High Dividend 50: Artisan Partners Asset Management

For the next high-yield stocks in this series, we will review a global investment management firm Artisan Partners Assets Management (APAM), which currently has a dividend yield of 11.3%.

Business Overview

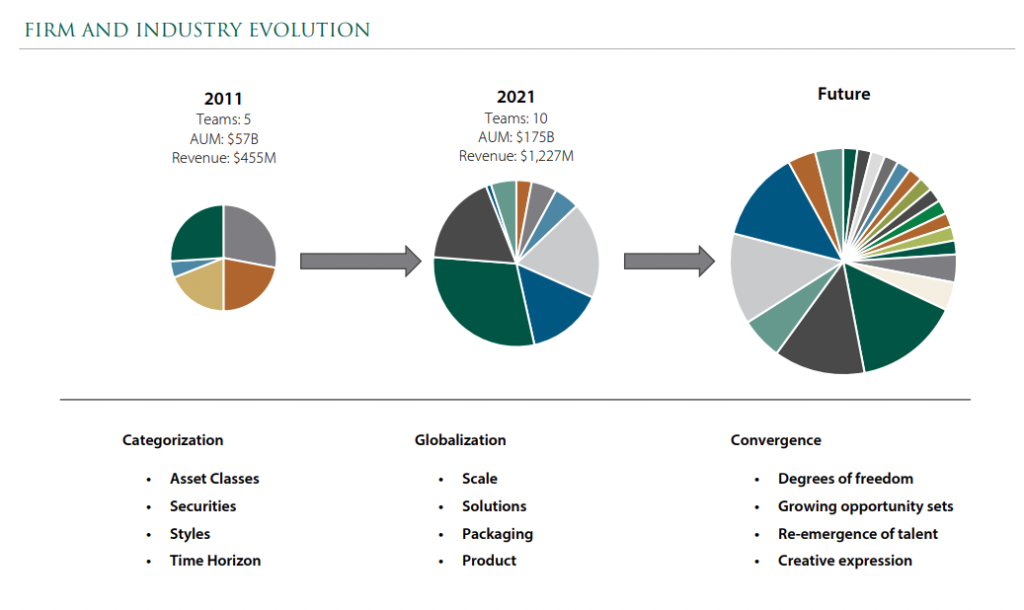

Artisan Partners Asset Management Inc. is a global investment management firm that provides a broad range of high-value asset investment strategies across several asset classes. The business model is structured as a hybrid of a boutique and a holding company or a fully integrated firm.

The company retains the benefits of a boutique through its autonomous investment team structure and the stability of a holding company or fully integrated firm due to its distinct business management team that leads a robust operational capability and an experienced distribution and client service effort.

(Click on image to enlarge)

Source: Investor Presentation

On February 1st, 2022, Artisan reported fourth-quarter and full-year earnings for Fiscal Year (FY) 2022 with earnings beating expectations but revenues missing by a small margin. Earnings-per-share (EPS) came to $1.29 on an adjusted basis for the fourth quarter, beating estimates by a penny.

Revenue soared 21% year-over-year to $315 million, but that fractionally missed estimates. Assets under management rose to $175 billion at the end of December, a 0.7% gain from the end of September. Revenue growth was due primarily to higher average Assets Under Management (AUM).

Operating expenses were $177 million in the fourth quarter, an increase of 2% compared to the third quarter of 2021. This was driven by higher incentive compensation expenses, increases in state and local taxes, and higher travel expenses.

Adjusted operating margin was 43.8% of revenue, up slightly from 43.5% in the year-ago period. Adjusted net income for the quarter was $102.4 million, or $1.29 per adjusted share, compared to adjusted net income of $105.8 million, or $1.33 per adjusted share, in the September 2021 quarter.

For the year, revenue was up 36.4%, compared to FY2020. Also, net income was up substantially for the year. Net income saw an increase of 58% growth compared to 2020. Earnings-per-share ended the year at $5.03, which is up 52.4% compared to 2020. We expect the company to make $4.60 in EPS for this year.

