High Dividend 50: First Interstate Bank

Image Source: Pixabay

High-yield stocks pay out dividends that are significantly more than market average dividends. For example, the S&P 500’s current yield is only ~1.2%, which is quite low on an absolute basis, but also on a historical basis.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

First Interstate Bank (FIBK) is part of our ‘High Dividend 50’ series, where we cover the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more to help investors find these high-yield stocks easily.

Next on our list of high-dividend stocks to review is First Interstate Bank (FIBK).

First Interstate Bank has a 10-year dividend increase streak, which certainly isn’t among the longest in the market. However, the stock is yielding north of 7% today, and barring a big decline in earnings, we believe the payout is safe for the foreseeable future.

Business Overview

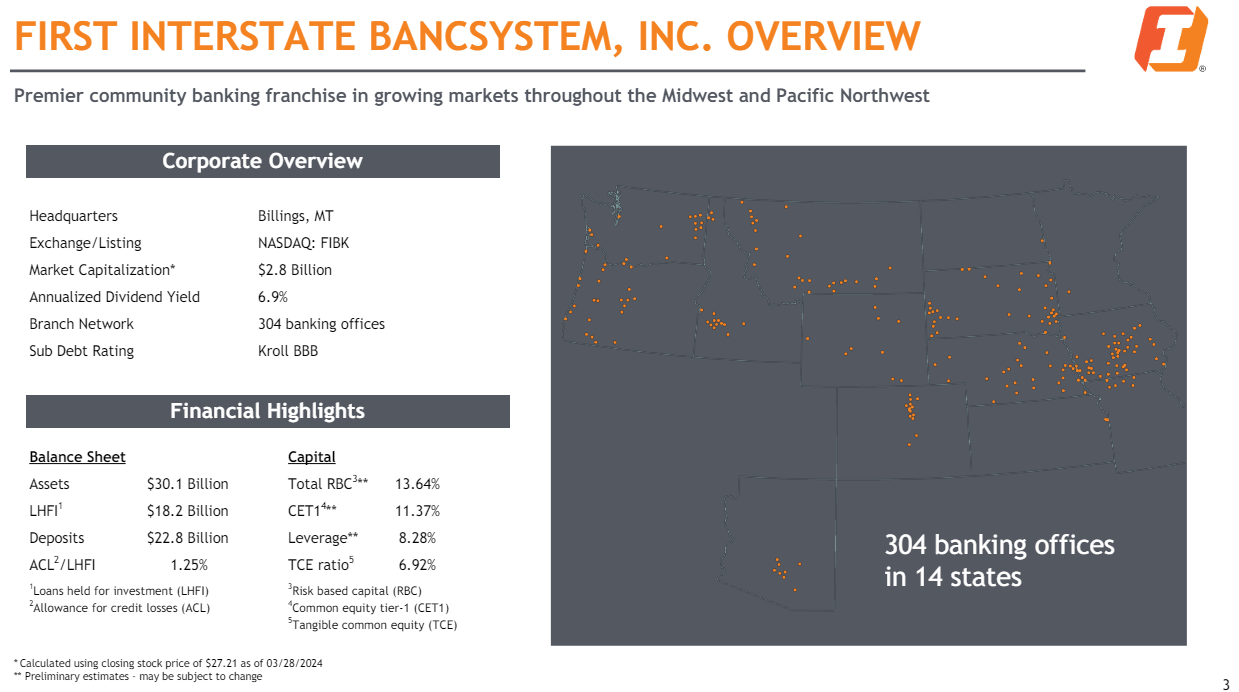

First Interstate BancSystem is a Montana-based bank holding company for First Interstate Bank, providing a range of traditional banking products and services in the US.

The company provides checking, savings, time deposits, real estate loans, consumer loans, credit cards, as well as an array of business-focused products.

(Click on image to enlarge)

Source: Investor presentation

The bank was founded in 1971, and has grown in the 53 years since then to about a billion dollars in revenue and a market cap of $2.6 billion.

The company reported first quarter earnings which showed some weakness. Revenue fell nearly 6% year-over-year to $242 million, but that was fractionally ahead of estimates. Earnings-per-share came to 57 cents, which was off from 72 cents a year ago, but was seven cents better than estimated.

Credit quality improved somewhat, as criticized loans declined more than $58 million from the year-ago period. Allowances for credit losses were 1.25% of average loans outstanding, or $228 million. These totals were virtually flat from a year ago.

Deposits ended the quarter at $22.8 billion, down 5.4% from a year ago. Net interest margin was 2.91%, down eight basis points sequentially and off 42 basis points from a year ago. We expect the bank to earn $2.29 per share this year after Q1 results.

