. The company may be a risky one under certain circumstances though, as it has little recession resistance. Proper due diligence is paramount in cases like these.

In this article, we will analyze the bank holding company, Huntington Bancshares Inc (HBAN).

Business Overview

Huntington Bancshares is a regional bank holding company with $174 billion in assets, headquartered in Columbus, Ohio. The company was founded in 1866 and today operates more than 1,000 branches across 11 states.

The company provides a comprehensive suite of banking, payments, wealth management and risk management products and services to consumers, small and middle-market businesses, corporations, municipalities, and other organizations.

Huntington reported Q4 and FY 2021 results for the period ending December 31st, 2021, on January 21st. The company generated total revenue of $1.65 billion in Q4, a 33% increase compared to $1.24 billion a year ago. The revenue increase can be explained primarily as a result of the TCF acquisition completed on June 9th, 2021.

Reported net income equaled $401 million, an increase over the $315 million earned in the year ago period. However, reported net income per share fell from $0.27 to $0.26, due to an increase in the outstanding share count. Adjusted earnings-per-share was $0.36.

For the full year, total revenue rose 24% to $6.0 billion compared to $4.8 billion, driven by the TCF acquisition and organic growth. Net income grew 61% to $1.15 billion or $0.90 per share compared to $717 million or $0.69 per share in 2020.

Lastly, tangible book value per share was 5% lower compared to the year ago period, down to $8.06 from $8.51.

Growth Prospects

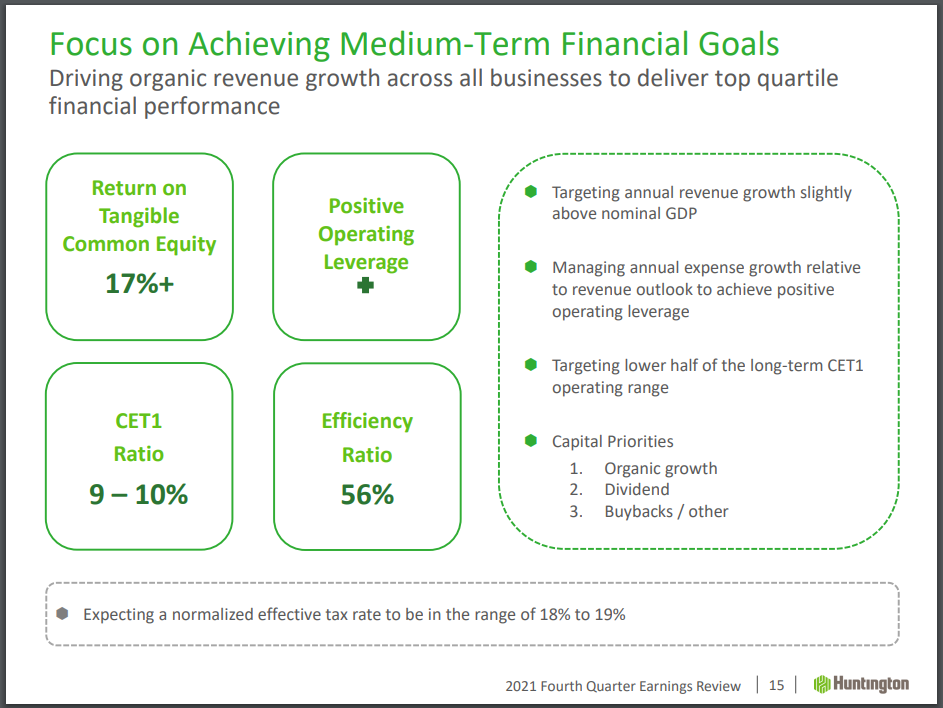

In the medium-term, Huntington is aiming for annual revenue growth to be just slightly higher than nominal GDP.

Source: Investor Relations

In the current year, average loans are anticipated to grow by high single digits, driven primarily by commercial loans, and mortgage, auto and RV/marine loans.

Net interest income will grow in the high single to low double digits as the company ticks up their net interest margin and increase their earning assets.

Finally, noninterest income will grow by single digits with growth in capital markets, payments, and wealth management, offset by mortgage banking normalization.

Also, the company’s cost savings program is paying off, and by the second quarter, Huntington anticipates a quarterly run-rate of about $1 billion in expenses.

Still yet, there are industry tailwinds which Huntington should benefit from, such as long-term economic improvements and an environment that may bolster a series of interest rate increases.

Competitive Advantages & Recession Performance

Huntington does not possess any major competitive advantage in the regional Midwest banking scene. Additionally, the company is hardly recession-resistant.

In the Great Recession, the company got clobbered. So badly that shares went as low as $1. The company struggled so severely in 2008 and 2009, that they slashed the dividend to a penny per quarter and practically doubled the share count.

Even though the company has become far more profitable since the Great Recession, the significant shareholder dilution has caused earnings-per-share to still come in below the pre-recession peak. Following the pandemic, shareholder dilution is still ongoing at a fairly quick pace.

Dividend Analysis

Huntington has increased their annual dividend for eleven years, following the penny a quarter payment in 2009 and 2010. And the company paid the same $0.15 quarterly payment for nine quarter straight before the latest 3.3% increase in 2021. Still, the company paid the dividend in a way that it was higher for the full year since 2011.

Huntington’s current quarterly dividend payout of $0.155 equates to an annual dividend of $0.52 in 2022. At the current HBAN share price, the company has a high dividend yield of 4.3%. The current dividend yield is a whole percentage point above the trailing decade average.

With anticipated earnings per share of about $1.10 for the year, the company has a fair payout ratio of 56%. The company may continue to grow the dividend very slowly, so that another situation like during the Great Recession doesn’t occur. It is more prudent to grow the dividend at a slow pace than to grow it immensely and crash and burn.

And while an above-average dividend yield can sometimes indicate shares are overvalued, this is one name where we don’t believe that to be the case. Even on an expected earnings basis, shares offer little to no margin of safety today.

Final Thoughts

Huntington Bancshares Inc. is not a recession-resistant company. In fact, it got decimated during the Great Recession, which saw shares trade as low as $1, a massive increase in shares outstanding, and a dividend of a penny a quarter.

The pandemic also hit the company’s earnings, just as the company was doing fairly well and reducing its share count. But following the pandemic, the share count has increased once again.

As a result, the company has significantly slowed its dividend increase rates. But still, Huntington has paid a higher annual dividend for the last eleven years straight. The payout ratio is not in any imminent danger at current levels, which should support continued slow dividend growth. At today’s price, shares aren’t too attractive, but they do have a high yield of 4.3%.