High Dividend 50: Dow Inc.

Most investors hesitate to invest in high-yield stocks, fearing that a dividend cut may be just around the corner. Indeed, in some cases, a high yield signals that the dividend is at the risk of being cut whenever the next downturn shows up.

However, some stocks offer a generous dividend with a wide margin of safety.

Dow Inc. (DOW) is currently offering a well-covered 4.4% dividend. In this article, we will analyze Dow’s business, growth prospects, and dividend safety.

Business Overview

Dow Inc. is a standalone company that was spun off from its former parent, DowDuPont, in 2019. DowDuPont has broken into three publicly traded, standalone companies, with the former Materials Science business being the new Dow.

Due to its sensitivity to the underlying economic conditions, Dow was hurt by the coronavirus crisis in 2020 and saw its earnings per share plunge 52% in that year. However, thanks to the strong recovery of the global economy from the pandemic, Dow has fully recovered from the health crisis.

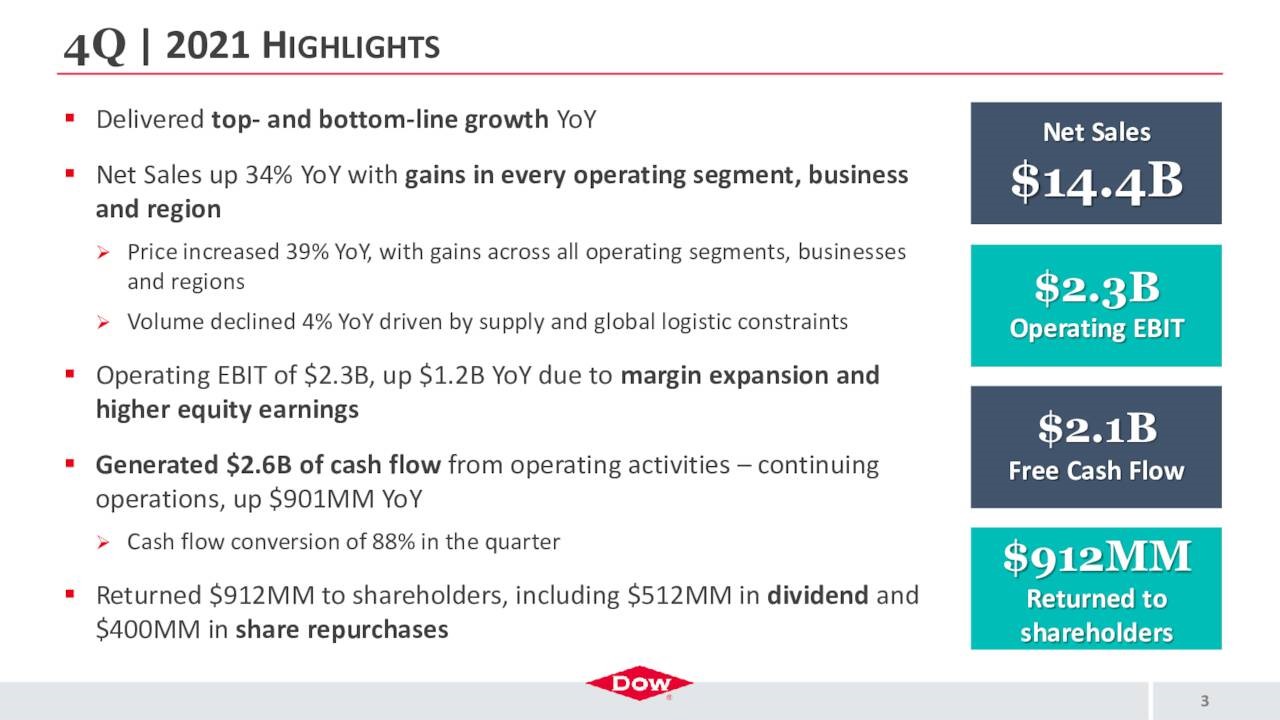

In the fourth quarter of 2021, Dow grew its revenue 34% over the prior year’s quarter, with improvement in every single operating segment, business and region. The company incurred a 4% decrease in its volumes due to the significant supply chain constraints caused by the pandemic, but it offset this headwind with a 39% average increase in realized prices.