Growth Prospects

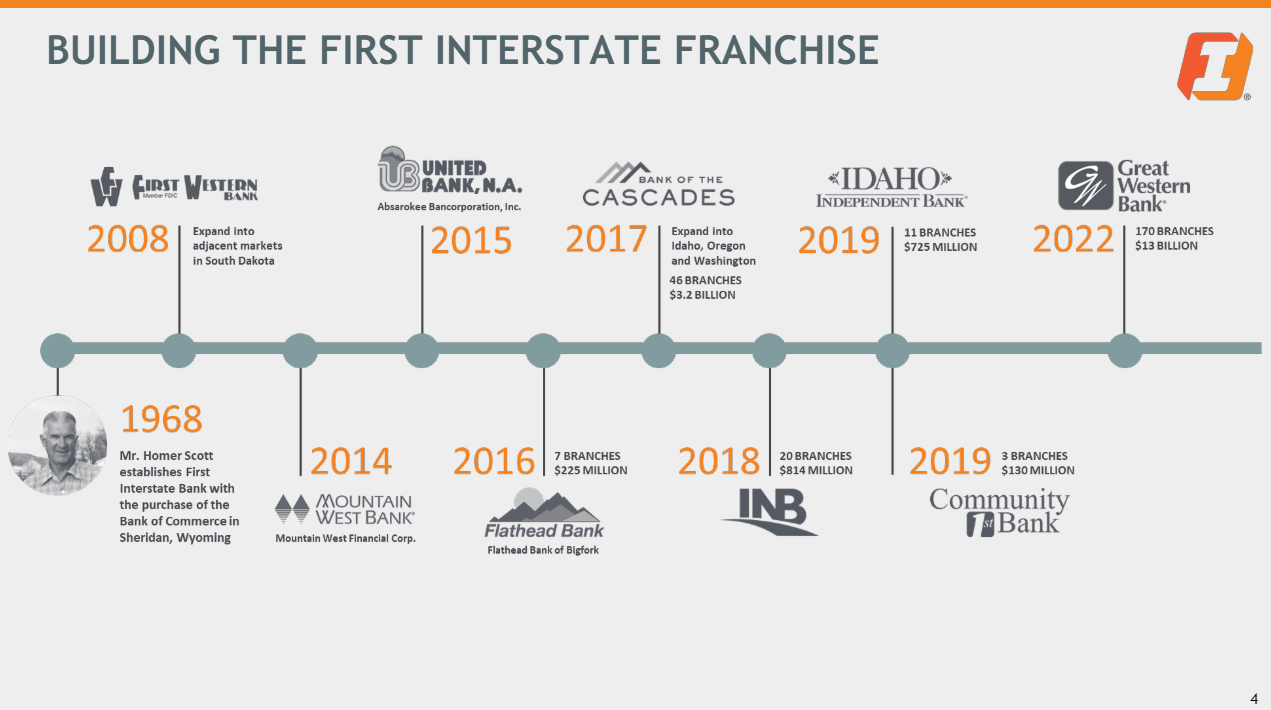

First Interstate has pursued a dual strategy of growth over the years. This is similar to how most banks attempt to take market share and grow over time, with the two components being organic and acquired growth.

First Interstate has undertaken a number of sizable acquisitions over the years, as we can see below.

Source: Investor presentation

In the past 16 years, First Interstate has fairly aggressively pursued market share gains via purchasing all or part of various competitors.

That has helped it expand from Montana into 13 additional states and more than 300 offices. The bank has used acquisitions to complement its organic growth quite effectively.

Going forward, we see 2% annual earnings-per-share growth, driven by a mix of relatively struggling credit quality, net interest margin weakness, and higher rates of lending.

We see the path forward from 2024 earnings as murky, and are therefore cautious on the bank’s ability to grow quickly.

Competitive Advantages & Recession Performance

Like any other bank, competitive advantages are hard to come by for First Interstate. Essentially all banks offer the same lineup of products and services, meaning pricing power is extremely limited.

Smaller regional banks like First Interstate therefore try to gain scale advantages by making acquisitions. However, we note this does not constitute a marketplace advantage in terms of competitiveness.

Another characteristic of banks is that they tend to be quite susceptible to recessions, and First Interstate’s performance during the Great Recession shows it is no exception.

The company saw a big earnings draw-down during the previous major economic downturn, the Great Recession of 2008-2009:

- 2008 earnings-per-share: $1.77

- 2009 earnings-per-share: $1.44

- 2010 earnings-per-share: $0.84

With this in mind, we caution investors to monitor the bank’s performance should a downturn arise, because it’s quite likely we’d see earnings decline, and potentially quite meaningfully.

