HEXO Corp. Q3 Financial Results Show 49% Improvement In EBITDA; Stock Jumps

TM Editors Note: This article discusses one or more penny stocks and/or microcaps. Such stocks are readily manipulated; do your own careful due diligence.

Details of HEXO Corp. (NYSE: HEXO) financial results for the Q3 2020 ended April 30, 2020, are reported below.

Financial Highlights (All amounts are expressed in Canadian dollars unless otherwise noted and all numbers are in comparison to those of the previous quarter unless otherwise noted.)

- Net Revenue: increased 30% to $22.1M

- Gross Margin (before fair value adjustments): increased 7% to $8.8M

- Gross Margin as a % of Net Revenue: increased to 40% from 33%

- Increase was driven by:

- decreased production costs through increased efficiencies,

- automation of packaging activities,

- and selection of strains which resulted in decreased labor costs.

- Increase was driven by:

- Operating Expenses: decreased to $26.8M from $281.5M

- Total Net Profit (Loss): decreased to ($19.5M) from ($298.2M)

- Net Loss/Share: increased to $0.07 compared to $0.04

- Adj. EBITDA: increased 49% to ($4.3M)

Operational Highlights

- explored (on-going) opportunities for non-alcohol hemp-derived CBD beverages in Colorado in a joint venture with Molson Coors.

- closed a $57.5M underwritten public offering for the purchase and sale of 55,600,000 units and 8,340,000 over-allotment units.

- obtained its Health Canada license amendment for the sale of dried and fresh cannabis, cannabis extracts, cannabis topicals and edible cannabis products for its cannabis manufacturing and processing facility in Belleville, Ontario.

- announced the launch of a new 30-gram medical flower format for its high-THC strain, Tsunami.

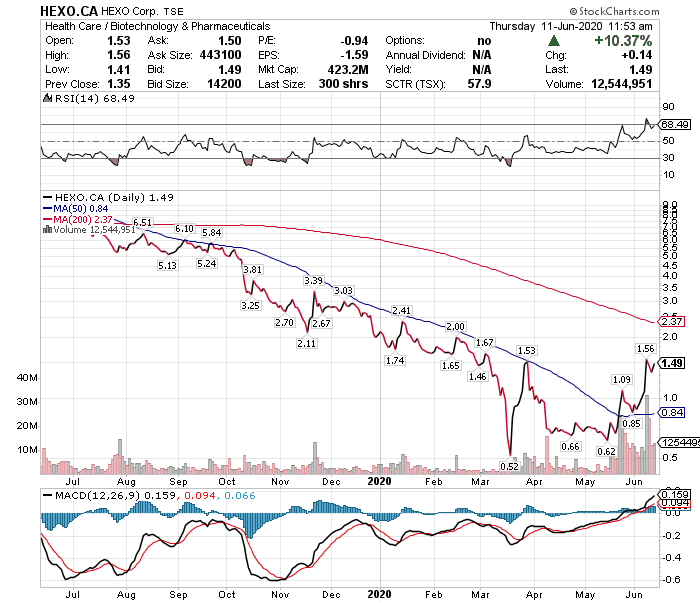

Stock Performance Over Past 12 Months

(Click on image to enlarge)

This article may discuss small-, micro- and nano-cap stocks so do your own careful due diligence. Visit more

Wow! Go $HEXO Go!