Here’s What The Q1 Stock Market Setback Means To Target Date Fund Investors. A Story Told With 2 Pictures.

Image Source: Pixabay

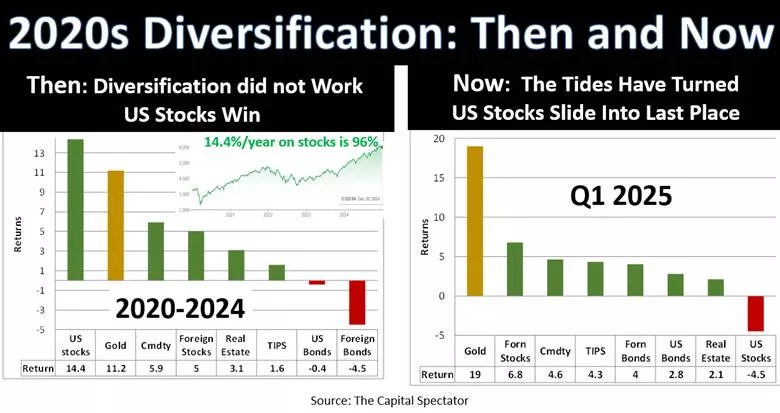

Until now, diversification beyond US stocks hurt performance because the best place to be was all in US stocks.

(Click on image to enlarge)

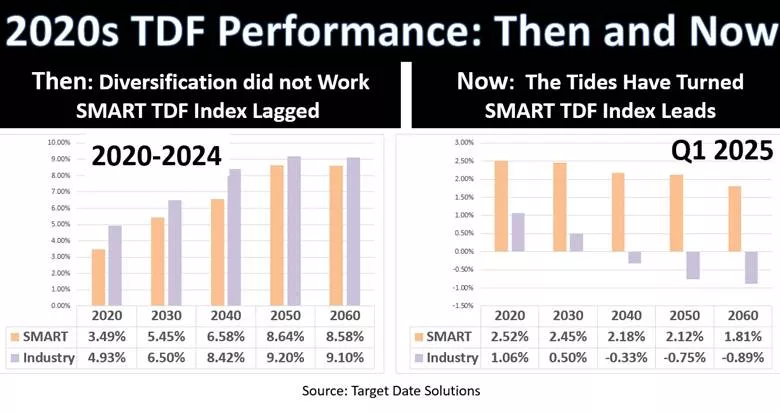

Retirement savers in target date funds (TDFs) didn’t realize it, but diversification was hurting them. That just stopped. Will diversification continue to help?

(Click on image to enlarge)

The SMART TDF Index is normative – the way TDFs should be. SMART is available on Morningstar Direct. The Industry is the S&P TDF Index that is an aggregation of all TDFs so it’s a consensus index of the way TDFs are. Most TDFs are concentrated in US stocks and bonds and risky at their target date, so they do not defend against sequence of return risk.

More By This Author:

The Catch-22 In The Fed’s Interest Rate Decision

Tariffs Intensify Inflation Threats

The World Is Changing. U.S. Stocks No Longer Lead