High Dividend 50: H&R Block

Since the Market had a significant pull back from its all-time high earlier this year, it also brought down a lot of other stocks. The beauty is that when a stock goes down, the dividend yield goes up if they pay a dividend. Today, we have a high dividend yield stock in H&R Block Inc. (HRB). While it doesn’t have a 5.0%+ yield currently, its dividend yield of 4.1% is still high compared to the low-interest-rate environment and the broader Market.

Business Overview

H&R Block Inc provides income tax return preparation services, digital do-it-yourself tax solutions, and other services related to income tax preparation to the general public in the United States, Canada, and Australia. However, the majority of the tax returns done by the company are for customers within the United States through its company-owned offices, franchise locations, and online tax software. The company prepares over 20 million tax returns annually.

The company derives most of its total revenue from U.S.-assisted tax preparation fees. Revenue from franchise and product royalties and digital do-it-yourself tax solutions is also relatively significant.

The company generates annual revenue of about $3.3 billion and has a market capitalization of $4.4 billion.

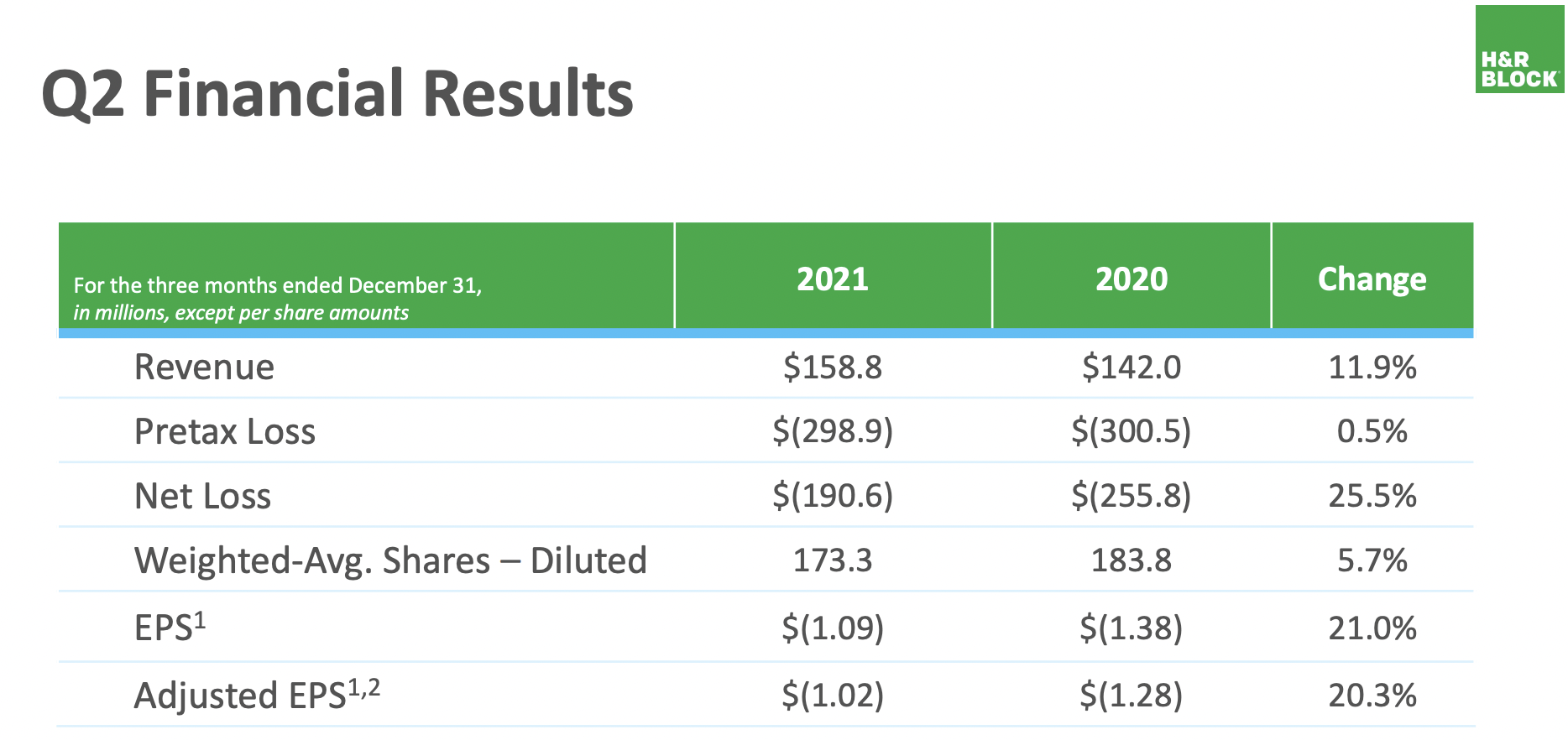

On February 1, 2022, the company reported its second-quarter and first six months results for Fiscal Year (FY)2022. The company ends its fiscal year at the end of June. For the quarter, the company reported total revenue of $159 million increase by $17 million, or 12%, from the prior year. The increase was primarily driven by strength in the Emerald Card and growth from Wave.

