High Dividend 50: Antero Midstream Corp.

Antero Midstream Corp. (AM) is a high-yield overlooked midstream company. The stock currently yields an impressive 9.2% dividend yield. With the most recent dividend cut and the increased Free Cash Flow for the foreseeable future, the stock looks to be acceptable for an income-driven investor.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

This article will analyze if Antero Midstream Corp. is a good stock for dividend/income investors.

Business Overview

Antero Resources Corporation formed Antero Midstream Corporation to service its rapidly increasing natural gas and NGL production in the Appalachian Basin. Headquartered in Denver, Colorado, the company is focused on creating value through developing midstream infrastructure in two of the premier North American Shale plays, the Marcellus and Utica Shales. Due to its transportation portfolio and midstream ownership through Antero Midstream, Antero is one of America’s most integrated NGL and natural gas businesses.

The company provides gathering and compression services (65% by EBITDA), processing and fractionation services, and pipeline services on a captive basis to Antero Resources (AR). AR is the 5th largest natural gas producer and 2nd largest NGL producer in the country, operating fields primarily in West Virginia. The company has gone through several structural changes since it began operation in 2011 and trades today with a $4.9 billion market capitalization.

On February 16, 2022, the company reported fourth-quarter and full-year results for Fiscal Year (FY)2021. Revenue for the quarter was up 6.2% from $203 million in 4Q2020 to $216.5 million last quarter. The company was able to keep operating expenses lower than in Q42020. Thus, operating income increased 11.8% year-over-year.

Net income was $79 million, or $0.16 per share, in line with the prior-year quarter. Adjusted Net Income was $95 million, or $0.20 per share, compared to $98 million, or $0.21 per share in the prior-year quarter. Adjusted EBITDA was $213 million, a 5% increase compared to the prior-year quarter.

