Here’s Why Bear Market Rallies Are So Powerful

The first two weeks of 2023 have been a godsend for the bulls.

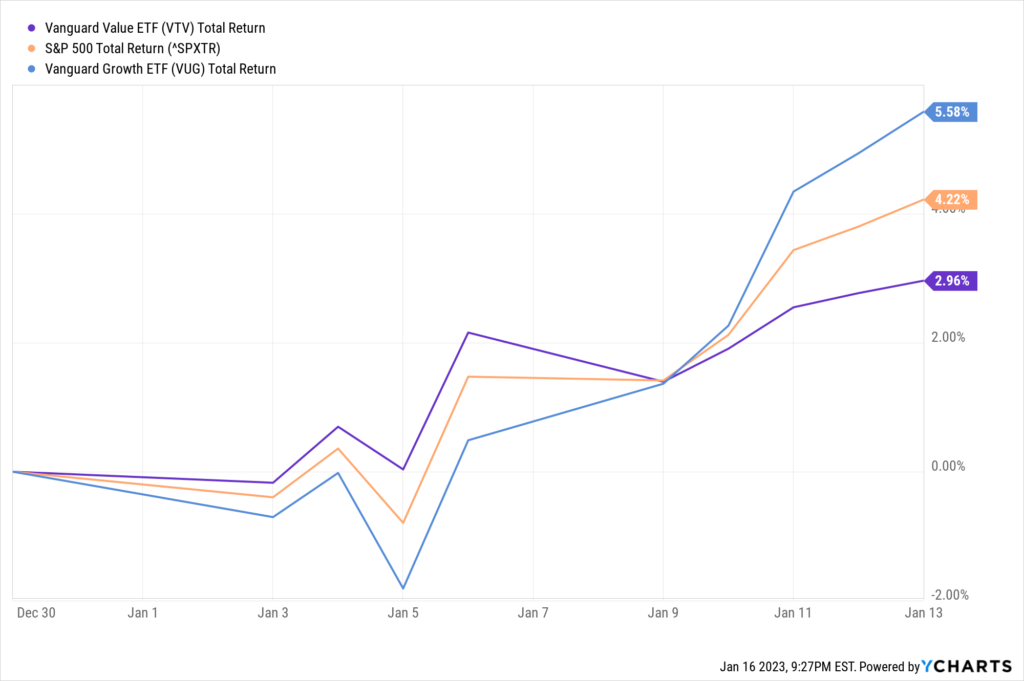

As of Friday’s close, the S&P 500 was up 4.2% in this brand-new year.

Speculative growth stocks did even better, notching a 5.6% gain.

And even value stocks which are typically “slow and steady” earners gained nearly 3% in just two weeks of trading.

Not bad for a market that was trending lower for the majority of 2022!

So does this rebound signal a new bull market is underway? Or is it just another bear market rally poised to roll over.

To form an objective opinion, let’s first take a look at what fuels a bear market rally…

Bear Market Rallies are Driven By Fear

The most powerful stock market rallies tend to happen within overall bear markets.

These rallies are driven by two very powerful fears investors can have.

First, there are traders and investors who are short stocks and expecting prices to move lower. These traders make money when stocks fall. And they lose money when stocks begin to rally.

The only way these bearish traders can avoid the losses is to buy back shares of stock. But by purchasing these shares, big institutional traders tend to drive stock prices higher.

When this occurs, it creates more losses and bearish traders have to buy even more!

The second fear comes from more traditional investors who own stocks.

During a bear market, many of these investors get discouraged. They either sell positions and hold more cash, or they rotate into more defensive stocks. (The value stocks in the chart above are a good example).

Once a bear market rally begins, these traditional investors become fearful that they are missing the next bull market.

And this fear of missing out (or FOMO) can be a powerful catalyst. Especially for professional money managers who are judged by how they stack up to the broad market.

If these managers are holding too much cash (or defensive stocks), they will quickly fall behind. And in the competitive world of investing, this can get you fired!

So at least for a time, these managers have a huge incentive to “keep up.” Which means they need to buy the stocks that are rallying (and quickly before they fall behind).

What Happens When the Buying is Done?

The problem with bear market rallies is that they don’t change anything about the overall environment.

In today’s economy, inflation is still running hot, the Fed is still hiking interest rates, and speculative tech stocks are still expensive.

Which means the broad market — and speculative tech stocks in particular — are still very vulnerable.

At some point in the process of every bear market rally, bearish traders finish buying back stock. Institutional traders become more “balanced”. And the short-term buying pressure abates.

That’s when fundamental factors (like valuation, economic growth, and earnings expectations) come back into play.

Stocks will eventually trade based on reasonable expectations of future profits. (The key word being “eventually”.)

Of course, you’ve probably heard the famous axiom: “The market can stay irrational for longer than you can remain solvent.”

So we still need to pay attention to the short-term price action and manage our risk carefully.

But as I watch this bear market rally in early 2023, I’m getting excited about the bearish plays that are setting up. My guess is that we’ll lock in some great profits from these opportunities before the first quarter is over. And possibly before the end of January!

More By This Author:

Three Ways To Play Gold’s 2023 Surge

This Income Strategy Is Perfect For 2023

BNPL: A Helpful Tool Or Ticking Time Bomb?