Total operating expenses were $436 million, which is an increase of $15 million, or 4%, compared to 2Q2021. This was driven by higher compensation and banking charges because of the growth in payments processed.

Net income for the quarter was a loss of $190 million compared to a loss of $255 million in 2Q2021. Adjusted earnings for the quarter were a loss of $1.02 per share compared to a loss of $1.28 per share, which was a 20.3% change.

Source: Investor Presentation

Thus far, for the six months of the fiscal year, the company’s total revenue is down 37%, from $559 million to $351 million. Net income is also down for the six months of the fiscal year from $318 million to $342 million. Thus, adjusted earnings are down to $1.95 per share for the six months thus far, compared to a loss of $1.69 per share last fiscal year’s first six months.

We expect the company to make $2.90 per share for FY2022. This would represent a decrease of 14.4% year-over-year compared to FY2021 when the company earned $3.39 per share.

Growth Prospects

The company’s growth will come from acquisitions and better marketing campaigns. For example, the company recently acquired The Wave Financial, which should boost the company’s otherwise sluggish growth outlook. Also, since more and more people are now using software that automates taxes like Turbo Tax, H&R Block needs to invest more into having its own more helpful software. Mixing this software with good marketing campaigns can help boost the company earning growth.

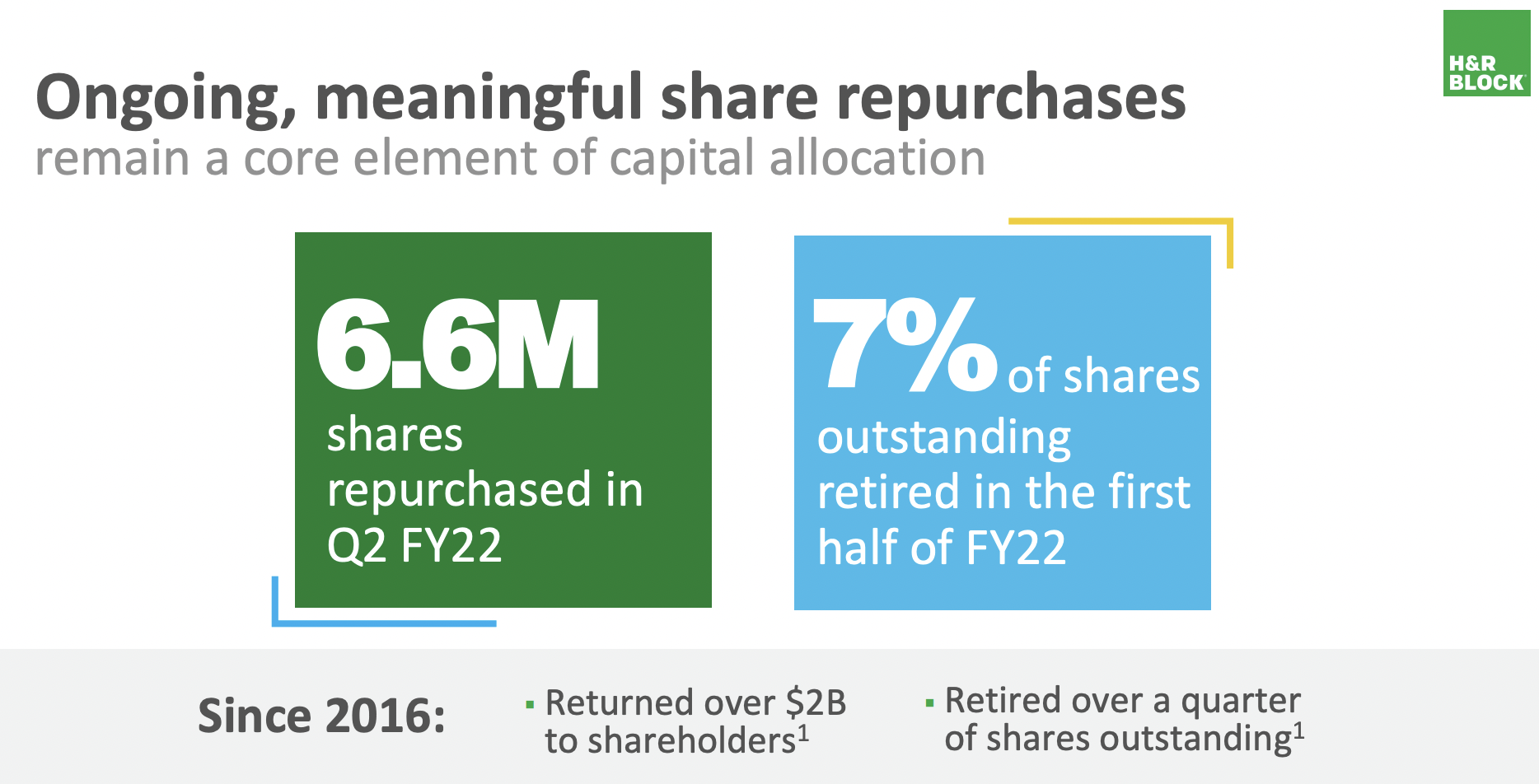

Another earning growth driver will come from share repurchase. Since the company stock price looks to be at a fair valuation, buying back shares at this level will help the company to reduce its share count, thus increasing earnings. Since 2016, the company has returned $2 billion to shareholders. Over the first half of FY2022, the company has retired 7% of its outstanding shares.

Source: Investor Presentation

Competitive Advantages & Recession Performance

H&R Block benefits from brand competitive advantages. It is a top brand in the tax preparation industry and provides a necessary service to taxpayers and customers for accounting purposes. H&R Block remained profitable each year during the Great Recession, and the company should be expected to remain profitable if and when another recession occurs in the United States.

The company performed well during the Great Recession of 2008-2010. However, the stock price saw a decrease of over 37% from the high of 2007 to the low in 2009, but earnings did not decrease at that same level.

HRB’s earnings-per-share throughout the Great Recession:

