High Dividend 50: Franklin Resources

Image Source: Unsplash

There are plenty of high dividend yield stocks in the market. But there are very few high yield stocks with a safe and growing dividend. Franklin Resources Inc. (BEN) is one of those few high yield stocks with a safe, high yield dividend that’s growing every year.

This article analyzes high-yield stock Franklin Resources in detail. While it doesn’t have a 5.0%+ yield currently, its dividend yield of 4.2% is still high, especially in today’s low-interest-rate environment.

Business Overview

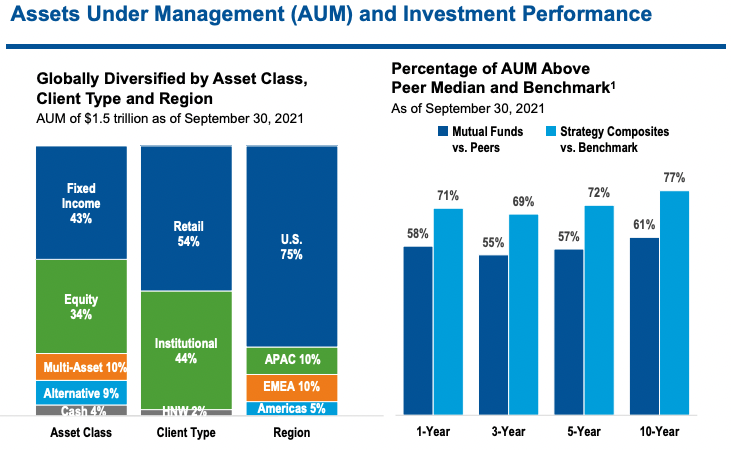

Franklin Resources, founded in 1947 and headquartered in San Mateo, CA, is a global asset manager with a long and successful history. The company offers investment management and related services to its customers, including sales, distribution, and shareholder servicing. As of Dec. 31, 2021, assets under management (AUM) totaled $1.578 trillion. The company has a current market capitalization of 14.02 billion.

Source: FranklinResources

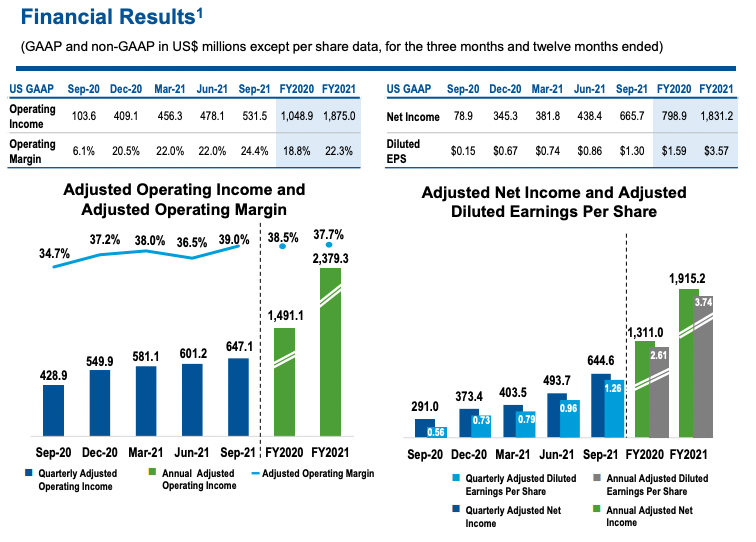

On Feb. 1, 2022, the company reported first-quarter results for Fiscal Year (FY) 2022. The company fiscal year ends in September. Total revenue for the quarter was $2,224 million compared to $1,995.1 million in total revenue the company made in Q1 2021, or an 11% increase.

The investment management fees segment, which is the company’s primary source of revenue, grew by 14% for the quarter year-over-year. The sales and distribution fees segment was flat, while the shareholder servicing fees segment saw a negative growth of 3% year-over-year.

Operating income grew 36% compared to the first quarter of 2021. The reported operating income was $557.7 million compared to $409.1 million a year ago for the same period. This was done even with the increase in total operating expenses of 5%.

Thus, adjusted net income was $553.6 million, and adjusted diluted earnings per share was $1.08 for the quarter, compared to $644.6 million and $1.26 for the previous quarter, and $373.4 million and $0.73 for the quarter ended Dec. 31, 2020. This represents a significant increase of 47.9% compared to the first quarter period.

The company CEO Jenny Johnson was delighted with the result for the first quarter. The company diversifies its business across products, geographies, vehicles, and asset classes. This will, in turn, help create broader sources of revenue and growth potential. Overall, all asset classes saw improved long-term net flows for the quarter, and alternatives posted a 10th consecutive quarter of long-term net inflows.

Overall, on an Earning per-share basis, the company made $3.74 for FY 2021, which is an increase of 43% compared to the $2.61 per share the company made in 2020. We expect the company will earn $3.50 per share for FY 2022. This will represent a decrease of 1% versus FY 2021. This is expected because the market is expected to have a modest to flat growth year.

