Hibbett Beats The Rest

Summary

- 100% technical buy signals.

- 11 new highs and up 26.11% in the last month.

- 268.74% gain in the last year.

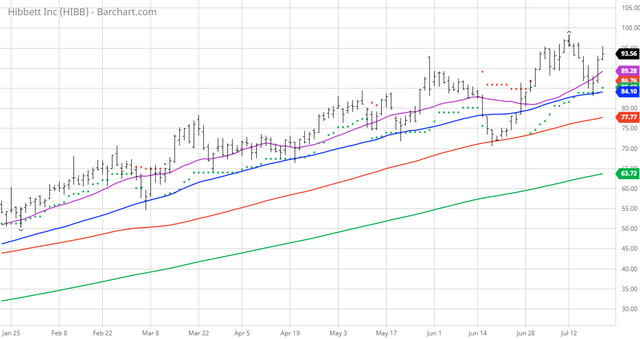

The Barchart Chart of the Day belongs to the athletic retailer Hibbett (Nasdaq: HIBB). I last featured Hibbett on 9/11/20 at 37.94; today it is trading around 93.55. I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. That resulted in a watch list of 13 stocks. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 6/30 the stock gained 4.29%.

Hibbett, Inc., together with its subsidiaries, engages in the retail of athletic-inspired fashion products. Its stores offer a range of merchandise, including athletic footwear, athletic and fashion apparel, team sports equipment, and related accessories. The company operates stores in small and mid-sized communities, and Website under the hibbett.com name. As of July 6, 2021, it operated approximately 1,070 retail stores under the Hibbett Sports and City Gear brands located in 35 states of the United States. The company was formerly known as Hibbett Sports, Inc. and changed its name to Hibbett, Inc. in June 2021. Hibbett, Inc. was founded in 1945 and is headquartered in Birmingham, Alabama.

Barchart technical indicators:

- 100% technical buy signals

- 234.50+ Weighted Alpha

- 268.74% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 26.11% in the last month

- Relative Strength Index 59.31%

- Technical support level at 87.85

- Recently traded at 93.55 with a 50 day moving average of 84.10

Fundamental factors:

- Market Cap $1.48 billion

- P/E 7.99

- Dividend yield 1.16%

- Revenue expected to grow 9.10% this year and another 2.00% next year

- Earnings estimated to increase 50.70% this year and continue to compound at an annual rate of 7.20% for the next 5 years

- Wall Street analysts issued 4 strong buy and 2 hold recommendation on the stock

- The individual investors following the stock on Motley Fool voted 117 to 24 that the stock will beat the market

- 4,620 investors are monitoring the stock on Seeking Alpha

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the ...

more