- 2007 earnings-per-share of $1.15

- 2008 earnings-per-share of $1.39 (21% increase)

- 2009 earnings-per-share of $1.53 (10% increase)

- 2010 earnings-per-share of $1.46 (5% decrease)

As you see, the company did well during this period. Earnings increased both in 2008 and in 2009, and it only saw a slight decrease in 2010. The company increased its dividend in those three years, which is impressive.

Dividend Analysis

The company has a dividend rate of $1.08 per share, which gives us a dividend yield of 4.1% at the current price. This is lower than the company own five-year dividend average of 4.5%. It is, however, more than three times the average dividend yield of the S&P 500 Index.

Since 2003, the company has been growing its dividend at a high signal digit rate. However, in 2011, the company froze its dividend growth but continued to pay out quarterly dividends. Since 2011, there have been years when the company increased its dividend. For example, 2012 and 2013 saw a dividend increase of 16.7% and 14.3%, respectively.

However, from 2014 to 2016, the company did not increase its dividend. Last year also saw a dividend growth freeze after the company had three consecutive years of increases from 2017 to 2020.

The company’s dividend is safe from earnings and free cash flow (FCF), with both covering the dividend with a good payout ratio. The payout ratio is ~37% based on the forward dividend rate and estimated 2022 earnings per share of $2.90. In addition, H&R Block generated an FCF of $3.04 per share in FY2021, which gives us a dividend payout ratio of ~34%. Thus, the dividend is safe.

The company also has an ok balance sheet. The company has a 4.9 debt-to-equity ratio, which aligns with its history. The company’s financial leverage ratio is 10.4, which is high. Furthermore, H&R Block has an S&P Credit Rating of “BBB.” This credit rating is an investment-grade rating from S&P.

Thus, the balance sheet is in ok condition, and investors trust that the company is running well, but again, the leverage ratio is high compared to its past ten years.

Final Thoughts

Overall, the company dividend is very safe. The company did well during both the Great Recession and the COVID-19 pandemic. The dividend survived both events. However, the company’s future earnings growth does not look too attractive. H&R Block is in the middle of a turnaround. It needs to invest in ancillary growth opportunities to adapt to a more challenging operating climate. This will inhibit the company’s growth over the next five years. Nevertheless, those investors willing to wait will receive an attractive, safe dividend yield for the foreseeable future.