High Dividend 50: Gap, Inc.

Image Source: Unsplash

The Gap Inc. (GPS) had to cut its dividend during the COVID-19 pandemic. Since then, the company reinstated its dividend on May 11, 2021, and it is now considered a high yield dividend stock.

This article analyzes the high-yield stock, The Gap Inc., in detail. While it doesn’t have a 5.0%+ yield currently, its dividend yield of 4.5% is still high, especially in today’s low-interest-rate environment.

Business Overview

The Gap Inc. is an American clothing and accessories retailer worldwide. The company was founded in 1982 by Nick Taylor, Donald Fisher, and Doris F. Fisher, and is headquartered in San Francisco, California. The company has a market capitalization of $5.69 billion.

The Gap operates six business lines: Gap, Banana Republic, Old Navy, Intermix, Hill City, and Athleta. The company has 3,399 store locations in over 40 countries, 2,835 of which were company operated.

The company reported fourth-quarter and full-year results for Fiscal Year (FY) 2021 on March 3, 2022. The company brought in $4.5 billion in net sales, down 3.2% compared to pre-pandemic 2019. Strategic permanent store closures and divestitures reduced net sales by approximately 9% versus 2019. Online sales grew 44% compared to the fourth quarter of 2019 and represented 43% of the total business.

Fourth-quarter comparable sales were up 3% versus 2019 and 3% year-over-year. For the quarter, net profit was a loss of $16 million compared to a loss of $184 million in Q4 2019. Thus, for the quarter, earnings per share were negative $0.04 versus a negative $0.49 in the fourth quarter of 2019.

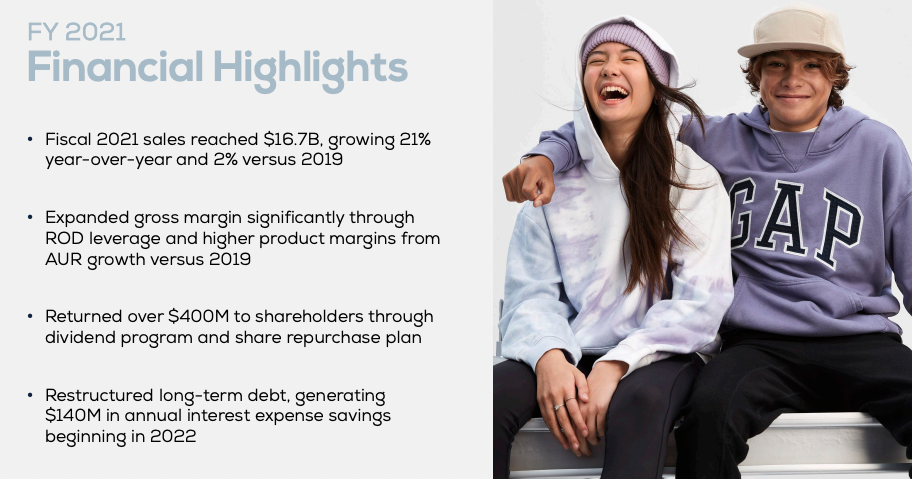

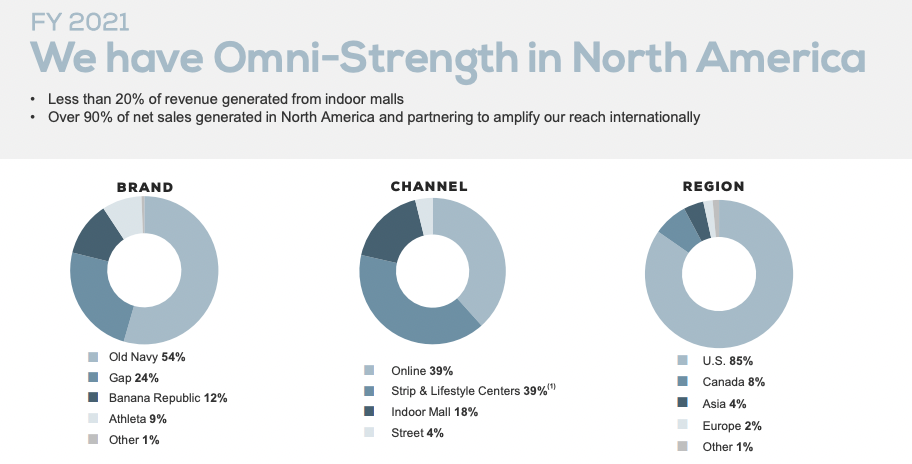

The fiscal year 2021 net sales were $16.7 billion, which is a 2% increase versus the fiscal year 2019. Online sales grew 57% versus 2019, and represented 39% of total net sales for the year. Comparable sales for the fiscal year 2021 increased 8% versus 2019 and were up 6% year-over-year.

The Old Navy segment saw slightly flat sales due to supply chain impacts. It was up 2% versus 2019, with comparable sales flat versus 2019. The brand crossed $9 billion in net sales for the year, up 14% compared to the fiscal year 2019, with comparable sales up 12% versus 2019. The Gap segment saw sales decline 13% versus 2019 for the quarter due to store closures, which the company estimates are a 17% decline.

Overall, the company reported diluted earnings per share of $0.67 with adjusted diluted earnings per share of $1.44, a significant improvement from 2020. The company also announced a 25% dividend increase from $0.12 per share per quarter to $0.15 per share per quarter. This announcement was made on Feb. 24, 2022.

