High Dividend 50: Fidus Investment Corporation

Image Source: Pixabay

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s recent yield is only around ~1.2%. High-yield stocks can be particularly beneficial in supplementing income after retirement. An investment of $120,000 in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Fidus Investment Corporation (FDUS) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more. You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link provided.

Next on our list of high-dividend stocks to review is Fidus Investment Corporation.

Business Overview

Fidus Investment Corporation is an externally managed business development company (BDC) that provides tailored debt and equity financing solutions to lower-middle-market companies.

The firm targets cash-flow-positive businesses with predictable revenues of $10 million to $150 million annually, emphasizing companies with defensible or leading positions in their industries. By focusing on this niche, Fidus aims to support the growth and stability of companies with strong fundamentals and sustainable business models.

Headquartered in Evanston, Illinois, Fidus Investment Corporation generates approximately $95 million in total investment income annually.

Through its strategic financing approach, the company leverages its expertise to structure investments that balance risk and return while fostering long-term value creation for both its portfolio companies and shareholders. Its focus on disciplined investment selection and customized financial solutions positions Fidus as a notable player in the lower middle-market financing space.

Source: Investor Relations

The company reported strong Q2 2025 results, with adjusted net investment income of $20.0 million ($0.57 per share) and total investment income of $39.97 million, up 12% year-over-year.

The company invested $94.5 million in new debt and equity positions and received $109.3 million from repayments and realizations. The board declared third-quarter dividends of $0.57 per share, including a base of $0.43 and a supplemental $0.14.

The portfolio includes 92 active companies and five exited investments, valued at $1.1 billion. About 71% of debt investments are variable-rate, with a weighted average yield of 13.1%.

New investments spanned software, materials testing, plumbing, and environmental consulting, reflecting Fidus’ focus on lower-middle-market businesses with predictable cash flows and resilient models.

Fidus holds $91.2 million in cash and $140 million of unused credit capacity, providing liquidity for future investments. Management remains focused on disciplined capital deployment, generating attractive risk-adjusted returns, growing net asset value, and returning income to shareholders through dividends and its reinvestment plan.

Growth Prospects

Fidus Investment Corporation has demonstrated consistent growth by maintaining stable net investment income (NII) through a disciplined yield spread between its investment returns and debt costs.

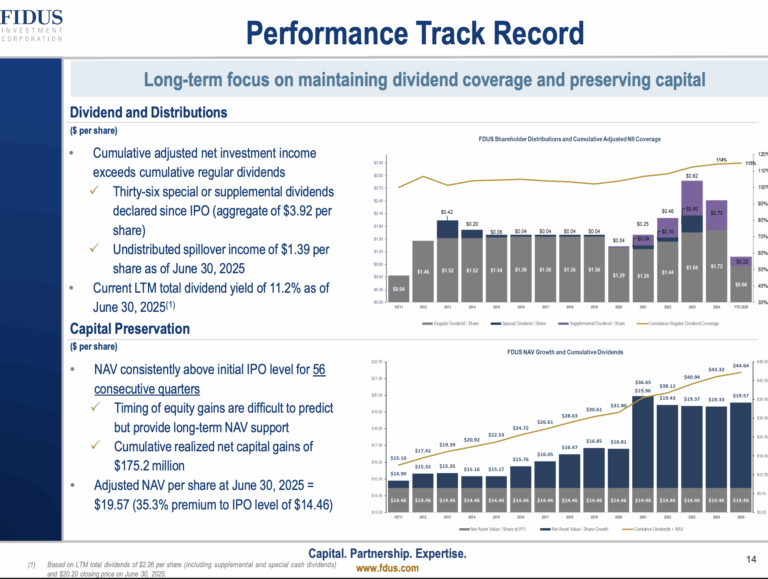

Since its IPO in 2011, the company’s net asset value per share has increased from $14.46 to $19.50, reflecting long-term value creation despite occasional periods where dividends exceeded gains.

Fidus has shown flexibility in its dividend strategy, temporarily reducing its quarterly dividend in 2020 before gradually restoring it to $0.43 per share, while also paying supplemental and special dividends totaling $0.27 in 2021, $0.56 in 2022, $1.20 in 2023, and $0.70 in 2024.

Looking ahead, Fidus is well-positioned to benefit from higher interest rates, which should enhance its income from debt investments, though growth in NII per share may be limited by its already high income base.

The company’s disciplined approach to capital deployment, its focus on lower-middle-market companies with resilient cash flows, and its strategic balance between regular and supplemental dividends support sustainable shareholder returns.

Overall, Fidus’ track record and portfolio management strategy suggest it can continue to generate attractive, risk-adjusted returns while steadily growing its net asset value.

Source: Investor Relations

Competitive Advantages & Recession Performance

Fidus Investment Corporation’s competitive advantage lies in its disciplined focus on lower middle-market companies with predictable cash flows and defensible market positions.

By tailoring debt and equity solutions to each portfolio company and maintaining a yield spread between investment returns and borrowing costs, Fidus generates stable net investment income while mitigating downside risk.

Its diversified portfolio across industries and its mix of variable- and fixed-rate debt further enhance resilience and provide flexibility in capital deployment. During economic downturns, Fidus has historically maintained portfolio stability and income generation. Its emphasis on cash-flow-positive businesses with resilient business models allows it to navigate recessions without significant impairment losses.

Even when dividends occasionally exceeded realized gains, resulting in temporary NAV pressure, the company’s long-term track record shows consistent NAV growth, demonstrating its ability to sustain returns and preserve shareholder value in challenging market environments.

Source: Investor Relations

Dividend Analysis

The company’s annual dividend is $1.72 per share. At its recent share price, the stock has a high yield of 8.5%.

Given the company’s 2025 earnings outlook, EPS is expected to be $2.00 per share. As a result, the company is expected to pay out roughly 86% its EPS to shareholders in dividends.

Final Thoughts

Since its IPO, Fidus Investment Corporation has delivered solid performance, consistently paying substantial dividends while growing its net asset value per share.

We project annualized returns of approximately 4.6% through 2030, largely driven by regular dividends, though potential valuation headwinds could limit growth. This estimate excludes special dividends, which Fidus has historically paid with consistency, suggesting total returns could be significantly higher. Based on this outlook, we maintain a hold rating on Fidus Investment Corporation.

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more

More By This Author:

High Dividend 50: Firm Capital Property TrustHigh Dividend 50: Plains GP Holdings, L.P.

High Dividend 50: Apple Hospitality REIT Inc.

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more