Source: Investor Presentation

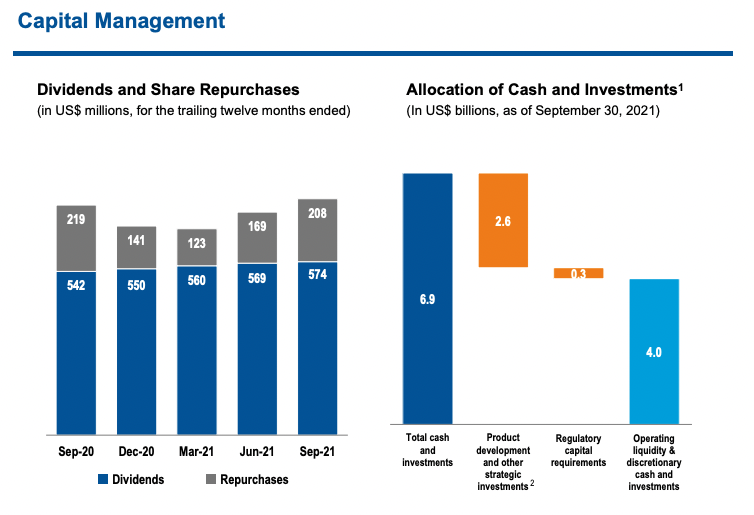

On Nov. 1, 2021, the company announced the acquisition of Lexington Partners, a Global Leader in Secondary Private Equity and Co-Investments. Franklin Templeton is acquiring 100% of Lexington from its current owners for a cash payment of $1.75 billion, made up of $1 billion at close and additional payments totaling $750 million over the next three years.

The transaction will be funded from Franklin Templeton’s existing balance sheet resources and is expected to be immediately added. This is expected to increase its adjusted earnings per share.

Growth Prospects

The main growth driver for the company will come from acquisitions as well as an influx of inflows from current clients/customers. For example, the company generated $24.1 billion in inflows, which helped lift the total AUM. However, fee compression is expected to be an ongoing issue for U.S.-based active asset managers.

Thus. we think that Franklin Resources will struggle to generate more than low-single-digit positive annual top-line growth during the next five years. As a result, profits margin will also see pressure as companies like Franklin Resources spend more heavily to improve investment performance and to enhance distribution capabilities.

Source: Investor Presentation

Competitive Advantages & Recession Performance

Franklin Resources has a narrow economic moat around its operations. This is because the company has well-known brands like Franklin, Templeton, Western Asset Management, ClearBridge Investments, Brandywine Global, Clarion Partners, Martin Currie, and Royce & Associates. The company also has about $1.578 trillion in AUM. This helps the company by providing it with the size and scale necessary to be competitive.

The company performed terribly during the Great Recession of 2008-2010. The stock price saw a decrease of over 59% from the high of 2007 to the low in 2009, and earnings decreased in that same period.

BEN’s earnings-per-share throughout the Great Recession were as follows:

- 2007 earnings-per-share of $2.34.

- 2008 earnings-per-share of $2.23 (5% decrease).

- 2009 earnings-per-share of $1.30 (42% decrease).

- 2010 earnings-per-share of $2.11 (63% increase).

As you see, the company did not do well during the 2008-2009 Great Recession. Earnings and the stock price decreased in those years. Fortunately, the company did not have to cut its dividend. Earnings in those years covered the dividend very well. As a matter of fact, the company increased its dividend every year during the Great Recession.

Dividend Analysis

The company has a very impressive dividend history. The company has been increasing its dividend for forty-two consecutive years. Over the past ten years, the dividend has had a Compound Annual Growth Rate (CAGR) of 12.9%. However, the company has been slowing down its dividend growth rate in recent years. Over the past five years, the dividend CAGR has been 9.2%, and over the past three years, it has been 6.8%.

The most recent dividend increase was announced on Feb. 23, 2022. The company reported a 4.0% increase in its dividend. Thus, the dividend increase rate has been slowing down noticeably.

The company also sports a very healthy dividend payout ratio. Last year, the company earned $3.47 per share and paid out a dividend of $1.12 per share. This gives us a dividend payout ratio of 29.9%. For FY 2022, we expect the company to make $3.50 per share and payout $1.16 in dividends per share. Thus, giving us a dividend payout ratio of 33%.

During the Great recession, the dividend payout ratio was not under pressure. For example, from 2007 to 2010 the dividend payout ratio was 8.5%, 12%, 21.6%, and 13.9%, respectively.

Source: Investor Presentation

The company also has a solid balance sheet. The company has a 0.7 debt-to-equity ratio, which is decent, and an interest coverage ratio of 35.7. Furthermore, Franklin Resources has an S&P Credit Rating of “A.” This credit rating is an investment-grade rating from S&P.

Thus, the balance sheet is in excellent condition and should help the company withstand a recession without a dividend cut. Therefore, we think the dividend is very safe.

Final Thoughts

Franklin Resources is an asset manager that must battle the rise of low-cost investing, which has been responsible for customers moving money from actively managed funds to ETFs. The company is in an interesting situation where the core business is declining, but the financial foundation has been stable.

The dividend is very well covered with earnings. Also, the company balance sheet is very healthy. Overall, the company is an outstanding stock to consider as a high dividend yield stock. This will make both dividend growth and income investors very happy for years to come.

We also cover a lot of other different high-yield stocks in our database. We have created a spreadsheet of stocks (and ...

more