Source: Investor Presentation

The management team provided the FY 2022 financial outlook. The management team expects diluted earnings to be $1.95 to $2.15 per share for the year. We will be more conservative and think that the company can earn $1.88 per share. Net sales growth is expected to be in the low single-digit range versus the fiscal year 2021, with first-quarter net sales expected to be down mid to high-single digits versus the first quarter of 2021.

Growth Prospects

The Gap Inc. manages a portfolio of brands and has the size and capital strength to acquire new brands to bolster its business or engage in aggressive share repurchases. Organic growth through acquisitions may represent an upside to investors.

The Gap could also capitalize on the retail industry’s weaknesses by buying distressed brands and assets. An example would be purchasing the high-end children’s clothing line Janie and Jack from bankrupt retailer, Gymboree, for $35 million.

For the year, online sales were 39% of the company revenue. Another form of growth could come from increasing online sales. This could be done by working with internet influencers and with online marketing.

Another source of growth for the company would be to try to increase its market shares in the Asia and Europe regions. Overall, the Asia market made up only 4% of the company’s total revenue, while the Europe market made up only 2%. Thus, there are many improvements that could be made in these markets.

Source: Investor Presentation

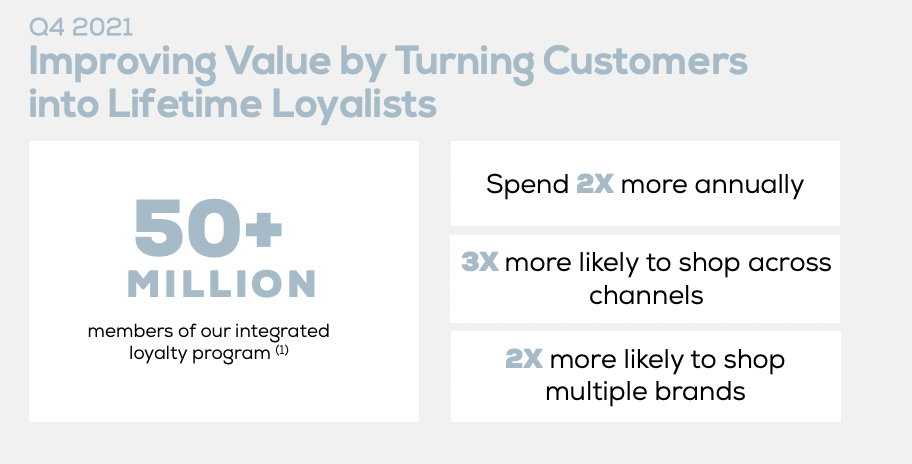

Another growth driver from the company could be loyalty programs. Currently, the company has over 50 million members. These members are more likely to spend two times more than non-members and are three times more likely to shop across different channels.

Source: Investor Presentation

Competitive Advantages & Recession Performance

We think that Gap does not necessarily have a competitive advantage. The company does have well know brands like Gap, Old Navy, and Banana Republic, but we do not think they have differentiated product or brand strength for premium pricing. The company Gap brand is highly dependent on basic apparel like T-shirts, jeans, shorts, polo shirts, and sweaters.

The company performed very well during the Great Recession of 2008-2010. However, the stock price saw a decrease of over 46% from the high of 2007 to the low in 2009, but earnings increased in that same period.

GPS’s earnings-per-share throughout the Great Recession were as follows:

- 2007 earnings-per-share of $0.93.

- 2008 earnings-per-share of $1.12 (20% increase).

- 2009 earnings-per-share of $1.34 (20% increase).

- 2010 earnings-per-share of $1.58 (18% increase).

As you can see, the company did well during the 2008-2009 Great Recession. Earnings increased in those years. Also, the company was able to increase its dividend in those years. During those years, earnings per share covered the dividend very well.

Dividend Analysis

The company pays out a high dividend yield currently. Because of the recent dividend cut that was caused because of the COVID-19 pandemic, the company dividend looks a lot safer. Before COVID-19, the company was paying about a 5.5% dividend yield. This was still covered by earnings, as the company earned $1.97 per share in FY 2019 while paying out a dividend of $0.97.

However, because of the cut, the company is now paying a dividend of $0.60 per share for the year. Since the company earned $1.44 per share for FY 2021, this gives us a dividend payout ratio of 42%. Thus, the dividend is very well covered with earnings.

As we mentioned above, we expect the company to earn $1.88 per share for FY 2022. Using the same dividend rate of $0.60 for the year will give us a dividend payout ratio of 32%. Thus, giving us more confidence that the dividend will be safe for the foreseeable future.

On a Free Cash Flow (FCF) basis, the dividend is also well covered. In FY 2021, the company reported an FCF of $1.41 per share. This presents us with a payout ratio of 43%. FCF is expected to decrease slightly for FY 2022, but it will still cover the dividend with a payout ratio of 49%.

The company also has a shaky balance sheet. The company has a 2.3 debt-to-equity ratio, which is a little high for us, and an interest coverage ratio of 2.9, which is low. Furthermore, Gap Inc. has an S&P Credit Rating of “BB.” This credit rating is not an investment-grade rating from S&P.

Thus, the balance sheet is in unreliable condition and investors should look through it thoroughly.

Final Thoughts

The company is undergoing a transformation in which costs will be incurred to restructure the business and grow through organic initiatives or inorganic acquisitions. We estimate 4% EPS growth annually over the next five years.

The Gap has a double-digit expected total return. This is due to lower valuation and higher expected earnings for FY 2022. Thus, we rate the company a Buy for speculative investors and those who are looking for a high dividend yield stock.

We also cover a lot of other different high-yield stocks in our database. We have created a spreadsheet of stocks (and ...

more