Dividend Analysis

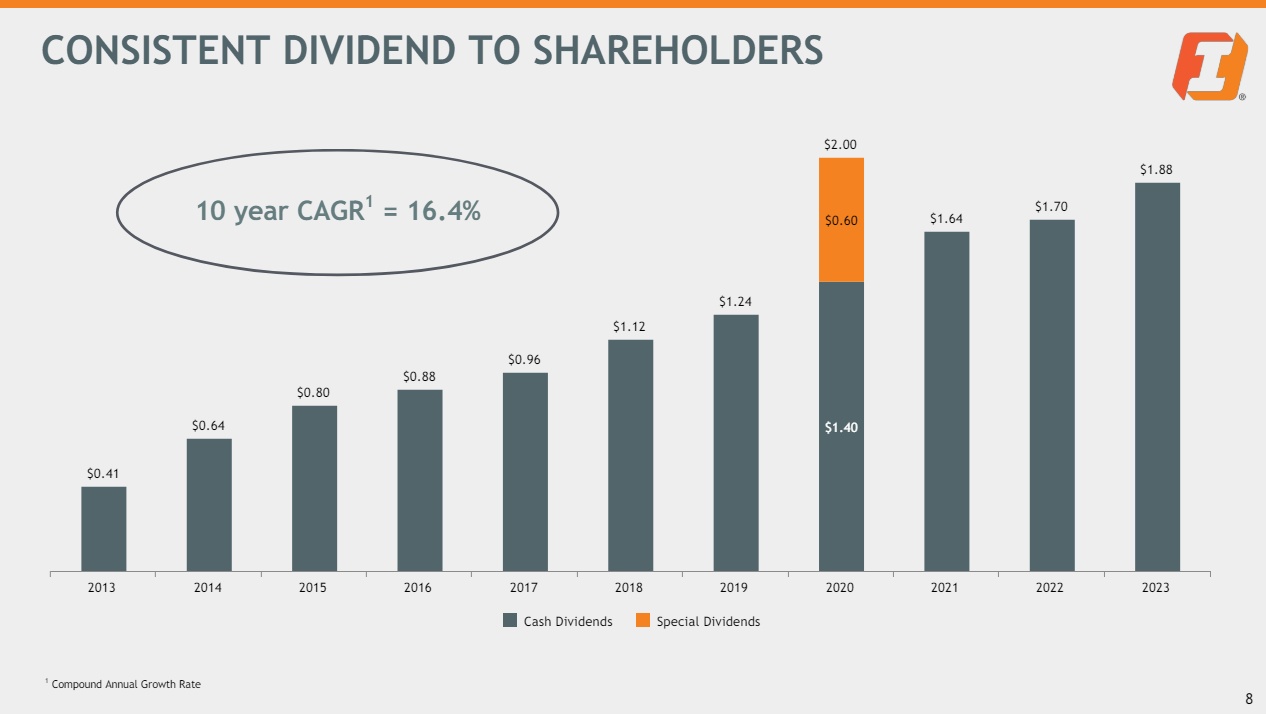

First Interstate’s current annual dividend is $1.88, which is the same dividend that’s been paid for the past seven quarters. First Interstate’s dividend increase history has been somewhat spotty given its lumpy earnings, and recession susceptibility.

We believe that is likely to continue give the payout ratio for this year is 82% of earnings. That high level means there is not only little room for increases, but little room for earnings declines before the payout would be at potential risk.

On the plus side, the yield is an eye-popping 7.5%, more than six times that of the S&P 500. On that measure, it is an outstanding income stock.

Source: Investor presentation

Management touts a 10-year compound average growth rate of more than 16% for the dividend, but we see nothing of the sort going forward. We are estimating no dividend growth for the foreseeable future, given the earnings situation.

Overall, the yield is extremely attractive, but we see it as a potential warning sign from the market that a cut may be necessary.

Final Thoughts

We see First Interstate as a stock with an extremely attractive yield, but also one that is seeing a fair amount of fundamental weakness.

The fact that the yield is so high is the result of a low share price, which itself is derived from a relatively weak earnings outlook.

With the sky-high yield, we think the market may be warning investors that the current dividend of $1.88 per share may be tough to maintain.

For now, as long as the dividend remains intact, it’s a terrific income stock, but we do caution investors that recent earnings reports have certainly show some weakness.

More By This Author:

3 Water Utility Stock For Long Term Dividend Growth

3 Dividend Stocks For Growth At A Reasonable Price

3 Dividend Growth Stocks For Long-Term Returns

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more