High Dividend 50: Cross Timbers Royalty Trust

Image Source: Unsplash

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s yield is only ~1.2%. High-yield stocks can be particularly beneficial in supplementing income after retirement. An investment of $120,000 in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Cross Timbers Royalty Trust (CRT) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more. You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link provided. Next on our list of high-dividend stocks to review is Cross Timbers Royalty Trust.

Business Overview

Cross Timbers Royalty Trust is an oil and gas trust established in 1991 by XTO Energy, a subsidiary of ExxonMobil. The trust generates income through a 90% net profit interest in gas-producing properties in Texas, Oklahoma, and New Mexico, including the San Juan Basin, and a 75% net profit interest in working interest oil properties in Texas and Oklahoma.

While the 90% interest is not subject to development costs, the 75% interest requires Cross Timbers Royalty Trust to share in production and development expenses, meaning distributions are delayed if costs exceed profits.

Cross Timbers Royalty Trust’s revenue is heavily weighted toward oil, which accounted for 72% of total revenue in 2024, with natural gas making up the remaining 28%. Historically, the trust has produced stable royalty income, generating $12.5 million in 2022 and $12.3 million in 2023. Monthly distributions are paid to unitholders by XTO Energy, and Cross Timbers Royalty Trust has a market capitalization of approximately $44 million, offering investors a royalty-based exposure to U.S. oil and gas production with predictable cash flows.

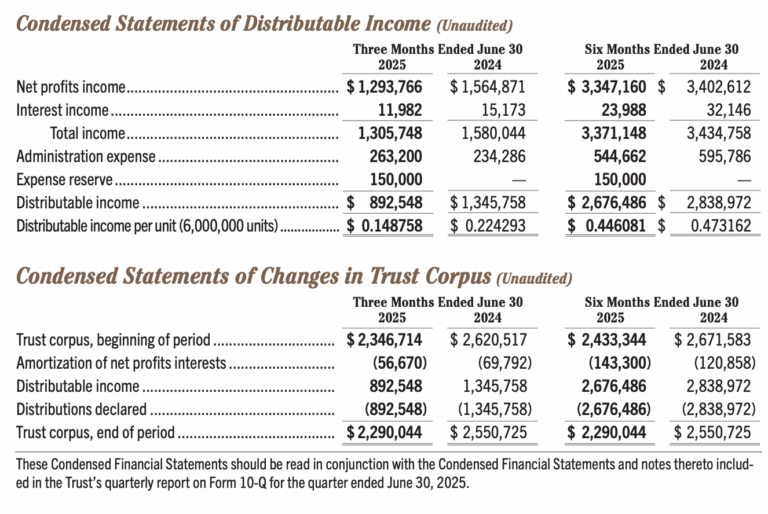

In mid‑August 2025, Cross Timbers Royalty Trust reported its Q2 results: oil volumes declined by ~18% year‑over‑year, and natural gas volumes fell by ~35%. At the same time, the average realized oil price dropped by ~14%. As a result, Cross Timbers Royalty Trust’s distributable cash flow (DCF) per unit decreased by around 17%.

Distributions have dropped significantly over the past five months amid lower oil prices and the unwinding of OPEC production cuts. Based on distributions over the first eight months of 2025, Cross Timbers Royalty Trust is offering an annualized yield of approximately 12.1%.

Source: Investor Relations

Growth Prospects

A key driver for Cross Timbers Royalty Trust is the price of oil and gas. Between 2014 and 2020, falling commodity prices limited the trust’s income, but the 2023 rally to 13-year highs allowed Cross Timbers Royalty Trust to achieve its highest distributable cash flow (DCF) per unit in eight years.

Strong commodity prices directly boost distributable income and, in turn, the unit price. However, as OPEC production cuts unwind, Cross Timbers Royalty Trust’s stock has pulled back from near all-time highs.

As a royalty trust, Cross Timbers Royalty Trust has minimal operating expenses, giving it significant leverage when revenues rise. Its distributable income and growth are therefore almost entirely dependent on commodity prices.

Over the past decade, Cross Timbers Royalty Trust has averaged $1.24 per unit in annual distributable and distributed cash flow, though this declined over much of the last eight years until 2022. Production from its properties naturally declines by 6%-8% per year, which presents a headwind to future returns. Coupled with the global shift toward renewable energy, we expect distributable cash flow to decline by an average of 5% annually over the next five years.

Competitive Advantages & Recession Performance

Cross Timbers Royalty Trust has a low-cost, royalty-based structure, meaning it avoids exploration and operating expenses. This gives the trust high leverage to commodity prices, allowing it to retain more revenue when oil and gas prices rise. Its diversified portfolio across Texas, Oklahoma, and New Mexico, including the San Juan Basin, reduces risk from declines in any single field.

Cross Timbers Royalty Trust has shown resilience in downturns. Minimal operating costs and predictable royalty income allow it to maintain distributions even during weak commodity periods, though payouts shrink with lower prices. Over the past decade, the trust has averaged $1.24 per unit in annual distributable cash flow, highlighting its stable, recession-resistant income relative to typical oil and gas producers.

Dividend Analysis

Cross Timbers Royalty Trust classifies its distributions as royalty income, which is taxed as ordinary income at the recipient’s marginal tax rate. Distributions are declared 10 calendar days before the record date, typically the last business day of each month.

Payouts have historically been volatile, reflecting swings in oil and gas prices. Between 2014 and 2020, distributions declined steadily due to weak commodity prices, falling from $1.43 per unit in 2018 to $0.78 in 2020, before rebounding in 2021 and 2022 as energy markets recovered. Cross Timbers Royalty Trust offered $1.92 per unit in 2023, yielding an average annual distribution of 10.9%, and an eight-year high of $1.96 per unit in 2022. Over the last 12 months, the yield has been recorded at approximately 12%.

Distributions are highly dependent on commodity prices, as Cross Timbers Royalty Trust distributes essentially all of its income and has no control over production or pricing. Dividend growth is tied directly to higher distributable income, making payouts unpredictable and highly cyclical.

While elevated oil and gas prices can yield generous distributions, the long-term risk of price declines—especially amid the global shift toward renewable energy—introduces significant volatility. Investors should understand that Cross Timbers Royalty Trust’s high yields come with considerable variability, and the trust’s payout pattern is best viewed as a reflection of commodity market performance rather than stable income.

Final Thoughts

Cross Timbers Royalty Trust has fallen roughly 34% from its peak over the past five months, primarily due to declining oil prices as OPEC restores production to normal levels. The stock’s high yield may appear attractive, but its performance remains closely tied to volatile commodity markets.

Looking ahead, Cross Timbers Royalty Trust could deliver an average annual return of about 6.8% over the next five years. This assumes a 12% starting distribution yield, 4% growth in distributable income, and a projected 5.5% valuation headwind. The trust continues to face risks from the cyclicality of oil and gas prices, long-term production declines, and operating costs. All of these factors support a sell rating for the stock.

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more

More By This Author:

The 10 Cheapest Dividend Kings Trading Below Fair ValueHigh Dividend 50: Plains All American Pipeline, L.P.

High Dividend 50: Timbercreek Financial Corp.

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more