Here Are The Most Popular ESG Fund Holdings

Every several years it's same old: not long after the start of the post-crisis era, the investing craze du jour was solar, followed by 3D printers and cloud stocks; when that fizzled it was replaced with craft burgers/sandwiches which then morphed into the biotech bubble; when that burst blockchain companies were the bubble darlings of the day, which in turn were replaced by cannabis stocks. Not longer after that, the pot bubble burst, leaving a void to be filled.

That's when the virtue-signaling tour de force that is ESG, or Environmental, Social, and Governance, made its first appearance, which just happened to coincide with the staged anti-global warming crusade spearheaded by a 16-year-old child (whose words are ghost-written by her publicity-starved parents) as well as central banks, politicians, the UN, the IMF, the World Bank, countless "green" corporations and NGOs, and pretty much everyone in the crumbling establishment.

After all, who can possibly be against fixing the climate, even if it costs quadrillions... or rather especially if it costs quadrillions - because in one fell swoop, central banks assured themselves carte blanche to print as much money as they would ever need, because who evil egotistical bastard would refuse the monetization of, well, everything if it was to make sure future generations - the same generations these same central banks have doomed to a life of record wealth and income inequality - had a better life (compared to some imaginary baseline that doesn't really exist).

And since the green movement was here to stay, so was the wave of pro-ESG investing which every single bank has been pitching to its clients because, well you know, it's the socially, environmentally and financially responsible thing.