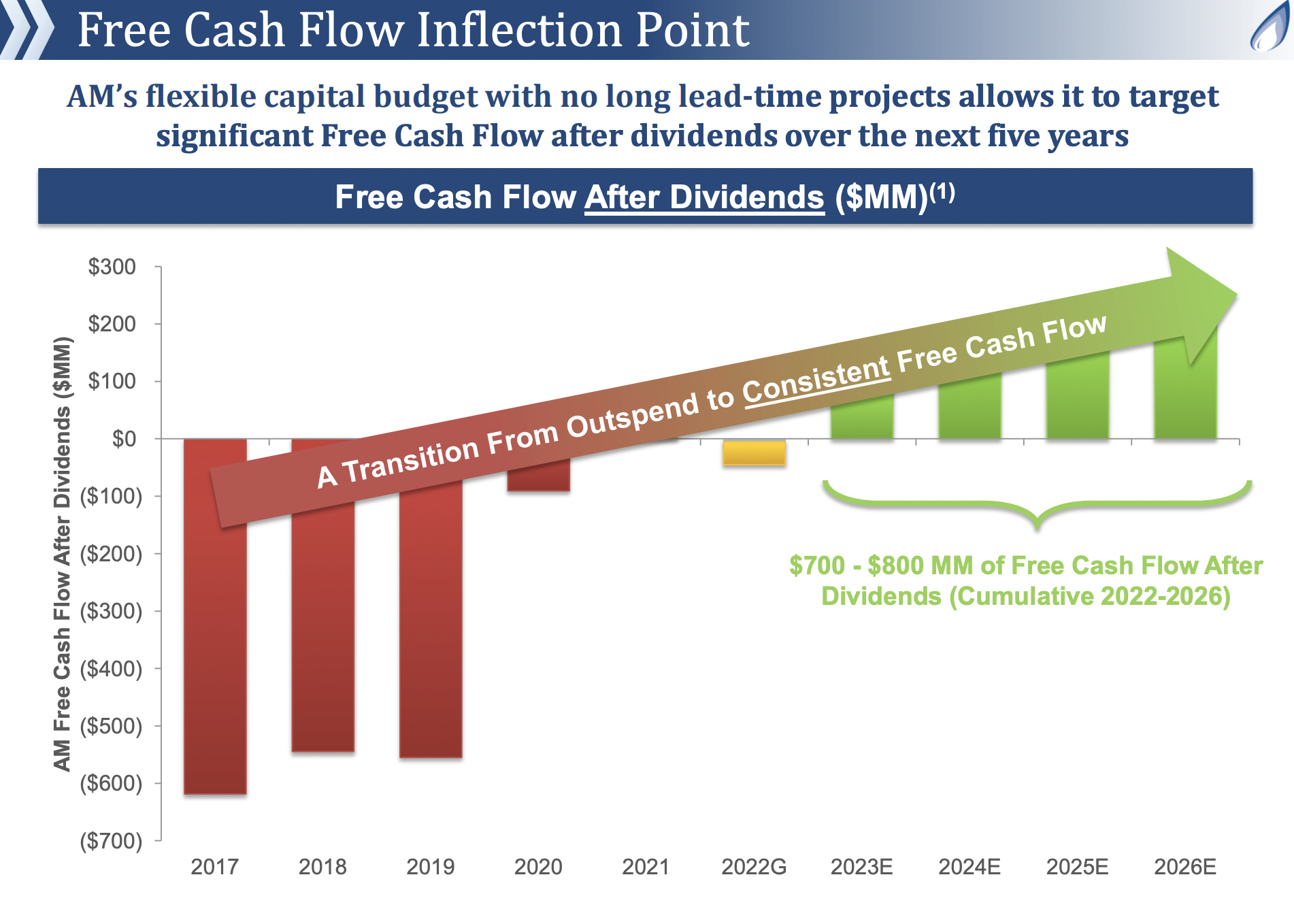

For the year, net income was $332 million, or $0.69 per share, compared to a $0.26 per share net loss in the prior year. Adjusted EBITDA was $876 million. Adjusted EBITDA was above the midpoint of Antero Midstream’s guidance range. Net cash provided by operating activities for the year was $710 million. Also, Free Cash Flow (FCF) before dividends was $439 million, and FCF after dividends were $10 million, both above the midpoint of their respective guidance ranges.