Source: Investor Presentation

Thanks to its impressive margin expansion, Dow more than doubled its operating earnings per share, from $0.81 to $2.15, exceeding the analysts’ estimates by $0.12. The company has beaten the analysts’ consensus by a wide margin in both lines for six consecutive quarters. This is a testament to its sustained business momentum.

Even better, management expects the supply chain bottlenecks to ease in the upcoming quarters and the strong demand from its customers to remain in place, given the excessive backlog and healthy economic growth worldwide.

Moreover, while many companies are hurt by cost inflationary pressures, as they can hardly pass their increased costs to their customers, Dow actually benefits from inflation, according to its management, as it can expand its margins significantly. The recent results of Dow confirm that the company can easily pass its increased costs to its customers.

Growth Prospects

Dow began trading as a standalone company only in 2019. As a result, it is challenging to forecast the future results of the company.

Dow expects the demand for its products to remain solid for the foreseeable future thanks to the strong financial condition of most consumers, who have accumulated cash during the pandemic, assisted by the immense fiscal stimulus packages offered by governments.

Source: Investor Presentation

The company also expects to benefit from increased investment in infrastructure as well as the secular growth of electric vehicles.

However, in 2021, Dow posted blowout earnings thanks to the strong recovery of the global economy from the pandemic, which resulted in pent-up demand, and the material price hikes that the company implemented.

Given these extraordinary tailwinds, we believe that Dow will not be able to match its performance in 2021 anytime soon. Demand for its products is likely to remain robust for the foreseeable future but the tailwind from pent-up demand will begin to fade at some point.

Moreover, the company is not likely to keep raising its prices in the near term. Therefore, given the non-recurring factors behind the stellar earnings per share of $8.98 in 2021, we expect the company to post earnings per share around $6.75 this year.

Competitive Advantages

The long history of Dow as a component of DowDuPont has helped the company build almost unparalleled expertise in its business. This expertise combined with the strong brand of Dow constitutes a significant competitive advantage.

On the other hand, due to its short history as a standalone company, Dow has hardly been tested under adverse economic conditions. The company proved highly vulnerable to the pandemic, as its earnings plunged 52% in 2020, but it is likely to prove somewhat more resilient to normal recessions, i.e., without the impact of lockdowns. Nevertheless, investors should be aware that Dow is sensitive to the underlying economic growth and is not immune to recessions.

Dividend Analysis

Dow is currently offering an above-average dividend yield of 4.4%, with a healthy payout ratio of 42%. In addition, the company has a solid balance sheet, with an interest coverage ratio of 12 and net debt of $31.4 billion, which is only 67% of the market capitalization of the stock and about 6 times the earnings of the company expected this year. Therefore, the dividend of Dow has a wide margin of safety.

On the other hand, it is important to note that Dow has paid the same dividend for 12 consecutive quarters. In other words, Dow has not raised its dividend since its formation as a standalone company. Given the high yield of the stock, management does not seem interested in raising the payout anytime soon. The absence of dividend growth is a red flag for income-oriented investors, particularly given the 40-year high inflation prevailing right now.

Overall, we believe that the dividend of Dow is safe for the foreseeable future but income-oriented investors should probably wait for a modest correction of the stock in order to lock in a higher dividend yield and enhance their future returns.

Final Thoughts

Dow has fully recovered from the coronavirus crisis and is likely to continue to enjoy strong business momentum for many more quarters thanks to its backlog and the absence of any signs of fatigue on the horizon. On the other hand, the company is not likely to match the blowout earnings it achieved last year, as the tailwind from pent-up demand will begin to attenuate at some point.

Moreover, the stock is offering a 4.4% dividend with a wide margin of safety but management has not shown any intention of raising the dividend. Given the high inflation prevailing right now, the absence of dividend growth is a concern.

In addition, the short history of Dow as a standalone company makes it challenging to forecast its future performance. As a result, we need a wider margin of safety to recommend purchasing this stock.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more