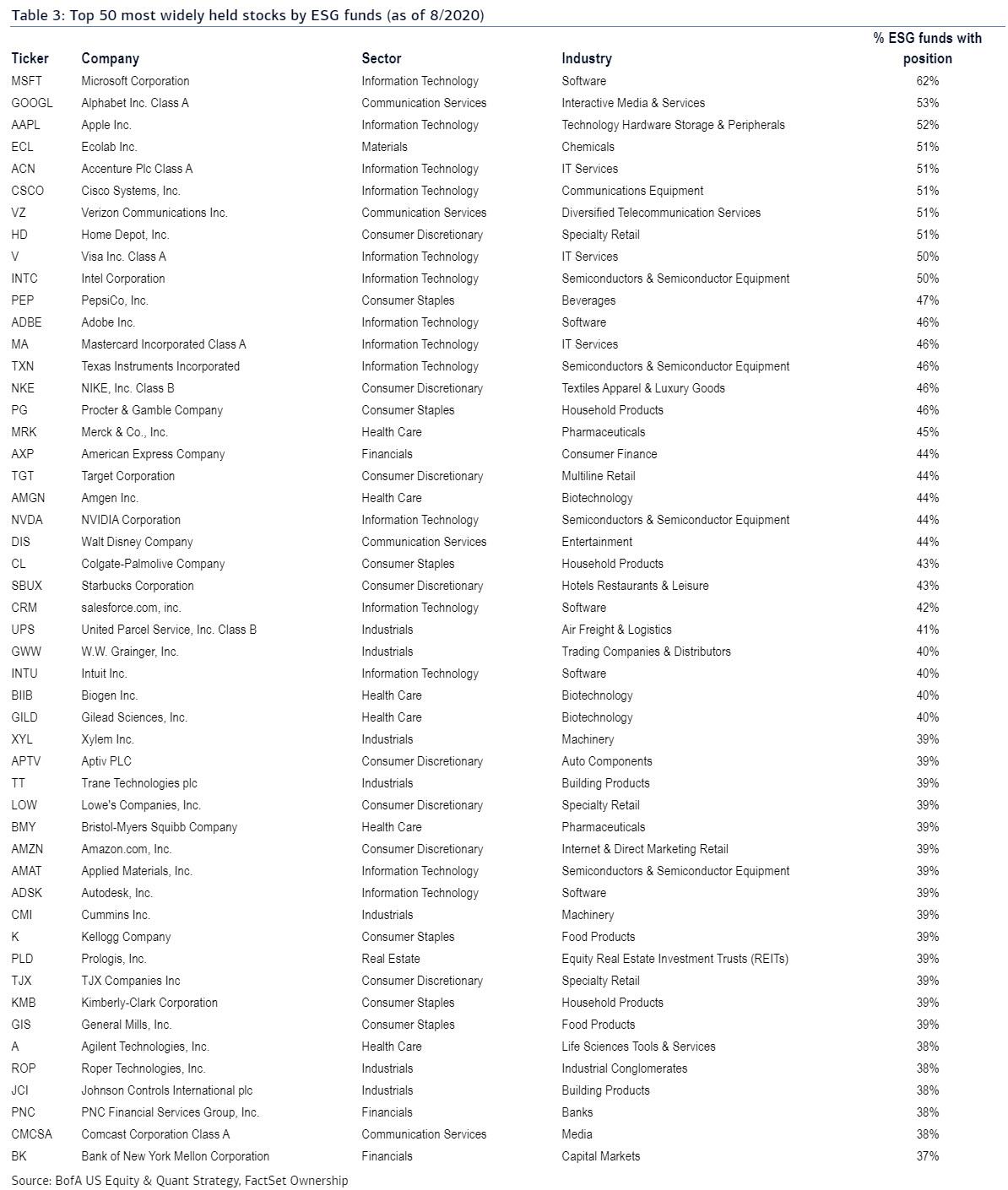

There is just one problem. Instead of finding companies that, well, care for the environment, for society or are for a progressive governance movement, women's rights or social equality (a bit of a paradox in a market that has led to the biggest wealth divide in history), it turns out that the most popular holdings of all those virtue signaling ESG funds are companies such as.... Microsoft, Alphabet, Apple and Amazon - you know, the world's four biggest companies (and in some cases anti-ESG monopolies) that just get bigger by the day - one which one would be hard pressed to explain how their actions do anything that is of benefit for the environment, society, or whatever the S and G stand for. It gets better: among the other most popular ESG companies are consulting company Accenture (?), Procter & Gamble (??), and Bank of New York Mellon (!!?!!!?!). At least Exxon is missing.

Yes, for all those who are speechless by the fact that the latest virtue-signaling investing farce is nothing more than the pure hypocrisy of Wall Street and America's most valuable corporations, which have all risen above the $1 trillion market cap bogey (and Apple is now $2 trillion) because they found a brilliant hook with which to attract the world's most gullible, bleeding-heart liberals and frankly everybody else into believing they are fixing the world by investing in "ESG" when instead they are just making Jeff Bezos richer beyond his wildest dreams, here is Bank of America's summary of the 50 most popular ESG funds. Please try hard not to laugh when reading what "socially responsible, environmentally safe, aggressively progressive" companies that one buys when one investing into the "Green", aka ESG scheme.