Growth Prospects

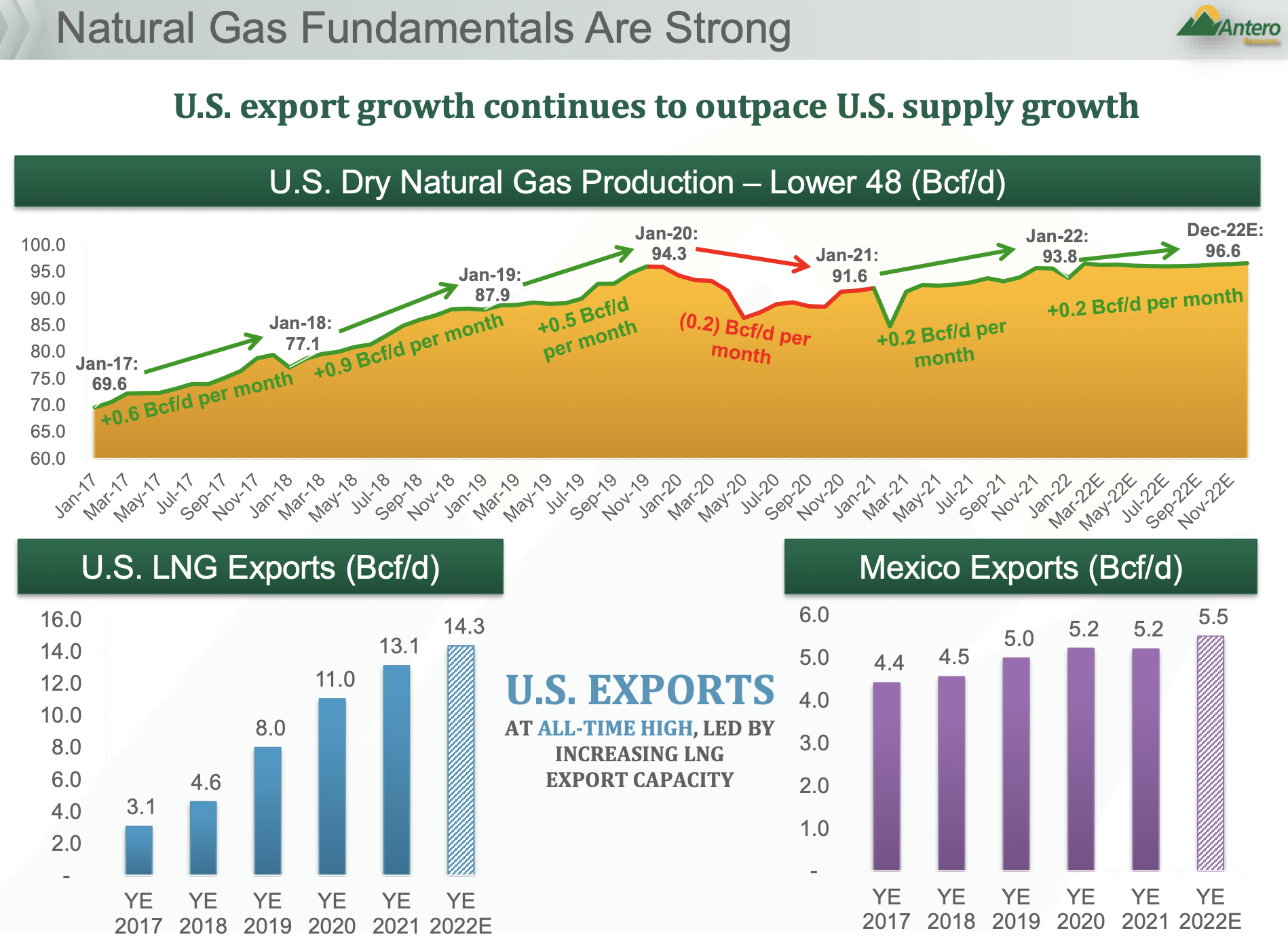

The biggest growth driver for the company will be the continued growth in U.S. exports. For example, U.S. dry natural gas production should continue to increase and the LNG exports and exports to Mexico. Besides that, there is not much more growth driver for the company.