Growth Prospects

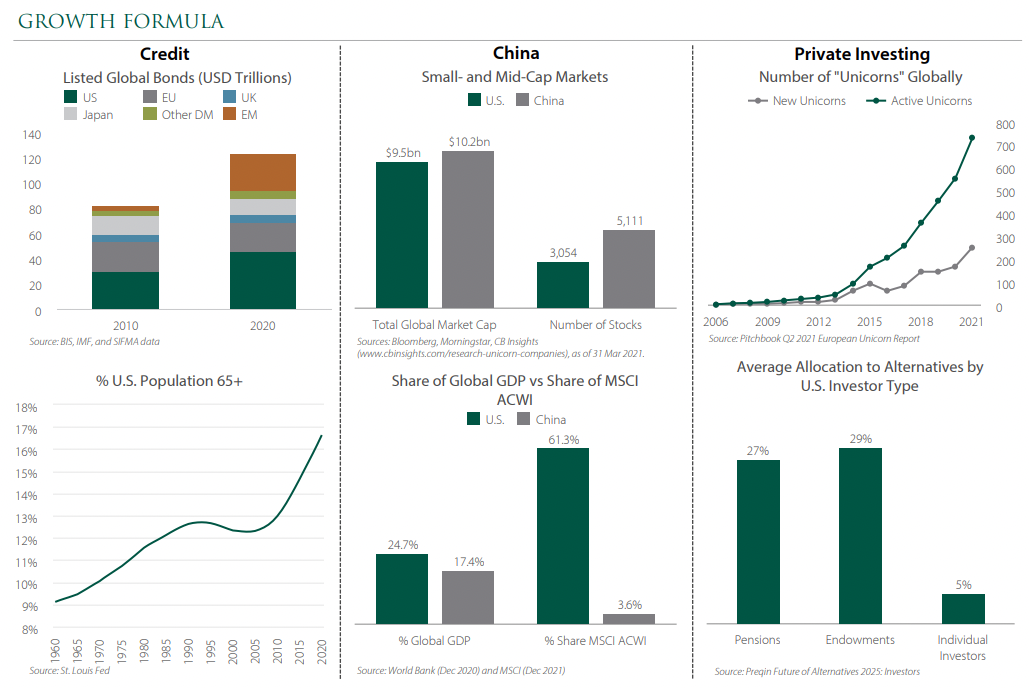

The company generates revenue by charging management fees for its services and funds. Thus, in order to increase revenue, the company needs to continue to grow AUM. Artisan can achieve this is by focusing on inefficient spaces and large-and-growing opportunity sets, either from an increasing number of issuers or by redefining a traditional opportunity set.

The Artisan management team needs to identify opportunities to differentiate and add value for clients, where the company expects there will be long-term demand from sophisticated allocators who value what truly active managers do.

Another growth driver would be China’s on and offshore listed markets that are already larger than those in the U.S., in terms of the number of issuers. They are growing, and they are less efficient. The company sees further opportunities with late-stage private investments, giving them greater access to growth in a world in which many growing companies are staying private longer.

(Click on image to enlarge)

Source: Investor Presentation

Competitive Advantages & Recession Performance

Artisan wasn’t public during the Great Recession, but we expect the damage to earnings could be meaningful during a prolonged recession that brings with it lower equity prices. Artisan is a highly cyclical company, so investors looking for safety and defensiveness would look elsewhere.

Since the company was not around throughout the Great Recession of 2007-2010. We will look at how the company did before, during, and post COVID-19 pandemic.

APAM’s earnings-per-share throughout the COVID-19 Pandemic:

- 2019 earnings-per-share of $2.67

- 2020 earnings-per-share of $3.33 (25% increase)

- 2021 earnings-per-share of $5.03 (51% increase)

As you see, the company did very well during the COVID-19 pandemic. This is because the stock market as a whole did very well in 2020 and 2021. As mentioned before, earnings would take a significant hit during a long recession.

Dividend Analysis

Artisan has paid a dividend since 2013 and currently yields 11.3% at today’s prices. The company pays a variable dividend. For example, on February 2, 2021, the company declared a dividend of $0.97 per share for the second quarter of FY2021. The next quarter, the company declared a dividend of $0.88 per share. The fluctuation of dividend payments does not necessarily mean a dividend cut. An investor would have to look at the total annual dividend payment year over year.

The company has also paid out yearly special dividends since 2013. It is as if the shareholder is receiving five dividend payments a year. In recent years, the company has been increasing its dividend since 2019. For example, 2020 saw a dividend increase of 18.2%, and in 2021, the company increased its dividend by 40.5%.

The dividend looks to be safe in the foreseeable future. For fiscal year 2021, earnings were $5.03 per share and the company paid out a dividend of $3.92 per share. This is a dividend payout ratio of 77.9%. For FY2022, we believe that the company will earn $4.60 per share and payout $4.12 per share. This is a dividend payout ratio of 89%. Some analysts are predicting that the company will make $4.63 per share in FY2023. Thus, increasing the dividend safety for the foreseeable future.

The company’s policy is to pay out 80% of the cash the company generates. Thus, it is fairly safe in the current environment. However, if there is a prolonged recession that will bring the company earnings per share down, we will see a dividend cut.

Source: Investor Presentation

The company has a solid balance sheet, with a debt-to-equity ratio of 1.1 and an interest coverage ratio of 52.1. Thus, making the dividend even safer. As you can see, cash on hand has increased year over year. While the leverage ratio has been decreasing year over year.

Source: Investor Presentation

Final Thoughts

Artisan can be seen as a play on the equity markets. When markets are rising, the company will benefit from ballooning AUM due to market returns and stronger client inflows, as we saw in 2020 and in 2021. Conversely, the company will likely perform very poorly during a bear market, as it did at the end of 2018.

If that happens, there is a strong possibility of a dividend cut because of the high payout ratios. With recent price action in the stock, as well as earnings estimates and the double-digit yield, we think that the dividend is safe in the foreseeable future.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more