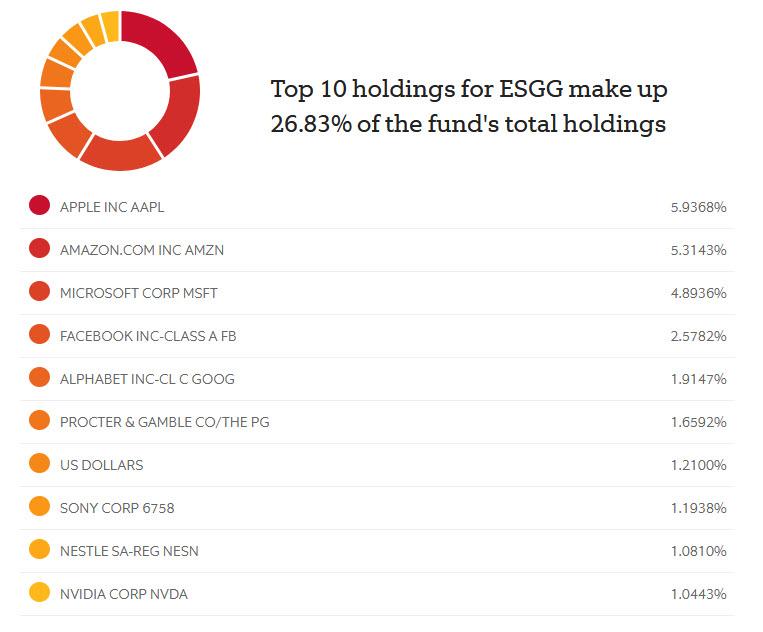

Impossible, you say. Nobody can be that hypocritical... surely Bank of America has made an error? Well, no. As confirmation here are the Top 10 Holdings of the purest ESG ETF available: the FlexShares ESGG fund. Below we present, without further commentary, its Top 10 holdings.