Source: Investor Presentation

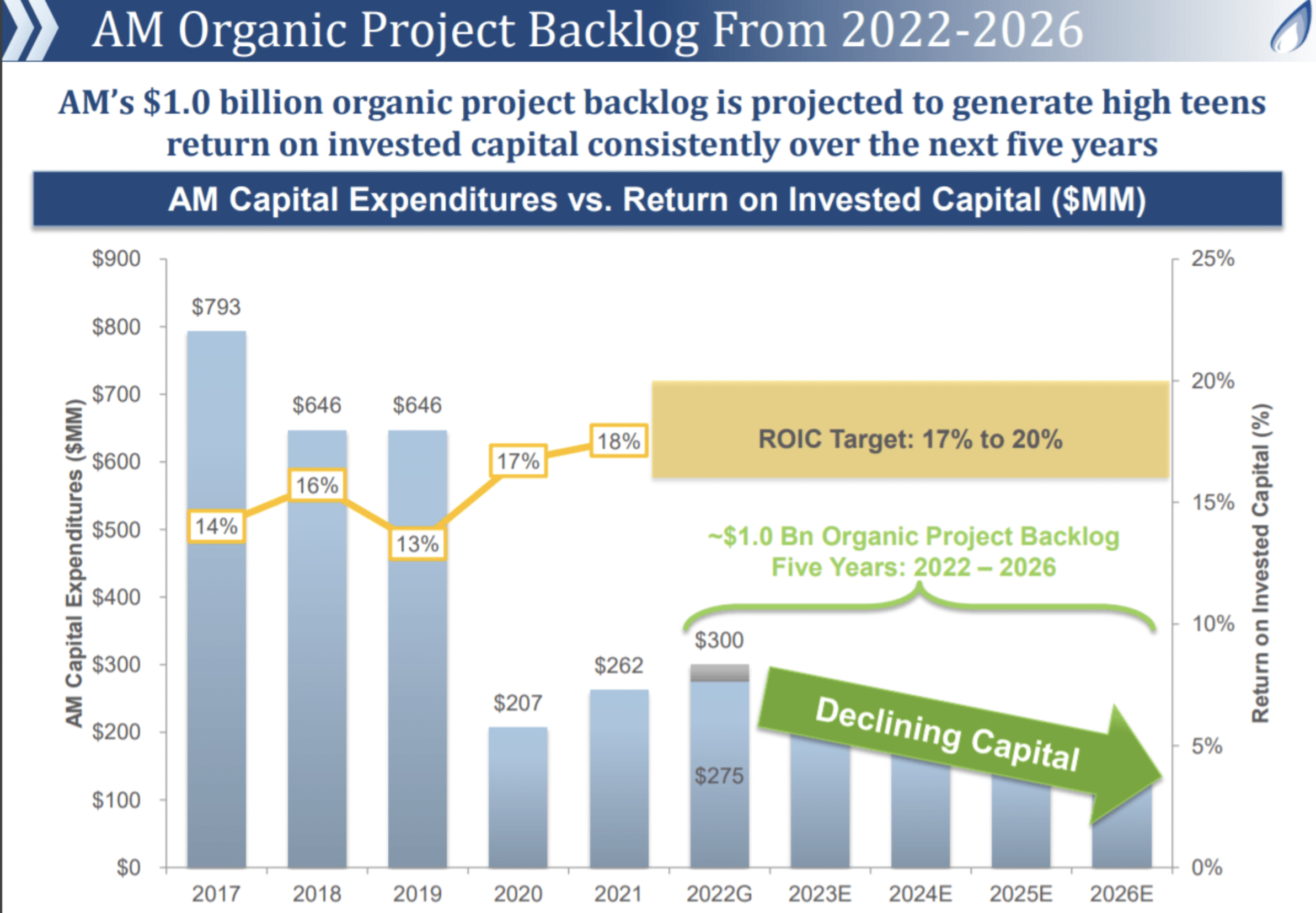

The decrease of capital expenditures and the cut of its dividend will help the company in the short term to continue to deleverage. This, in turn, will help the company in the future to increase cash flow and thus start to increase or have safer dividend payments.

Source: Investor Presentation

Competitive Advantages & Recession Performance

Antero Midstream’s most significant competitive advantage is the company’s assets. The company has assembled a set of energy infrastructure assets that we believe would be very difficult to replicate. Its pipelines and storage facilities are significant assets. It makes it a challenge for another company to construct a competing pipeline.

As for recession performance, the company was not around during the 2008-2009 Great Recession. Thus, we will look at how well the company did during the COVID-19 pandemic.

AM’s Discounted Cash Flow (DCF) per share throughout the COVID-19 pandemic:

- 2019 earnings-per-share of $1.30

- 2020 earnings-per-share of $1.39 (6.9% increase)

- 2021 earnings-per-share of $1.25 (10.1% decrease)

As you can see, the company did reasonably well during the COVID-19 pandemic. DCF is expected to increase to $1.38 per share for 2022. This will represent an increase of 10.4% compared to 2021.

Dividend Analysis

The company pays a very attractive dividend yield of 9.3%. However, the company had to cut its dividend by 26.8% on April 14, 2021. Since then, the company has been paying a quarterly dividend of $0.225 per share.

However, we do not think a dividend cut will come anytime soon as the company expects the FCF to continue to grow for the foreseeable future. This will help investors have peace of mind with the high dividend.

For example, for FY2021, the company DCF was $1.25 per share. Last year, Antero paid out $0.98 per share in dividend payment. This represents a dividend payout ratio of 78.4%. Since the dividend cut, the company is expected to pay $0.90 per share for 2022. We expect the company to make $1.38 DCF per share for Fy2022, which would make a dividend payout ratio of 65%. This is an acceptable payout ratio for such a high dividend yield.

Source: Investor Presentation

In addition, the company has a satisfactory balance sheet, with an interest coverage ratio of 3.6 and a debt-to-equity ratio of 1.4. Both ratios are at modest levels. However, the company does not have an S&P credit rating.

As a result, we view the dividend of Antero Midstream Corporation as somewhat safe for the foreseeable future. The company just recently cut its dividend and free cash flow is starting to increase.

Final Thoughts

AM looks excellent because of the dividend yield and distributable cash flow basis. However, the main challenge to the investment thesis is assuring investors that dependable cash flows cover its equity and debt securities and that it will be able to keep leverage ratios down even if its cash flows decline somewhat. As a result, despite the attractive yield, we see this as a particularly attractive income investment for investors because of the high yield, but it does come with risks.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more