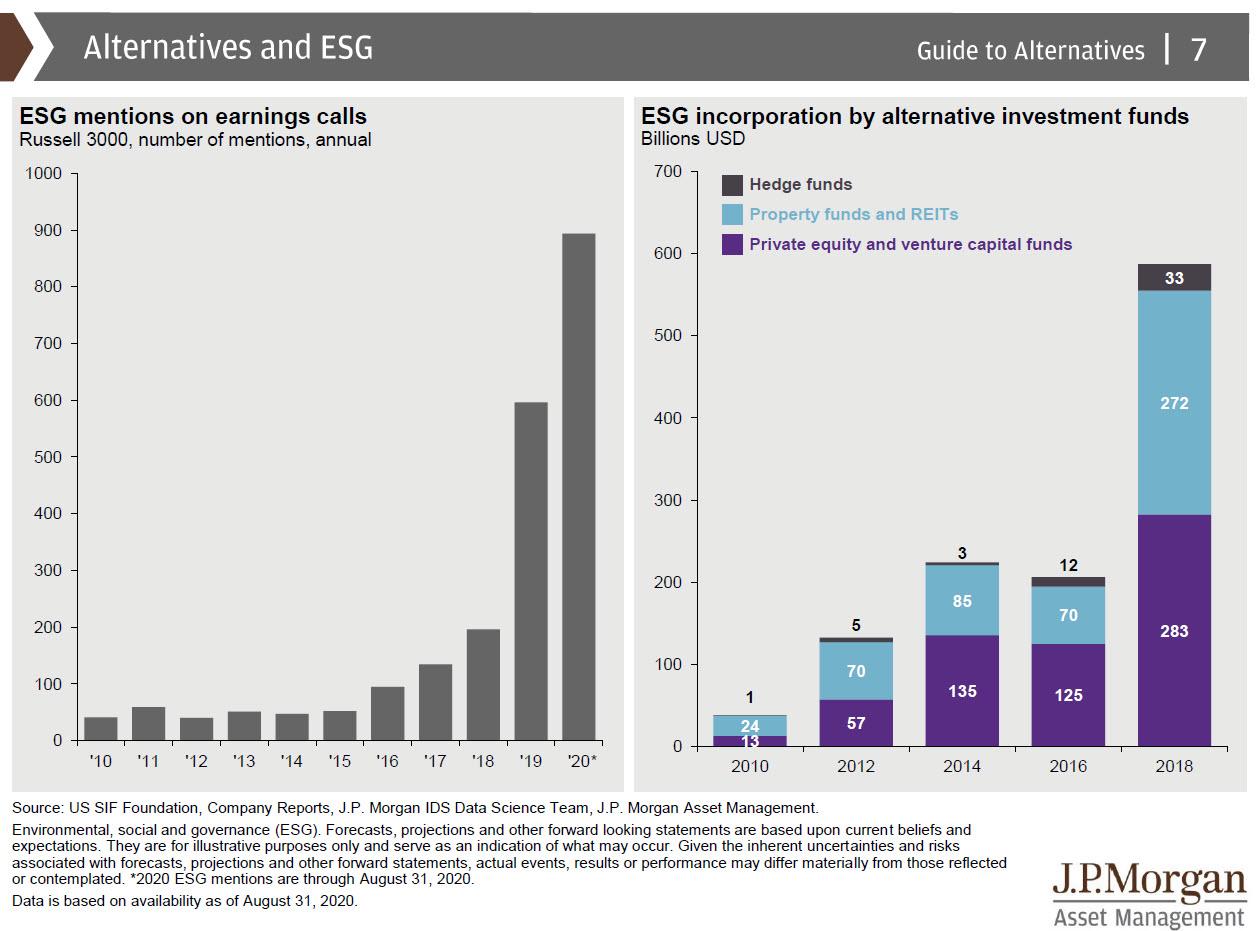

And the punchline: this gimmick actually works - as the following slide from JPMorgan shows, ESG is now all the absolute rage on both earnings calls, where it has become one of the most popular terms among virtue-signalling companies, and has also seen a tremendous increase in capital inflows by various alternative investment funds.

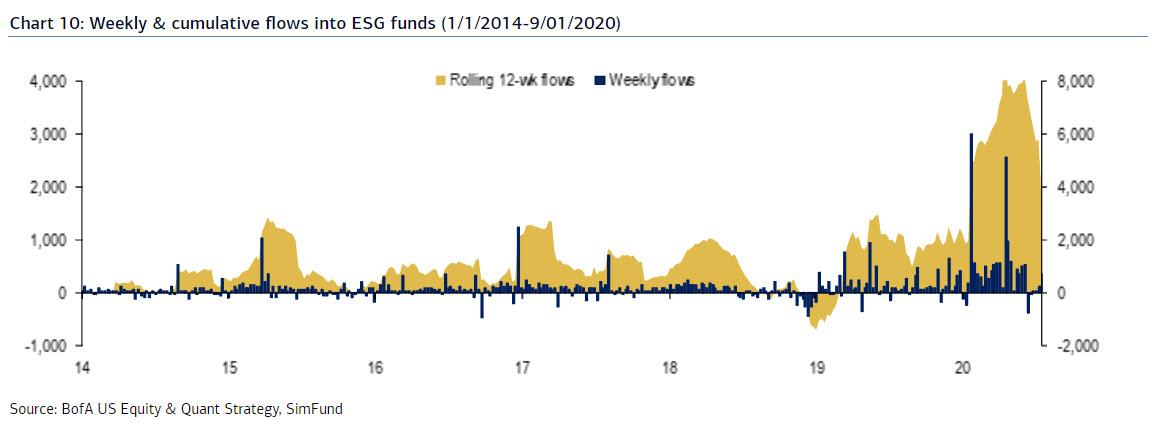

As the next chart shows, while some had hoped that the COVID-19 pandemic would at least eradicate the poseurs, the weekly inflows into ESG funds are now off the charts.

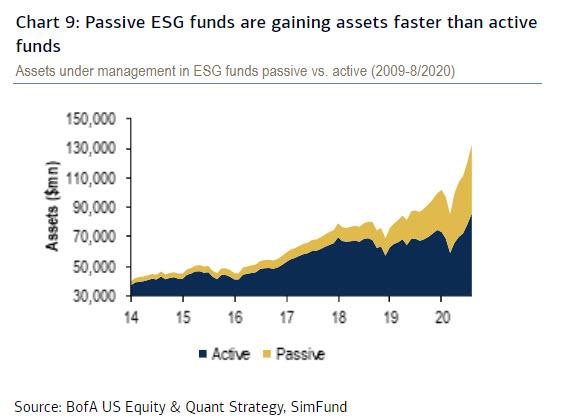

Or perhaps it isn't humans that are that gullible but only the robots: as BofA notes, passive ESG funds have been gaining assets at a much faster rate than the active ESG funds.

Almost two centuries ago, PT Barnum said "there's a sucker born every minute." Little did he know how appropriate that phrase would be more than a hundred years later to describe investors in the virtue-signaling craze that has taken over markets today.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more